PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842565

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842565

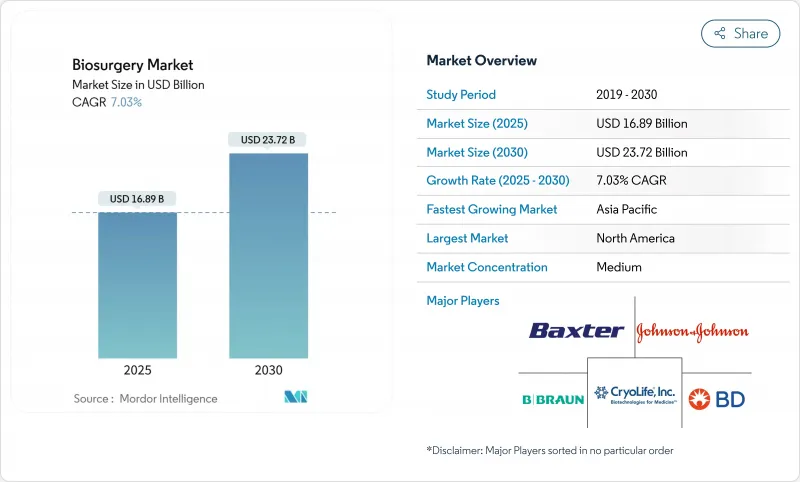

Biosurgery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Biosurgery Market size is estimated at USD 16.89 billion in 2025, and is expected to reach USD 23.72 billion by 2030, at a CAGR of 7.03% during the forecast period (2025-2030).

This expansion reflects the combined impact of population aging, higher surgical complexity, and widespread adoption of minimally invasive techniques that demand refined solutions for hemostasis, tissue repair, and wound closure. Hospitals are intensifying their focus on rapid-recovery protocols, which elevates demand for next-generation biomaterials that shorten operating times and curb transfusions. Meanwhile, real-time 3-D-printed, bioresorbable scaffolds are making patient-specific implants economically viable, strengthening the biosurgery market's momentum. The rise of hospital-at-home models, supported by new Medicare coding for caregiver wound-care training, is shifting a portion of postoperative care into residential settings, creating fresh opportunities for portable sealing and adhesive kits. North America leads in reimbursement sophistication, yet Asia-Pacific's accelerating surgical volumes position it as the fastest-growing region through 2030. Competitive pressure is moderate but mounting as specialized innovators challenge long-standing incumbents with smart biomaterials and digital-enabled surgical platforms.

Global Biosurgery Market Trends and Insights

Surging Geriatric & Co-Morbid Patient Pool

The median age of surgical patients climbed from 56 to 59 years between 2008 and 2020 and is projected to reach 61.5 years by 2030, amplifying demand for products that safely control bleeding in fragile tissue. Concurrently, obesity prevalence among surgical candidates is increasing, with 80% expected to present above-normal BMI by 2030, further complicating hemostasis. A Geneva tertiary center documented a 48.3% rise in high-risk elderly anesthesia cases over the past decade, underscoring healthcare systems' willingness to operate on complex geriatric profiles. Complication rates exceed 32% in patients over 90 years when general anesthesia is applied, compared with 19.4% under regional techniques, highlighting the need for advanced, minimally traumatic biosurgical options. These demographic shifts secure long-horizon growth for the biosurgery market.

Rise in Complex & Minimally Invasive Surgical Volumes

Robotic hernia repairs, though under 5% of all repairs in Nordic countries, are climbing steadily, reflecting global adoption of robotic platforms that work within confined anatomical spaces. Laparoscopic and robotic lumbar fusion surgeries show lower complication rates and reduced recovery times than open procedures, but they depend on sealants and adhesives that perform reliably in limited fields. Cardiovascular settings echo this trend: pulsed-field ablation products yielded nearly 30% revenue growth for a leading manufacturer in 2025, signalling robust uptake of advanced devices that must integrate seamlessly with bioactive adjuncts. As emerging markets invest in robotics and high-definition imaging, the biosurgery market receives another tailwind.

Premium Pricing & Limited Reimbursement

CMS plans a 2.93% cut to average wound-care payments in 2025, tightening hospital budgets and pressuring procurement of premium biosurgery products. Autologous platelet-rich plasma lacks consistent reimbursement despite favorable outcomes in diabetic ulcers, prompting clinicians to weigh cost against efficacy. Emerging markets magnify the challenge; Brazil's import tariffs elevate prices and restrict access to high-end biomaterials. As reimbursement lags innovation, uptake of the newest offerings is uneven, tempering the biosurgery market's full potential.

Other drivers and restraints analyzed in the detailed report include:

- Pipeline of Next-Gen Biomaterials & Combination Products

- Hospital-At-Home Reimbursement Accelerating Demand for Rapid Wound-Closure Kits

- Stringent Multi-Jurisdiction Biologic Approval Pathways

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Bone-graft substitutes captured 33.37% of the biosurgery market share in 2024, owing to escalating orthopedic and dental surgery volumes. The segment benefits from tri-element-doped hydroxyapatite-polycaprolactone scaffolds that inhibit tumor recurrence, foster osteogenesis, and provide inherent antibacterial action. Hemostatic agents remain core staples across specialties, as 54 FDA-approved formulations offer varied formats for open and minimally invasive procedures. Adhesion barriers, typified by SEPRAFILM, decrease repeat operations by limiting fibrous scar formation. While niche, staple-line reinforcement products gain traction alongside robotic surgeries that amplify staple use.

Surgical sealants and adhesives, the fastest-growing product set at 7.83% CAGR, benefit from innovations such as a fibrin sealant that cut transfusions 35% and trimmed operating time by 25 minutes. A room-temperature patch launched in 2025 eliminates refrigeration, easing logistics and broadening reach. LIQUIFIX liquid adhesive, the only FDA-cleared internal hernia sealant, exemplifies device specialization in complex repairs. These breakthroughs highlight how materials science, ease-of-use, and procedure-time savings propel the biosurgery market.

Biologic offerings commanded 61.94% of 2024 revenue, buoyed by fibrin and collagen matrices that integrate naturally into healing pathways. Demand for plasma-derived medicinal products is projected to climb 30% by 2030, yet collection shortfalls linger, prompting governments to localize plasma supply. Clinical trials such as Grifols' ADFIRST fibrinogen study underline ongoing biologic innovation.

Synthetic and semi-synthetic materials, however, are outpacing the market at an 8.73% CAGR. Polymer constructs like a fully absorbable P4HB scaffold now in breast revision trials promise durable support without foreign-body permanence. Injectable alginate-collagen hydrogels loaded with antibiotics demonstrated single-dose efficacy equal to multi-dose systemic regimens, mitigating infection risk while curbing overall antibiotic exposure. Rising pharmaceutical cold-chain investment (USD 9.6 billion expected by 2035) underscores biologic distribution hurdles that synthetics circumvent. The biosurgery market thus bifurcates, with biologics prevailing in high-performance indications and synthetics thriving where cost and logistics matter most.

The Biosurgery Market Report is Segmented by Product (Bone-Graft Substitutes, Hemostatic Agents, Adhesion Barriers, and More), Source (Biologic, Synthetic/Semi-synthetic), Application (Orthopedic Surgery, General Surgery, and More), End User (Hospitals, Ambulatory Surgical Centres, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America represented 41.74% of the biosurgery market in 2024, underpinned by robust reimbursement, high procedure volumes, and steady regulatory throughput. Multiple platelet-rich-plasma devices cleared by the FDA in 2024 spotlight the region's rapid technology adoption. Canada accelerates public-hospital modernization, while Mexico leverages cross-border device supply chains, though regulatory harmonization continues to evolve.

Europe sustains strong uptake of room-temperature sealing patches that bypass cold logistics, widening access especially in midsize hospitals. EMA-FDA cooperative frameworks support simultaneous submissions, yet subtle documentation differences prolong some approvals. Investments in manufacturing automation and sustainability align with the region's stringent environmental standards, steadily shaping procurement criteria.

Asia-Pacific, forecast at an 8.26% CAGR, is propelled by demographic momentum and infrastructure spend, with the local production initiatives, such as a USD 15 million plasma-collection facility in China, aim to secure supply and meet viral-safety norms. The region confronts fragile cold chains, spurring AI-driven monitoring tools that maintain product integrity in tropical climates. Middle East & Africa and South America trail but show rising procedure rates as public and private insurers broaden surgical coverage; regulatory overhauls in Brazil signal growing regional standardization.

- Johnson & Johnson

- Baxter

- Beckton Dickinson

- Medtronic

- B. Braun

- Integra LifeSciences

- CSL Behring

- CryoLife (Artivion)

- Hemostasis

- Arch Therapeutics

- Kuros Biosciences

- Zimmer Biomet

- Stryker

- Sanofi

- Terumo

- Advanced Medical Solutions (AMS)

- Grifols

- Gluetec AG

- Collagen Matrix

- Orthofix

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging Geriatric & Co-Morbid Patient Pool

- 4.2.2 Rise in Complex & Minimally-Invasive Surgical Volumes

- 4.2.3 Pipeline of Next-Gen Biomaterials & Combination Products

- 4.2.4 Hospital-At-Home Reimbursement Accelerating Demand for Rapid Wound-Closure Kits

- 4.2.5 Point-Of-Care 3-D Printed, Bioresorbable Scaffolds

- 4.2.6 Supplier Localisation of Plasma-Derived Sealants for Viral-Safety Compliance

- 4.3 Market Restraints

- 4.3.1 Premium Pricing & Limited Reimbursement

- 4.3.2 Stringent Multi-Jurisdiction Biologic Approval Pathways

- 4.3.3 Cold-Chain Fragility of Biologic Sealants in Emerging Markets

- 4.3.4 Collagen-Derived Graft Contamination & AMR Scrutiny

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product Type

- 5.1.1 Bone-Graft Substitutes

- 5.1.2 Hemostatic Agents

- 5.1.3 Surgical Sealants & Adhesives

- 5.1.4 Adhesion Barriers

- 5.1.5 Soft-Tissue Attachments

- 5.1.6 Staple-Line Reinforcement

- 5.2 By Source

- 5.2.1 Biologic

- 5.2.2 Synthetic / Semi-synthetic

- 5.3 By Application

- 5.3.1 Orthopedic Surgery

- 5.3.2 General Surgery

- 5.3.3 Neurological Surgery

- 5.3.4 Cardiovascular Surgery

- 5.3.5 Gynecological Surgery

- 5.3.6 Thoracic & Reconstructive Surgery

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Ambulatory Surgical Centres

- 5.4.3 Speciality Clinics

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Johnson & Johnson

- 6.3.2 Baxter International Inc.

- 6.3.3 Becton, Dickinson & Company

- 6.3.4 Medtronic

- 6.3.5 B. Braun Melsungen AG

- 6.3.6 Integra LifeSciences

- 6.3.7 CSL Behring

- 6.3.8 CryoLife (Artivion)

- 6.3.9 Hemostasis LLC

- 6.3.10 Arch Therapeutics

- 6.3.11 Kuros Biosciences

- 6.3.12 Zimmer Biomet

- 6.3.13 Stryker Corporation

- 6.3.14 Sanofi

- 6.3.15 Terumo Corporation

- 6.3.16 Advanced Medical Solutions (AMS)

- 6.3.17 Grifols S.A.

- 6.3.18 Gluetec AG

- 6.3.19 Collagen Matrix Inc.

- 6.3.20 Orthofix Medical Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment