PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842567

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842567

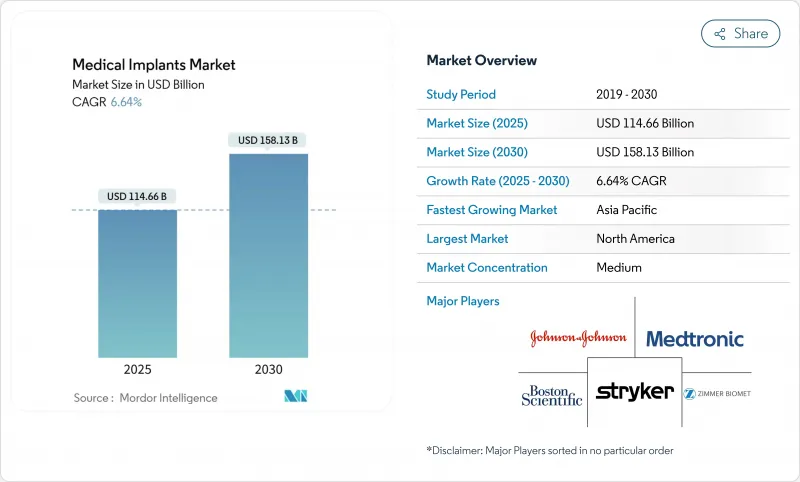

Medical Implants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The medical implants market size is estimated at USD 114.66 billion in 2025, and is expected to reach USD 158.13 billion by 2030, at a CAGR of 6.64% during the forecast period (2025-2030).

Persistent demand from an aging population, expanding chronic disease burden, and steady technology adoption underpin this growth path despite ongoing cost and regulatory pressures. Smart-sensor-enabled devices, 3-D printed components, and widening access in emerging economies are reshaping competitive dynamics, while manufacturers capable of navigating stringent approval processes and proving cost-effectiveness are positioned to capture outsized gains in the medical implants market.

Global Medical Implants Market Trends and Insights

Aging Population & Higher Chronic Disease Burden

Demand for orthopedic joints, cardiovascular devices, and dental prosthetics is accelerating as 1 in 5 people will be over 60 by 2030. Higher prevalence of osteoarthritis and heart disease is pushing procedure volumes upward, prompting payers to update reimbursement policies to accommodate larger case loads. Innovations such as the titanium artificial heart that kept a patient home for 100 days illustrate how next-generation implants meet complex geriatric needs. Health-system planners therefore view demographic momentum as a long-run catalyst for the medical implants market.

Technological Advancements: Bioresorbable Materials and Smart Implants

Bioresorbable scaffolds that dissolve when healing is complete are growing at 7.63% annually and reducing revision surgeries. Parallel advances in wireless telemetry have produced Wi-Fi-enabled knee systems that report joint angles and load in real time. Closed-loop neurostimulators and shape-memory 3-D printed constructs further demonstrate how materials science and digital integration enhance outcomes. As these solutions gain approval, they are enlarging the addressable base for the medical implants market.

Intensifying Regulatory Scrutiny & Prolonged Approval Timelines

The FDA's 2026 quality-system overhaul and post-Brexit surveillance rules in the United Kingdom add documentation layers and delay launches. Smaller developers face scale-driven compliance costs that may impede pipeline progress, concentrating approvals among larger firms and slightly tempering short-term expansion of the medical implants market.

Other drivers and restraints analyzed in the detailed report include:

- Shift Toward Minimally Invasive & Outpatient Implant Procedures

- Healthcare Infrastructure Development & Medical Tourism

- High Cost & Limited Reimbursement

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Orthopedic devices generated 36.22% of the medical implants market in 2024, supported by hip and knee replacement demand. Dental systems, though smaller, are forecast to outpace with an 8.65% CAGR, lifted by higher esthetic awareness and expanding middle-class spending in Asia Pacific. Innovations such as high-strength zirconia abutments and navigated placement techniques raise success rates and shorten chair time. The medical implants market size for dental solutions is projected to widen rapidly, with specialty clinics leveraging 97.29% success statistics to promote elective uptake. Manufacturers are tailoring portfolio investments toward tooth-borne solutions to capture this momentum.

Continued orthopedic leadership stems from proven titanium and cobalt-chromium platforms, but robotic-assisted procedures, exemplified by the ROSA Shoulder System cleared in 2024, are delivering precision gains and smaller incisions. Sustained musculoskeletal disease prevalence, combined with technology refresh cycles, secures orthopedic revenue streams even as dental outgrows. Cardiovascular, ophthalmic, and breast categories provide incremental diversification, buffering cyclical exposure within the broader medical implants market.

Metallic biomaterials retained 45.13% share of the medical implants market in 2024 due to unmatched load-bearing strength. Titanium and cobalt-chromium alloys remain primary in hips, knees, and stents, supported by decades of clinical evidence. However, bioresorbable polymers are expanding at 7.63% CAGR, closing gaps where long-term foreign bodies are undesirable. The medical implants market size for bioresorbables is benefiting from breakthroughs such as NIR-programmable shape-memory PLA/PCL scaffolds that conform to irregular bone defects and modulate immune response.

Polymer and ceramic segments occupy vital mid-spectrum niches. Drug-eluting polymer matrices and wear-resistant alumina dental crowns afford unique performance advantages. Meanwhile, specialty start-ups are engineering hybrid composites that blend resorption with structural integrity, positioning themselves as disruptive entrants. As regulatory familiarity improves, natural material adoption should accelerate, gradually eroding metallic share while broadening design possibilities within the medical implants market.

The Medical Implants Market Report is Segmented by Product (Orthopedic Implants, Cardiovascular Implants, Ophthalmic Implants, Dental Implants, and More), Type of Material (Metallic Biomaterial, Polymers Biomaterial, and More), Technology (Conventional Implants and More), End User (Hospitals, and More) and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

North America contributed 41.41% of global revenue in 2024, underpinned by robust insurance coverage, innovation funding, and 3,326 FDA 510(k) clearances in 2023. Recent draft guidance on dental and bone-plate devices further clarifies pathways, encouraging pipeline replenishment. Continued replacement demand among aging cohorts keeps procedure volumes elevated, reinforcing the region's anchor role in the medical implants market.

Asia Pacific is projected to deliver a 7.84% CAGR between 2025-2030. India's multilayer hospital build-out, including five new AIIMS sites, is boosting advanced surgery capacity. China's Healthy China 2030 reforms prioritize streamlined device reviews and post-market vigilance, trimming bureaucratic lag while tightening quality. Regulatory flexibility, combined with price-competitive clinical services, positions the region as both demand and manufacturing hub for the medical implants market.

Europe remains a vital contributor owing to universal coverage structures and high chronic disease prevalence. With 21.3% of the population aged 65 or older, demand for orthopedic and heart valves persists. Research into polymeric valve platforms is elevating long-term durability prospects. Concurrently, implementation of the EU Medical Device Regulation raises compliance thresholds, modestly tempering near-term launches but ultimately ensuring product safety. These elements sustain Europe's strategic relevance in the medical implants market.

- Johnson & Johnson (DePuy Synthes, Ethicon, Mentor)

- Medtronic

- Stryker

- Zimmer Biomet

- Abbott Laboratories

- Boston Scientific

- BIOTRONIK

- Conmed

- Globus Medical

- Integra LifeSciences Holdings

- Smith+Nephew plc

- Straumann Group

- Dentsply Sirona

- Osstem Implant Co., Ltd.

- GC Aesthetics

- Arthrex

- Cook Group

- B. Braun

- uteshiyamedicare

- gpcmedical.com

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Ageing Population & Higher Chronic Disease Burden

- 4.2.2 Surge in Elective Cosmetic & Dental Procedures

- 4.2.3 Technological Advancements in the Medical Implants

- 4.2.4 Shift Toward Minimally Invasive & Outpatient Implant Procedures Reducing Hospital Stay

- 4.2.5 Healthcare Infrastructure Development & Medical Tourism

- 4.2.6 Growing Popularity of 3D Printing

- 4.3 Market Restraints

- 4.3.1 Intensifying Regulatory Scrutiny & Prolonged Approval Timelines Across Major Markets

- 4.3.2 High Cost & Limited Reimbursement

- 4.3.3 Historical Product Recalls Fueling Patient & Surgeon Hesitancy

- 4.3.4 Limited Reimbursement Policies for Advanced Implants

- 4.4 Regulatory Outlook

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value & Volume)

- 5.1 By Product

- 5.1.1 Orthopedic Implants

- 5.1.1.1 Hip Orthopedic Devices

- 5.1.1.2 Knee Orthopedic Devices

- 5.1.1.3 Spine Orthopedic Devices

- 5.1.1.4 Joint Reconstruction

- 5.1.1.5 Other Orthopedic Products

- 5.1.2 Cardiovascular Implants

- 5.1.2.1 Pacing Devices

- 5.1.2.2 Stents

- 5.1.2.3 Structural Cardiac Implants

- 5.1.3 Ophthalmic Implants

- 5.1.3.1 Intraocular Lens

- 5.1.3.2 Glaucoma Implants

- 5.1.4 Dental Implants

- 5.1.5 Facial Implants

- 5.1.6 Breast Implants

- 5.1.7 Other Implants

- 5.1.1 Orthopedic Implants

- 5.2 By Type of Material

- 5.2.1 Metallic Biomaterials

- 5.2.2 Polymer Biomaterials

- 5.2.3 Ceramic Biomaterials

- 5.2.4 Natural / Bioresorbable Biomaterials

- 5.3 By Technology

- 5.3.1 Conventional Implants

- 5.3.2 3-D Printed / Additive Manufactured Implants

- 5.3.3 Smart Sensor-Enabled Implants

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Specialty Clinics

- 5.4.3 Ambulatory Surgical Centers

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Johnson & Johnson (DePuy Synthes, Ethicon, Mentor)

- 6.3.2 Medtronic plc

- 6.3.3 Stryker Corporation

- 6.3.4 Zimmer Biomet Holdings

- 6.3.5 Abbott Laboratories

- 6.3.6 Boston Scientific Corporation

- 6.3.7 BIOTRONIK SE & Co. KG

- 6.3.8 CONMED Corporation

- 6.3.9 Globus Medical, Inc.

- 6.3.10 Integra LifeSciences Holdings

- 6.3.11 Smith+Nephew plc

- 6.3.12 Institut Straumann AG

- 6.3.13 Dentsply Sirona

- 6.3.14 Osstem Implant Co., Ltd.

- 6.3.15 GC Aesthetics

- 6.3.16 Arthrex, Inc.

- 6.3.17 Cook Medical

- 6.3.18 B. Braun SE

- 6.3.19 uteshiyamedicare

- 6.3.20 gpcmedical.com

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment