PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842566

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842566

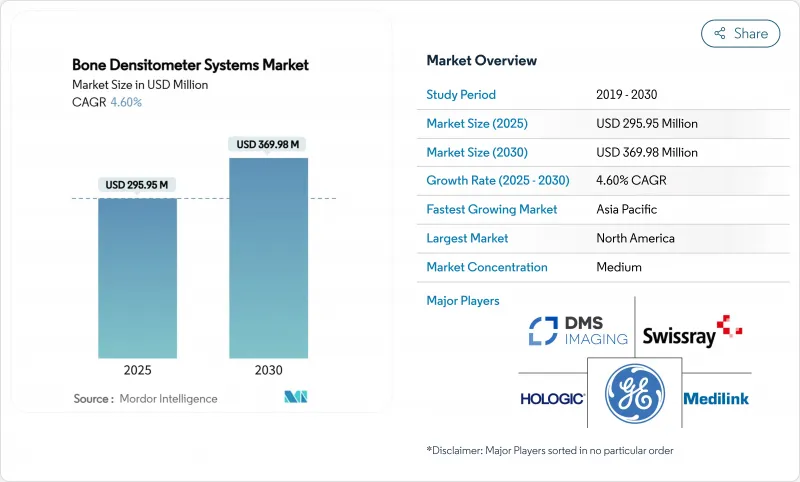

Bone Densitometer Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The bone densitometry market generated USD 295.95 million in 2025 and is on track to reach USD 369.98 million by 2030, advancing at a 4.6% CAGR.

Growth is propelled by aging populations, rising osteoporosis prevalence, and the rapid integration of artificial intelligence that enables opportunistic screening on existing CT images without extra radiation. Hardware and software innovation, coupled with portable system roll-outs in pharmacies and community clinics, are widening access and tightening follow-up protocols. Vendors are also prioritizing radiation-free modalities such as quantitative ultrasound and REMS, a shift that answers safety concerns while opening doors to primary-care deployment. Regional opportunities are strongest in Asia Pacific, where demographic shifts and expanding health-insurance schemes support accelerated device adoption. Meanwhile, reimbursement pressures and technologist shortages in North America are prompting providers to embrace cloud-based analytics, automated quality control, and shared-service models that keep scanning costs in check.

Global Bone Densitometer Systems Market Trends and Insights

Surge in Incidence of Osteoporosis & Vitamin D Deficiency

The osteoporosis burden now touches an estimated 500 million individuals, and epidemiologists forecast that more than half of all fragility fractures will occur in Asia by 2050. In China alone, 13.54% of adults show DXA-defined osteoporosis, equating to roughly 145.86 million people.Vitamin D deficiency compounds fracture risk and has catalyzed device innovation, such as the FDA-cleared Osteoboost wearable that slows bone loss in post-menopausal women. Health-system costs remain steep: Medicare spent USD 5.7 billion on osteoporotic fractures in 2016, yet only 9% of women with a fracture received a follow-up DXA scan within six months, illustrating persistent screening gaps. High unmet need sustains demand for the bone densitometry market across hospitals, imaging centers, and new pharmacy-based programs.

Rapidly Ageing Population Base

Adults aged 65 years or older are set to double globally by 2050, intensifying screening requirements. Medicare has already expanded bone-mass-measurement coverage to include bone-disease-arthritis and relaxed copay rules to boost uptake.[ Countries such as Japan and South Korea, where one-quarter of citizens surpass age 65, are scaling community DXA programs and piloting remote read-outs. Workforce supply lags; technologist vacancy rates reached 6.9% in 2023, pushing providers to adopt AI triage and tele-interpretation to maintain service levels. As fracture incidence rises, hip fractures alone may climb 310% in men and 240% in women. As 2050 accessible scanning becomes an imperative for cost-containment.

Radiation & Safety Concerns with Serial Scans

Although a DXA exam emits only 0.001-0.01 mSv-similar to one day of background exposure-cumulative doses over decades worry clinicians and younger patients. Regulators responded with refreshed dose-control guidance that obliges manufacturers to embed optimization algorithms and heightened shielding. The attention is steering demand toward radiation-free REMS and ultrasound, while also spurring ultra-low-dose DXA research. Providers increasingly apply ALARA principles and run patient-education campaigns to counter misconceptions that may delay vital scans.

Other drivers and restraints analyzed in the detailed report include:

- Wider Adoption of Densitometers in Primary-Care Settings

- Continuous DXA & QUS Technology Upgrades

- High Capital & Lifecycle Cost of DXA Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The bone densitometry market remains anchored by DXA, which secured 64.2% revenue in 2024 thanks to entrenched clinical guidelines and broad payer coverage. Yet quantitative ultrasound is rising quickly with a double-digit CAGR and threatens to erode DXA's dominance as providers migrate to radiation-free workflows. Quantitative computed tomography retains a foothold for three-dimensional, trabecular-focused research but is too costly for routine assessment. REMS, an ultrasound-derived modality, exemplifies the leap toward portable, AI-ready devices that can operate in retail clinics or bedside settings.

Manufacturers are racing to enhance detector sensitivity, automate phantom calibration, and embed machine learning that generates fracture-risk scores in real time. Several systems now link directly to electronic health records, routing alerts when T-scores drop beyond monitored thresholds. Such integrations help sustain the bone densitometry market by embedding measurements into chronic-disease dashboards. Meanwhile, opportunistic screening software mines archived CT scans, a workflow that expands the bone densitometry market size without any hardware outlay. As radiation-free modalities gain guideline recognition, buyers weigh total cost-of-ownership, throughput, and AI support when upgrading fleets.

Hospitals still anchor the bone densitometry market, holding 53.4% of study volumes in 2024. Their dominance rests on integrated electronic records, on-site specialists, and bundled reimbursement for fracture management pathways. Nonetheless, imaging centers are advancing at 9.9% CAGR as outpatient demand rises and insurers steer low-complexity scans toward cost-efficient settings. Pharmacist-run programs and orthopedic clinics form a third pillar, leveraging compact ultrasound or REMS units that fit small footprints and need limited shielding.

To counter workforce deficits, hospitals increasingly outsource secondary reads to teleradiology pools, while imaging centers deploy AI triage that pre-sorts normal studies, shortening technologist workloads. Rural facilities, unable to justify dedicated scanners, contract rotating mobile services-a model that extends the bone densitometry market into new ZIP codes. Providers that blend remote read-outs with automated quality control can maintain ISO compliance even with lean staffing. This distributed care fabric is central to sustaining growth as demographics steepen fracture risk curves.

The Bone Densitometer Systems Market is Segmented by Technology (Axial {DEXA, QCT} and Peripheral {SEXA, and More}), End User (Hospitals, and More), Application (Osteoporosis Diagnosis, and More), Portability (Fixed/In-room Systems and More), Component (Hardware, Software & Analytics, Consumables & Accessories), and Geography (North America, Europe, and More). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 24.5% of the bone densitometry market in 2024 due to well-established reimbursement, high osteoporosis awareness, and deep installed DXA bases. CMS's decision to waive patient copays for preventive scans sustains routine testing, although declining fee schedules squeeze outpatient margins. Technologist shortages-vacancies hit 6.9%-push providers to embrace AI and remote read models to maintain throughput. Rural screening remains patchy, fueling growth in mobile vans and pharmacy programs that bring scanners closer to at-risk seniors.

Asia Pacific is the engine of future expansion, clocking an 8.3% CAGR. China alone counts nearly 146 million osteoporotic adults, a prevalence that drives provincial health budgets to subsidize community DXA rooms. Japan mandates DXA in its "Checkup Kensa" for seniors, while South Korea's national insurance added portable REMS codes in 2025. Vendors such as DMS Group posted 68% sales growth in Asia during 2024, underscoring the region's appetite for smart, space-saving units

Europe delivers steady, mid-single-digit growth behind harmonized guidelines and robust fracture-liaison services. Italy officially endorsed REMS in 2024, unlocking reimbursement for radiation-free scans. The European Spine Phantom anchors calibration consistency across multination networks, supporting reliable longitudinal comparisons. Middle East & Africa and South America trail in adoption but represent white-space where mobile units and shared-service leasing offset budget constraints and specialist scarcity, broadening the global bone densitometry market.

- GE Healthcare

- Hologic

- BeamMed Ltd.

- DMS Imaging (France)

- Swissray International Inc.

- Medilink Global

- Osteometer MediTech

- CompuMed

- Echolight S.p.A

- Eurotec Medical Systems Srl

- Xingaoyi Medical Equipment

- Trivitron Healthcare

- Scanflex Healthcare

- Medonica

- OsteoSys Corp.

- Fujifilm Holdings Corp.

- Hitachi Ltd. (Healthcare)

- Stratec Medizintechnik GmbH

- Furuno Electric Co. Ltd.

- Nipro

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge In Incidence Of Osteoporosis & Vitamin-D Deficiency

- 4.2.2 Rapidly Ageing Population Base

- 4.2.3 Wider Adoption Of Densitometers In Primary Care Settings

- 4.2.4 Continuous DXA & QUS Technology Upgrades

- 4.2.5 Point-Of-Care Portable DXA Roll-Out In Pharmacies

- 4.2.6 AI-Enabled Opportunistic BMD Reading From CT Archives

- 4.3 Market Restraints

- 4.3.1 Radiation & Safety Concerns With Serial Scans

- 4.3.2 High Capital & Lifecycle Cost Of DXA Systems

- 4.3.3 Shortage Of Trained DXA Technologists

- 4.3.4 Slow Harmonisation Of ISO-10012 Calibration Standards

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Technology

- 5.1.1 Axial Bone Densitometry

- 5.1.1.1 Dual-Energy X-ray Absorptiometry (DEXA)

- 5.1.1.2 Quantitative Computed Tomography (QCT)

- 5.1.2 Peripheral Bone Densitometry

- 5.1.2.1 Single-Energy X-ray Absorptiometry (SEXA)

- 5.1.2.2 Peripheral DEXA (pDEXA)

- 5.1.2.3 Radiographic Absorptiometry (RA)

- 5.1.2.4 Quantitative Ultrasound (QUS)

- 5.1.2.5 Peripheral QCT (pQCT)

- 5.1.1 Axial Bone Densitometry

- 5.2 By End User

- 5.2.1 Hospitals

- 5.2.2 Specialty & Orthopaedic Clinics

- 5.2.3 Diagnostic Imaging Centers

- 5.2.4 Others

- 5.3 By Application

- 5.3.1 Osteoporosis Diagnosis

- 5.3.2 Body Composition Analysis

- 5.3.3 Paediatric Bone Health

- 5.3.4 Sports Medicine & Performance

- 5.4 By Portability

- 5.4.1 Fixed / In-room Systems

- 5.4.2 Portable & Cart-based Systems

- 5.5 By Component

- 5.5.1 Hardware

- 5.5.2 Software & Analytics

- 5.5.3 Consumables & Accessories

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia Pacific

- 5.6.4 Middle East & Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East & Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 GE HealthCare

- 6.3.2 Hologic Inc.

- 6.3.3 BeamMed Ltd.

- 6.3.4 DMS Imaging (France)

- 6.3.5 Swissray International Inc.

- 6.3.6 Medilink Global

- 6.3.7 Osteometer MediTech

- 6.3.8 CompuMed Inc.

- 6.3.9 Echolight S.p.A

- 6.3.10 Eurotec Medical Systems Srl

- 6.3.11 Xingaoyi Medical Equipment Co. Ltd

- 6.3.12 Trivitron Healthcare

- 6.3.13 Scanflex Healthcare AB

- 6.3.14 Medonica Co. Ltd

- 6.3.15 OsteoSys Corp.

- 6.3.16 Fujifilm Holdings Corp.

- 6.3.17 Hitachi Ltd. (Healthcare)

- 6.3.18 Stratec Medizintechnik GmbH

- 6.3.19 Furuno Electric Co. Ltd.

- 6.3.20 Nipro Corporation

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment