PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842543

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842543

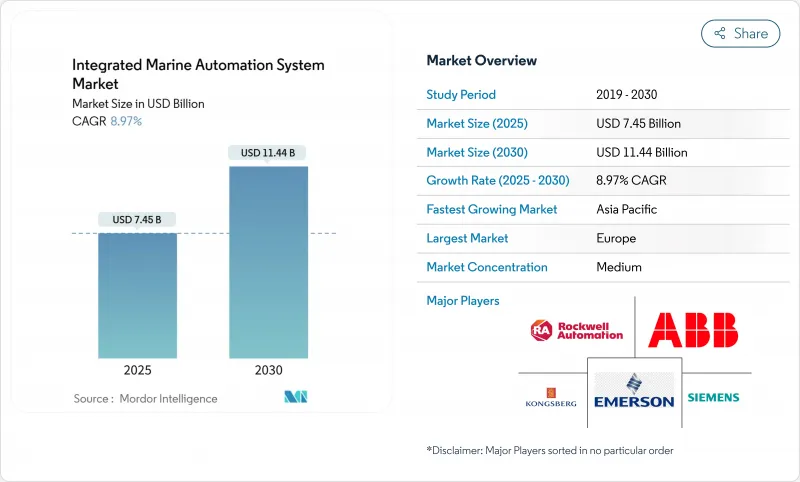

Integrated Marine Automation System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The integrated marine automation system market size is expected to be valued at USD 7.45 billion in 2025 and is forecast to reach USD 11.44 billion by 2030, registering a CAGR of 8.97%.

Rising demand for real-time vessel optimization, predictive maintenance, and autonomous operations is accelerating adoption across commercial and defense fleets. Regulatory pressure from the International Maritime Organization (IMO) on carbon-intensity reduction is creating compelling economics for digitalized platforms. Hardware still generates the bulk of revenue, yet software-centric analytics solutions are scaling rapidly as operators seek fuel savings, lower crew costs, and enhanced cybersecurity. Regionally, Europe retains leadership thanks to offshore wind activity and stringent environmental directives, while Asia-Pacific is gaining momentum on the back of shipbuilding capacity and seaborne trade expansion.

Global Integrated Marine Automation System Market Trends and Insights

IMO Energy-Efficiency Regulations Driving Digital Automation

Integrated marine automation system market participants are accelerating deployments to comply with the IMO Carbon Intensity Indicator and Energy Efficiency Existing Ship Index. Real-time power-management software, digital twins, and route-planning analytics allow fleets to shave fuel burn and meet the 40% carbon-intensity cut mandated for 2030. The EU-specific FuelEU Maritime Regulation advances the timeline further, forcing ships over 5,000 gross tonnage calling at European ports to reach a 2% greenhouse-gas intensity reduction by 2025, scaling to 80% by 2050. Early adopters report tangible savings, yet high integration costs and legacy-system compatibility remain barriers.

Volumetric Growth in Seaborne Trade

Global seaborne trade expanded 2.4% in 2023 and continues to benefit from elevated South-South flows, lifting demand for container tracking, predictive maintenance, and port automation. With international trade turnover projected to climb toward USD 34 trillion in 2025, terminals are investing in AI-enabled cargo-handling systems that synchronize vessel arrival, berth allocation, and hinterland logistics. While these upgrades alleviate congestion, they introduce new cybersecurity risks as operational technology becomes networked.

Vulnerability to Cyber-Attacks Through Digitalization

Intercepted VSAT traffic shows that unencrypted data still leaves many vessels exposed to chart manipulation and crew-data theft. Industrial control systems controlling propulsion and steering can be compromised remotely, prompting classification societies to introduce cyber-resilience notations. Operators must now budget for intrusion detection, network segmentation, and crew training alongside automation upgrades.

Other drivers and restraints analyzed in the detailed report include:

- Crew Cost Optimization Amid Seafarer Shortage

- Remote-Operated and Autonomous Vessels for Offshore-Wind Maintenance

- High Upfront Cost and Integration Complexity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware accounted for 62% of the integrated marine automation system market share in 2024, led by sensors, control modules, and navigation electronics that remain indispensable. Software revenues are rising faster, recording a 9.2% CAGR as operators deploy cloud-connected platforms for predictive maintenance, fuel-route optimization, and cyber monitoring. Control modules are incorporating edge-AI chips that execute autonomy algorithms on board, cutting reliance on intermittent satellite links. Meanwhile, analytics vendors monetize subscription-based dashboards that translate raw sensor feeds into actionable insights. The transformation shifts value creation from one-off hardware sales to recurring digital services, though heterogeneous legacy equipment complicates seamless data collection.

Vessel-management suites held 37.2% of integrated marine automation system market size in 2024 by unifying propulsion, navigation, and auxiliary controls under a single interface. However, analytics and predictive-maintenance solutions are outpacing at 9.7% CAGR as shipowners chase fuel savings and regulatory compliance. Power-management modules that balance main engines, batteries, and alternative-fuel systems reinforce decarbonization goals.

Digital twins enable operators to stress-test routing, propulsion, and cargo-load scenarios on shore before deployment, shortening decision cycles. Safety and security packages integrate radar, cameras, and cyber-threat intelligence to provide holistic risk visibility. Although demand is rising, the proliferation of proprietary protocols hinders interoperability, underscoring the need for open-architecture standards.

Integrated Marine Automation System Market is Segmented by Product Type (Hardware and Software), Solution (Vessel-Management Systems, Power-Management Systems, and More), Installation Type (New-Build and Retrofit/Upgrade), End User (Commercial and Defense), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe led the integrated marine automation system market with 31.7% revenue share in 2024, buoyed by offshore-wind vessel demand, advanced shipbuilding in Norway and the Netherlands, and strict environmental regulations. Norway's USD 360 million support program for zero-emission maritime technologies channels funds toward hydrogen and battery solutions that rely on sophisticated power-management automation. Major yards integrate automation during design, lowering lifecycle costs and easing compliance.

Asia-Pacific is the fastest-growing region, projected to expand at 10.2% CAGR through 2030. China accounts for nearly half of global new-build tonnage and is embedding automation to raise productivity and bridge labor shortages. Japan and South Korea differentiate through high-end LNG carriers and naval platforms requiring advanced control systems. Regional governments run digital-port initiatives that inject demand for shoreside monitoring and satellite-based navigation enhancement, further lifting the integrated marine automation system market.

North America ranks third but is critical for defense-driven automation. The U.S. Navy pursues unmanned surface and undersea vehicles, spurring domestic suppliers to develop cyber-hardened Integrated Platform Management Systems. Port authorities from Los Angeles to Halifax roll out AI berth-allocation systems and shore-power infrastructure. The Middle East and Africa remain nascent yet promising as Gulf states invest in smart-port projects and diversify into offshore wind, creating a long-run adoption curve.

- Kongsberg Gruppen

- ABB Group

- Wrtsil

- Siemens AG

- Emerson Electric Co.

- Rolls-Royce Power Systems (MTU)

- Rockwell Automation Inc.

- Honeywell Marine

- GE Power Conversion

- Schneider Electric

- Navis (Cargotec)

- Praxis Automation Technology

- Marine Technologies LLC

- Ulstein Group

- Jason Marine Group

- SMEC Automation

- Logimatic

- Sedni Marine Systems

- Hyundai Heavy Industries (Avikus)

- Damen Shipyards Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High growth in maritime tourism industry

- 4.2.2 Volumetric growth in seaborne trade

- 4.2.3 IMO energy-efficiency regulations driving digital automation

- 4.2.4 Crew cost optimisation amid seafarer shortage

- 4.2.5 Remote-operated and autonomous vessels for offshore-wind maintenance

- 4.2.6 Defence IPMS adoption for cyber-secure fleets

- 4.3 Market Restraints

- 4.3.1 Vulnerability to cyber-attacks through digitalisation

- 4.3.2 High upfront cost and integration complexity

- 4.3.3 Interoperability gaps among proprietary systems

- 4.3.4 Limited satellite bandwidth on remote routes

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Force Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assesment of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Hardware

- 5.1.1.1 Sensors and Field Devices

- 5.1.1.2 Control Modules

- 5.1.1.3 Navigation and Communication Systems

- 5.1.1.4 Others

- 5.1.2 Software

- 5.1.2.1 Integrated Platform-Management SW

- 5.1.2.2 Safety and Security SW

- 5.1.2.3 Analytics and Predictive-Maintenance SW

- 5.1.2.4 Others

- 5.1.1 Hardware

- 5.2 By Solution

- 5.2.1 Vessel-Management Systems

- 5.2.2 Power-Management Systems

- 5.2.3 Safety and Security Systems

- 5.2.4 Others

- 5.3 By Installation Type

- 5.3.1 New-build

- 5.3.2 Retrofit / Upgrade

- 5.4 By End User

- 5.4.1 Commercial

- 5.4.2 Defense

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Norway

- 5.5.3.5 Russia

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 UAE

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Kongsberg Gruppen

- 6.4.2 ABB Group

- 6.4.3 Wrtsil

- 6.4.4 Siemens AG

- 6.4.5 Emerson Electric Co.

- 6.4.6 Rolls-Royce Power Systems (MTU)

- 6.4.7 Rockwell Automation Inc.

- 6.4.8 Honeywell Marine

- 6.4.9 GE Power Conversion

- 6.4.10 Schneider Electric

- 6.4.11 Navis (Cargotec)

- 6.4.12 Praxis Automation Technology

- 6.4.13 Marine Technologies LLC

- 6.4.14 Ulstein Group

- 6.4.15 Jason Marine Group

- 6.4.16 SMEC Automation

- 6.4.17 Logimatic

- 6.4.18 Sedni Marine Systems

- 6.4.19 Hyundai Heavy Industries (Avikus)

- 6.4.20 Damen Shipyards Group

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment