PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842530

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842530

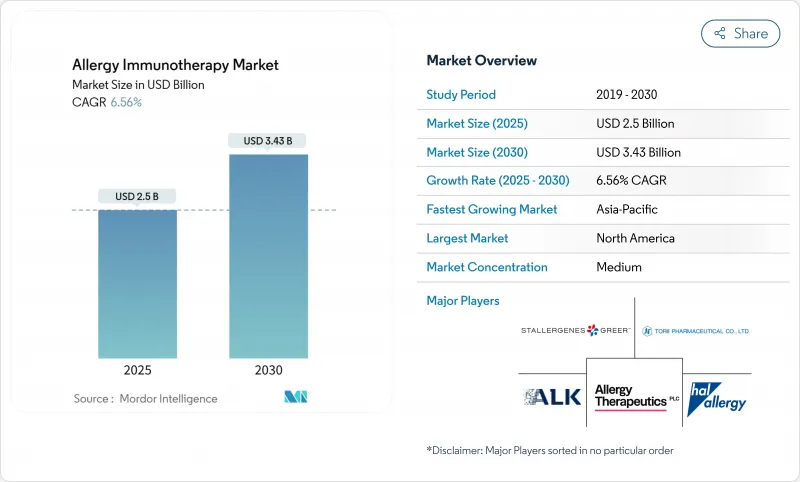

Allergy Immunotherapy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The allergy immunotherapy market is valued at USD 2.50 billion in 2025 and is projected to reach USD 3.43 billion by 2030, advancing at a 6.56% CAGR during the forecast period.

Growth stems from regulatory convergence that speeds product approvals, expanded reimbursement tied to value-based care, and steady advances in patient-centric delivery technologies that raise adherence and clinical success. FDA decisions such as the February 2024 approval of Xolair for multiple food allergies confirm biologics as a core pillar of the allergy immunotherapy market, while the March 2025 authorization of an interchangeable omalizumab biosimilar introduces price competition that broadens access. Demand also benefits from rising global prevalence of respiratory and food allergies, with over 40% of the world's population now affected, and from AI-guided personalization platforms that shorten treatment duration. Supply-side constraints around GMP-grade allergen extracts and climate-linked variability in raw materials remain headwinds yet are gradually mitigated by capacity expansions and novel synthetic production methods.

Global Allergy Immunotherapy Market Trends and Insights

Growing burden and economic cost of respiratory and food allergies

Untreated allergic disease imposes substantial indirect costs, with European studies showing EUR 2,405 per patient annually compared with EUR 125 for properly managed cases, a nineteen-to-one gap that motivates payer support for disease-modifying options. In the United States, food allergies alone create USD 24.8 billion in yearly economic impact including medical expenses, lost productivity and quality-of-life effects. As prevalence climbs past 40% of the global population, health systems view allergen immunotherapy as a cost-saving intervention that can halt progression from rhinitis to asthma. These pressures underpin sustained expansion of the allergy immunotherapy market even as biosimilar price erosion takes hold. Driven by payer interest, providers increasingly initiate early intervention that reduces downstream medication use and emergency visits.

Expedited approvals of SLIT tablets in the US, EU and Japan

Harmonized review pathways shorten development cycles and allow simultaneous launches. ALK's tree pollen tablet obtained European clearance for children aged 5-17 years in April 2025, widening its treatable base ahead of the 2025/26 season. The FDA's collaborative path with DBV Technologies on Viaskin Peanut and Japan's inclusion in accelerated routes provide a trilateral platform that cuts sequential filing costs for smaller firms. Faster access to these standardised tablets enhances patient uptake thanks to predictable dosing and pharmacy supply, supporting momentum in the allergy immunotherapy market. Early convergence is most pronounced for respiratory allergens but sets precedent for food and venom indications.

Low diagnosis and therapy uptake in low-income regions

Infrastructure gaps constrain adoption: China hosts about 300 million allergic rhinitis sufferers yet fewer than 1% receive immunotherapy, reflecting limited standardized vaccines and scarce trial data tailored to local populations. Similar patterns appear in rural South Asia and Africa, where specialist shortages and travel costs deter patients. Cultural preference for traditional medicine further suppresses demand. Overcoming these barriers will be essential to unlock the full global potential of the allergy immunotherapy market.

Other drivers and restraints analyzed in the detailed report include:

- Inclusion of AIT in value-based care and reimbursement frameworks

- AI-guided personalization of allergen extracts and dosing

- Irregular supply of GMP-grade allergen source materials

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Subcutaneous Immunotherapy retained 45.55% of 2024 revenue, validating its clinical heritage and extensive physician experience within the allergy immunotherapy market. Yet Epicutaneous Immunotherapy is on track for a 14.25% CAGR to 2030 as Viaskin Peanut reported 67% toddler responders at 12 months and sustained benefit at 36 months. Patient comfort drives preference: EPIT shows 90% compliance in trials versus frequent drop-outs seen with injections.

Growing tablet and drop options advance sublingual immunotherapy, but adverse event profiles have curbed enthusiasm for high-dose oral protocols. Phase III data found 36% of omalizumab recipients tolerated 2,000 mg peanut protein versus 19% with oral therapy, guiding clinicians toward combined or biologic-first strategies. Modified six-injection PQ Grass regimens and ultrasound-guided intralymphatic protocols further illustrate ongoing attempts to shorten courses without sacrificing effectiveness. These innovations collectively sustain growth in the allergy immunotherapy market while diversifying patient options.

Food allergy treatments are forecast to expand at 15.15% CAGR, reshaping allocation of R&D capital inside the allergy immunotherapy market. FDA clearance of Xolair for multi-food indications in 2024 enabled 68% of participants to tolerate 600 mg peanut protein compared with 5% on placebo, proving systemic therapy viability. Cross-reactivity strategies also show promise; birch pollen tablets improved related food allergy symptoms in adults, allowing efficient dual-benefit prescribing.

Allergic asthma maintains the largest 2024 share at 36.53%, driven by chronic disease prevalence and established insurance coverage. Rhinitis volumes stay resilient as climate change lengthens pollen seasons. Venom and atopic dermatitis sub-segments continue to attract research into combined microbiome and immunotherapy approaches, supporting broader application breadth. Collectively, these shifts extend the total allergy immunotherapy market size while keeping therapy diversification in motion.

The Allergy Immunotherapy Market Report is Segmented by Immunotherapy Type (Subcutaneous Immunotherapy and Sublingual Immunotherapy (SLIT))-Drops, and More), Allergy Type (Allergic Rhinitis, Allergic Asthma, and More), Formulation (Injectable Suspensions, and More), Distribution Channel (Direct-To-Physician Sales, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 40.72% of 2024 revenue, buoyed by FDA agility exemplified by approvals of Xolair for food allergy and neffy nasal spray for anaphylaxis. Robust private and public reimbursement, coupled with widespread specialist availability, sustain broad uptake. Commercial launch of neffy generated USD 7.8 million net revenue in Q1 2025, underscoring swift market response.

Asia-Pacific is projected to record a 14.22% CAGR through 2030. China's 300 million rhinitis patients present the largest untreated cohort and drive policy interest in localized vaccine production. Japan's fast-track review schemes and mature payer environment ease entry for novel tablets and patches. South Korea and Australia leverage strong diagnostics and patient education, while India's vast population requires price-sensitive, telehealth-enabled solutions to unlock volume growth.

Europe posts steady gains underpinned by EMA alignment across member states, comprehensive insurance coverage and solid clinical infrastructure. Germany commands the biggest patient base, and Stallergenes Greer's investment in sales training supports wider Nordic, Italian and Spanish penetration. The United Kingdom advances innovative practice through NHS trials using daily food allergen micro-dosing. Middle East and Africa plus South America reside at earlier adoption stages, yet rising urban income and smartphone penetration foster future expansion via digital distribution. Collectively these regional dynamics reinforce the resilience and breadth of the allergy immunotherapy market.

- ALK-Abello

- Stallergenes Greer

- Allergy Therapeutics plc

- HAL Allergy Group

- Torii Pharmaceutical

- Adamis Pharmaceuticals

- DBV Technologies

- Prota Therapeutics

- Aimmune Therapeutics (Nestle)

- LETI Pharma

- HollisterStier Allergy (Jubilant Pharma)

- Biomay

- Inmunotek S.L.

- Circassia Group

- ALK-Scherax

- Allergy Solutions

- Tunitas Therapeutics

- Camallergy

- Merck

- AnaptysBio

- Allovate Therapeutics

- Vida Pharmaceuticals

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Burden & Economic Cost of Respiratory And Food Allergies

- 4.2.2 Expedited Approvals of SLIT Tablets In The US, EU & Japan

- 4.2.3 Inclusion of AIT In Value-Based Care & Reimbursement Frameworks

- 4.2.4 AI-Guided Personalization of Allergen Extracts & Dosing

- 4.2.5 Microbiome-Modulating Adjuvants Boosting Efficacy & Durability

- 4.2.6 Home-Based Self-Administration Platforms Improving Adherence

- 4.3 Market Restraints

- 4.3.1 Low Diagnosis & Therapy Uptake In Low-Income Regions

- 4.3.2 Product-Specific Anaphylaxis & Safety-Monitoring Costs

- 4.3.3 Irregular Supply of GMP-Grade Allergen Source Materials

- 4.3.4 Regulatory Uncertainty For Novel Adjuvants & Delivery Systems

- 4.4 Porter's Five Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Immunotherapy Type

- 5.1.1 Subcutaneous Immunotherapy (SCIT)

- 5.1.2 Sublingual Immunotherapy (SLIT) - Drops

- 5.1.3 Sublingual Immunotherapy (SLIT) - Tablets

- 5.1.4 Epicutaneous Immunotherapy (EPIT)

- 5.1.5 Oral Immunotherapy (OIT)

- 5.2 By Allergy Type

- 5.2.1 Allergic Rhinitis

- 5.2.2 Allergic Asthma

- 5.2.3 Food Allergy

- 5.2.4 Venom Allergy

- 5.2.5 Atopic Dermatitis

- 5.2.6 Others

- 5.3 By Formulation

- 5.3.1 Injectable Suspensions

- 5.3.2 Sublingual Drops

- 5.3.3 Sublingual Tablets

- 5.3.4 Transdermal Patches

- 5.4 By Distribution Channel

- 5.4.1 Direct-to-Physician Sales

- 5.4.2 Retail & Hospital Pharmacies

- 5.4.3 E-commerce / Mail-Order

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 ALK-Abello A/S

- 6.3.2 Stallergenes Greer

- 6.3.3 Allergy Therapeutics plc

- 6.3.4 HAL Allergy Group

- 6.3.5 Torii Pharmaceutical Co., Ltd.

- 6.3.6 Adamis Pharmaceuticals

- 6.3.7 DBV Technologies

- 6.3.8 Prota Therapeutics

- 6.3.9 Aimmune Therapeutics (Nestle)

- 6.3.10 LETI Pharma

- 6.3.11 HollisterStier Allergy (Jubilant Pharma)

- 6.3.12 Biomay AG

- 6.3.13 Inmunotek S.L.

- 6.3.14 Circassia Group

- 6.3.15 ALK-Scherax

- 6.3.16 Allergy Solutions

- 6.3.17 Tunitas Therapeutics

- 6.3.18 Camallergy

- 6.3.19 Merck KGaA (Allergopharma)

- 6.3.20 AnaptysBio

- 6.3.21 Allovate Therapeutics

- 6.3.22 Vida Pharmaceuticals

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment