PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842557

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842557

Dental Biomaterials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

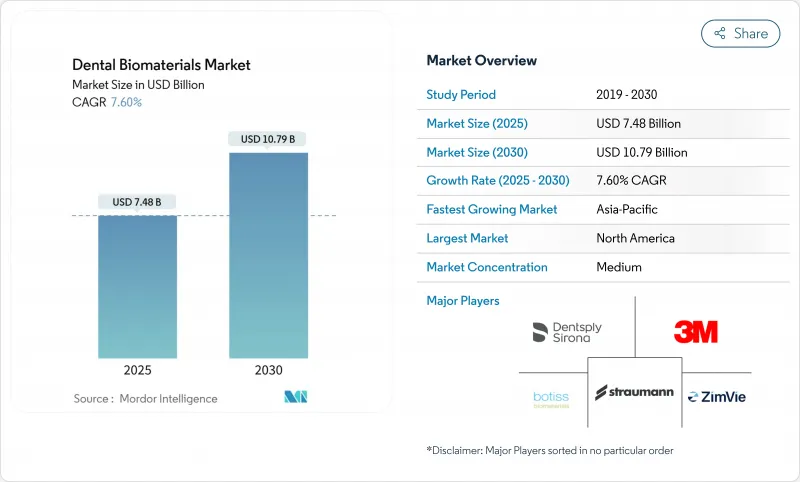

The dental biomaterials market stands at USD 7.48 billion in 2025 and is forecast to reach USD 10.79 billion by 2030, advancing at a 7.6% CAGR.

Rising edentulism in aging populations, broader insurance coverage for implantology, and expanding dental tourism corridors are reshaping purchase decisions and supply-chain priorities. Rapid adoption of CAD/CAM milling, 3D printing, and nano-engineering is shortening restoration cycles and opening premium pricing tiers for bioactive ceramics and hybrid composites. Post-2025 launches of regenerative scaffolds that stimulate osteogenesis represent a pivot from passive compatibility to active tissue integration. Intensifying price competition from Asia-Pacific laboratories compels Western manufacturers to refine zirconia sourcing and intensify chair-side digital workflows, allowing same-day crowns and bridges that align with evolving patient expectations for convenience and aesthetics.

Global Dental Biomaterials Market Trends and Insights

Ageing population & edentulism surge

Longer life expectancy combined with higher expectations for oral function is transforming demand in the Dental biomaterials market. Edentulous rates remain highest in people over 65, and this cohort increasingly requests metal-free, highly aesthetic materials that closely replicate natural enamel. The pivot from removable dentures to implant-anchored restorations is especially clear in North America and Western Europe, where public and private insurers are slowly broadening coverage for implant therapy. Senior patients also present more challenging bone physiology, which has encouraged clinicians to switch toward oxide-ceramic implants to avoid corrosion risk and facilitate soft-tissue response. Between 2025 and 2030, active seniors are expected to constitute the single largest purchasing segment, and their willingness to pay for premium materials should offset pricing pressure elsewhere in the value chain.

Rising adoption of dental implants & prosthetics

Average five-year implant survival now exceeds 95%, a milestone that has removed long-standing clinical hesitancy and widened patient eligibility. Treatment workflows that integrate CBCT imaging, guided-surgery sleeves and chair-side milling cut operative times dramatically, making implant therapy viable for busy urban clinics. Suppliers such as Straumann have introduced protocols that trim patient visits by 40%, allowing practices to generate higher daily throughput while improving patient satisfaction. Surface-texturing technologies and bioactive coatings push osseointegration speed higher, enabling immediate-load protocols that appeal to younger, working-age patients who cannot accommodate lengthy healing periods. These dynamics are multiplying unit volumes in the Dental biomaterials market and stimulating demand for grafts, membranes and abutment materials that complement the fixture itself.

High cost of advanced biomaterials & limited reimbursement

Premium zirconia blanks, osteoinductive grafts and nano-coated implants often retail at two to five times the price of base-grade alternatives, placing them out of reach for cash-pay patients in low-income settings. Insurance cover remains patchy; in many OECD countries the benefit caps for dental still sit below USD 2,000 per year, forcing patients to self-fund extensive rehabilitation. In April 2025, new tariffs added up to 54% to the landed price of certain imported dental materials in the United States, prompting clinicians to reassess inventory strategies. These price shocks threaten to slow diffusion of innovative materials just as clinical evidence mounts in their favour. Suppliers are responding with tiered product lines and subscription-style consumable bundles, but affordability remains a critical drag on the Dental biomaterials market.

Other drivers and restraints analyzed in the detailed report include:

- Advances in CAD/CAM, 3-D printing & nano-engineering

- Dental tourism in emerging markets

- Stringent multi-region regulatory clearances

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Metals commanded 44.56% capture of the Dental biomaterials market share in 2024, underpinned by titanium's proven biomechanical profile and clinician familiarity. Unit volumes remain high in posterior load-bearing zones and full-arch prosthetics, where fatigue resistance overrides aesthetic concerns. Yet ceramics, led by zirconia, are growing at an 8.97% CAGR as translucency advances narrow the visual gap with lithium-disilicate glass. Elevated consumer demand for metal-free restorations along with growing sensitivity to allergic reactions accelerates the ceramic migration path. Suppliers now pitch multi-layer zirconia discs that blend flexural strength cores with enamel-like surface layers, allowing one-piece full-contour crowns milled chair-side without veneering. That capability aligns neatly with single-visit dentistry trends and positions ceramics for continued share gain inside the Dental biomaterials market.

Digital design requirements are reshaping R&D agendas across all material classes. New polymer-infiltrated ceramic networks target hybrid indications, promising fracture toughness comparable to metals and polishing behaviour that mitigates antagonist wear. At the same time, resin-matrix composites with nano-filler scaffolds are capturing interim and long-span indications where weight savings matter. In the metals segment, cold-spray and selective-laser-melting processes are lowering porosity and enabling lattice-style structures that tune elasticity closer to cortical bone. Such improvements reinforce the incumbent position of metals in specialty cases even as cosmetic dentistry swings toward ceramics. The result is a nuanced competitive landscape in which each formulation occupies a clearly delineated price-performance niche, sustaining multi-material coexistence within the broader Dental biomaterials market.

Implantology retained 49.76% share of the Dental biomaterials market size in 2024 thanks to its composite demand for fixtures, abutments, grafts and barriers that extend the revenue footprint of every procedure. Implants have become the default standard of care whenever viable bone is present, and even in compromised cases clinicians increasingly rely on guided-bone-regeneration rather than opting for removable prostheses. However, regenerative dentistry outpaces all other groups with a 9.23% CAGR, propelled by breakthroughs in cell-laden hydrogels and growth-factor soaked membranes that stimulate endogenous healing. Academic-industry partnerships are moving enamel-matrix derivatives from periodontal therapy into broader alveolar-bone applications, setting the stage for a sizeable future revenue pocket inside the Dental biomaterials market.

Interdisciplinary overlaps are rising. Complex full-arch cases often marry implantology with sinus-lift grafts and onlay regenerative membranes, blurring category lines and lifting average selling prices per patient. Endodontics too is being revitalised as bioceramic sealers enable regenerative apexification protocols that keep teeth viable and delay extraction. Orthodontic anchorage screws fabricated from beta-titanium alloys now come pretreated with antibacterial nano-silver to limit peri-implantitis, illustrating continuous cross-pollination of material science. The competitive opportunity therefore hinges on platform technologies adaptable across applications rather than on standalone products, a trend that favours suppliers with broad portfolios in the Dental biomaterials market.

The Dental Biomaterials Market Report Segments Into by Type (Metallic Biomaterials, Ceramic Biomaterials, and More), by Product Category (Dental Bone Graft Substitutes, Barrier Membranes and More), by Application (Orthodontics, Prosthodontics, and More), by End User (Dental Clinics, Dental Laboratories and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America remains the single largest regional contributor to the Dental biomaterials market, driven by a high incidence of implant procedures, robust insurance penetration, and rapid adoption of digital chair-side systems. The United States sees pronounced demand in sun-belt states where older retirees cluster and where DSOs roll out scalable care models that standardise material protocols. Canada mirrors these trends on a smaller scale but benefits from public reimbursement frameworks that now fund select implant cases for seniors, extending addressable volume.

Europe follows closely, though growth patterns vary by sub-region. Western Europe sustains replacement cycles for ageing fixed prostheses and increasingly favours ceramic-based materials in response to patient demand for metal-free smiles. Central and Eastern Europe, led by Poland and Hungary, have built a thriving dental tourism corridor catering primarily to German and Nordic patients seeking lower procedure costs. This inflow pushes clinics to stock branded implants and high-translucency zirconia, lifting average selling prices and enriching the Dental biomaterials market.

Asia-Pacific records the fastest aggregate expansion, propelled by rising disposable incomes, aggressive infrastructure investments, and supportive government measures in South Korea and Japan that subsidise implant therapy for seniors. China's tier-one cities host cutting-edge university spin-offs producing nano-engineered grafts, yet uneven insurance cover keeps adoption skewed toward coastal metros. India and Southeast Asia benefit from returning medical tourists and cost-competitive labour, though import tariffs on premium biomaterials push clinics toward domestic alternatives. Collectively these vectors position the region as the foremost incremental growth engine for suppliers operating in the global Dental biomaterials market.

- Straumann Group

- Dentsply Sirona

- Zimmer Biomet

- Geistlich Pharma

- 3M

- Ivoclar Vivadent

- GC Corporation

- Kuraray Noritake Dental

- Coltene Holding

- VOCO

- Septodont

- Shofu Inc.

- DenMat Holdings

- Osstem Implant Co. Ltd.

- Envista (Nobel Biocare, Kerr, etc.)

- Henry Schein Inc. (Biomet 3i)

- BioHorizons IPH

- Bego GmbH

- ZimVie

- Kettenbach GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Ageing population & edentulism surge

- 4.2.2 Rising adoption of dental implants & prosthetics

- 4.2.3 Advances in CAD/CAM, 3-D printing & nano-engineering

- 4.2.4 Dental tourism in emerging markets

- 4.2.5 Emergence of bioactive / regenerative biomaterials post-2025

- 4.2.6 Chair-side milling demand for pre-shaded zirconia & hybrids

- 4.3 Market Restraints

- 4.3.1 High cost of advanced biomaterials & limited reimbursement

- 4.3.2 Stringent multi-region regulatory clearances

- 4.3.3 Supply-chain risk in medical-grade zirconia powder

- 4.3.4 Eco-regulation curbing coral/xenograft sourcing

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Material Type (Value)

- 5.1.1 Metallic Biomaterials

- 5.1.2 Ceramic Biomaterials

- 5.1.3 Polymeric Biomaterials

- 5.1.4 Metal-Ceramic Hybrids

- 5.1.5 Natural / Bio-derived Materials

- 5.2 By Application (Value)

- 5.2.1 Implantology

- 5.2.2 Prosthodontics

- 5.2.3 Orthodontics

- 5.2.4 Regenerative Dentistry

- 5.2.5 Periodontics

- 5.2.6 Endodontics

- 5.3 By Product Category (Value)

- 5.3.1 Dental Bone Graft Substitutes

- 5.4 Barrier MembranesScaffolds & Hydrogels

- 5.4.1 Barrier Membranes

- 5.4.2 Scaffolds & Hydrogels

- 5.4.3 Adhesives & Cements

- 5.4.4 CAD/CAM Blocks & Discs

- 5.4.5 Liners & Bases

- 5.5 By End User (Value)

- 5.5.1 Dental Clinics

- 5.5.2 Hospitals & Multi-Specialty Centers

- 5.5.3 Dental Laboratories

- 5.5.4 Academic & Research Institutes

- 5.6 By Geography (Value)

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC Countries

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 Institut Straumann AG

- 6.3.2 Dentsply Sirona Inc.

- 6.3.3 Zimmer Biomet Holdings Inc.

- 6.3.4 Geistlich Pharma AG

- 6.3.5 3M Company

- 6.3.6 Ivoclar Vivadent AG

- 6.3.7 GC Corporation

- 6.3.8 Kuraray Noritake Dental

- 6.3.9 Coltene Holding AG

- 6.3.10 VOCO GmbH

- 6.3.11 Septodont Holding

- 6.3.12 Shofu Inc.

- 6.3.13 DenMat Holdings

- 6.3.14 Osstem Implant Co. Ltd.

- 6.3.15 Envista (Nobel Biocare, Kerr, etc.)

- 6.3.16 Henry Schein Inc. (Biomet 3i)

- 6.3.17 BioHorizons IPH

- 6.3.18 Bego GmbH

- 6.3.19 ZimVie Inc.

- 6.3.20 Kettenbach GmbH

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment