PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842535

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842535

Oxygen Therapy Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

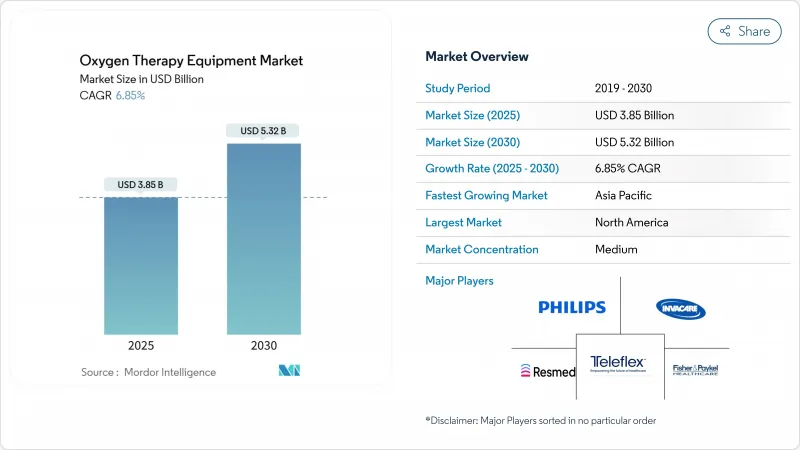

The oxygen therapy equipment market generated USD 3.85 billion in 2025 and is forecast to reach USD 5.32 billion by 2030, advancing at a 6.85% CAGR.

Growth is propelled by the rising global burden of chronic respiratory diseases, rapid device miniaturization, sustained investment in home healthcare, and supportive reimbursement frameworks. Intensifying product recalls and exits by prominent manufacturers are widening supply gaps that agile competitors are filling, while IoT-enabled monitoring is redefining care pathways across acute and chronic settings. At the same time, evolving regulatory regimes and component-level supply chain vulnerabilities are shaping competitive strategies and capital allocation priorities. Heightened clinical demand for portable concentrators, telehealth integration, and advanced battery chemistries underscores the market's pivot toward patient-centric, data-driven respiratory care solutions.

Global Oxygen Therapy Equipment Market Trends and Insights

Rising COPD & Other Respiratory Disease Prevalence

The escalating incidence of COPD, asthma, and interstitial lung diseases is a critical demand driver for the oxygen therapy equipment market. Nearly 90% of COPD-related deaths occur in low- and middle-income countries, underscoring unmet therapeutic needs . Environmental pollution accounts for 41.79% of COPD risk factors among younger cohorts, while smoking contributes 19.81%, indicating structural demand independent of tobacco trends. As global populations age, prevalence rises in tandem, particularly across Asia-Pacific economies experiencing rapid demographic shifts.

Shift Toward Home-Based Oxygen Therapy & Portable Devices

Cost-containment imperatives and patient preference for independence are accelerating the transition from facility-based to home-based therapy. US home healthcare expenditures for 3 million Medicare beneficiaries totaled USD 125.2 billion in 2024. The Home Health Value-Based Purchasing Model now links payments to quality outcomes, stimulating adoption of connected portable concentrators that support real-time monitoring. Inogen's Rove 4-which delivers 840 ml/min oxygen at under 1.36 kg-exemplifies how design advances eliminate mobility barriers.

Stringent Global Regulatory Approvals & Compliance Costs

The European Union Medical Device Regulation (EU 2017/745) mandates broader clinical evidence, post-market surveillance, and Unique Device Identification by 2027-2028, materially escalating compliance spending . Smaller manufacturers face disproportionate burdens, potentially hastening consolidation. In the United States, the FDA's updated medical gas regulations effective December 2025 revise CGMP standards and safety reporting obligations, adding documentation layers for oxygen suppliers .

Other drivers and restraints analyzed in the detailed report include:

- Rapid Device Miniaturization & IoT-Enabled Monitoring

- Next-Gen Lithium-Sulfur Batteries Enabling Ultra-Light POCs

- High Capital/Reimbursement Burden for Long-Term Therapy

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Oxygen Source Equipment held 65.35% of the oxygen therapy equipment market share in 2024. Concentrators drive this segment through pressure-swing adsorption efficiency gains, while liquid systems cater to high-purity therapeutic niches. Compressed cylinders remain vital for emergency back-up, particularly in EMS fleets. The oxygen therapy equipment market size for delivery devices is refining at a 7.25% CAGR, fueled by patient comfort innovations such as Fisher & Paykel's F&P Nova Nasal mask with integrated humidity control. Smart cannulas fitted with saturation sensors relay adherence data, improving regulatory compliance with emerging quality-of-life metrics.

Supporting this shift, concentric supply disruptions-most notably Philips Respironics' 2024 discontinuation of 19 respiratory SKUs-have encouraged hospitals and distributors to dual-source delivery interfaces. Rapid regulatory approvals for alternative interfaces accelerated portfolio diversification. Digital fit-testing, 3-D-printed adapter options, and antimicrobial tubing coatings have entered mainstream procurement discussions across US hospital groups.

Stationary concentrators still captured 53.82% of the oxygen therapy equipment market size in 2024 even as consumer discourse focuses on portability. Reliability and continuous high-flow capabilities suit severe hypoxemic COPD patients, and payers often reimburse these devices preferentially under capped rental models. Recent releases like Caire's IntenOxy 5 deliver 95.5% purity at 5 LPM while drawing under 330 W, reducing electricity costs for seniors on fixed incomes. Manufacturers also add smart-grid interfaces to balance residential power loads and claim sustainability credits.

Portable devices account for the remaining share but post the market's fastest absolute revenue gains. The oxygen therapy equipment market demonstrates 8.9% CAGR for ultra-portable devices as battery energy densities climb, extending run-time beyond 6 hours at pulse setting 3. Companies are bundling service subscription models that cover consumables, firmware upgrades, and telemonitoring analytics. Integrators experiment with modular ecosystems pairing a bedside station with a backpack-size concentrator using interchangeable sieve cartridges, ensuring continuity during travel or outages.

The Report Covers Global Oxygen Therapy Device Market Share and Size. The Market is Segmented by Product (Oxygen Source Equipment and More), Portability (Stationary Devices and Portable Devices), Application (Asthma, Obstructive Sleep Apnea, Chronic Obstructive Pulmonary Disorder (COPD), and More), End User (Hospitals and Home Healthcare) and Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 43.62% of 2024 revenue, supported by robust reimbursement systems, high COPD prevalence, and mature distribution networks. The FDA's December 2025 medical gas mandate intensifies audit preparation among US manufacturers, while Canada's federal-provincial drug plans continue to integrate portable concentrator benefits. Mexico's Seguro Popular expansion drives localized assembly partnerships to reduce import duties.

Asia-Pacific is the fastest-growing territory, posting 9.14% CAGR thanks to healthcare spending growth, universal insurance rollouts, and aging demographics. China's medical device market is projected to reach USD 138 billion by 2027. Though COPD prevalence is stabilizing, absolute patient volumes remain huge. India witnesses double-digit demand growth as public-private partnerships upgrade district hospitals with oxygen plants. Japanese and South Korean suppliers leverage domestic R&D to export connected concentrators across ASEAN markets, while Australian telehealth frameworks accelerate cross-border RPM adoption.

Europe maintains steady growth underpinned by MDR-compliant product refresh cycles and aging populations. Germany's sickness funds reimburse portable concentrators when paired with adherence-monitoring apps, boosting smart device uptake. The United Kingdom's NHS Community Oxygen Service deploys remote titration pilots aimed at reducing clinic visits. Southern European economies align procurement criteria with EU medical gas standards, expanding opportunities for value-focused vendors.

The Middle East & Africa region records double-digit growth from a low base as governments establish pressure swing adsorption plants following COVID-19 shortages. MedAccess and development banks finance manufacturing hubs to localize sieve production, enhancing regional self-sufficiency. Latin America's trajectory is mixed: Brazil's Unified Health System rolls out oxygen concentrators to secondary hospitals, yet currency volatility challenges importer margins in Argentina and Colombia.

- Koninklijke Philips

- Caire

- Invacare

- Drive DeVilbiss Healthcare

- Resmed

- Fisher & Paykel Healthcare

- Teleflex

- Smiths Group

- Linde Healthcare

- Dragerwerk

- Chart Industries (AirSep)

- Inogen Inc.

- Nidek Medical Products

- Air Liquide

- Allied Healthcare Products

- GCE Group

- Hersill S.L.

- TECNO-GAZ

- OxyGo LLC

- BPL

- Precision Medical

- Besco Medical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising COPD & Other Respiratory Disease Prevalence

- 4.2.2 Shift Toward Home-Based Oxygen Therapy & Portable Devices

- 4.2.3 Rapid Device Miniaturisation & Iot-Enabled Monitoring

- 4.2.4 Next-Gen Lithium-Sulfur Batteries Enabling Ultra-Light Pocs

- 4.2.5 Stricter Hospital Accreditation Standards

- 4.2.6 Telehealth-Integrated Remote Oxygen Management Demand

- 4.3 Market Restraints

- 4.3.1 Stringent Global Regulatory Approvals & Compliance Costs

- 4.3.2 High Capital/Reimbursement Burden For Long-Term Therapy

- 4.3.3 Supply-Chain Fragility Of Zeolite Molecular-Sieves

- 4.3.4 Rising Fire-Safety & Insurance Restrictions In Home Use

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Product

- 5.1.1 Oxygen Source Equipment

- 5.1.1.1 Oxygen Cylinders

- 5.1.1.2 Oxygen Concentrators

- 5.1.1.3 Liquid Oxygen Devices

- 5.1.1.4 Others

- 5.1.2 Oxygen Delivery Devices

- 5.1.2.1 Oxygen Masks

- 5.1.2.2 Nasal Cannula

- 5.1.2.3 Venturi Masks

- 5.1.2.4 Non-Rebreather Masks

- 5.1.2.5 Others

- 5.1.1 Oxygen Source Equipment

- 5.2 By Portability

- 5.2.1 Stationary Devices

- 5.2.2 Portable Devices

- 5.3 By Application

- 5.3.1 Asthma

- 5.3.2 Obstructive Sleep Apnea

- 5.3.3 Chronic Obstructive Pulmonary Disease (COPD)

- 5.3.4 Respiratory Distress Syndrome

- 5.3.5 Others

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Home Healthcare

- 5.4.3 Ambulatory Surgical Centers

- 5.4.4 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.3.1 Koninklijke Philips N.V.

- 6.3.2 CAIRE Inc.

- 6.3.3 Invacare Corporation

- 6.3.4 Drive DeVilbiss Healthcare

- 6.3.5 ResMed

- 6.3.6 Fisher & Paykel Healthcare

- 6.3.7 Teleflex Incorporated

- 6.3.8 Smiths Medical

- 6.3.9 Linde Healthcare

- 6.3.10 Dragerwerk AG & Co. KGaA

- 6.3.11 Chart Industries (AirSep)

- 6.3.12 Inogen Inc.

- 6.3.13 Nidek Medical Products

- 6.3.14 Air Liquide Healthcare

- 6.3.15 Allied Healthcare Products

- 6.3.16 GCE Group

- 6.3.17 Hersill S.L.

- 6.3.18 TECNO-GAZ SpA

- 6.3.19 OxyGo LLC

- 6.3.20 BPL Medical Technologies

- 6.3.21 Precision Medical Inc.

- 6.3.22 Besco Medical

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment