PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842553

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842553

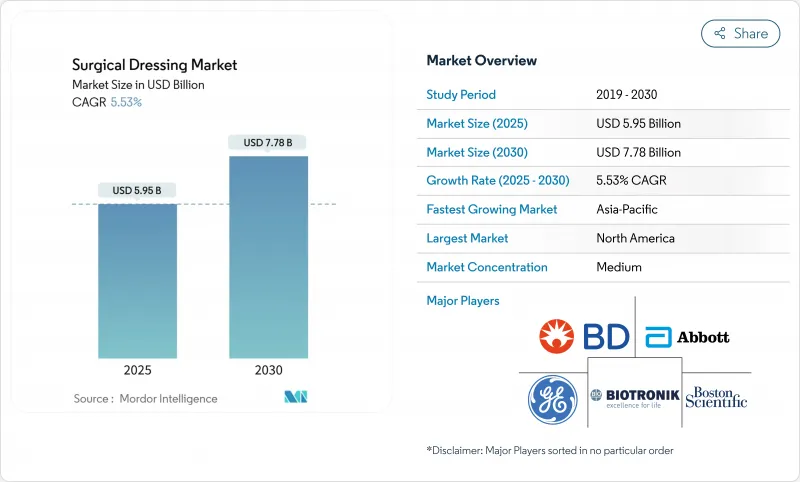

Surgical Dressing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The surgical dressings market is valued at USD 5.95 billion in 2025 and is forecast to reach USD 7.38 billion by 2030, advancing at a 5.53% CAGR.

Demand growth rests on three pillars: the accelerating incidence of chronic wounds among older adults, the migration of procedures to outpatient settings, and steady innovation in smart, antimicrobial, and bio-active dressings. Real-time sensor integration, such as Caltech's iCares bandage that measures biomarkers in exudate, signals a shift from passive coverage to active therapy. Regulatory reforms in China, India, and the United States lower adoption barriers for premium products, while payer policies that now reimburse skin-substitute dressings broaden market access. Supply chain risks in specialty polymers and possible FDA reclassification of antimicrobial dressings temper optimism, yet the underlying demographic and clinical need continues to anchor the surgical dressings market trajectory.

Global Surgical Dressing Market Trends and Insights

Aging Population & Rise in Chronic Wounds

Chronic wounds already affect more than 40 million people worldwide and cost the United States healthcare system over USD 28 billion each year . Diabetes and peripheral arterial disease elevate ulcer risk, prompting the International Working Group on the Diabetic Foot to recommend sucrose octasulfate dressings for non-healing ulcers . Medicare reports that 10.5% of beneficiaries present with chronic wounds but generate outsized resource use, so payers welcome therapies that shorten healing time. Meta-analyses show advanced dressings can accelerate closure by an average of 1.09 days and lower pain scores versus traditional gauze. This demographic driver supports steady, recession-resistant demand across advanced and standard products in the surgical dressings market.

Shift Toward Outpatient & Home-Based Care

Procedure migration to ambulatory sites raises need for dressings that stay in place longer and simplify self-care. Remote monitoring platforms such as WoundConnect help clinicians oversee healing progress without daily visits, reducing hospital utilization by up to 15%. New CMS codes (G0541, G0542) pay for caregiver wound-care training delivered via telehealth, incentivizing home-based management. Solventum's V.A.C. Peel & Place dressing, designed for seven-day wear and two-minute application, typifies products tailored to the outpatient shift. These factors collectively lift demand across the surgical dressings market for extended-wear, low-skill solutions.

Stringent Multi-Jurisdiction Regulatory Pathways

The EU Medical Device Regulation now demands comprehensive clinical evaluation and post-market surveillance, adding 12-18 months and significant expense to approval timelines. The FDA is consulting on reclassifying antimicrobial dressings from Class I to Class II or III, which could shift many legacy products into a stricter pre-market review. Japan continues to post the longest med-tech approval lag among G7 countries, averaging 24-36 months according to its Pharmaceuticals and Medical Devices Agency. Smart dressings that incorporate software draw additional cybersecurity scrutiny, challenging smaller firms. These hurdles slow roll-out of novel technologies within the surgical dressings market.

Other drivers and restraints analyzed in the detailed report include:

- Product Innovations in Antimicrobial & Bio-Active Dressings

- Reimbursement Expansion for Advanced Dressings (US, EU)

- Price Erosion from Tender-Driven Hospital Procurement

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Primary dressings generated 66.54% of surgical dressings market revenue in 2024 due to their central role at the wound bed. Hydrogel and alginate variants maintain an ideal moisture balance, and recent trials show a 1.09-day faster closure versus gauze. Film dressings now house printed pH sensors that flag infection ahead of visible symptoms, giving clinicians an early-warning advantage. Foam dressings with super-absorbent polymers gained share after Paul Hartmann reported EUR 608.9 million in wound revenue on strong silicone-foam uptake. Secondary dressings grow fastest at 6.12% CAGR because layered protocols call for added absorption and securement. Companies refine adhesive borders to reduce skin trauma in frail patients while retaining seal integrity for seven-day wear.

Smart primary dressings capable of Bluetooth connectivity remain a niche, limited by battery life and cost, yet pilot studies in veteran hospitals show high patient satisfaction. Synthetic polymer films still dominate volume but bio-engineered cellulose composites that release antimicrobials on demand capture clinician interest. As value-based contracts reward lower readmissions, purchasers weigh the higher unit price of active dressings against demonstrated reductions in total care costs. Continuous innovation keeps primary dressings at the forefront of the surgical dressings market.

Ulcer care contributed 31.25% to the surgical dressings market size in 2024, reflecting the ongoing burden of pressure and venous ulcers among aging populations. Yet diabetes-related surgery represents the fastest-growing use case at 5.93% CAGR. The International Working Group on the Diabetic Foot now endorses sucrose octasulfate dressings when neuro-ischemic ulcers stall after four weeks of standard care. Negative-pressure therapy after cardiovascular procedures further broadens application scope.

Burn treatment remains dependent on silver-impregnated options, but debate over optimal ion release persists. Organ-transplant recipients demand high-performance dressings that guard against opportunistic infections while promoting granulation. Payers increasingly require photographic proof and digital planimetry to authorize multiple high-cost dressing applications, pushing suppliers to embed image-capture tools within smart products. These evolving needs reinforce growth prospects for specialty segments within the wider surgical dressings market.

The Surgical Dressing Market Report Segments the Industry Into by Product (Primary Dressing, Secondary Dressing), by Application (Ulcers, Burns, Organ Transplants, and More), by End-User (Hospitals/Clinics, Ambulatory Surgical Centers, and More), Wound Type (Acute Wounds and Chronic Wounds), Material (Natural Fibers, and More), and Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America maintains leadership, holding 42.15% of the surgical dressings market in 2024. Robust reimbursement under Medicare and private payers rewards technologies that shorten healing or reduce clinic visits. The Department of Defense in 2025 awarded Smith+Nephew a USD 75 million contract for negative-pressure systems, signaling government confidence in advanced modalities. Recent CMS policy shifts that classify certain skin substitutes as wound management products simplify billing, fostering faster uptake of premium offerings. FDA fast-track designations for cellular therapies such as Aurase Wound Gel indicate regulatory support for biologic innovation.

Asia-Pacific is the fastest-growing region, expanding at a 7.15% CAGR through 2030. China's 2024 medical device law tightens quality management while setting accelerated review lanes for urgently needed products via its National Medical Products Administration. India's voluntary code on medical device promotion encourages ethical marketing and clearer labeling, improving clinician trust. Japan's USD 40 billion device market grows as its aging population and universal coverage sustain demand, although lengthy approval timelines constrain rapid launches. Australia's recognition of select overseas approvals speeds registration for dressings that already hold FDA clearance, benefiting exporters.

Europe records steady growth under the Medical Device Regulation despite higher compliance costs. Companies that invested early in clinical data and post-market surveillance now gain a competitive edge. Hartmann reported 4.4% organic wound-care growth in 2024, aided by silicone foam uptake, even as hospital tenders drove pricing pressure. Sustainability goals in Nordic countries have prompted pilots of biodegradable dressings, aligning with circular-economy policies. Post-Brexit, UK manufacturers must file separate CE and UKCA submissions, adding complexity but also stimulating domestic innovation grants. Across all sub-regions, diverse reimbursement schemes require localized economic evidence, compelling suppliers to tailor value dossiers to each payer system.

- 3M

- Smiths Group

- Molnlycke Health Care

- Convatec

- Coloplast

- Cardinal Health

- Medtronic

- Medline Industries

- Johnson & Johnson

- B. Braun

- Hollister

- Hartmann Group

- Lohmann & Rauscher GmbH

- Urgo Medical

- BSN medical (Essity)

- Acelity (KCI) - 3M Advanced Wound Care

- Derma Sciences (Integra LifeSciences)

- Winner Medical Co.

- Advancis Medical

- Medipur

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Ageing population & rise in chronic wounds

- 4.2.2 Shift toward outpatient & home-based care

- 4.2.3 Product innovations in antimicrobial & bio-active dressings

- 4.2.4 Reimbursement expansion for advanced dressings (US, EU)

- 4.2.5 Growth of surgical volumes in emerging Asia

- 4.2.6 Integration of smart/IoT sensors in dressings

- 4.3 Market Restraints

- 4.3.1 Stringent multi-jurisdiction regulatory pathways

- 4.3.2 Price erosion from tender-driven hospital procurement

- 4.3.3 Supply-chain volatility in specialty polymers & fibers

- 4.3.4 Clinical data gaps limiting adoption of "smart" dressings

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Primary Dressing

- 5.1.1.1 Film Dressing

- 5.1.1.2 Hydrogel Dressing

- 5.1.1.3 Hydrocolloid Dressing

- 5.1.1.4 Foam Dressing

- 5.1.1.5 Alginate Dressing

- 5.1.1.6 Other Primary Dressings

- 5.1.2 Secondary Dressing

- 5.1.2.1 Absorbents

- 5.1.2.2 Bandages

- 5.1.2.3 Adhesive Tapes

- 5.1.2.4 Protectives

- 5.1.2.5 Other Secondary Dressings

- 5.1.1 Primary Dressing

- 5.2 By Application

- 5.2.1 Ulcers

- 5.2.2 Burns

- 5.2.3 Organ Transplants

- 5.2.4 Cardiovascular Surgery

- 5.2.5 Diabetes-Related Surgery

- 5.2.6 Other Applications

- 5.3 By End-User

- 5.3.1 Hospitals & Clinics

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Home-Care & Other End-Users

- 5.4 By Wound Type

- 5.4.1 Acute Wounds

- 5.4.2 Chronic Wounds

- 5.5 By Material

- 5.5.1 Natural Fibers

- 5.5.2 Synthetic Polymers

- 5.5.3 Bio-engineered / Composite

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East & Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East & Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 3M Company

- 6.3.2 Smith & Nephew Plc

- 6.3.3 Molnlycke Health Care AB

- 6.3.4 ConvaTec Group Plc

- 6.3.5 Coloplast A/S

- 6.3.6 Cardinal Health Inc.

- 6.3.7 Medtronic Plc

- 6.3.8 Medline Industries LP

- 6.3.9 Johnson & Johnson (Ethicon)

- 6.3.10 B. Braun SE

- 6.3.11 Hollister Inc.

- 6.3.12 Paul Hartmann AG

- 6.3.13 Lohmann & Rauscher GmbH

- 6.3.14 Urgo Medical

- 6.3.15 BSN medical (Essity)

- 6.3.16 Acelity (KCI) - 3M Advanced Wound Care

- 6.3.17 Derma Sciences (Integra LifeSciences)

- 6.3.18 Winner Medical Co.

- 6.3.19 Advancis Medical

- 6.3.20 Medipur

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment