PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842559

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842559

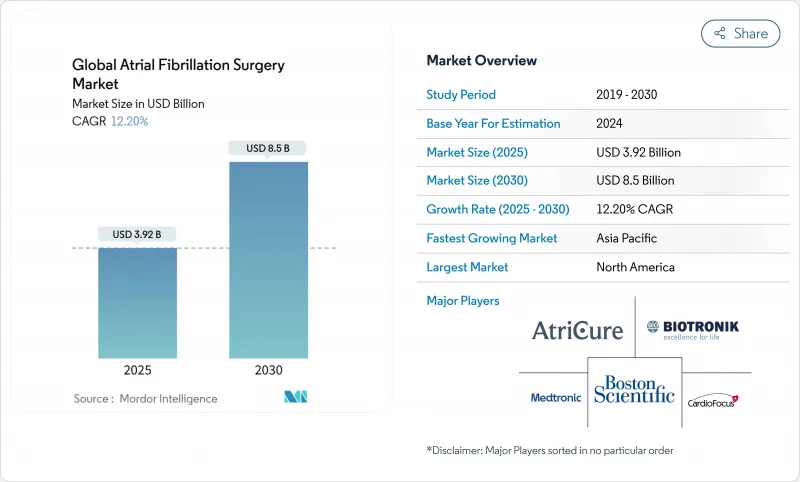

Global Atrial Fibrillation Surgery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The atrial fibrillation ablation market reached USD 3.92 billion in 2025 and is forecast to climb to USD 8.50 billion by 2030, reflecting a 13.74% CAGR.

Rising procedure volumes track sharply higher atrial fibrillation (AF) prevalence, wider availability of elective electrophysiology programs, and rapid migration toward pulsed-field ablation (PFA) systems that shorten procedure times while improving safety. Hospitals keep investing in integrated electrophysiology-hybrid suites even as ambulatory surgical centers (ASCs) draw case volumes through site-neutral payment rules and same-day discharge protocols. Capital flows into catheter innovation, mapping software, and AI-guided workflow analytics continue to reshape competitive positioning. Meanwhile, reimbursement revisions in the United States and Europe now recognize the complexity of combined left-atrial appendage closure and ablation, supporting revenue expansion for providers.

Global Atrial Fibrillation Surgery Market Trends and Insights

Ageing population & AF prevalence surge

Lifetime AF risk climbed from 24.2% for Danes born 2000-2010 to 30.9% for those born 2011-2022, signaling a broad expansion of the treatable patient pool. US prevalence estimates now exceed prior forecasts as remote monitoring uncovers asymptomatic episodes. This demographic pressure intersects with improving detection technologies to lift referral volumes for rhythm-control procedures. Emerging economies mirror the trend; Korean national data reveal similar age-linked incidence curves. Health-system planners therefore frame AF ablation capacity expansion as a long-tail volume growth opportunity.

Rising adoption of minimally invasive catheter ablation

A meta-analysis of 22 randomized trials covering 6,400 patients confirmed that ablation halves AF relapse risk relative to medical therapy and cuts all-cause hospitalization by 43%. Endorsement of same-day discharge by US specialty societies accelerated uptake; Canadian centers reported 79.2% same-day release with negligible readmissions. Cumulative evidence positions ablation earlier in the treatment algorithm, making first-line rhythm control a mainstream option.

Capital-intensive hybrid-OR build-outs

Turn-key electrophysiology-surgical suites cost USD 2-5 million per room, straining rural or small-system budgets and slowing diffusion of advanced energy platforms outside tier-one centers.

Other drivers and restraints analyzed in the detailed report include:

- Hospital cap-ex cycle toward single-shot PFA systems

- Reimbursement upgrades for same-day discharge AF surgery

- Shortage of EP-trained surgeons

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Catheter ablation retained 64.45% revenue in 2024, anchoring the atrial fibrillation ablation market even as pulsed-field ablation logs a breakout 14.78% CAGR to 2030. The atrial fibrillation ablation market size for PFA-based procedures is therefore projected to almost triple within the decade. Balloon-based single-shot systems routinely isolate all pulmonary veins in under 20 minutes, while the MANIFEST-17K registry documented zero esophageal injuries versus historic 1-3% for thermal energy. Clinical validation such as the ADVENT trial confirmed non-inferiority on efficacy and superiority on safety against cryoablation, while procedure duration declined by 35%. Although the NEMESIS-PFA registry flagged elevated troponin release, ongoing waveform optimization aims to minimize myocardial stun.

Persistent AF remains challenging; hybrid maze or convergent approaches combine epicardial and endocardial lines to raise single-procedure success, but volumes stay niche. Surgical maze is anchored to valve or coronary bypass cases that already require sternotomy, keeping its share stable. Long-term, industry analysts expect PFA to capture incremental share from both radiofrequency and cryoballoon techniques as operator confidence strengthens and next-generation catheters expand lesion sets beyond pulmonary veins.

The Atrial Fibrillation Surgery Market is Segmented by Procedure (Catheter Ablation, Surgical Maze & Mini-Maze and More), by Product (Catheter Ablation Devices, Surgical Ablation Systems and More), End User (Hospitals, Ambulatory Surgical Centers, and Other End Users), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, and South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 39.45% of 2024 revenue and remains the benchmark for early adoption as payer coverage spans both thermal and pulsed-field technologies. FDA approvals of PulseSelect and VARIPULSE triggered a fresh equipment replacement cycle, while CMS creation of MS-DRG 317 improved facility reimbursement for combined ablation and appendage closure. Market tailwinds include robust ASC roll-outs across Texas, Florida, and California plus capital access that funds hybrid-suite builds. Headwinds are modest: a 2.93% cut in the 2025 Medicare Physician Fee Schedule trims professional income, but throughput gains offset revenue erosion.

Europe positions as the second-largest regional cluster with strong clinical-trial leadership and structured training programs. CE Mark clearance for Abbott's Volt PFA system in March 2025 unlocked broad commercial use, and the MANIFEST-17K study-largely European-cemented safety credentials. Germany, France, and the United Kingdom anchor procedural volume, while Eastern Europe accelerates from a low base. The United Kingdom's National Institute for Health and Care Excellence published an analysis indicating that PFA lowers average procedure costs by GBP 743 relative to cryoablation, supporting adoption inside the National Health Service.

Asia-Pacific is the growth engine with a forecast 17.23% CAGR. Japan validated PFA efficacy in the PULSED-AF trial, creating a template for other regulators. China's Healthy China 2030 agenda prioritizes chronic disease management and domestic device innovation, prompting local start-ups to co-develop PFA catheters with academic hospitals. India's middle-class expansion and widening insurance penetration diversify referral channels beyond elite private hospitals. South Korea and Australia function as training hubs for Southeast Asian electrophysiologists. Regional constraints include specialist shortages outside tier-one cities and fragmented reimbursement but remain outweighed by demographic drivers and rapid capital deployment into tertiary cardiac centers.

Latin America and the Middle East & Africa contribute smaller shares but show rising interest in single-shot balloons that shorten general-anesthesia time and fit within limited cath-lab schedules. Multinational vendors often bundle training and warranty packages to reduce ownership cost, easing entry barriers in resource-constrained systems.

- Medtronic

- Boston Scientific

- Johnson & Johnson

- Abbott Laboratories

- AtriCure

- MicroPort EP

- Acutus Medical

- CardioFocus

- Siemens Healthineers

- Koninklijke Philips

- Field Medical

- Adagio Medical

- BIOTRONIK

- Lepu Medical

- Biosense Webster

- CathRx

- Volta Medical

- Kardium

- NContact Surgical

- Imricor Medical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Ageing population & AF prevalence surge

- 4.2.2 Rising adoption of minimally-invasive catheter ablation

- 4.2.3 Expansion of outpatient EP labs & ambulatory centers

- 4.2.4 Hospital cap-ex cycle toward single-shot PFA systems (under-the-radar)

- 4.2.5 Reimbursement upgrades for same-day discharge AF surgery (under-the-radar)

- 4.3 Market Restraints

- 4.3.1 Capital-intensive hybrid-OR build-outs

- 4.3.2 Shortage of EP-trained surgeons

- 4.3.3 Long-term durability concerns for PFA (under-the-radar)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Industry Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Procedure

- 5.1.1 Catheter Ablation

- 5.1.2 Surgical Maze & Mini-Maze

- 5.1.3 Hybrid Convergent

- 5.1.4 Pulsed Field Ablation (PFA)

- 5.2 By Product Type

- 5.2.1 Catheter Ablation Devices

- 5.2.2 Surgical Ablation Systems

- 5.2.3 PFA Systems

- 5.2.4 Mapping & Navigation Systems

- 5.2.5 Ancillary Accessories

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Cardiac Catheterization Laboratories

- 5.3.4 Specialty Clinics

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 GCC

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Medtronic

- 6.3.2 Boston Scientific

- 6.3.3 Johnson & Johnson (Biosense Webster)

- 6.3.4 Abbott Laboratories

- 6.3.5 AtriCure

- 6.3.6 MicroPort EP

- 6.3.7 Acutus Medical

- 6.3.8 CardioFocus

- 6.3.9 Siemens Healthineers

- 6.3.10 Koninklijke Philips

- 6.3.11 Field Medical

- 6.3.12 Adagio Medical

- 6.3.13 Biotronik

- 6.3.14 Lepu Medical

- 6.3.15 Biosense Webster

- 6.3.16 CathRx

- 6.3.17 Volta Medical

- 6.3.18 Kardium

- 6.3.19 NContact Surgical

- 6.3.20 Imricor Medical

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment