PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842533

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842533

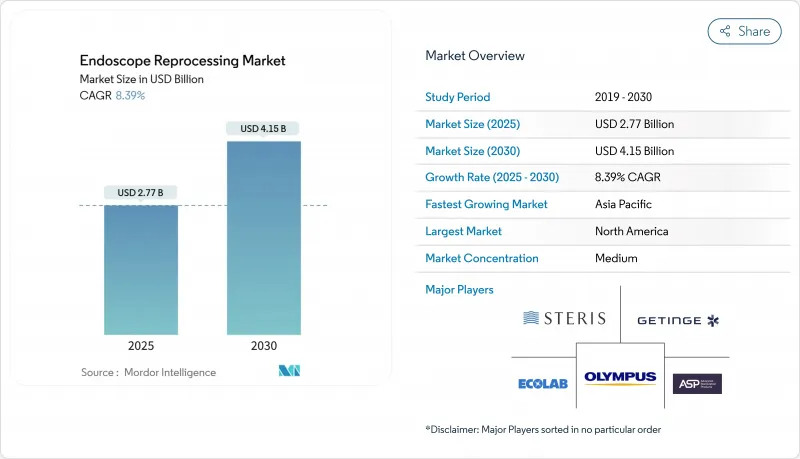

Endoscope Reprocessing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The endoscope reprocessing market was valued at USD 2.77 billion in 2025 and is forecast to reach USD 4.15 billion by 2030, reflecting an 8.39% CAGR over 2025-2030.

This expansion underscores the central role of the endoscope reprocessing market in curbing healthcare-associated infections through rigorous cleaning, disinfection, and sterilization of reusable scopes. Strong procedure growth, particularly in gastrointestinal (GI) and pulmonology suites, keeps demand elevated for consumables, automated reprocessors, and drying cabinets. Hospitals and ambulatory surgery centers (ASCs) are upgrading from high-level disinfection to sterilization following updated AAMI and ASGE guidance. At the same time, single-use scopes gain traction where reprocessing complexity remains high. Vendors respond with liquid chemical sterilization systems that shorten cycle times and with digitally enabled traceability platforms that log every stage of the cleaning workflow. Capital purchases are most pronounced in North America and Western Europe, whereas emerging Asia Pacific markets focus on high-volume, cost-efficient solutions.

Global Endoscope Reprocessing Market Trends and Insights

Rising Endoscopy Procedures: Aging Demographics Fuel Demand

An expanding elderly population and broader cancer-screening guidelines are driving double-digit increases in GI and respiratory scope use, giving the endoscope reprocessing market sustained tailwinds. More than 20 million GI examinations are performed annually in the United States alone, according to a 2024 meta-analysis. Higher procedural throughput obliges facilities to invest in additional reprocessing capacity, rapid turnaround detergents and leak-testing tools that uphold sterility for every cycle.

Minimally Invasive Surgery: Scope Turnover Drives Reprocessing Innovation

Ambulatory surgery centers rely on tight scheduling and quick scope turnaround to remain profitable. A LEAN workflow pilot cut waiting-room time by 48.8% and reduced total facility time by 12%. These gains highlight why the endoscope reprocessing market increasingly favors fully automated washers, drying cabinets and real-time tracking software that shorten bottlenecks without compromising infection-control protocols.

Workforce Challenges: Technician Shortages Impede Implementation

Effective cleaning demands specialized knowledge of scope architecture and channel brushing techniques. Yet many hospitals struggle to recruit and retain certified staff, with error-prone steps contributing to notable contamination events. Although automation offsets some manual tasks, qualified personnel remain indispensable for inspection, trouble-shooting and quality assurance across the endoscope reprocessing market.

Other drivers and restraints analyzed in the detailed report include:

- Infection-Control Standards: Regulatory Pressure Transforms Practices

- Automated Reprocessing: Technology Reduces Human Error

- Cost Barriers: Financial Constraints Limit Technology Adoption

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

High-level disinfectants and indicator strips hold a 32.26% endoscope reprocessing market share in 2024, reflecting the historical reliance on chemical HLD for flexible scopes. Novel enzymatic detergents that eliminate rinse steps now save nearly 25 L of water and cut manual cleaning time by 15%. Yet outbreaks linked to residual biofilm are steering infection-control committees toward sterilants such as vaporized hydrogen peroxide and peracetic acid. This shift boosts demand for integrated washer-sterilizers that complete validated cycles without operator adjustment, a key performance criterion as accreditation audits intensify.

Automated endoscope reprocessors are the fastest-growing product group at a 10.82% CAGR, propelling the overall endoscope reprocessing market. Vendors emphasize closed-loop documentation, RFID tagging and cloud-based analytics that record every scope serial number, cycle parameters and leak-test result. Drying and storage cabinets also gain prominence; systems such as WASSENBURG DRY 320 preserve microbiological quality for 30 days under HEPA-filtered airflow. Together, these products help facilities demonstrate compliance and reduce costly re-processing failures.

Flexible endoscopes commanded 71.83% of 2024 revenue, underpinning the current endoscope reprocessing market size at the modality level. Owing to their reach and articulation, they remain indispensable across GI, respiratory, ENT, and urology suites. However, their complexity makes them vulnerable to channel debris. Structured borescope inspections and fluorescence markers are thus being adopted to affirm cleaning efficacy.

Robot-assisted endoscopes are projected to rise 11.65% annually through 2030, carving new opportunities in the endoscope reprocessing market. Two-armed robotic colonoscopes and multi-visceral surgical robots promise enhanced ergonomics and autonomy. Their adoption will demand dedicated washer racks, protocol modifications, and staff retraining. Rigid scopes retain a stable niche for arthroscopy and laparoscopy, benefiting from simpler lumens that sterilize reliably in steam autoclaves.

The Endoscope Reprocessing Market Report is Segmented by Product (High-Level Disinfectants and Test Strips, Detergents and Enzymatic Wipes, AER [Single-Basin and Dual-Basin], and More), Endoscope Modality (Flexible Endoscopes and More), Application (Gastrointestinal Endoscopy and More), End-User (Hospitals and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 40.85% of 2024 revenue, supported by high procedural volumes and rigorous oversight from the FDA, CDC and accreditation bodies. A spotlight on infection outbreaks at leading centers has intensified demand for traceable, automated workflows and for vaporized hydrogen peroxide cabinets capable of sterilizing duodenoscopes within 35 minutes. Regional growth is projected at an 8.02% CAGR through 2030, with spending tilted toward data-rich reprocessors, borescope inspection cameras, and disposable duodenoscopes for high-risk ERCP cases.

Asia-Pacific is the fastest-expanding territory, anticipated to advance 10.76% annually. India's medical-device roadmap seeks USD 50 billion in sector output by 2030, with endoscopy systems and ancillary reprocessing devices eligible for production incentives. China, Japan, and South Korea allocate capital to negative-pressure drying cabinets and channel-specific leak testers, while resource-limited Pacific Islands confront shortages of purified water and certified technicians.

Europe commands roughly 30% of the endoscope reprocessing market, posting an 8.25% CAGR projection to 2030. EU surveillance attributes more than 3.5 million healthcare-associated infections to reusable devices each year. NHS contracts exceeding GBP 250,000 awarded in 2024 reflect hospital moves to validate decontamination equipment and ensure scope-level traceability. The Middle East & Africa and South America follow with moderate growth as tertiary centers modernize CSSD units and adopt AERs capable of handling mixed scope inventories without repeated chemical changes.

- Advanced Sterilization Products Services Inc

- ARC Group of Companies Inc.

- Belimed

- BES Healthcare Ltd

- Creo Medical GmbH

- Ecolab

- Envista Holdings (Metrex Research)

- Getinge

- HOYA Corporation (Pentax Medical)

- Matachana Group

- Olympus

- Shinva Medical Instrument Co.

- Steelco

- STERIS

- UV Smart BV

- Wassenburg Medical B.V.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising endoscopy procedures due to gastrointestinal disorders and cancers

- 4.2.2 Increasing adoption of minimally invasive surgeries and daily scope turnover demands

- 4.2.3 Tightening infection-control and accreditation standards mandating validated reprocessing cycles

- 4.2.4 Advances in automated reprocessors that cut turnaround time and errors

- 4.2.5 Growing demand for single-use endoscopic accessories with compatible disinfectants

- 4.2.6 Expanding outpatient and ambulatory surgery center adoption of endoscopic procedures

- 4.3 Market Restraints

- 4.3.1 Shortage of certified endoscope reprocessing technicians and high turnover rates

- 4.3.2 High upfront and lifecycle costs for automated reprocessing systems and drying cabinets

- 4.3.3 Safety concerns with residual contamination in complex duodenoscopes

- 4.3.4 Frequent audits and documentation cause high consumable costs and workflow disruptions

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 High-Level Disinfectants & Test Strips

- 5.1.2 Detergents & Enzymatic Wipes

- 5.1.3 Automated Endoscope Reprocessors (AER)

- 5.1.3.1 Single-basin

- 5.1.3.2 Dual-basin

- 5.1.4 Manual Cleaning Stations

- 5.1.5 Endoscope Drying, Storage & Transport Cabinets

- 5.1.6 Others

- 5.2 By Endoscope Modality

- 5.2.1 Flexible Endoscopes

- 5.2.2 Rigid Endoscopes

- 5.2.3 Robot-Assisted Endoscopes

- 5.3 By Application

- 5.3.1 Gastro-intestinal Endoscopy

- 5.3.2 Pulmonology & Bronchoscopy

- 5.3.3 Urology & Gynaecology

- 5.3.4 ENT & Laparoscopy

- 5.4 By End-User

- 5.4.1 Hospitals

- 5.4.2 Ambulatory Surgery Centres (ASC)

- 5.4.3 Other End-Users

- 5.5 By Geography (Value)

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Product Portfolio Analysis

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Advanced Sterilization Products Services Inc

- 6.4.2 ARC Group of Companies Inc.

- 6.4.3 Belimed AG

- 6.4.4 BES Healthcare Ltd

- 6.4.5 Creo Medical GmbH

- 6.4.6 Ecolab Inc.

- 6.4.7 Envista Holdings (Metrex Research)

- 6.4.8 Getinge AB

- 6.4.9 HOYA Corporation (Pentax Medical)

- 6.4.10 Matachana Group

- 6.4.11 Olympus Corporation

- 6.4.12 Shinva Medical Instrument Co.

- 6.4.13 Steelco S.p.A.

- 6.4.14 STERIS plc

- 6.4.15 UV Smart BV

- 6.4.16 Wassenburg Medical B.V.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment