PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842556

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842556

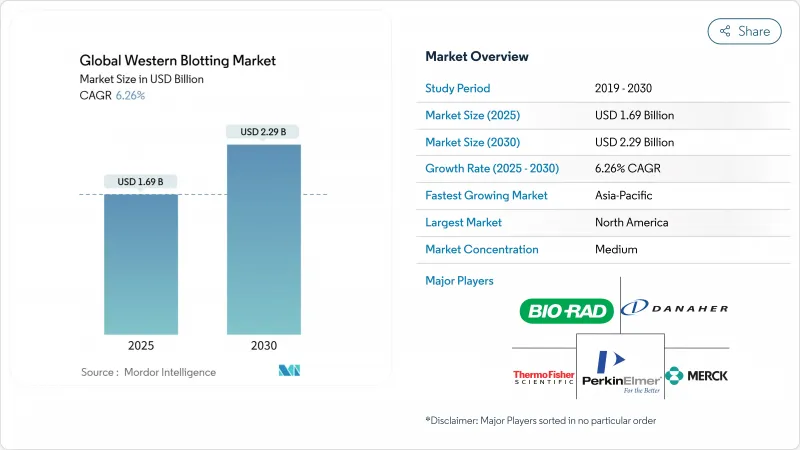

Global Western Blotting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The western blot market is valued at USD 1.69 billion in 2025 and is forecast to reach USD 2.29 billion by 2030, advancing at a 6.26% CAGR.

Increased chronic-disease incidence, the expansion of proteomics pipelines, and a wave of automation investments reinforce demand for protein confirmation assays in research and diagnostic workflows. Automated and microfluidic platforms are attracting laboratories that need higher throughput, less reagent consumption, and better reproducibility, while the ongoing preference for validated antibody-based techniques protects the core consumables business. Integration of artificial intelligence (AI) in antibody validation, tighter regulatory guidance on analytical robustness, and sustained life-sciences funding collectively anchor future growth for the Western blot market. Competitive pressure from multiplex immunoassays and mass-spectrometry-based approaches is intensifying, yet western blotting remains a benchmark method for confirming protein expression, post-translational modifications, and therapeutic product quality.

Global Western Blotting Market Trends and Insights

Rising Prevalence of Chronic Diseases

Cancer incidence climbed 58% in Europe between 1995 and 2022, creating sustained demand for protein biomarker confirmation in tumor biology and metabolic-disorder studies.Oncology research now requires the detection of low-abundance proteins and subtle post-translational changes, functions that western blotting supports reliably. The growing elderly population further enlarges case volumes for chronic conditions, reinforcing routine use of blot consumables and imaging reagents. As precision-medicine programs multiply, laboratories integrate automated blot platforms that handle higher throughput with minimal manual error. These patterns together lengthen the revenue runway for the Western blot market.

Expansion of Proteomics & Biomarker Discovery Pipelines

Large-scale proteomics initiatives are reshaping pharmaceutical discovery. Thermo Fisher Scientific's USD 3.1 billion purchase of Olink added more than 5,300 validated biomarker targets to its portfolio. Single-cell protein assays enabled by microfluidic western blotting now reveal heterogeneity that bulk analyses miss. AI-driven antibody screening accelerates candidate selection, cutting validation time and widening use cases. Rising sales of tandem-mass-tag reagents, up 18% to USD 4.01 million in 2024, indicate vigorous spending on complementary proteomics tools. These trends underpin continuous platform upgrades within the Western blot market.

Rapid Uptake of Alternative Immunoassay & Alpha Technologies

Parallel-reaction-monitoring mass spectrometry now offers antibody-free detection with enhanced sensitivity, directly challenging conventional immunoblotting. Multiplex platforms such as MSD, Luminex, and AlphaLISA permit simultaneous cytokine measurements with femtogram-level detection. These systems shorten assay time, simplify quantity, and align with high-throughput screening needs. Laboratories focused on speed and multiplexing migrate certain workflows away from western blotting, pressuring manufacturers to innovate with microfluidic chips and integrated imaging. While western blotting retains validation roles, the alternative technologies limit expansion in routine quantitation segments of the western blot market.

Other drivers and restraints analyzed in the detailed report include:

- Escalating Pharma / Biotech R&D Budgets

- Adoption of Automated & Microfluidic WB Platforms

- High Capital & Operating Cost of Western Blot Instruments & Antibodies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Consumables generated 65.2% of revenue in 2024, reflecting recurring sales of membranes, antibodies, buffers, and chemiluminescent substrates. This broad installed base secures stable cash flow for suppliers in the Western blot market. Automated and microfluidic instruments, while representing a smaller absolute revenue pool, are expanding at 8.12% CAGR to 2030 as users prioritize speed and low reagent footprints. Kit-based solutions further streamline workflows, lowering user variability and facilitating regulatory documentation. The segment's resilience resides in unavoidable consumable replacement cycles, regardless of platform sophistication.

Microfluidic devices reduce antibody usage to 1% of conventional volumes, trimming per-assay costs and easing supply constraints. Imaging systems now include embedded AI algorithms that assess band intensity, reducing interpretation subjectivity. Traditional wet-transfer equipment still serves academic labs where capital budgets limit the adoption of high-end automation. Gel and capillary electrophoresis modules continue to bridge sample preparation with downstream blotting, supporting overall western blot market continuity.

The Western Blotting Market is Segmented by Product (Instruments {Gel & Capillary Electrophoresis Systems and More} and Consumables), Application (Biomedical & Biochemical Research, Disease Diagnostics, and More), by End-User (Academia and Research Institutes, Biopharma Companies, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 42.0% of worldwide revenue in 2024, underpinned by mature research infrastructure, substantial biopharmaceutical R&D outlays, and rigorous regulatory oversight that values validated protein methods. The United States accounts for most sales, while Canada and Mexico contribute incremental gains through growing biotech clusters and clinical-trial activity. Government grants, venture capital flow, and an advanced supplier ecosystem foster early adoption of automated blot platforms, sustaining regional leadership.

Europe follows with well-established biotechnology hubs in Germany, the United Kingdom, France, and Switzerland. European regulators now demand reproducible analytics, reinforcing preferences for validated antibody sources and standard operating procedures. Switzerland's biotech network of more than 1,500 companies and 60,000 jobs illustrates how concentrated innovation feeds equipment demand. Markets such as Italy and Spain add volume via pharmaceutical manufacturing and university research, though budget constraints influence instrument penetration rates.

Asia Pacific is the fastest-growing territory, projected at an 8.80% CAGR through 2030. China's significant venture investments and state-sponsored life-sciences parks drive substantial procurement of blotting consumables and automated imaging systems. India accelerates adoption through government initiatives supporting translational research and domestic biologics production. Japan and South Korea leverage strong pharmaceutical bases and regulatory alignment with global standards to sustain replacement cycles. Australia and Southeast Asian countries, while smaller, are channeling grant funding toward proteomics facilities, strengthening regional participation in the western blot market. Collaborative models linking academia, government, and industry bolster infrastructure, ensuring long-term growth momentum.

List of Companies Covered in this Report:

- Thermo Fisher Scientific

- Bio-Rad Laboratories

- Danaher (Cytiva & ProteinSimple)

- Merck

- PerkinElmer

- LI-COR Biosciences

- Bio-Techne

- GE Healthcare

- Abcam

- Agilent Technologies

- Roche

- Azure Biosystems

- Rockland Immunochemicals

- Advansta Inc.

- GenScript Biotech

- RayBiotech Life

- ProteinSimple (Sartorius)

- Biovision

- Promega

- SignalChem Biotech

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of Chronic Diseases

- 4.2.2 Expansion of Proteomics & Biomarker Discovery Pipelines

- 4.2.3 Escalating Pharma / Biotech R&D Budgets

- 4.2.4 Adoption of Automated & Microfluidic Wb Platforms

- 4.2.5 Ai-Driven Antibody Validation Workflows Boosting Western Blot Demand

- 4.2.6 Regulatory Focus on Reproducible Protein Data

- 4.3 Market Restraints

- 4.3.1 Rapid Uptake of Alternative Immunoassay & Alpha Technologies

- 4.3.2 High Capital & Operating Cost of Western Blot Instruments & Antibodies

- 4.3.3 Antibody Batch-To-Batch Variability Undermining Reproducibility

- 4.3.4 Laboratory Decarbonization Targets Favoring Low-Reagent Assays

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Instruments

- 5.1.1.1 Gel & Capillary Electrophoresis Systems

- 5.1.1.2 Traditional Wet / Semi-dry / Dry Blotting Systems

- 5.1.1.3 Automated & Microfluidic Platforms

- 5.1.1.4 Imagers

- 5.1.2 Consumables

- 5.1.2.1 Reagent and Buffers

- 5.1.2.2 Kits

- 5.1.1 Instruments

- 5.2 By Application

- 5.2.1 Biomedical & Biochemical Research

- 5.2.2 Disease Diagnostics

- 5.2.3 Agricultural & Food Safety Testing

- 5.3 By End-User

- 5.3.1 Academic & Research Institutes

- 5.3.2 Biopharma & Biotechnology Companies

- 5.3.3 Hospitals & Diagnostic Laboratories

- 5.3.4 CROs & Contract Testing Labs

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Thermo Fisher Scientific

- 6.3.2 Bio-Rad Laboratories

- 6.3.3 Danaher (Cytiva & ProteinSimple)

- 6.3.4 Merck KGaA (Millipore Sigma)

- 6.3.5 PerkinElmer

- 6.3.6 LI-COR Biosciences

- 6.3.7 Bio-Techne Corporation

- 6.3.8 GE Healthcare

- 6.3.9 Abcam plc

- 6.3.10 Agilent Technologies

- 6.3.11 Roche Diagnostics

- 6.3.12 Azure Biosystems

- 6.3.13 Rockland Immunochemicals

- 6.3.14 Advansta Inc.

- 6.3.15 GenScript Biotech

- 6.3.16 RayBiotech Life

- 6.3.17 ProteinSimple (Sartorius)

- 6.3.18 BioVision Inc.

- 6.3.19 Promega Corporation

- 6.3.20 SignalChem Biotech

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment