PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842551

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842551

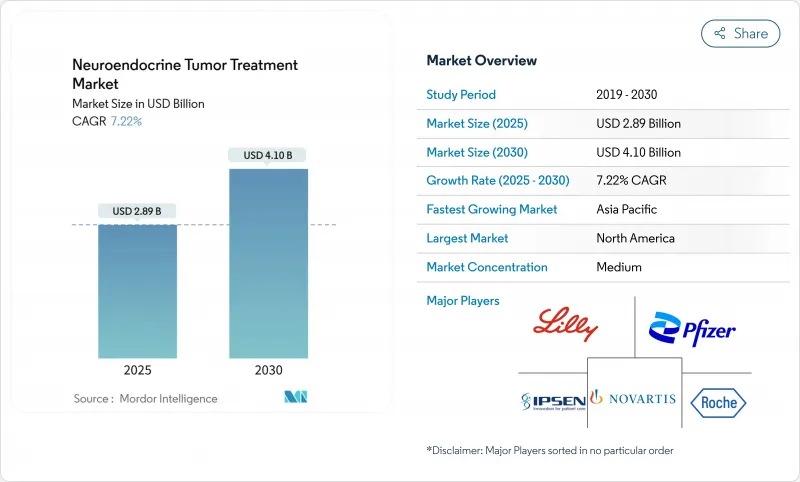

Neuroendocrine Tumor Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The neuroendocrine tumor treatment market is valued at USD 2.89 billion in 2025 and is forecast to reach USD 4.10 billion by 2030, expanding at a 7.22% CAGR.

Rapid capacity additions for medical isotopes, especially Lutetium-177, remove past supply bottlenecks and let hospitals adopt peptide receptor radionuclide therapy (PRRT) as a first-line option. Forthcoming PRRT guidelines, orphan-drug incentives and positive NETTER-2 data continue to widen clinical acceptance. Investors are backing vertically integrated radiopharmaceutical platforms, while liquid biopsy technologies such as NETest sharpen diagnosis and help match patients to targeted agents. Health systems also gain confidence from large deals-ITM's NOVA plant and Curium's Netherlands site-showing that the isotope supply chain can now scale.

Global Neuroendocrine Tumor Treatment Market Trends and Insights

Rising prevalence of NETs

Steadily improving imaging and population aging lift incidence, with Dutch registries counting nearly 1,000 new diagnoses in 2024. Health systems answer by launching specialist NET centers and funding isotope capacity. Clinical teams now detect earlier-stage disease, which broadens the candidate pool for PRRT and targeted agents. Industry surveys estimate 350,000 gastro-enteropancreatic NET patients across the EU and US who need long-term care. Multidisciplinary clinics thus adopt standardized pathways to manage rising caseloads efficiently.

Advances in imaging & diagnostics

NETest liquid biopsy tracks microscopic residual disease more accurately than legacy chromogranin A assays and is being validated across ENETS Centers of Excellence. When paired with high-resolution PET/CT, clinicians gain a near-real-time view of tumor biology and treatment response. This integration supports earlier therapy switches and underpins precision oncology programs now spreading from Europe to the United States. The upgrade shortens diagnostic delays, a long-standing barrier in NET care.

High cost of novel therapeutics

Lutathera infusions require shielded suites, radiation monitoring and specialist staff, pushing total treatment costs well above the drug price. Health technology assessment bodies in Europe now scrutinize cost-per-QALY results before adding agents to formularies. Multidisciplinary hubs are emerging to pool patient volumes, cut duplication and improve cost-effectiveness.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of approved targeted & PRRT drugs

- Orphan-drug incentives & favorable reimbursement

- Isotope (Lu-177/Ga-68) supply bottlenecks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Somatostatin analogs retained 44.23% share in the neuroendocrine tumor treatment market during 2024, reflecting long-standing use for symptom control and tumor stabilization. PRRT, buoyed by community uptake of [177Lu]Lu-Oxodotreotide, is projected to log a 10.32% CAGR and stands out as the primary growth engine. PRRT protocols gained uniformity through the Italian Association of Nuclear Medicine's new guidelines, encouraging broader European uptake. Parallel advances in manufacturing assure a reliable isotope stream, further sustaining momentum.

Clinical preference now shifts toward combination regimens-PRRT plus somatostatin analogs, or PRRT alongside DNA-repair inhibitors under investigation-thereby widening the addressable population. Chemotherapy preserves its role for poorly differentiated carcinomas, while emerging immunotherapy-chemotherapy trials explore synergy in high-grade disease. Targeted therapy, led by everolimus and cabozantinib, offers individualized options for patients unsuitable for radionuclide therapy, underscoring how the neuroendocrine tumor treatment market keeps diversifying.

The Neuroendocrine Tumor Treatment Market Report is Segmented by Treatment Modality (Somatostatin Analogs (SSAs), Targeted Therapy, Chemotherapy, and More), Indication (Gastrointestinal, Pancreas, Lung and More), End User (Hospitals, Specialty/Oncology Clinics, and More), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with 39.87% share of the neuroendocrine tumor treatment market size in 2024. Medicare's separate payment for high-cost tracers and the FDA's track record of timely approvals underpin early adoption. Major US cancer centers already integrate PRRT with targeted and checkpoint inhibitors in trial settings, while Canada's universal system reimburses core PRRT indications nationally.

Europe benefits from the EMA's orphan-drug pathway and coordinated payer frameworks that streamline access to rare-disease therapies. Local isotope capacity, notably Curium's Netherlands Lu-177 line, strengthens supply security. Germany, France and the United Kingdom host dense networks of ENETS-accredited centers, ensuring consistent quality across borders. Southern European nations expand capabilities through EU cohesion funds and shared training programs.

Asia-Pacific posts the highest 10.06% CAGR, powered by Japan's swift regulatory clearance of diagnostic agents and China's oncology infrastructure build-out. Australia subsidizes PRRT under the Pharmaceutical Benefits Scheme, while South Korea and India establish partnerships with European isotope firms. Regional manufacturers invest in domestic supply chains to avoid import delays, further accelerating neuroendocrine tumor treatment market penetration.

- Novartis

- Ipsen

- Pfizer

- Roche

- Eli Lilly and Company

- Boehringer Ingelheim

- Bristol-Myers Squibb

- Lantheus

- ITM Isotope Technologies Munich

- Crinetics Pharmaceuticals

- Camurus AB

- Tarveda Therapeutics

- Hutchmed (Hutchison MediPharma)

- Jubilant Radiopharma

- Peptidyne Therapeutics

- Avion Pharmaceuticals

- Exelixis

- Merck

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence Of Nets

- 4.2.2 Advances In Imaging & Diagnostics

- 4.2.3 Expansion Of Approved Targeted & PRRT Drugs

- 4.2.4 Orphan-Drug Incentives & Favorable Reimbursement

- 4.2.5 Adoption Of Multi-Analyte Liquid Biopsy (Netest)

- 4.2.6 Inclusion Of Nets In Precision-Oncology Trials

- 4.3 Market Restraints

- 4.3.1 High Cost Of Novel Therapeutics

- 4.3.2 Limited Physician Awareness & Diagnostic Delays

- 4.3.3 Safety Concerns With PRRT/Chemo Regimens

- 4.3.4 Isotope (Lu-177/Ga-68) Supply Bottlenecks

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technology Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Treatment Modality

- 5.1.1 Somatostatin Analogs (SSA)

- 5.1.2 Peptide Receptor Radionuclide Therapy (PRRT)

- 5.1.3 Targeted Therapy (TKI/mTOR)

- 5.1.4 Immunotherapy (ICI)

- 5.1.5 Chemotherapy

- 5.1.6 Others (Interferons, Supportive)

- 5.2 By Indication

- 5.2.1 Gastrointestinal (Mid-gut)

- 5.2.2 Pancreas

- 5.2.3 Lung

- 5.2.4 Other NET Sites

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Specialty/Oncology Clinics

- 5.3.3 Ambulatory Surgery Centers

- 5.3.4 Academic & Research Institutes

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Novartis AG

- 6.3.2 Ipsen SA

- 6.3.3 Pfizer Inc.

- 6.3.4 F. Hoffmann-La Roche Ltd.

- 6.3.5 Eli Lilly and Company

- 6.3.6 Boehringer Ingelheim GmbH

- 6.3.7 Bristol Myers Squibb

- 6.3.8 Lantheus Holdings Inc.

- 6.3.9 ITM Isotope Technologies Munich

- 6.3.10 Crinetics Pharmaceuticals

- 6.3.11 Camurus AB

- 6.3.12 Tarveda Therapeutics

- 6.3.13 Hutchmed (Hutchison MediPharma)

- 6.3.14 Jubilant Radiopharma

- 6.3.15 Peptidyne Therapeutics

- 6.3.16 Avion Pharmaceuticals

- 6.3.17 Exelixis Inc.

- 6.3.18 Merck & Co.

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment