PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842564

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842564

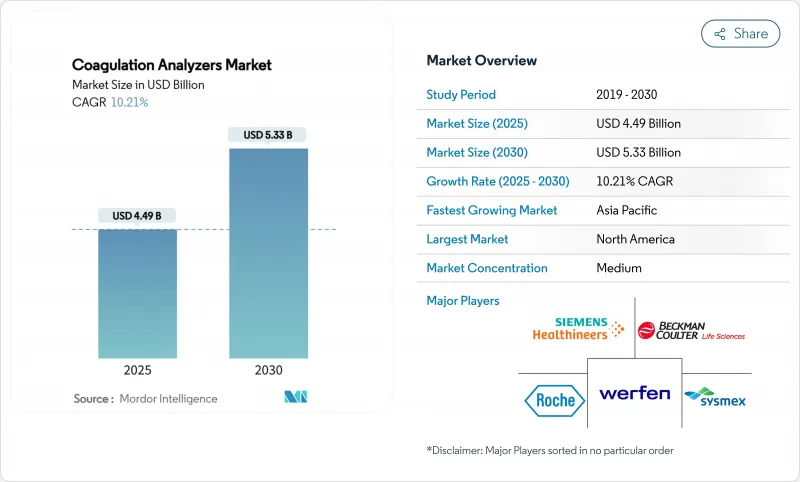

Coagulation Analyzers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The coagulation analyzers market size stands at USD 4.49 billion in 2025 and is forecast to touch USD 5.33 billion by 2030, advancing at a 6.2% CAGR.

Growth stems from the shift toward real-time viscoelastic platforms, tighter quality regulations, and wider adoption of AI-guided dosing that trims adverse events by 30% compared with conventional monitoring. Viscoelastic analyzers deliver complete clotting profiles within minutes, enabling surgical teams to save blood products and shorten operating room time. At the same time, Class II re-classification in May 2025 has lowered regulatory barriers, encouraging regional manufacturers to enter the coagulation analyzers market and diversify supply. Intensifying M&A activity-such as Werfen's purchase of Accriva and the long-term Siemens-Sysmex OEM pact-signals a race to secure reagent lines and embedded analytics.

Global Coagulation Analyzers Market Trends and Insights

Growing Prevalence of Bleeding & Thrombotic Disorders

Hemophilia affects 273,000 diagnosed individuals, with an additional 563,000 likely undiagnosed, elevating demand for precise coagulation monitoring.Von Willebrand disease remains the most common hereditary bleeding disorder, and 72-94% of patients experience clinical bleeding episodes that benefit from rapid laboratory confirmation. New therapies such as fitusiran, cleared by the FDA in March 2025, require antithrombin assays, further broadening the coagulation analyzers market.

Ageing Population & Chronic-Disease Burden

Surging atrial fibrillation prevalence in seniors heightens long-term anticoagulation needs. Thromboelastography demonstrates superior bleed-prediction accuracy versus conventional tests in elderly cohorts. Direct oral anticoagulant uptake, led by apixaban, underlines a market pivot toward newer drugs that still warrant episodic coagulation checks.

Other drivers and restraints analyzed in the detailed report include:

- Laboratory Automation & High-Throughput Analyzers

- Rise of Point-of-Care Clotting Tests

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Systems and analyzers held a 60.2% share of the coagulation analyzers market in 2024 as laboratories prioritized walk-away automation to control rising test volumes without adding staff. Point-of-care units posted the quickest uptake, supported by the TEG 6s clearance that expanded viscoelastic testing into cardiac theaters. Robust throughput-402 tests per hour on high-end models-reduces bottlenecks during morning phlebotomy peaks, cementing vendor lock-in through consumable contracts.

Consumables form the recurring backbone of the coagulation analyzers market. Reagent integrity demands have sharpened since porcine-heparin contamination alerts triggered global recalls. In response, OEM alliances such as the 2024 Siemens-Sysmex pact guarantee steady reagent pipelines and forward-integration of AI-enabled QC packs. Calibration materials also benefit from stricter CLIA precision goals, nudging laboratories toward premium controls with validated lot-to-lot consistency.

PT/INR continues to anchor chronic warfarin surveillance, capturing 30.6% of coagulation analyzers market size in 2024. Nonetheless, clinicians increasingly prefer anti-Xa assays for low-molecular-weight heparin, reflecting therapy migration. D-Dimer, meanwhile, is posting the fastest 12.4% CAGR as emergency departments rely on it to triage venous thromboembolism and monitor post-COVID coagulopathy.

Fibrinogen and platelet-function panels round out the catalog, supporting trauma protocols and antiplatelet agent adjustment. Global hemostasis applications-TEG and ROTEM-are expanding beyond operating theaters into intensive-care settings, fueled by the May 2025 Class II reclassification that trimmed time-to-market for new cartridges.

The Coagulation Analyzers Market is Segmented by Product (Systems/Analyzers {High, and More} and Consumables {Reagents & Assays, and More), Test Type (Prothrombin Time, and More), Technology (Optical, Mechanical, and More), Modality (Central-Laboratory Platforms, and More), End User (Hospitals, and More), and Geography (North America, Europe, and More). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America leads the coagulation analyzers market, supported by well-funded hospitals, rapid AI adoption, and favorable reimbursement frameworks. The March 2025 FDA approval of fitusiran with a companion antithrombin assay illustrates how therapeutic innovation immediately triggers diagnostic demand. Canada's single-payer model drives nationwide INR management networks, while Mexico's emerging private hospital chains are investing in point-of-care devices to shorten emergency room stay times.

Asia Pacific is the fastest-advancing region, reflecting swift infrastructure upgrades and growing senior populations that require routine coagulation surveillance. China's role as the world's largest heparin supplier offers cost advantages but also vulnerability to raw-material shocks. Japan's stringent device review process ensures high laboratory standards, whereas recent regulatory reforms in India have opened pathways for domestic manufacturing of mid-throughput analyzers. Sysmex reported double-digit regional sales growth in Q1 2025, underscoring unmet demand for reagents and controls.

Europe balances strong scientific capability with the added burden of IVDR compliance. Germany, France, and the United Kingdom operate expansive reference-lab networks that already meet most new documentation mandates, but smaller centers face costly validation work. Supply concerns around porcine-derived reagents have sparked pilot studies into bovine alternatives, while NHS blood shortage episodes in England spotlight the importance of viscoelastic testing for judicious transfusion practice.

- Siemens Healthineers

- Sysmex

- Roche

- Beckman Coulter (Danaher)

- Werfen (Instrumentation Laboratory)

- Diagnostica Stago SAS

- Abbott Laboratories

- Thermo Fisher Scientific

- HORIBA

- Helena Laboratories

- Sysmex America

- Trivitron Healthcare

- Eurolyser Diagnostica

- Haemonetics

- Meril Life Sciences

- Nihon Kohden

- Tosoh

- Stago UK

- Medirox AB

- Rayto Life and Analytical Sciences

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Prevalence Of Bleeding & Thrombotic Disorders

- 4.2.2 Ageing Population & Chronic-Disease Burden

- 4.2.3 Laboratory Automation & High-Throughput Analyzers

- 4.2.4 Rise Of Point-Of-Care Clotting Tests

- 4.2.5 Rapid Uptake Of Viscoelastic Testing (TEG/ROTEM)

- 4.2.6 AI-Driven, Patient-Specific Anticoagulation Algorithms

- 4.3 Market Restraints

- 4.3.1 High Capital & Reagent Costs

- 4.3.2 Limited Adoption In Low-Income Nations

- 4.3.3 Reagent-Supply Shocks From Porcine-Heparin & IVDR Changes

- 4.3.4 Emerging Non-Invasive Hemostasis Biomarkers

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Systems / Analyzers

- 5.1.1.1 High-throughput Lab Analyzers

- 5.1.1.2 Mid-throughput Lab Analyzers

- 5.1.1.3 Point-of-Care Analyzers

- 5.1.2 Consumables

- 5.1.2.1 Reagents & Assays

- 5.1.2.2 Calibrators & Controls

- 5.1.2.3 Others

- 5.1.1 Systems / Analyzers

- 5.2 By Test Type

- 5.2.1 Prothrombin Time (PT/INR)

- 5.2.2 Activated Partial Thromboplastin Time (aPTT)

- 5.2.3 D-Dimer

- 5.2.4 Fibrinogen

- 5.2.5 Platelet Function

- 5.2.6 Anti-Factor Xa

- 5.2.7 Global Hemostasis (TEG/ROTEM)

- 5.2.8 Other Tests

- 5.3 By Technology

- 5.3.1 Optical

- 5.3.2 Mechanical

- 5.3.3 Electrochemical

- 5.3.4 Magnetic / Viscoelastic

- 5.3.5 Other Technologies

- 5.4 By Modality

- 5.4.1 Central-Laboratory Platforms

- 5.4.2 Point-of-Care Devices

- 5.4.3 Self-Testing / Home-care Devices

- 5.5 By End User

- 5.5.1 Hospitals

- 5.5.2 Clinical & Reference Laboratories

- 5.5.3 Ambulatory Surgical Centers

- 5.5.4 Home-care Settings

- 5.5.5 Others

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia Pacific

- 5.6.4 Middle East & Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East & Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 Siemens Healthineers

- 6.3.2 Sysmex Corporation

- 6.3.3 F. Hoffmann-La Roche Ltd

- 6.3.4 Beckman Coulter (Danaher)

- 6.3.5 Werfen (Instrumentation Laboratory)

- 6.3.6 Diagnostica Stago SAS

- 6.3.7 Abbott Laboratories

- 6.3.8 Thermo Fisher Scientific

- 6.3.9 Horiba Ltd

- 6.3.10 Helena Laboratories

- 6.3.11 Sysmex America

- 6.3.12 Trivitron Healthcare

- 6.3.13 Eurolyser Diagnostica GmbH

- 6.3.14 Haemonetics Corporation

- 6.3.15 Meril Life Sciences

- 6.3.16 Nihon Kohden Corporation

- 6.3.17 Tosoh Corporation

- 6.3.18 Stago UK

- 6.3.19 Medirox AB

- 6.3.20 Rayto Life and Analytical Sciences

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment