PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842563

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842563

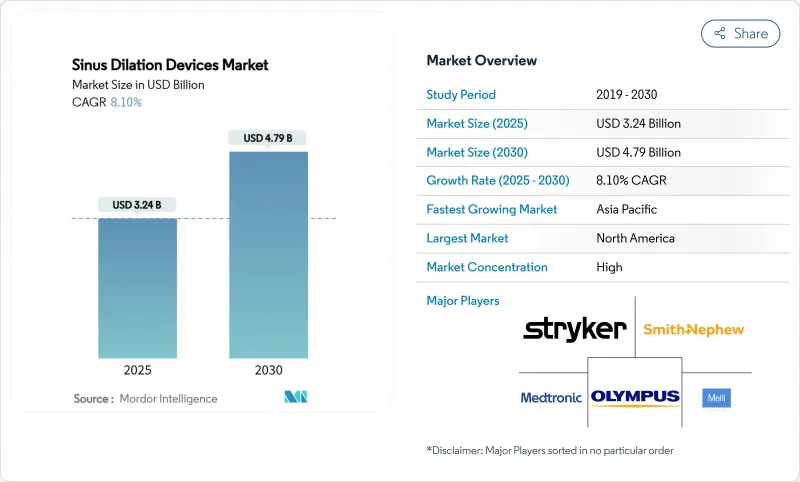

Sinus Dilation Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The sinus dilation devices market is worth USD 3.24 billion in 2025 and is forecast to climb to USD 4.79 billion by 2030, advancing at an 8.1% CAGR.

The shift from traditional functional endoscopic sinus surgery to balloon-based techniques is anchored in rising chronic rhinosinusitis prevalence, rapid device innovation, and an accelerating move toward office-based care that lowers overall treatment costs. Demand receives further support from drug-eluting implants that keep sinuses patent, AI-guided navigation systems that raise first-pass success, and payer policies that reimburse minimally invasive approaches across major markets. Hospitals still perform most procedures, yet ENT specialty clinics are gaining ground as focused care delivery models show better patient flow and shorter wait times. Regionally, North America holds leadership through well-defined reimbursement codes, while Asia Pacific shows the steepest adoption curve as infrastructure rises and an aging population drives need.

Global Sinus Dilation Devices Market Trends and Insights

Rising Prevalence of Chronic Rhinosinusitis

Chronic rhinosinusitis affects 12% of adults worldwide, expanding the candidate pool for sinus dilation device procedures. Environmental factors such as pollution and urban living intensify mucosal inflammation and shorten the time to surgical intervention when medication fails. Clinical guidance now positions balloon dilation earlier in the treatment pathway, increasing overall procedure volume. Aging populations in developed regions add to the burden, correlating with higher per-capita treatment rates. The resulting uptick in surgical demand boosts device sales and encourages new product launches that target durability and ease of use.

Growing Preference for Minimally Invasive Sinus dilation devices

Patients favor procedures that limit tissue trauma and shorten recovery, prompting a steady migration from conventional sinus surgery to balloon-based dilation. Clinical studies note lower complication rates and a return-to-work window measured in days rather than weeks. Office-based feasibility eliminates general anesthesia and reduces facility fees, easing both payer costs and patient copays. Coverage uniformity across major private insurers lowers financial uncertainty for providers. These dynamics combine to accelerate uptake across hospitals, ambulatory surgery centers, and physician offices.

Peri-Operative Risks and Post-Operative Complications

Although generally safe, balloon dilation can cause orbital injury, cerebrospinal fluid leak, or bleeding when performed without adequate visualization. MAUDE reports cite stent migration and mucosal irritation linked to corticosteroid-eluting implants. Variability in surgeon skill magnifies these risks, especially in settings with limited training resources. Safety concerns may delay adoption in health systems that demand robust outcome data before switching to new techniques. Structured training and clear patient selection criteria remain essential to mitigate complications.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advances: Drug-Eluting Stents and Image-Guided Systems

- Favorable Reimbursement Policies in the US and EU

- Shortage of Skilled Otolaryngologists in Emerging Nations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Balloon sinus dilation systems continue to hold 31.7% of the sinus dilation devices market in 2024, reflecting their role as the procedural cornerstone. Navigation software, AI consoles, and real-time imaging hardware, however, are forecast to record an 11.40% CAGR and are pulling the overall sinus dilation devices market toward data-rich, precision-guided workflows. Drug-eluting implants that deliver mometasone furoate for three months reduce revision surgery and open new revenue channels with premium margins. Hand-held dilation tools remain important in cost-constrained settings, ensuring that lower-income markets can still access the therapy.

Accessories and consumables generate predictable revenue for manufacturers. Single-use balloons, guidewires, and irrigation kits form the bulk of procedural spend. Hybrid devices that blend balloon dilation with drug release occupy a growing niche, allowing providers to justify higher per-case reimbursement. The strong link between consumable pull-through and capital unit placement encourages suppliers to create leasing and service models that lower upfront costs and secure long-term account loyalty. The sinus dilation devices market size contribution from high-margin navigation platforms is expected to widen as hospitals refresh fleets to meet digital surgery initiatives.

The Sinus Dilation Devices Market is Segmented by Product (Balloon Sinus Dilation Systems, Drug-Eluting Sinus Implants/Stents, and More), Procedure (Standalone Balloon Sinuplasty and Hybrid Balloon + FESS Procedures), End User (Hospitals, ENT/Specialty Clinics, Ambulatory Surgical Centers, and More), and Geography (North America, Europe, Asia Pacific, and More). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for USD 0.98 billion of the sinus dilation devices market size in 2024 and maintained 30.3% share thanks to CPT-coded reimbursement, mature surgeon training programs, and widespread adoption of AI-enhanced navigation. Canada's single-payer system supports consistent access, while Mexico's private hospitals drive cross-border procedure volumes.

Europe follows with a diversified payer landscape; Germany, the United Kingdom, France, Italy, and Spain lead uptake under national health insurance frameworks that recognize the cost-benefit of minimally invasive sinus care. EU-MDR compliance, however, introduces timelines that may slow the rollout of biodegradable implants, affecting near-term growth.

Asia Pacific posts the fastest trajectory at 9.60% CAGR. China's regulatory reforms streamline device approvals, and provincial reimbursement pilots improve affordability. Japan's aging population and preference for technology drive premium platform sales, whereas India focuses on cost-effective dilation kits paired with training programs that expand specialist coverage. Combined, these factors are set to lift regional revenue past Europe by 2030, reinforcing Asia Pacific as the primary incremental contributor to global sinus dilation devices market expansion.

- Medtronic

- Johnson & Johnson (Acclarent)

- Stryker Corporation (Entellus)

- Smiths Group

- Olympus

- Intersect ENT

- SinuSys

- Meril Life Science

- Intersect ENT

- Dalent Medical

- InnAccel Technologies

- Accurate Surgical & Scientific Instruments

- Karl Storz

- Summit Medical LLC

- Boston Scientific

- Olympus

- OptiNose Inc.

- Bentley Innomed GmbH

- Jilin Coronado Medical Equipment Co.

- Chengdu Mechan Electronic Technology

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence Of Chronic Rhinosinusitis

- 4.2.2 Growing Preference For Minimally?Invasive Balloon Sinuplasty

- 4.2.3 Technological Advances: Drug-Eluting Stents & Image-Guided Systems

- 4.2.4 Favorable Reimbursement Policies In The US & EU

- 4.2.5 Shift Toward Office-Based ENT Procedures Lowers Total Treatment Cost

- 4.2.6 AI-Enabled Endoscopic Visualization Improving First-Pass Success

- 4.3 Market Restraints

- 4.3.1 Peri-Operative Risks & Post-Operative Complications

- 4.3.2 Shortage Of Skilled Otolaryngologists In Emerging Nations

- 4.3.3 ASP Compression From Influx Of Low-Cost Asian OEM Devices

- 4.3.4 EU-MDR Uncertainty For Biodegradable Sinus Implants

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Balloon Sinus Dilation Systems

- 5.1.2 Drug-eluting Sinus Implants/Stents

- 5.1.3 Hand-held Dilatation Instruments

- 5.1.4 Endoscopes & Navigation Systems

- 5.1.5 Accessories & Consumables

- 5.1.6 Other Products

- 5.2 By Procedure

- 5.2.1 Standalone Balloon Sinuplasty

- 5.2.2 Hybrid Balloon + FESS Procedures

- 5.3 By End-User

- 5.3.1 Hospitals

- 5.3.2 ENT / Specialty Clinics

- 5.3.3 Ambulatory Surgical Centers

- 5.3.4 Office-based Physician Practices

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products, and Recent Developments)

- 6.3.1 Medtronic Plc

- 6.3.2 Johnson & Johnson (Acclarent)

- 6.3.3 Stryker Corporation (Entellus)

- 6.3.4 Smith & Nephew plc

- 6.3.5 Olympus Corporation

- 6.3.6 Intersect ENT Inc.

- 6.3.7 SinuSys Corporation

- 6.3.8 Meril Life Sciences Pvt. Ltd.

- 6.3.9 Intersect ENT Inc.

- 6.3.10 Dalent Medical

- 6.3.11 InnAccel Technologies

- 6.3.12 Accurate Surgical & Scientific Instruments

- 6.3.13 KARL STORZ SE & Co. KG

- 6.3.14 Summit Medical LLC

- 6.3.15 Boston Scientific Corporation

- 6.3.16 Olympus Corporation

- 6.3.17 OptiNose Inc.

- 6.3.18 Bentley Innomed GmbH

- 6.3.19 Jilin Coronado Medical Equipment Co.

- 6.3.20 Chengdu Mechan Electronic Technology

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment