PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842560

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842560

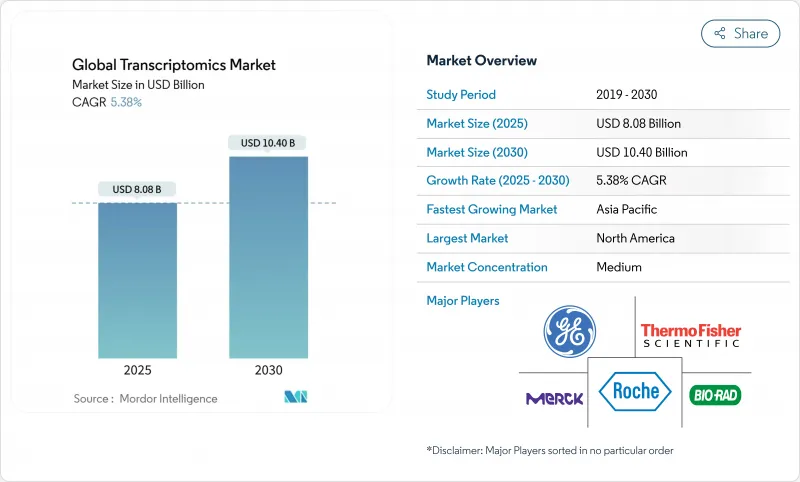

Global Transcriptomics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The transcriptomics market size reached USD 8.08 billion in 2025 and is projected to expand to USD 10.40 billion by 2030, reflecting a steady 5.38% compound annual growth rate (CAGR).

Near-term growth stems from rising clinical demand for gene-expression profiling across oncology, immunology, and rare-disease applications, while longer-term expansion will be driven by artificial-intelligence (AI) integration, spatial sequencing advances, and broad reimbursement adoption. Single-cell RNA sequencing (scRNA-seq) underpins almost half of current revenues, yet spatial transcriptomics is outpacing all other technologies as laboratories seek tissue-architecture context. North America's mature reimbursement pathways sustain its leadership, whereas Asia-Pacific benefits from state-backed genomics initiatives and lower clinical-trial costs. Strategic acquisitions that bundle transcriptomics with proteomics and metabolomics signal a market pivot toward end-to-end precision-medicine solutions rather than stand-alone expression platforms.

Global Transcriptomics Market Trends and Insights

Rapid Adoption Of RNA-Seq Platforms

Clinical laboratories increasingly integrate RNA-sequencing workflows following 2024 FDA approvals of assays such as TruSight Oncology Comprehensive, creating reimbursement certainty and accelerating platform uptake . Long-read technologies from Oxford Nanopore and Pacific Biosciences have solved splice-variant detection, reporting median 98.8% read accuracy for direct RNA sequencing. Clinical sequencing revenues exceeded research use for the first time in 2023, pushing manufacturers to emphasize automation and interpretation software rather than throughput. The shift raises quality-control expectations but simultaneously unlocks premium pricing, reinforcing a recurring consumables model that underpins sustained transcriptomics market growth.

Expansion Of Transcriptomics-Based Drug Discovery

Pharmaceutical companies deploy multi-omics AI to mine scRNA-seq data for drug targets, cutting development timelines; Recursion Pharmaceuticals' approach exemplifies this trend. Spatial transcriptomics adds micro-environment context critical for oncology research, and FDA guidance from its 2024 Omics Days conference clarified biomarker-validation pathways, spurring investment. Resulting translational studies move expression biomarkers from discovery to pivotal trials faster, lifting demand for high-throughput sequencing reagents.

High Platform & Consumable Costs

A scRNA-seq run ranges from USD 3,170 to USD 25,540, straining research grants and discouraging small clinical labs. Consumables outpace instrument costs over a platform's life, yet limited supplier competition slows price declines. Emerging entrants Element Biosciences and Ultima Genomics promise lower-cost chemistries, but widespread adoption remains two years away. Leasing and service models help offset capital expenditure, though they raise lifecycle costs and reduce workflow flexibility.

Other drivers and restraints analyzed in the detailed report include:

- Rising Chronic Disease Burden & Precision Diagnostics Demand

- Emergence Of Spatial & Single-Cell Transcriptomics

- Bioinformatics Skill Gap & Data-Handling Complexity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Single-cell RNA sequencing held 47.25% transcriptomics market share in 2024, underscoring its role in resolving cellular heterogeneity that bulk methods overlook . The segment's maturity redirects innovation toward workflow throughput and cost reduction, while spatial platforms record a 6.45% CAGR as laboratories seek tissue-structure context.

The transcriptomics market continues to tilt toward multimodal solutions that merge scRNA-seq with spatial barcoding, enhancing insight without sacrificing resolution. Long-read chemistries capture complex isoforms, broadening oncologic and neurologic study scope. Although microarrays fade, quantitative PCR maintains a foothold for rapid, low-plex assays. Vendors therefore balance portfolios between high-content discovery tools and targeted clinical panels to secure diverse revenue streams.

Consumables generated 54.28% of the transcriptomics market size in 2024, emphasizing the power of a razor-razorblade model that assures recurrent cash flow. Instrument sales slowed as core features converged across vendors, yielding only 6.71% growth.

Software and analytical-service revenues accelerate as data complexity grows, allowing specialized providers to capture value beyond wet-lab reagents. Cloud-native pipelines democratize advanced bioinformatics, yet premium prices for clinical-grade kits keep margins high. As the installed instrument base saturates top research centers, consumable vendors pivot to emerging markets and mid-tier hospitals, tailoring kit sizes and price points to local budgets.

The Transcriptomics Market Report Segments the Industry Into by Technology (Microarray, Real-Time Quantitative Polymerase Chain Reaction (Q-PCR), and More), by Product (Consumables, Instruments, and More), by Application (Diagnostics and Disease Profiling, Drug Discovery, and More), and Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 45.28% transcriptomics market share in 2024, anchored by abundant venture capital, dense biopharma clusters, and FDA companion-diagnostic pathways that encourage clinical validation. Public-private partnerships such as the Cancer Moonshot sustain large-scale expression-atlas projects, keeping domestic consumables demand high. Canada leverages a single-payer system to run population-level gene-expression studies, while Mexico lures contract-manufacturing investment through lower costs and rising clinical-trial activity.

Asia-Pacific posts a 7.29% CAGR, propelled by China's multi-billion-dollar precision-medicine grants and Japan's early adoption of spatial-omic diagnostics. India's contract-research ecosystem couples vast patient pools with cost-efficient trials that increasingly include transcriptomic endpoints. Australia's government-funded Genomics Australia program encourages translational-omics collaborations, funneling academic breakthroughs into commercial assays. Diverse regulatory regimes remain both opportunity and obstacle, with some markets offering accelerated approvals and others demanding prolonged local validation.

Europe maintains strong basic-research output through projects like Genome of Europe, yet stringent General Data Protection Regulation (GDPR) rules lengthen time-to-clinic for novel diagnostics. Germany, the United Kingdom, and France dominate test volumes, supported by established reimbursement codes. Smaller nations such as Switzerland and the Netherlands specialize in high-content single-cell analytics and platform integration consulting. Post-Brexit collaboration frameworks ensure continued data exchange, preserving the region's cohesive R&D landscape.

- Illumina

- Thermo Fisher Scientific

- 10x Genomics

- Agilent Technologies

- BGI

- Bio-Rad Laboratories

- NanoString Technologies

- Pacific Biosciences of California

- QIAGEN

- Roche

- Merck KGaA (MilliporeSigma)

- PerkinElmer

- Standard BioTools (Fluidigm)

- Oxford Nanopore Technologies

- Dovetail Genomics

- Promega

- Guardant Health

- Takara Bio

- Danaher

- Beckton Dickinson

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Adoption Of RNA-Seq Platforms

- 4.2.2 Expansion Of Transcriptomics-Based Drug Discovery

- 4.2.3 Cloud-Native Ai Pipelines Are Democratizing Large-Scale Transcriptomic Data Analysis,

- 4.2.4 Rising Chronic Disease Burden & Precision Diagnostics Demand

- 4.2.5 Emergence Of Spatial & Single-Cell Transcriptomics

- 4.2.6 Agri-Genomics Programs In Food-Insecure Regions

- 4.3 Market Restraints

- 4.3.1 High Platform & Consumable Costs

- 4.3.2 Bioinformatics Skill Gap & Data-Handling Complexity

- 4.3.3 Stringent Data-Privacy / Clinical-Validation Regulations

- 4.3.4 Supply Bottlenecks For Single-Cell Reagents

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD Million)

- 5.1 By Technology

- 5.1.1 Microarray

- 5.1.2 Real-time Quantitative PCR (qPCR)

- 5.1.3 Next-Generation Sequencing (RNA-Seq)

- 5.1.4 Single-cell RNA-Seq

- 5.1.5 Spatial Transcriptomics

- 5.1.6 In-situ Hybridization & Other Methods

- 5.2 By Product

- 5.2.1 Consumables & Reagents

- 5.2.2 Instruments

- 5.2.3 Software & Services

- 5.3 By Application

- 5.3.1 Drug Discovery & Development

- 5.3.2 Diagnostics & Disease Profiling

- 5.3.3 Biomarker & Target Identification

- 5.3.4 Agriculture & Plant Science

- 5.3.5 Others

- 5.4 By End User

- 5.4.1 Academic & Research Institutes

- 5.4.2 Pharmaceutical & Biotechnology Companies

- 5.4.3 Clinical & Diagnostic Laboratories

- 5.4.4 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, Recent Developments)

- 6.3.1 Illumina Inc.

- 6.3.2 Thermo Fisher Scientific

- 6.3.3 10x Genomics

- 6.3.4 Agilent Technologies Inc.

- 6.3.5 BGI Genomics

- 6.3.6 Bio-Rad Laboratories Inc.

- 6.3.7 NanoString Technologies

- 6.3.8 Pacific Biosciences of California

- 6.3.9 Qiagen NV

- 6.3.10 F. Hoffmann-La Roche AG

- 6.3.11 Merck KGaA (MilliporeSigma)

- 6.3.12 PerkinElmer Inc.

- 6.3.13 Standard BioTools (Fluidigm)

- 6.3.14 Oxford Nanopore Technologies

- 6.3.15 Dovetail Genomics

- 6.3.16 Promega Corporation

- 6.3.17 Guardant Health

- 6.3.18 Takara Bio Inc.

- 6.3.19 Danaher (Cytiva)

- 6.3.20 Becton, Dickinson & Co.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment