PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842546

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842546

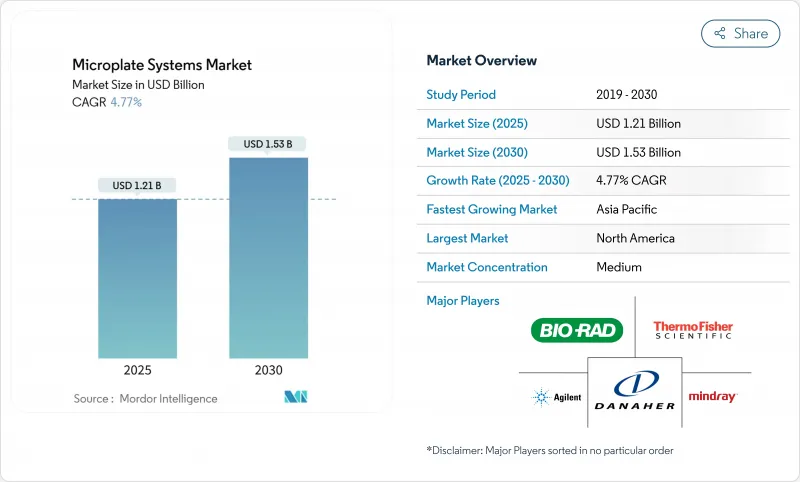

Microplate Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Microplate Systems Market size is estimated at USD 1.21 billion in 2025, and is expected to reach USD 1.53 billion by 2030, at a CAGR of 4.77% during the forecast period (2025-2030).

Laboratories are replacing manual plate handling with AI-enabled, high-throughput platforms that combine fluorescence, luminescence, and absorbance detection in a single unit. Capital spending remains healthy because pharmaceutical companies continue to intensify drug-discovery pipelines, clinical laboratories automate routine diagnostics, and biotechnology firms embrace data-rich proteomics and genomics projects. Energy-efficiency mandates are accelerating instrument replacement, as laboratories consume 5-10 times more energy per square foot than office space. Meanwhile, tariff-driven price pressures and supply-chain risk are pushing manufacturers toward regionalized production and service hubs.

Global Microplate Systems Market Trends and Insights

R&D spending surge in proteomics and genomics

Investment in omics research now targets individualized therapies and novel biomarker discovery. Laboratories need multi-mode readers that process large sample sets quickly, and AI-driven analytics shorten data-interpretation cycles, reinforcing equipment upgrades. Government grants in North America and Europe underwrite new genomics centers, while agricultural and environmental scientists increasingly adopt the same platforms.

Rise in chronic-disease-related diagnostic testing

An aging population raises test volumes for cardiovascular, diabetic, and oncology panels. Hospitals are converting batch workflows to continuous automation, cutting labor while boosting throughput. AI-assisted image analysis lowers error rates and meets fresh accreditation standards that prioritize automated quality control.

High capital and maintenance costs limiting adoption

Multi-mode readers command premium list prices while annual service contracts absorb 15-20% of purchase value. Tariffs of 10-54% on imported lab equipment inflate budgets, forcing academic centers to delay upgrades. Subscription models ease upfront expense but can raise total cost over the instrument's life.

Other drivers and restraints analyzed in the detailed report include:

- Lab automation and integrated high-throughput workflows

- Expansion of decentralized high-throughput labs

- Limited awareness and technical expertise in emerging economies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Single-mode readers held the largest slice of the microplate systems market in 2024 at 51.25%, favored for routine ELISA and protein-quantification workflows. Multi-mode readers, however, will expand at a 5.37% CAGR, reflecting laboratories' need to consolidate fluorescence, luminescence, and absorbance assays within a smaller footprint. AI-optimized detection parameters now self-adjust, cutting set-up time and reducing reagent waste.

Compact models such as the Absorbance 96 appeal to space-constrained labs, while high-end platforms integrate live-cell imaging and micro-volume quantification. Software subscriptions for data management, compliance logging, and analytics are becoming a significant revenue stream for suppliers. Automated pipetting systems and plate washers complement reader installations, tightening end-to-end workflow integration.

The Microplate Systems Market Report Segments the Industry Into by Product Type (Single-Mode Microplate Readers, and More), Application (Genomics and Proteomics Research, and More), End-User (Hospital and Diagnostic Laboratories, and More), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 39.47% of 2024 revenue. The United States dominates regional demand thanks to robust NIH funding, a dense pharmaceutical cluster, and fast adoption of AI-driven automation. Canadian life-science parks and Mexican contract-manufacturing corridors add complementary growth. Tariffs on imported lab equipment are squeezing margins, yet suppliers counter by expanding in-country service and refurbishment centers cen.acs.org. Energy-efficiency programs drive replacements, and Agilent's 6% year-over-year revenue growth in Q2 2025 underscores market vitality.

Asia is the fastest-growing territory at a 7.19% CAGR. China's NMPA is rolling out updated device standards that favor advanced microplate technologies. Japan's rapidly aging populace fuels automated diagnostics, while South Korea's biotech accelerators invest in high-throughput screening suites. India's upcoming Shimadzu factory signals a pivot toward local production that may shorten lead times and lower costs. Governments from Singapore to Australia earmark funding for precision-medicine infrastructure, widening the regional customer base.

Europe shows steady progress driven by Germany, the United Kingdom, and France. Stringent quality frameworks and the EU Green Deal incentivize adoption of low-energy instrumentation. Brexit logistics disruptions moderated United Kingdom shipments, yet sustained demand across biopharmaceutical hubs kept overall European momentum intact. Southern European countries leverage EU recovery funds to refurbish hospital laboratories with automated plate-processing lines. Continual emphasis on personalized medicine and centralized biobank expansion keeps microplate investments high across the continent.

- Agilent Technologies

- Danaher

- Thermo Fisher Scientific

- PerkinElmer

- Bio-Rad Laboratories

- Tecan Group

- BMG LABTECH GmbH

- Corning

- Lonza Group

- Promega

- Mindray

- Eppendorf

- Biotek Instruments

- Berthold Technologies

- Titertek-Berthold

- Enzo Biochem

- Accuris Instruments

- Rayto Life & Analytical Sciences

- Dynex Technologies

- Biochrom

- Greiner Bio-One GmbH

- Inheco Industrial Heating & Cooling

- Skanlab A/S

- Hudson Robotics

- Hamilton Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 R&D Spending Surge in Proteomics and Genomics

- 4.2.2 Rise In Chronic-Disease-Related Diagnostic Testing

- 4.2.3 Lab Automation and Integrated High-Throughput Screening (HTS) Workflows

- 4.2.4 Expansion of Decentralized High-Throughput Labs in the Post-Pandemic Era

- 4.2.5 Adoption of AI-Enabled Multimode Analytics for Precision and Efficiency

- 4.2.6 Sustainability Mandates Driving Demand for Energy-Efficient Instrumentation

- 4.3 Market Restraints

- 4.3.1 High Capital and Maintenance Costs Limiting Adoption

- 4.3.2 Limited Awareness and Technical Expertise in Emerging Economies

- 4.3.3 Data Integration and Interoperability Hurdles with Legacy Lab Systems

- 4.3.4 Critical Raw-Material Supply-Chain Vulnerabilities Affecting Production

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product Type

- 5.1.1 Single Mode Readers

- 5.1.1.1 Fluorescence Plate Readers

- 5.1.1.2 Absorbance Plate Readers

- 5.1.1.3 Luminescence Plate Readers

- 5.1.2 Multi Mode Readers

- 5.1.2.1 Filter-Based

- 5.1.2.2 Monochromator-Based

- 5.1.2.3 Hybrid

- 5.1.3 Microplate Software & Analytics

- 5.1.4 Pipetting Systems & Dispensers

- 5.1.5 Microplate Washers

- 5.1.6 Microplate Handlers

- 5.1.7 Consumables

- 5.1.8 Accessories

- 5.1.1 Single Mode Readers

- 5.2 By Application

- 5.2.1 Genomics & Proteomics Research

- 5.2.2 Drug Discovery & High-Throughput Screening

- 5.2.3 Clinical Diagnostics & Disease Screening

- 5.2.4 Cell-based Assays & Toxicity Testing

- 5.2.5 Environmental Testing & Food Safety

- 5.2.6 Other Applications

- 5.3 By End-User

- 5.3.1 Hospitals & Diagnostic Laboratories

- 5.3.2 Biotechnology & Pharmaceutical Companies

- 5.3.3 CROs & CMOs

- 5.3.4 Academic & Research Institutes

- 5.3.5 Other Industrial Labs

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of MEA

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Agilent Technologies Inc.

- 6.3.2 Danaher Corporation

- 6.3.3 Thermo Fisher Scientific Inc.

- 6.3.4 PerkinElmer Inc.

- 6.3.5 Bio-Rad Laboratories Inc.

- 6.3.6 Tecan Group Ltd.

- 6.3.7 BMG LABTECH GmbH

- 6.3.8 Corning Incorporated

- 6.3.9 Lonza Group AG

- 6.3.10 Promega Corporation

- 6.3.11 Shenzhen Mindray Bio-Medical Electronics Co., Ltd

- 6.3.12 Eppendorf AG

- 6.3.13 BioTek Instruments

- 6.3.14 Berthold Technologies GmbH & Co. KG

- 6.3.15 Titertek-Berthold

- 6.3.16 Enzo Life Sciences Inc.

- 6.3.17 Accuris Instruments

- 6.3.18 Rayto Life & Analytical Sciences

- 6.3.19 Dynex Technologies

- 6.3.20 Biochrom Ltd

- 6.3.21 Greiner Bio-One GmbH

- 6.3.22 Inheco Industrial Heating & Cooling

- 6.3.23 Skanlab A/S

- 6.3.24 Hudson Robotics

- 6.3.25 Hamilton Company

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment