PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842531

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842531

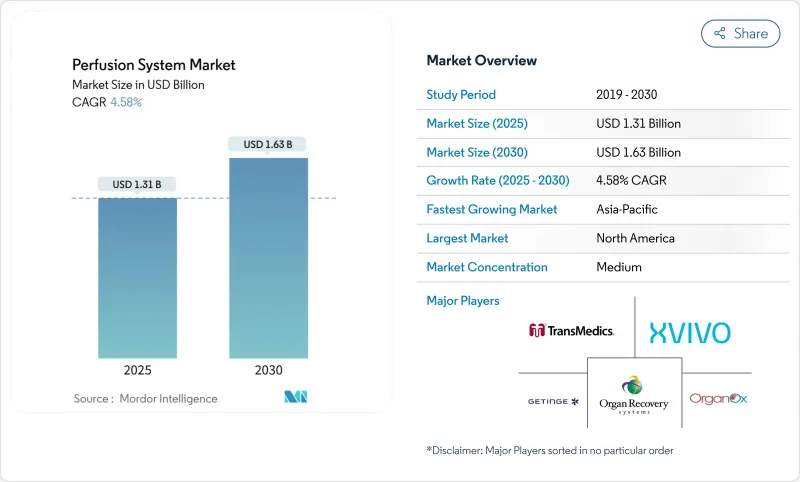

Perfusion System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The perfusion system market is valued at USD 1.31 billion in 2025 and is forecast to reach USD 1.63 billion by 2030, reflecting a steady 4.58% CAGR.

The current expansion mirrors the sector's shift from experimental preservation toward standardized clinical use, supported by converging regulations and an urgent push to use every viable donor organ. Demand scales further as transplantation programs adopt machine perfusion technologies that keep organs close to physiologic conditions, enabling longer preservation windows and broader donor eligibility. Growing reliance on real-time analytics, wider clinical guidelines, and strategic acquisitions by leading vendors all raise the innovation bar and intensify competition. At the same time, device costs, uneven reimbursement, and a persistent shortage of trained perfusionists restrain adoption, especially in emerging economies where healthcare budgets are under pressure.

Global Perfusion System Market Trends and Insights

Rising demand for organ transplantation

More than 103,000 people remain on the U.S. transplant waiting list, with a new registration every 8 minutes, underscoring the relentless supply-demand gap that machine perfusion aims to close.Organ shortage pressures mount further as chronic diseases enlarge the eligible recipient pool faster than donor numbers can keep up. The Increasing Organ Transplant Access Model incentivizes U.S. hospitals to scale surgery volumes, embedding perfusion technology into routine protocols.These factors keep long-term demand for advanced systems high and stable.

Increasing prevalence of cardiovascular & respiratory diseases

Escalating rates of liver cirrhosis, chronic obstructive pulmonary disease and heart failure expand candidate lists and complicate donor organ quality. Asia-Pacific carries roughly 75% of global chronic Hepatitis B infections, feeding a pipeline of liver transplant demand. Machine perfusion allows metabolic assessment during storage, enabling surgeons to accept marginal livers, hearts and lungs that once failed static cold criteria. Integration of AI algorithms by leading centers further sharpens viability decisions, reducing discard rates and enlarging the effective donor pool.

High cost of perfusion devices & transplantation procedures

A kidney procurement in the United States averages USD 35,427 with overhead exceeding 60% of that total; advanced devices raise costs further through single-use circuits and longer machine times.Liver transplant charges continue to climb, reflecting extra logistics and staffing tied to perfusion protocols. Budget-sensitive centers in Latin America, Africa and parts of Asia delay adoption until capital grants or donor programs offset outlays.

Other drivers and restraints analyzed in the detailed report include:

- Rising government & NGO initiatives for organ donation

- Adoption of perfusion for marginal/extended-criteria donor organs

- Diverse regulatory & reimbursement barriers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hypothermic machine perfusion generated 54.23% of total 2024 revenue, underlining its deep clinical roots and multi-organ validation. Historically favored for kidneys and livers, hypothermic protocols cut delayed graft function and shorten ICU stays, helping hospitals justify the investment. The perfusion system market sees normothermic platforms accelerating at a 7.24% CAGR as physicians value the chance to monitor lactate, bile production and hemodynamics in real time. Early data from a leading U.S. center indicate a potential 14% rise in annual liver transplant volume after integrating normothermic protocols, hinting at broader clinical impact. Portable systems that maintain physiologic temperature during air transport remove the six-hour heart-transport ceiling, letting surgeons accept grafts from farther afield and thereby easing urban-rural access disparities.

The Cleveland Clinic successfully transplanted 15 out of 21 livers once deemed unsuitable, demonstrating practical gains in organ yield. Simultaneously, hypothermic oxygenated perfusion (HOPE) shows lungs can remain viable up to 20 hours with no rejections reported in pilot cohorts. As vendors release dual-temperature consoles capable of both modes, purchasing committees weigh one-machine flexibility against higher upfront price tags. Over the next five years, hybrid consoles are likely to capture share, especially at high-volume transplant hubs that process multiple organ types daily.

The Perfusion System Market Report is Segmented by Technology (Normothermic Machine Perfusion, Hypothermic Machine Perfusion and More), Organ Type (Heart, Lung, Kidney, Liver, Pancreas and More), End User (Transplant Centers, Hospitals and Academic & Research Institutes) and Geography (North America, Europe, Asia Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 34.87% of global revenue in 2024, benefiting from a robust reimbursement ecosystem and the Organ Procurement and Transplantation Network's target of 60,000 procedures by 2026. The perfusion system market size for the region is supported by Medicare models that reward volume growth and drive near-universal adoption at Level I centers. TransMedics' Organ Care System underpins much of this surge, with company revenue up 64% year-on-year and ambitions to reach 10,000 U.S. deployments annually by 2028.

Europe maintains consistent uptake as cross-border sharing via the FOEDUS portal eases organ flow, and MDR transitional rules, though complex, ultimately harmonize technical dossiers across 27 member states. The European Society for Organ Transplantation's advanced-therapy roadmap likewise removes ambiguity for combination products, giving vendors clearer guidance. Companies such as Paragonix and OrganOx secure CE marks and Health Canada approvals, then roll out commercial launches in Germany, France and the Nordics where centralized procurement agencies fund capital upgrades.

Asia-Pacific registers the fastest 8.12% CAGR through 2030 as governments build transplant capacity and disease prevalence swells the candidate list. India completed the world's third-largest number of surgeries in 2023 but could meet less than 10% of its kidney demand, underlining the need for technologies that salvage marginal grafts. China, Japan and South Korea invest in portable perfusion fleets that connect rural donor hospitals to urban transplant centers within clinically acceptable timelines. Australia's National Organ Matching System, integrated with AI-enabled analytics, likewise depends on real-time perfusion data to optimize allocation. In Southeast Asia, pilot public-private partnerships subsidize device leases, accelerating first-time adoption at tertiary hospitals.

- TransMedics Group Inc.

- Organ Recovery Systems

- Xvivo Perfusion

- Organox

- Getinge (Paragonix Technologies Inc.)

- Bridge to Life Ltd.

- Organ Assist BV

- Waters Medical Systems

- Preservation Solutions Inc.

- Institut Georges Lopez (ISOT) SA

- EBERS Medical Technology SL

- Shenzhen Lifotronic Technology Co. Ltd.

- Genus Medical Technologies LLC

- Terumo

- Medtronic

- LivaNova

- Nanjing Biolight Meditech Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand For Organ Transplantation

- 4.2.2 Increasing Prevalence Of Cardiovascular & Respiratory Diseases

- 4.2.3 Rising Government & NGO Initiatives For Organ Donation

- 4.2.4 Adoption Of Perfusion For Marginal/Extended-Criteria Donor Organs

- 4.2.5 AI-Driven Real-Time Perfusion Analytics Improving Organ Utilization

- 4.2.6 Inclusion Of Normothermic And Hypothermic Machine Perfusion In Emerging International Transplant-Care Guidelines

- 4.3 Market Restraints

- 4.3.1 High Cost Of Perfusion Devices & Transplantation Procedures

- 4.3.2 Diverse Regulatory & Reimbursement Barriers

- 4.3.3 Cross-Border Organ-Logistics Bottlenecks

- 4.3.4 Scarcity Of Specialized Perfusionists And 24/7 Transplant-Team Staffing

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technology Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Technology

- 5.1.1 Normothermic Machine Perfusion

- 5.1.2 Hypothermic Machine Perfusion

- 5.1.3 Normothermic Regional Perfusion

- 5.1.4 Next-gen Portable Perfusion Platforms

- 5.2 By Organ Type

- 5.2.1 Heart

- 5.2.2 Lung

- 5.2.3 Kidney

- 5.2.4 Liver

- 5.2.5 Pancreas

- 5.2.6 Composite Tissue (VCA)

- 5.3 By End User

- 5.3.1 Transplant Centers

- 5.3.2 Hospitals

- 5.3.3 Academic & Research Institutes

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 TransMedics Group Inc.

- 6.3.2 Organ Recovery Systems Inc.

- 6.3.3 XVIVO Perfusion AB

- 6.3.4 OrganOx Limited

- 6.3.5 Getinge (Paragonix Technologies Inc.)

- 6.3.6 Bridge to Life Ltd.

- 6.3.7 Organ Assist BV

- 6.3.8 Waters Medical Systems LLC

- 6.3.9 Preservation Solutions Inc.

- 6.3.10 Institut Georges Lopez (ISOT) SA

- 6.3.11 EBERS Medical Technology SL

- 6.3.12 Shenzhen Lifotronic Technology Co. Ltd.

- 6.3.13 Genus Medical Technologies LLC

- 6.3.14 Terumo Corporation

- 6.3.15 Medtronic PLC

- 6.3.16 LivaNova PLC

- 6.3.17 Nanjing Biolight Meditech Co., Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment