PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842555

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842555

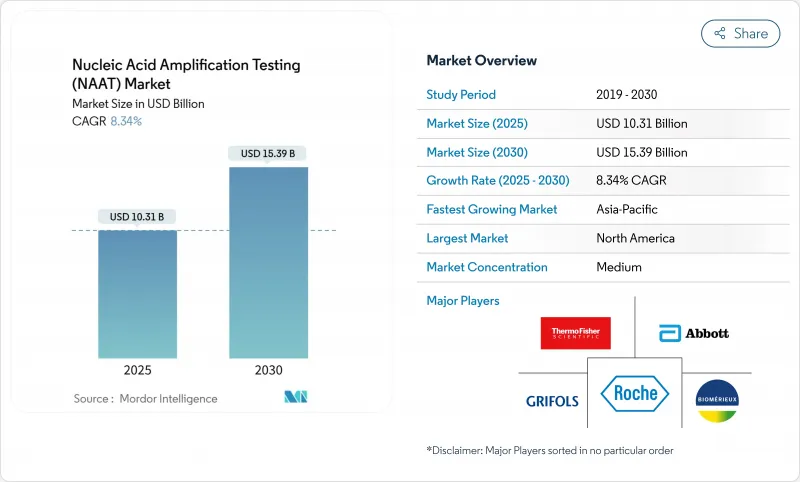

Nucleic Acid Amplification Testing (NAAT) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The nucleic acid amplification testing (NAAT) market size is valued at USD 10.31 billion in 2025 and is projected to reach USD 15.39 billion by 2030, registering an 8.34% CAGR during the period.

A shift toward precision medicine, routine syndromic surveillance, and value-based care is amplifying demand as molecular assays become embedded in everyday clinical work-flows. Hospitals and reference laboratories alike are scaling capacity through automation, while artificial-intelligence modules optimize everything from sample triage to result interpretation. These digital layers reduce human error, accelerate clinical decisions, and mitigate staffing shortfalls. At the same time, the nucleic acid amplification testing market is expanding into primary-care clinics, retail health, and public-health programs once reliant on conventional immunoassays. Isothermal chemistries advance decentralization, and regulatory momentum around liquid biopsy is positioning molecular oncology as the next high-volume frontier.

Global Nucleic Acid Amplification Testing (NAAT) Market Trends and Insights

Escalating Demand for Multiplex Respiratory Pathogen Panels

Syndromic respiratory panels allow clinicians to detect several viruses and bacteria in one run, cutting diagnostic uncertainty and guiding targeted therapy within hours. Hospitals report shorter lengths of stay and reduced empiric antibiotic use, advantages that align with value-based payment models. Laboratory managers also appreciate streamlined workflows that ease staffing pressure during seasonal surges. Because many of these panels are cartridge-based, they integrate smoothly with existing analyzers and help laboratories justify capital upgrades. Overall, their adoption is pushing the nucleic acid amplification testing market deeper into urgent-care and outpatient settings.

Rapid Adoption of Isothermal Loop-Mediated Platforms for Decentralized Testing

Loop-mediated amplification eliminates thermal cycling, enabling devices the size of a smartphone to perform sensitive detection in clinics, pharmacies, and field sites. Publication volume on LAMP and RPA rose steadily from 2013-2024, signalling maturing science. Coupled with microfluidic chips, these chemistries support sample-to-answer formats that require no lab bench. As emerging markets invest in infectious-disease surveillance, isothermal tools can reach rural zones where PCR systems are impractical, broadening the nucleic acid amplification testing market footprint.

Shortage of Qualified Molecular Technologists

Vacancy rates in public-health and clinical labs climbed in 2024, increasing overtime costs and limiting batch runs. Training pipelines lag behind demand, and rural facilities struggle to offer competitive salaries. Consequently, vendors emphasize plug-and-play designs that require minimal expertise, ensuring the nucleic acid amplification testing market can still grow despite labor shortages.

Other drivers and restraints analyzed in the detailed report include:

- Integration of NAAT with Automated Sample-to-Answer Cartridges

- Inclusion of NAAT in Blood-Screening Mandates

- High Per-Test Cost of Proprietary Cartridge Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Consumables represented 57.32% of 2024 revenue, anchoring the nucleic acid amplification testing market with dependable, repeat sales tied directly to test volumes. Reagent kits, probe mixtures, and disposable cartridges form the backbone of laboratory budgets. Multi-year procurement contracts shield buyers from price swings and assure manufacturers of predictable run-rates, reinforcing the segment's projected 9.77% CAGR. Meanwhile, smart packaging that embeds RFID tags supports automated inventory tracking, addressing stock-out risk and helping laboratories meet accreditation requirements. As point-of-care platforms proliferate, single-use cartridges become the dominant consumable form factor, further scaling the nucleic acid amplification testing market size for consumables.

Instruments and systems, although purchased less frequently, catalyze assay expansion. Modular analyzers that accept both PCR and isothermal chemistries protect capital investment and future-proof laboratories. Software and services revenue rises as facilities subscribe to cloud analytics and preventive-maintenance packages. Machine-learning upgrades that classify amplification curves in real time can be sold as annual licenses, giving vendors recurring top-line growth that rivals consumables within the nucleic acid amplification testing market.

PCR held 67.89% nucleic acid amplification testing market share in 2024, leveraging decades of validation, robust supply chains, and a vast installed base. Vendors refine multiplex kits to detect up to 30 targets, making PCR panels competitive with newer syndromic arrays. High-speed thermal cyclers now complete 45-cycle runs in under 20 minutes, keeping PCR relevant even when rapid results are mandatory.

Isothermal nucleic-acid amplification technology is projected to post a 10.12% CAGR, the fastest in the nucleic acid amplification testing market. LAMP's six-primer architecture confers exceptional specificity, and colorimetric readouts remove the need for fluorescence optics, cutting hardware costs. Recombinase polymerase amplification operates at body temperature, simplifying heater design for portable devices. These attributes position isothermal tools for field diagnostics, border-screening, and emergency triage. Ligase chain reaction, albeit niche, remains indispensable for single-nucleotide variant confirmation in targeted oncology assays, securing a small but stable slice of the nucleic acid amplification testing market.

The Nucleic Acid Amplification Testing (NAAT) Market Report is Segmented by Product (Consumables [Reagents and More] and More), Technology (Polymerase Chain Reaction (PCR) and More), Application (Infectious Disease [Tuberculosis and More], Oncology, and More), End-User (Hospitals and More) and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 43.52% of global revenue in 2024, supported by mature reimbursement, continuous innovation, and early adoption of digital-health integrations. Precision-oncology programs bolster molecular volumes, and capitated payment models reward faster, more accurate diagnoses. Cloud-based result portals allow rural clinicians to access expert molecular data, extending specialty care beyond tertiary hospitals. The nucleic acid amplification testing market is expected to advance at a steady pace as these dynamics deepen.

Asia-Pacific is projected for the fastest 10.15% CAGR, propelled by rising health budgets and domestic manufacturing. China's provincial procurement schemes favor made-in-China instruments, accelerating local adoption. India's public-private laboratory networks are expanding molecular menus in tuberculosis and HIV programs, offering vendors scale. Portable isothermal systems remove infrastructure barriers in Southeast Asia, further enlarging the nucleic acid amplification testing market.

Europe commands a significant share with an 8.25% CAGR outlook. Stringent quality regulations mandate standardized result reporting, boosting demand for instruments with built-in audit trails. Funding initiatives such as the EU4Health program finance molecular upgrades across member states, sustaining growth. The Middle East & Africa will grow at 9.88% CAGR; Gulf countries invest in world-class hospital complexes featuring full molecular suites, while donor-funded programs retrofit GeneXpert systems for broader disease panels. South America is set for 9.31% CAGR as Brazil and Colombia expand universal-health coverage and adopt rapid molecular diagnostics for Zika, dengue, and COVID-flu combos. Together, these regions deepen global penetration, lifting the nucleic acid amplification testing market.

- Abbott Laboratories

- Beckton Dickinson

- BGI Genomics Co. Ltd.

- bioMerieux

- Bio-Rad Laboratories

- Bruker

- Danaher

- Diasorin S.p.A.

- Roche

- Grifols

- Hologic

- Molbio Diagnostics Pvt. Ltd.

- Mylab Discovery Solutions

- Pfizer Inc (Lucira Health)

- QuidelOrtho Corp.

- Randox Laboratories

- Sansure Biotech Inc.

- Seegene

- Siemens Healthineers

- Thermo Fisher Scientific

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating Demand for Multiplexed Respiratory Pathogen Panels

- 4.2.2 Rapid Adoption of Isothermal Loop-Mediated Platforms for Decentralized Testing

- 4.2.3 Integration of NAAT with Automated Sample-to-Answer Cartridges

- 4.2.4 Inclusion of NAAT in Blood-Screening Mandates

- 4.2.5 Growth of ctDNA NAAT Companion Diagnostics in Oncology

- 4.2.6 Private Investment Surge in Portable CRISPR-Based NAAT Solutions

- 4.3 Market Restraints

- 4.3.1 Shortage of Qualified Molecular Technologists

- 4.3.2 High Per-Test Cost of Proprietary Cartridge Systems

- 4.3.3 Primer Redesign Needs Owing to Pathogen Mutations

- 4.3.4 Reagent Supply-Chain Vulnerabilities During Demand Surges

- 4.4 Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry Intensity

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Consumables

- 5.1.1.1 Reagents

- 5.1.1.2 Assay Kits

- 5.1.1.3 Other Consumables

- 5.1.2 Instruments & Systems

- 5.1.3 Software & Services

- 5.1.1 Consumables

- 5.2 By Technology

- 5.2.1 Polymerase Chain Reaction (PCR)

- 5.2.2 Isothermal Nucleic Acid Amplification Technology (INAAT)

- 5.2.3 Ligase Chain Reaction (LCR)

- 5.3 By Application

- 5.3.1 Infectious Disease

- 5.3.1.1 COVID-19

- 5.3.1.2 Sexually Transmitted Infections

- 5.3.1.3 Mosquito Borne

- 5.3.1.4 Gastrointestinal Infections

- 5.3.1.5 Tuberculosis

- 5.3.1.6 Hepatitis

- 5.3.1.7 Other Infectious Diseases

- 5.3.2 Oncology

- 5.3.3 Genetic & Mitochondrial Disorder Testing

- 5.3.4 Others

- 5.3.1 Infectious Disease

- 5.4 By End-User

- 5.4.1 Hospitals

- 5.4.2 Independent & Reference Laboratories

- 5.4.3 Other End-Users

- 5.5 By Geography (Value)

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Product Portfolio Analysis

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 Becton, Dickinson and Company

- 6.3.3 BGI Genomics Co. Ltd.

- 6.3.4 bioMerieux SA

- 6.3.5 Bio-Rad Laboratories Inc.

- 6.3.6 Bruker Corporation

- 6.3.7 Danaher Corporation

- 6.3.8 Diasorin S.p.A.

- 6.3.9 F. Hoffmann-La Roche AG

- 6.3.10 Grifols SA

- 6.3.11 Hologic Inc.

- 6.3.12 Molbio Diagnostics Pvt. Ltd.

- 6.3.13 Mylab Discovery Solutions

- 6.3.14 Pfizer Inc (Lucira Health)

- 6.3.15 QuidelOrtho Corp.

- 6.3.16 Randox Laboratories Ltd.

- 6.3.17 Sansure Biotech Inc.

- 6.3.18 Seegene Inc.

- 6.3.19 Siemens Healthineers AG

- 6.3.20 Thermo Fisher Scientific Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment