PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842552

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842552

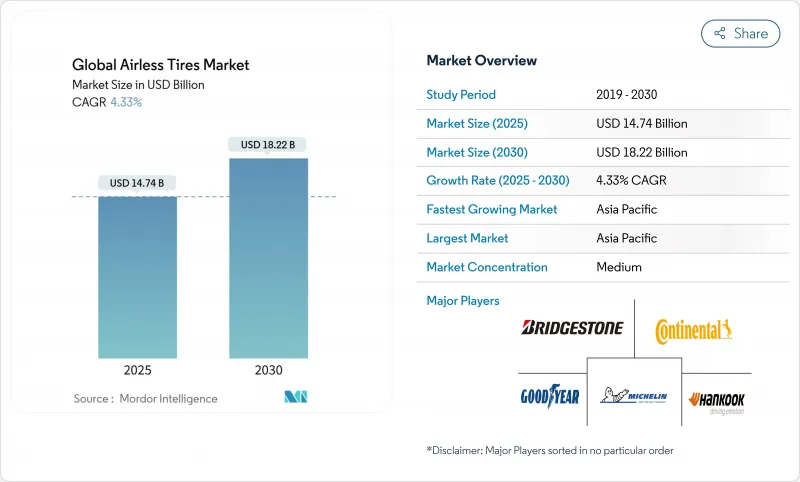

Airless Tires - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The airless tires market size is currently valued at USD 14.74 billion in 2025 and is forecast to reach USD 18.22 billion by 2030, expanding at a 4.33% CAGR.

The transition from prototypes to commercial lines is progressing as electric-vehicle (EV) makers seek puncture-proof solutions, defense agencies specify run-flat mobility platforms, and sustainability regulations tighten disposal rules. Partnerships such as Tesla's ongoing testing discussions with Michelin's Uptis line illustrate how original equipment manufacturer (OEM) engagement accelerates mainstream acceptance. Rising demand from mining fleets, expanding micro-mobility services, and rapid iteration enabled by 3-D printed lattice structures further reinforce the airless tires market growth path. Incumbent tire firms deploy deep materials-science portfolios, yet higher unit costs and certification limits above 130 km/h continue to moderate the near-term adoption curve.

Global Airless Tires Market Trends and Insights

Rapid Puncture-Proof Solutions Demanded by EV OEMs

EV makers eliminate spare-tire space to extend cabin volume and curb weight; doing so elevates the cost of roadside failures. Uptis trials with Tesla illustrate how a single OEM decision can pull the wider airless tires market toward volume adoption. Fleet operators report up to 80% fewer breakdowns after switching to non-pneumatic tires, cutting unplanned downtime costs. Higher load tolerance for battery mass and torque aligns with airless construction advantages, while Michelin projects 200 million tire scrappage avoidance annually once deployment scales. These factors position EV platforms as the medium-term catalyst for the airless tires market momentum.

Mining Sector Push to Cut Tire Downtime

Haul-truck immobilization can exceed USD 100,000 in lost ore output. Bridgestone's Smart On-Site bundle couples airless tires with AI diagnostics, delivering predictive scheduling for pit fleets. Michelin's tire recycling plant in Chile processes 30,000 tons of earthmover tires annually, linking durability with circular value capture. The proven ROI persuades mine operators to accept premium pricing, sustaining Asia-Pacific-led expansion of the airless tires market.

Higher Unit Cost Versus Radial Tires

Current non-pneumatic units cost 40-60% above comparable radials owing to specialized polyurethane and composite inputs. Global output of 2.4 billion pneumatic units dwarfs current airless capacity, limiting economies of scale. Fleets in mining or parcel logistics are still buying due to downtime savings, yet mainstream passenger sales remain price sensitive, tempering the airless tires market trajectory during the medium term.

Other drivers and restraints analyzed in the detailed report include:

- Rising Military Spending on Run-Flat Mobility Platforms

- Stricter EU Landfill Rules Favoring Recyclable Non-Pneumatics

- Limited High-Speed Load Certifications

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Off-road vehicles posted the highest 7.46% CAGR outlook, even though passenger models retained the largest 46.12% share. The airless tires market size for off-road machinery reached a significant value as mine operators prioritized uptime. Recreational ATVs and UTVs use spoked designs offering higher radial stiffness for rough terrain, thereby widening consumer segments.

The commercial-truck niche shows steady conversion because total-cost-of-ownership models reward puncture avoidance. Power-sports makers differentiate models through maintenance-free features attractive to remote trail riders. Two-wheeler use is a niche yet growing in urban settings where e-bike fleets value reliability. Overall, diverse vehicle classes collectively expand the airless tires market beyond its initial industrial anchor points.

Rubber held a 65.33% share in 2024, reflecting legacy supply chains and cost advantages, whereas composite elastomers are projected to register the fastest 6.15% CAGR. Incorporation of bio-sourced feedstocks advances circularity pledges; Michelin targets 40% renewable and recyclable content by 2030. Polyurethane-based elastomers offer superior crack resistance for spoke assemblies, enhancing durability across the airless tires market.

Rubber remains cost-effective for high-volume runs, yet environmental levies favor composites. Plastic formulations serve specialist chemical-resistant niches such as airport GSE. The materials evolution underscores how sustainability mandates are reshaping supplier strategies and reinforce premium positioning within the airless tires market.

The Airless Tires Market Report is Segmented by Vehicle Type (Passenger Vehicles, Commercial Vehicles, and More), Material (Rubber, Plastic, and More), Manufacturing Technology (3-D Printed Lattice, Molded Spoke Web, and More), Sales Channel (OEM and Aftermarket), and Geography (North America, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific combined the largest 38.55% slice with the fastest 8.25% CAGR. Government EV incentives, a dense OEM base, and domestic innovators such as Hankook's iFlex program power regional momentum. China's 34 of the top 75 global tire companies deliver scale and cost advantages, propelling the airless tires market in local and export channels.

North America benefits from defense contracts and advanced R&D ecosystems. American Engineering Group's zero-pressure work and Tesla-Michelin pilots demonstrate cross-sector validation. Producer-responsibility regulations in several states support recyclable designs, underpinning long-term growth of the airless tires market despite higher upfront costs.

Europe orchestrates stringent emission and landfill rules. Euro 7 tyre abrasion caps and extended-producer-responsibility frameworks align with airless recyclability attributes. Michelin leverages continental policy trends through Vision-aligned production, helping the regional airless tires market meet climate commitments while safeguarding performance.

- Michelin Group

- Goodyear Tire & Rubber Co.

- Continental AG

- Hankook Tire & Technology Group

- Bridgestone Corporation

- Trelleborg AB

- Toyo Tire Corporation

- Amerityre Corporation

- Tannus Ltd

- Polaris Inc. (Resilient Technologies)

- Kenda Rubber Industrial Co.

- Marathon Industries Inc.

- SMART Tire Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid puncture-proof solutions demanded by EV OEMs

- 4.2.2 Mining sector's push to cut tyre downtime

- 4.2.3 Rising military spending on run-flat mobility platforms

- 4.2.4 Stricter EU landfill rules favouring recyclable non-pneumatics

- 4.2.5 3-D printed lattice wheels slashing prototyping cycles

- 4.2.6 Growing micro-mobility fleets for last-mile logistics

- 4.3 Market Restraints

- 4.3.1 Higher unit cost versus radial tires

- 4.3.2 Limited high-speed load certifications

- 4.3.3 OEM hesitation due to NVH concerns

- 4.3.4 Regulatory uncertainty on new road-worthiness standards

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Vehicle Type

- 5.1.1 Passenger Vehicles

- 5.1.2 Commercial Vehicles

- 5.1.3 Off-Road Vehicles

- 5.1.4 Two-Wheeler

- 5.1.5 Power Sports (ATV/UTV, Snowmobile)

- 5.2 By Material

- 5.2.1 Rubber

- 5.2.2 Plastic

- 5.2.3 Composite Elastomers

- 5.3 By Manufacturing Technology

- 5.3.1 3-D Printed Lattice

- 5.3.2 Molded Spoke Web

- 5.3.3 Layered Honeycomb

- 5.4 By Sales Channel

- 5.4.1 OEM

- 5.4.2 Aftermarket

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Italy

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 New Zealand

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Egypt

- 5.5.5.4 Turkey

- 5.5.5.5 South Africa

- 5.5.5.6 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Michelin Group

- 6.4.2 Goodyear Tire & Rubber Co.

- 6.4.3 Continental AG

- 6.4.4 Hankook Tire & Technology Group

- 6.4.5 Bridgestone Corporation

- 6.4.6 Trelleborg AB

- 6.4.7 Toyo Tire Corporation

- 6.4.8 Amerityre Corporation

- 6.4.9 Tannus Ltd

- 6.4.10 Polaris Inc. (Resilient Technologies)

- 6.4.11 Kenda Rubber Industrial Co.

- 6.4.12 Marathon Industries Inc.

- 6.4.13 SMART Tire Company

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment