PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842549

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842549

Anthrax Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

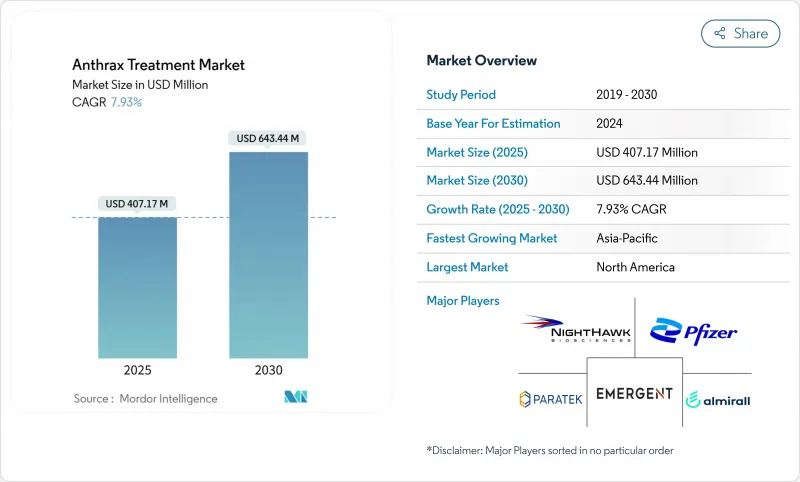

The anthrax therapeutics market was valued at USD 407.17 million in 2025 and is forecast to reach USD 643.44 million by 2030, reflecting a 7.93% CAGR during the period.

Momentum stems from sustained government biodefense budgets, accelerated regulatory pathways, and heightened security awareness that positions medical countermeasures as national assets rather than conventional pharmaceutical products. Project BioShield's multi-year contracts, the Public Health Emergency Medical Countermeasures Enterprise's mention need of USD 79.5 billion funding for 2023-2027, and similar European and Asia-Pacific initiatives collectively anchor long-term demand. The anthrax therapeutics market benefits from next-generation vaccine approvals, maturing monoclonal-antibody platforms, and AI-enabled drug-repurposing pipelines that shorten discovery timelines while diversifying treatment modalities. Commercial profitability remains modest, yet predictable sovereign procurement and replenishment cycles provide contractors with revenue visibility that offsets the absence of broad civilian sales channels.

Global Anthrax Treatment Market Trends and Insights

Government Biodefense Funding & Stockpiling Programs

Steady, multi-year public funding converts the anthrax therapeutics market into a quasi-sovereign procurement arena. BARDA's replenishment contracts for NUZYRA and its USD 6.7 billion Strategic National Stockpile expansion demonstrate a move from episodic purchasing to life-cycle management that rewards manufacturers able to sustain surge capacity. NIH-funded development of novel agents such as epetraborole illustrates how public capital underwrites early-stage R&D, insulating companies from commercial demand risk. Similar frameworks in the European Union and Australia mirror this model, creating synchronized global demand that stabilizes manufacturing economics. The result is a predictable production pipeline that supports specialized facilities and a resilient supply chain, reinforcing long-run growth for the anthrax therapeutics market.

Rising Bioterrorism Threat & National Security Focus

Escalating geopolitical tensions elevate biological weapons from niche concerns to mainstream defense priorities. The Defense Threat Reduction Agency's USD 12.2 million hazard-prediction program and NATO's integrated CBRN preparedness exercises show how governments couple intelligence assessments with real procurement commitments. Security agencies demand therapies that remain stable, deployable, and effective in austere environments, encouraging formulation research that stretches beyond traditional hospital settings. These operational requirements, framed within military doctrine, ensure that funding remains insulated from economic downturns and electoral cycles. Consequently, the anthrax therapeutics market gains a durable revenue base tied to national security rather than discretionary healthcare spending.

Limited Commercial Profitability Discouraging Private R&D

Revenue for anthrax therapeutics hinges on batch purchases that follow stockpile replenishment calendars rather than continuous market pull. Emergent BioSolutions' 71% revenue swing between Q4 2023 and Q4 2024 underscores how contract timing creates financial volatility that pure-play biotech investors often avoid. For small-molecule antibiotics, development costs can exceed USD 100 million, yet the total accessible anthrax therapeutics market size is constrained by government allocations, capping upside returns. This structural dynamic narrows the field of active developers, slows pipeline diversification, and elevates supply-chain concentration risk over the forecast horizon.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Fast-Track Incentives for CBRN Countermeasures

- Monoclonal-Antibody Platform Scale Efficiencies

- Escalating Antimicrobial Resistance Reducing Antibiotic Utility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The anthrax therapeutics market size for antibiotics stood highest in 2024 thanks to their long-established role in post-exposure prophylaxis and treatment regimens. Stockpile managers favor ciprofloxacin and doxycycline for cost-efficiency, but efficacy debates and resistance trends stimulate portfolio diversification. Antitoxins, while holding a smaller revenue base, exhibit the strongest growth owing to their toxin-neutralizing capacity independent of bacterial resistance. Raxibacumab and Obiltoxaximab are standard inclusions in U.S. Strategic National Stockpile planning, while Anthrasil contributes plasma-derived diversity that mitigates single-source vulnerability. UPMC's 2025 breakthrough extending therapeutic windows beyond the historical "point of no return" promises to widen clinical applicability. Computational repurposing has flagged several small-molecule inhibitors of edema and lethal factors, suggesting future adjunct therapies that may further reshape the anthrax therapeutics market.

Government contracts increasingly package antibiotics and antitoxins together, acknowledging the complementary roles each class plays in multi-phase response protocols. The anthrax therapeutics market share for antitoxins thus benefits from policy shifts rather than pure clinical demand. Vaccines remain primarily preventive for pre-exposure settings such as military deployments, yet South Korea's recombinant platform approval could broaden indications toward civilian prophylaxis. Adjunctive therapies addressing coagulopathies and systemic inflammation still command modest revenue but provide critical value in severe cases, reinforcing the holistic treatment paradigm that now defines the anthrax therapeutics market.

Injectable formats dominate stockpiles due to rapid systemic availability, especially for severe inhalational anthrax where time-to-treatment is decisive. Raxibacumab and Obiltoxaximab remain intravenous only, anchoring this preference. Nonetheless, oral antibiotics are gaining favor for post-exposure prophylaxis campaigns where mass distribution is required within narrow windows. Preclinical studies confirm therapeutic efficacy when dosing commences within 24 hours of exposure, validating the logistical appeal of tablets in field conditions. Updated CDC guidelines recommend oral doxycycline or levofloxacin for 60-day prophylaxis courses, aligning policy with evolving evidence.

Temperature stability trials for capsule formulations mirror vaccine thermostability research, seeking to eliminate cold-chain dependence that constrains tropical deployments. Adoption of strip-packaged antibiotics suitable for parachute or drone delivery hints at future innovations that meld pharmaceutical design with defense logistics. Other routes, including inhalational powder formulations under investigation, could eventually complement current options, yet regulatory familiarity with oral and injectable pathways means these two will continue shaping the anthrax therapeutics market over the forecast horizon.

The Anthrax Treatment Market Report Segments the Industry Into by Product Type (Antibiotics, Antitoxinx and More), Rouet of Administration (Oral, Injectabales and More), by End User (Military & Defense Personnel, Civilian Emergency Stockpiles and More), by Distribution Channel (Government Procurement Agencies, Hospitals and More) and Geography (North America, Europe, Asia Pacific and More).

Geography Analysis

North America dominated the anthrax therapeutics market in 2024, accounting for 52.23% revenue on the back of the world's largest biodefense outlays and streamlined FDA approval processes. BARDA's multi-year contracts underpin local manufacturing capacity, while Project BioShield's predictable replenishment cycles stabilize supplier cash flows. Canada and Mexico contribute incremental demand through trilateral defense cooperation and shared supply-chain logistics, ensuring regional resilience against supply disruptions.

Europe ranks second in revenue, though fragmentation among national procurement strategies dilutes buying power relative to the United States. EU-level initiatives led by the Health Security Committee are gradually harmonizing stockpile specifications and exploring joint purchasing akin to pandemic vaccine models. NATO exercises reinforce cross-border interoperability, prompting member states to update procurement roadmaps that could lift regional demand during 2026-2030. Regulatory alignment with EMA accelerates dual filing strategies, making Europe an attractive supplementary market for U.S.-approved anthrax countermeasures.

Asia-Pacific is the fastest growing geography, set for a 9.49% CAGR driven by South Korea's 2025 recombinant vaccine approval, Japan's QUAD-aligned biodefense investments, and Australia's expanding Medical Countermeasures Initiative. Defense alliances translate into coordinated procurement, with bulk buys favoring next-generation platforms that promise broader strain coverage and improved thermostability. China and India signal rising interest, evidenced by pilot projects in indigenous vaccine development and BSL-4 research center expansion, although opaque regulatory systems temper near-term revenue prospects. Collectively, these trends propel regional momentum that could raise Asia-Pacific's anthrax therapeutics market share to rival Europe by 2030.

- Emergent Bio Solutions

- GlaxoSmithKline (GSK)

- Elusys Therapeutics

- Altimmune

- Soligenix

- Bavarian Nordic

- Pfizer

- Roche

- DynPort Vaccine Company

- SIGA Technologies

- Tonix Pharmaceuticals

- AN2 Therapeutics

- GC Biopharma

- Emergent Product Development (Raxibacumab)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government biodefense funding & stockpiling programs

- 4.2.2 Rising bioterrorism threat & national security focus

- 4.2.3 Regulatory fast-track incentives for CBRN counter-measures

- 4.2.4 Monoclonal-antibody platform scale efficiencies

- 4.2.5 AI-driven drug-repurposing pipelines for B. anthracis

- 4.2.6 APAC defence alliances boosting joint procurement

- 4.3 Market Restraints

- 4.3.1 Limited commercial profitability discouraging private R&D

- 4.3.2 Escalating antimicrobial resistance reducing antibiotic utility

- 4.3.3 Cold-chain gaps for antitoxin/vaccine deployment in tropics

- 4.3.4 Public skepticism over emergency-use authorizations

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Antibiotics

- 5.1.2 Antitoxins

- 5.1.3 Vaccines

- 5.1.4 Adjunctive & Supportive Therapies

- 5.2 By Route of Administration

- 5.2.1 Oral

- 5.2.2 Injectable

- 5.2.3 Others

- 5.3 By End User

- 5.3.1 Military & Defense Personnel

- 5.3.2 Civilian Emergency Stockpiles

- 5.3.3 Hospitals & Specialty Clinics

- 5.4 By Distribution Channel

- 5.4.1 Government Procurement Agencies

- 5.4.2 Hospital Pharmacies

- 5.4.3 Retail & Online Pharmacies

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 GCC

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Emergent BioSolutions

- 6.3.2 GlaxoSmithKline (GSK)

- 6.3.3 Elusys Therapeutics

- 6.3.4 Altimmune

- 6.3.5 Soligenix

- 6.3.6 Bavarian Nordic

- 6.3.7 Pfizer

- 6.3.8 Roche

- 6.3.9 DynPort Vaccine Company

- 6.3.10 SIGA Technologies

- 6.3.11 Tonix Pharmaceuticals

- 6.3.12 AN2 Therapeutics

- 6.3.13 GC Biopharma

- 6.3.14 Emergent Product Development (Raxibacumab)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment