PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842550

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842550

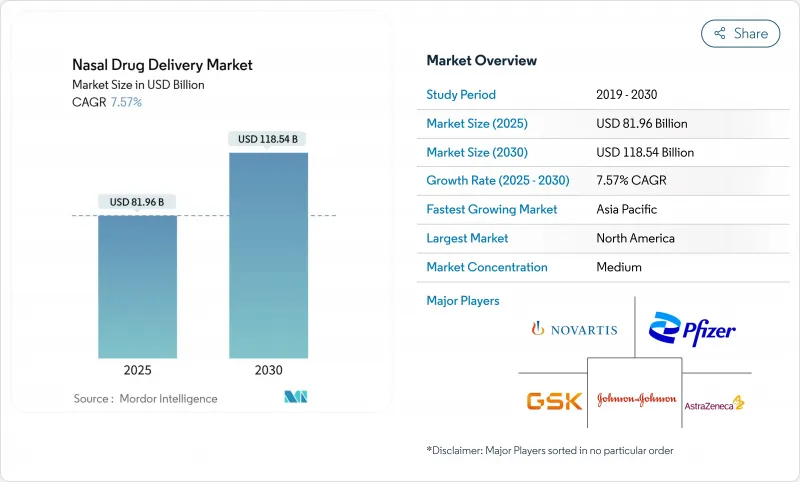

Nasal Drug Delivery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The nasal drug delivery market is valued at USD 81.96 billion in 2025 and is forecast to reach USD 118.04 billion in 2030, advancing at a 7.57% CAGR.

This solid growth reflects regulatory approvals that have shifted intranasal administration from niche use to a mainstream option for both small- and large-molecule therapeutics. Needle-free epinephrine, at-home influenza vaccination, and the first intranasal antidepressant in China illustrate the powerful pull of patient-centric innovation. Companies are matching the regulatory momentum with new device-drug combinations, especially where self-administration reduces the burden on overcrowded care settings. Dry-powder technologies, pressurized delivery systems, and smart-device integration together deepen the competitive moat for firms that can balance formulation science with engineering rigor. Across every region, the nasal drug delivery market benefits from patients seeking faster onset, less invasive routes, and freedom from cold-chain constraints.

Global Nasal Drug Delivery Market Trends and Insights

Increasing Prevalence of Allergic Rhinitis & Chronic Sinusitis

The rising burden of allergic rhinitis and chronic sinusitis sustains steady demand for intranasal therapies. The FDA cleared fluticasone propionate (XHANCE) for chronic rhinosinusitis without nasal polyps in March 2024, validating exhalation-delivery technology that targets inflamed nasal tissue. Phase 3 data show marked symptom relief and fewer exacerbations, broadening the addressable respiratory market. Pipeline programs extend to biologics such as stapokibart, an IL-4 receptor monoclonal antibody that improved nasal and ocular scores in late-stage trials, pointing to a new class of targeted intranasal immunotherapies.

Growing Adoption of Self-Administration Practices

Regulators now back patient-handled delivery. In September 2024 the FDA authorized FluMist for at-home use, the first vaccine approved for self-administration. Usability studies confirmed safe delivery across age brackets, removing both needle anxiety and clinic scheduling bottlenecks. Similar design principles guided neffy, which enables emergency epinephrine without medical supervision, a meaningful advance for people who avoid injectors. Education programs from hospital pharmacists reinforce correct technique, tightening the feedback loop between device innovation and real-world adherence.

Overuse Complications Causing Rhinitis Medicamentosa

Prolonged vasoconstrictor use can trigger rebound congestion. Surveys show 75% of Canadian otolaryngologists think current warning labels are insufficient, and nearly 30% of patients cannot stop over-the-counter sprays despite counseling. Severe cases call for surgical turbinate reduction, adding complexity and cost.

Other drivers and restraints analyzed in the detailed report include:

- Rising Patient Preference for Needle-Free Routes

- Regulatory Approvals of Large-Molecule Biologics Via Intranasal Route (2025+)

- Patent Cliff For Leading Allergic-Rhinitis Brands (2025-27)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Sprays owned 43.23% of the nasal drug delivery market in 2024, reflecting decades of clinical familiarity. Dry powders, however, are projected to grow 10.56% annually as firms harness freeze-drying and spray-drying methods to stabilize antibodies and peptides. Thin-film freeze-dried monoclonal antibodies achieve effective aerosol performance without refrigeration. Breath-actuated insufflators, combined with mucoadhesive excipients, further lift residence time. Drops retain a role in pediatrics, while gels cater to chronic cases needing sustained mucosal contact. Each modality meets distinct clinical needs, yet powders capture the highest forward momentum by marrying stability with patient convenience.

The nasal drug delivery market size for dry powders is set to expand at the fastest clip, whereas sprays continue to anchor baseline revenue. Product design now centers on Quality by Design frameworks that link particle morphology to consistent dosing. Nanocarrier-loaded powders push the therapeutic frontier into vaccines, gene therapy, and brain-targeted oncology. This balanced portfolio lets manufacturers hedge mature volume against high-growth innovation streams.

Non-pressurized formats delivered 62.12% of 2024 sales due to low cost and simple design. Pressurized systems are on a 9.66% CAGR trajectory because biologics often need exact, repeatable doses. Aptar's acquisition of SipNose technology signals confidence in soft-mist platforms that protect fragile proteins. Bespak's customizable valves add another layer of precision. At the same time, unit-dose devices such as NasaDose improve sterility, making them attractive for emergency neurologic sprays.

As the nasal drug delivery market evolves, container choice increasingly follows molecule complexity. Large antibodies favor pressurized devices that guarantee plume geometry and minimal shear stress. Small molecules and decongestants stay in pump sprays for price sensitivity. The push-pull dynamic means suppliers must maintain dual manufacturing lines while upgrading quality control to meet combination-product regulations.

Nasal Drug Delivery Market Report is Segmented by Dosage Form (Sprays, Drops & Liquids, Gels, Dry Powders and Others), Container Type (Non-Pressurized Containers and Pressurized Containers), Therapeutic Application (Rhinitis, Nasal Congestion, Asthma, Pain Management and More), End User (Hospitals, Home Health Care and More) and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 38.47% market share in 2024 on the back of a mature regulatory framework, early adopter payers, and high allergic-rhinitis prevalence. The region also acts as the first launch pad for large-molecule nasal biologics, reflecting strong FDA engagement. Europe follows with robust reimbursement structures, yet growth is more measured as generics temper price points. Stringent device guidelines, though, preserve premium space for engineered combination products.

Asia Pacific is the standout growth engine at a 10.16% CAGR. China's June 2024 approval of esketamine nasal spray for depression validated the route for central-nervous-system biologics and unlocked a sizeable untreated segment. Japan positions itself as a fast follower: Aculys Pharma's diazepam filing in 2024 signals future intranasal seizure-rescue launches. Australia mirrors these trends by fast-tracking needle-free epinephrine.

Middle East and Africa benefit from ongoing cold-chain upgrades that allow sensitive biologics to reach major urban centers. In South America, high respiratory-disease incidence and crowded outpatient clinics strengthen the appeal of self-administered sprays. As supply chains mature, the nasal drug delivery market will continue to widen its geographic footprint through localized manufacturing and regulatory harmonization.

- Solventum

- Neurelis Inc.

- AptarGroup Inc.

- AstraZeneca

- BD (Becton, Dickinson & Co.)

- GlaxoSmithKline

- Johnson & Johnson

- Merck

- Novartis

- Pfizer

- Teva Pharmaceutical Industries

- Cipla

- Bausch Health

- OptiNose Inc.

- Impel NeuroPharma Inc.

- Kurve Technology Inc.

- Recipharm

- Sun Pharma Industries Ltd.

- Hikma Pharmaceuticals

- Dr. Reddy's Laboratories Ltd.

- Sandoz Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Prevalence Of Allergic Rhinitis & Chronic Sinusitis

- 4.2.2 Growing Adoption Of Self-Administration Practices

- 4.2.3 Rising Patient Preference For Needle-Free Routes

- 4.2.4 Regulatory Approvals Of Large-Molecule Biologics Via Intranasal Route (2025+)

- 4.2.5 Pandemic-Driven Cold-Chain Cost-Saving Push

- 4.2.6 Sensor-Enabled Smart Nasal Devices For Adherence Tracking

- 4.3 Market Restraints

- 4.3.1 Overuse Complications Causing Rhinitis Medicamentosa

- 4.3.2 Patent Cliff For Leading Allergic-Rhinitis Brands (2025-27)

- 4.3.3 Cold-Chain Integrity Risk For Temperature-Sensitive Biologics

- 4.3.4 Stringent Regulations

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technology Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Dosage Form

- 5.1.1 Sprays

- 5.1.2 Drops & Liquids

- 5.1.3 Gels

- 5.1.4 Dry Powders

- 5.1.5 Others

- 5.2 By Container Type

- 5.2.1 Non-Pressurized Containers

- 5.2.2 Pressurized Containers

- 5.3 By Therapeutic Application

- 5.3.1 Rhinitis

- 5.3.2 Nasal Congestion

- 5.3.3 Asthma

- 5.3.4 Pain Management

- 5.3.5 Vaccination

- 5.3.6 Others

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Home Health Care

- 5.4.3 Ambulatory Surgery Centers

- 5.4.4 Specialty Clinics

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Solventum

- 6.3.2 Neurelis Inc.

- 6.3.3 AptarGroup Inc.

- 6.3.4 AstraZeneca PLC

- 6.3.5 BD (Becton, Dickinson & Co.)

- 6.3.6 GlaxoSmithKline PLC

- 6.3.7 Johnson & Johnson Services Inc.

- 6.3.8 Merck & Co., Inc.

- 6.3.9 Novartis AG

- 6.3.10 Pfizer Inc.

- 6.3.11 Teva Pharmaceutical Industries Ltd.

- 6.3.12 Cipla Ltd.

- 6.3.13 Bausch Health Companies Inc.

- 6.3.14 OptiNose Inc.

- 6.3.15 Impel NeuroPharma Inc.

- 6.3.16 Kurve Technology Inc.

- 6.3.17 Recipharm AB

- 6.3.18 Sun Pharma Industries Ltd.

- 6.3.19 Hikma Pharmaceuticals PLC

- 6.3.20 Dr. Reddy's Laboratories Ltd.

- 6.3.21 Sandoz International GmbH

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment