PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842538

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842538

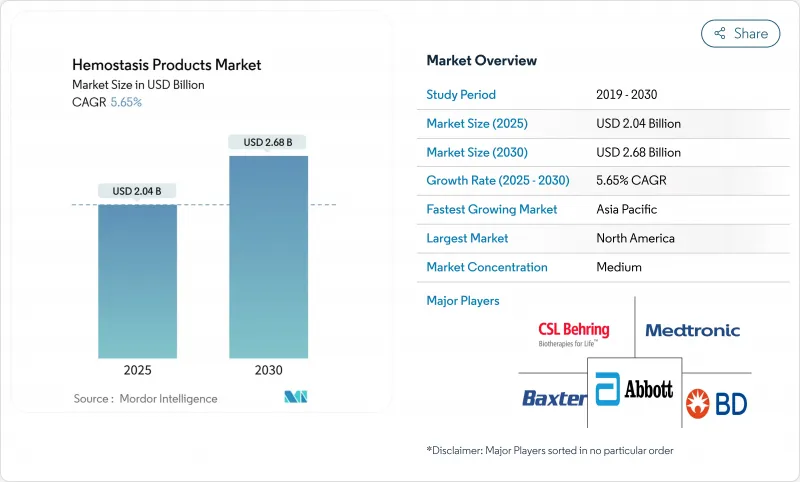

Hemostasis Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The hemostasis products market reached USD 2.04 billion in 2025 and is forecast to advance to USD 2.68 billion by 2030, translating into a 5.65% CAGR.

Steady demand for rapid bleeding control in trauma, emergency care, and minimally invasive surgery is shifting the Hemostasis products market toward synthetic and active agents that shorten procedure time and reduce transfusion needs. Regulatory greenlights for next-generation solutions-such as FDA-cleared Traumagel for severe bleeding-confirm a robust clinical pipeline and accelerate product launches. Hospitals are prioritizing agents with proven operating-room efficiency, while surgeons favour liquid and spray formats that deliver precise coverage in confined fields. Consolidation among large med-tech firms seeking full-spectrum bleeding management portfolios underlines the strategic value of differentiated technology. Meanwhile, policymakers have begun scrutinising supply resilience after hurricane-linked shortages exposed the fragility of single-site manufacturing for critical inputs.

Global Hemostasis Products Market Trends and Insights

Rising Volume of Trauma & Surgical Procedures

Global surgical caseload is climbing, with South Asia alone facing a 1.6 billion patient access deficit that is now a policy priority. Updated damage-control resuscitation guidelines place hemorrhage control ahead of airway management, cutting exsanguination mortality by 65% and expanding front-line demand for rapid topical agents. Military field medicine-particularly the Joint Trauma System-has normalised early blood-product use, and its protocols are diffusing into civilian trauma networks. These changes enlarge the Hemostasis products market by embedding bleeding control into every step of patient management, from roadside triage to advanced operating suites. Suppliers offering integrated kits that combine diagnostics, topical gels, and factor concentrates will capture hospitals seeking streamlined procurement.

Rapid Product Innovation in Topical & Advanced Hemostats

Self-assembling peptide hydrogels reach hemostasis in seconds, remain transparent for visualisation, and avoid pathogen transmission risks tied to animal tissue. Sequential-crosslinking fibrin glues form dual-network seals within 15 seconds, outperforming legacy fibrin sealants that need minutes to polymerise. Covalently reactive microparticles create fortified clots even under arterial pressure, achieving sub-20-second control in preclinical models. FDA clearance of plant-derived Traumagel validates the commercial pathway for biomimetic actives. This innovation wave lifts the Hemostasis products market by replacing slow, plasma-based agents with agile formulations that integrate seamlessly into modern surgical workflows.

Stringent Global Regulatory & Reimbursement Hurdles

The FDA recently shifted viscoelastic coagulation analysers into Class II, adding quality-system and clinical-data burdens for device makers. Europe's Medical Device Regulation has lengthened review queues, delaying small-company launches and tilting the Hemostasis products market toward incumbents with regulatory infrastructure. Payment reform is equally challenging; new CMS bundling rules could narrow coverage for autologous blood-derived dressings, forcing hospitals to justify premium spend through hard outcomes.

Other drivers and restraints analyzed in the detailed report include:

- Growing Adoption of Minimally Invasive & Robotic Surgeries

- Aging Population-Linked Comorbidities Expanding Target Pool

- High Cost of Active Sealants in Low-Resource Settings

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Infusible therapies retained 35.55% of the Hemostasis products market share in 2024 because factor concentrates remain essential during major bleeds and hemophilia management. Demand, however, is plateauing as gene therapy and FXIa inhibitors progress. The Hemostasis products market is pivoting toward synthetic and biomimetic active sealants that address performance gaps in speed, adhesion, and immunogenicity.

Advanced offerings are projected to grow at 10.25% CAGR through 2030, setting the pace for market expansion. FDA approval of VISTASEAL and plant-based Traumagel illustrates regulatory willingness to endorse novel actives. Competitive intensity is rising as multinationals acquire start-ups for technology access, with Stryker's USD 4.9 billion Inari acquisition broadening peripheral vascular reach.

Liquid and spray formats captured 38.53% of 2024 revenues, reflecting surgeon preference for no-mix systems that can be deployed through laparoscopic ports or robotic arms. This slice of the Hemostasis products market size benefits from delivery-device innovation, including battery-powered applicators that modulate flow rates for complex anatomy.

Matrix-gel systems are advancing at 8.15% CAGR as sequential-crosslinking chemistries deliver 15-second seals even on moist tissue. Instantly adhesive patches using ultra-elastic substrates extend the Hemostasis products industry to thoracic and cardiac repairs where organ motion frustrates traditional pads.

The Hemostasis Products Market Report is Segmented by Product (Topical Hemostasis, Infusible Hemostasis, and Advanced Hemostasis), Formulation (Matrix & Gel, Powder, and More), Application (Trauma, Surgery, Myocardial Infarction, and More), End User (Hospitals, Clinics, and More) and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 42.72% of 2024 revenues, a position reinforced by high surgical density, rigorous clinical-trial infrastructure, and sizeable defence R&D funding for synthetic blood programmes. FDA fast-track pathways and the Defence Production Act have together promoted domestic production resilience after supply shocks, helping stabilise regional availability of critical hemostats.

European markets continue to set safety benchmarks; EMA approvals for marstacimab and efanesoctocog alfa confirm the region's leadership in hemophilia therapeutics. Adoption varies, however, with southern economies scrutinising cost-effectiveness before broad rollout. Medical Device Regulation timelines favour firms with mature quality systems, encouraging partnerships between mid-caps and large strategics seeking contiguous portfolios.

Asia-Pacific is the fastest growing area of the Hemostasis products market as hospital infrastructure modernises and elective surgery backlogs unwind. Japan's announcement of a two-year shelf-life synthetic blood underscores regional innovation capability. South Asia's surgical access gap creates latent demand likely to unlock as universal health-coverage schemes expand. Local manufacturing incentives are attracting investment into plasma fractionation and peptide synthesis plants, reducing import reliance and diversifying global supply.

- Abbott Laboratories

- Baxter

- Becton Dickinson (BD)

- CSL Behring

- Grifols

- Johnson & Johnson

- Medtronic

- Pfizer

- Tricol Biomedical

- CryoLife

- Integra LifeSciences

- B. Braun

- Teleflex

- Zimmer Biomet

- Hemostasis

- Marine Polymer Technologies

- LifeBond Ltd.

- KitoTech Medical

- Arch Biomedical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Volume of Trauma & Surgical Procedures

- 4.2.2 Rapid Product Innovation In Topical & Advanced Hemostats

- 4.2.3 Growing Adoption of Minimally-Invasive & Robotic Surgeries

- 4.2.4 Aging Population-Linked Comorbidities Expanding Target Pool

- 4.2.5 Military Demand For Shelf-Stable Plasma & Synthetic Blood

- 4.2.6 Breakthrough Self-Assembling Peptide Gels For GI Bleeding

- 4.3 Market Restraints

- 4.3.1 Stringent Global Regulatory & Reimbursement Hurdles

- 4.3.2 High Cost Of Active Sealants In Low-Resource Settings

- 4.3.3 Fragile Biologic Supply Chains (Bovine/Porcine Thrombin)

- 4.3.4 FXIa Inhibitor Pipeline Cannibalizing Infusible Products

- 4.4 Porter's Five Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Topical Hemostasis (Collagen, ORC, Gelatin, Polysaccharides)

- 5.1.2 Infusible Hemostasis (FFP, Platelet Conc, Factor VIII, PCC)

- 5.1.3 Advanced Hemostasis (Flowable, Thrombin, Fibrin, Synthetic)

- 5.2 By Formulation

- 5.2.1 Matrix & Gel

- 5.2.2 Sponge & Pad

- 5.2.3 Powder

- 5.2.4 Liquid / Spray

- 5.3 By Application

- 5.3.1 Trauma

- 5.3.2 Surgery

- 5.3.3 Hemophilia

- 5.3.4 Myocardial Infarction

- 5.3.5 Thrombosis

- 5.3.6 Others

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Clinics & ASCs

- 5.4.3 Others

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 Baxter International

- 6.3.3 Becton Dickinson (BD)

- 6.3.4 CSL Behring

- 6.3.5 Grifols S.A.

- 6.3.6 Johnson & Johnson (Ethicon)

- 6.3.7 Medtronic plc

- 6.3.8 Pfizer Inc.

- 6.3.9 Tricol Biomedical

- 6.3.10 CryoLife Inc.

- 6.3.11 Integra LifeSciences

- 6.3.12 B. Braun Melsungen

- 6.3.13 Teleflex Inc.

- 6.3.14 Zimmer Biomet

- 6.3.15 Hemostasis LLC

- 6.3.16 Marine Polymer Technologies

- 6.3.17 LifeBond Ltd.

- 6.3.18 KitoTech Medical

- 6.3.19 Arch Biomedical

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment