PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842568

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842568

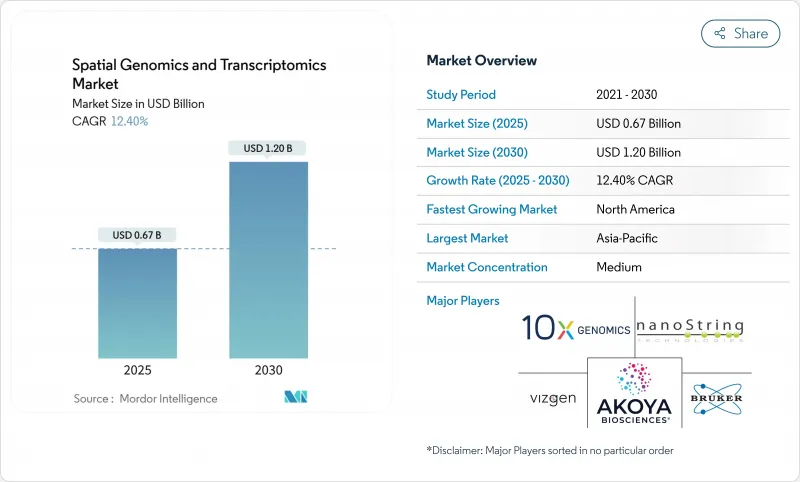

Spatial Genomics And Transcriptomics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The spatial genomics and transcriptomics market size stands at USD 673 million in 2025 and is on track to reach USD 1,207.39 million by 2030, delivering a 12.40% CAGR.

The sharp rise mirrors escalating demand from pharmaceutical firms that now rely on spatial context to explain cellular interactions inside intact tissue. Steady integration of artificial intelligence with spatial biology platforms enables automated cell-type identification, richer biomarker discovery, and faster translational workflows. Consortium-level initiatives, including the NIH BRAIN Cell Census Network, have secured long-term public funding and cemented the technology's research relevance. Simultaneously, fourth-generation sequencing instruments are pushing throughput and cost thresholds, widening clinical feasibility. Strategic acquisitions such as Bruker-NanoString and the pending Quanterix-Akoya deal signal that turnkey spatial solutions are attracting premium valuations and accelerating platform consolidation. Overall, competitive intensity is shifting toward software differentiation and ecosystem partnerships.

Global Spatial Genomics And Transcriptomics Market Trends and Insights

Emerging Potential of Spatial Analyses as Cancer Diagnostics

Spatial analysis technologies are transforming cancer diagnostics by revealing tumor microenvironment complexities that traditional genomics cannot capture. Recent studies using Visium HD spatial transcriptomics have identified distinct macrophage subpopulations with pro-tumor functions in colorectal cancer, demonstrating how spatial context influences therapeutic targeting strategies. The technology's ability to map cellular interactions at single-cell resolution enables precision oncology approaches that match patients to immunotherapies based on spatial biomarker signatures rather than bulk tumor genetics. Clinical validation studies show that spatial transcriptomics can predict treatment responses in liver cancer and characterize complex tumor microenvironments in glioblastoma, directly supporting FDA companion diagnostic development pathways. This diagnostic potential extends beyond research applications, with pharmaceutical companies integrating spatial analysis into clinical trial design to identify patient populations most likely to respond to targeted therapies. The convergence of spatial biology with AI-driven pathology workflows promises to revolutionize cancer diagnosis by providing clinicians with unprecedented insights into tumor biology and treatment resistance mechanisms.

Rapid Advances in High-Resolution Imaging & Barcoding Chemistries

Technological breakthroughs in imaging resolution and molecular barcoding are expanding spatial transcriptomics capabilities beyond current limitations. Illumina's unveiling of next-generation spatial transcriptomics technology in February 2025 promises cellular resolution with capture areas nine times larger than existing solutions, enabling analysis of millions of cells in a single experiment. Advanced barcoding chemistries now support simultaneous RNA and protein detection, with Bio-Techne's protease-free RNAscope multiomics workflow preserving tissue morphology while enabling comprehensive molecular profiling. These advances address critical bottlenecks in spatial analysis, particularly the trade-off between resolution and throughput that has limited clinical adoption. High-definition platforms like 10x Genomics' Visium HD achieve subcellular resolution while maintaining whole-transcriptome profiling capabilities, enabling researchers to identify rare cellular phenotypes and interactions critical for disease understanding. The integration of advanced imaging with computational analysis tools creates opportunities for real-time spatial analysis in clinical settings, potentially transforming diagnostic workflows in oncology and neurology.

Slow Implementation Across Clinical Labs

Adoption in diagnostic laboratories lags because spatial workflows require specialized imaging hardware, advanced bioinformatics, and standardized tissue handling. Many facilities lack capital budgets and trained staff, forcing reliance on reference centers. Additionally, reimbursement codes for spatial assays remain undefined in several markets, limiting return on investment. Regulatory clarity around analytical validity and clinical utility is progressing, yet laboratories still navigate uncertain approval routes. Until protocol harmonization matures, sample-to-sample variability can hinder result reproducibility and operator confidence.

Other drivers and restraints analyzed in the detailed report include:

- Advent of Fourth-Generation Sequencing Platforms

- Growing Single-Cell Multi-Omics Adoption in Drug Discovery

- Entrenched Conventional Genomics Workflows

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Spatial transcriptomics accounted for 54.8% of the spatial genomics and transcriptomics market in 2024, supported by whole-transcriptome coverage and compatibility with existing RNA-seq pipelines. Imaging-based approaches such as MERFISH and Xenium are adding sub-cellular precision, broadening uptake among neurologists seeking synaptic-level detail. Spatial genomics is projected to grow at a 23.0% CAGR, narrowing the gap as pharma groups realize the benefit of direct DNA context when profiling tumor evolution. The spatial genomics and transcriptomics market size for sequencing-centric platforms is forecast to outpace imaging systems from 2025 to 2030 due to falling flow-cell costs and integrated software workflows.

Competition pivots around throughput and resolution. 10x Genomics expands Xenium to single-molecule detection, while Vizgen defends patented barcoding strategies. Fourth-generation players like Singular Genomics employ in-situ reaction cycles that cut run times considerably, challenging incumbents. AI-enabled analytics remain a universal differentiator; vendors pairing hardware with cloud pipelines capture recurring license revenue and lock in users across discovery and clinical settings.

Consumables generated 46.3% of the spatial genomics and transcriptomics market revenue in 2024, underpinned by recurring demand for probes, slide kits, and tissue reagents. Labs processing hundreds of sections weekly treat reagent spend as the dominant operational cost. However, software is scaling fastest at a 21.4% CAGR because expanding dataset sizes demand automated interpretation. Image segmentation and multimodal integration modules reach subscription fees that rival per-run reagent costs, proving their strategic value. Instrument sales catalyze platform entry yet contribute a smaller revenue slice, though hardware placements lock future consumable pull-through.

Developers differentiate through turnkey pipelines. BioTuring's SpatialX combines dimensionality reduction with intuitive dashboards, cutting analysis time for non-bioinformaticians. Cloud delivery lowers entry thresholds for mid-tier hospitals lacking on-premise compute. As regulatory guidelines evolve, compliance.

The Spatial Genomics and Transcriptomics Market is Segmented by Technology (Spatial Transcriptomics {Sequencing and More} and Spatial Genomics {In-Situ Sequencing, and More), Product (Instruments, and More), Sample Type (FFPE Tissue, and More), Application (Oncology, and More), End User (Pharmaceutica and More), and Geography (North America, Europe, and More). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the spatial genomics and transcriptomics market in 2024, catalyzed by NIH allocations exceeding USD 867 million that underwrite multi-center consortia and equipment grants. The density of platform vendors such as 10x Genomics, Illumina, and PacBio ensures early access to prototypes and technical support. Robust venture funding continues to spin out analytic-software start-ups, reinforcing ecosystem maturity. United States regulators are crafting companion diagnostic pathways that, once finalized, could further entrench regional dominance.

Europe demonstrates cohesive growth through flagship programs like LifeTime, which channels EUR 1 million (USD 1.2 million) to harmonize spatial multi-omics across 100 institutions. Harmonized ethical frameworks and pan-EU data-sharing agreements streamline multi-site studies. Germany, the United Kingdom, and France host strong pharma clusters that translate discoveries into trials, while Nordic countries supply imaging innovation. EMA-driven guidance on digital pathology is expected to shorten approval cycles for spatial tests, fostering market expansion.

Asia Pacific is the fastest-growing region as national precision-medicine plans scale genome infrastructure. China pours state funds into oncology genomics, driving bulk procurement of spatial platforms for provincial cancer centers. Japan's aging demographics elevate neurodegenerative research budgets, spurring adoption of brain-focused spatial assays. Southeast Asian nations integrate spatial modules into infectious disease surveillance. Although regulatory frameworks for clinical spatial tests trail Western counterparts, rising CRO presence accelerates pharmaceutical outsourcing, feeding regional demand.

- 10x Genomics

- NanoString Technologies

- Akoya Biosciences

- Vizgen

- Advanced Cell Diagnostics

- Bio-Techne

- Illumina

- Dovetail Genomics

- Fluidigm

- Horizon Discovery

- S2 Genomics

- Seven Bridges Genomics

- Bruker

- Ultivue

- Danaher

- Roche (OmniSeq)

- PacBio

- Singular Genomics

- Bionano Genomics

- CARTANA (10x)

- Parse Biosciences

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Emerging Potential Of Spatial Analyses As Cancer Diagnostics

- 4.2.2 Rapid Advances In High-Resolution Imaging & Barcoding Chemistries

- 4.2.3 Advent Of Fourth-Generation Sequencing Platforms

- 4.2.4 Growing Single-Cell Multi-Omics Adoption In Drug Discovery

- 4.2.5 AI-Enabled Spatial Pathology Pipelines

- 4.2.6 FFPE-Compatible In-Situ Capture Chemistries

- 4.3 Market Restraints

- 4.3.1 Slow Implementation Across Clinical Labs

- 4.3.2 Entrenched Conventional Genomics Workflows

- 4.3.3 Data-Storage & Compute-Burden Scalability

- 4.3.4 Limited Barcoded Reagents For Non-Model Organisms

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Technology

- 5.1.1 Spatial Transcriptomics

- 5.1.1.1 Sequencing-based

- 5.1.1.2 Imaging-based

- 5.1.2 Spatial Genomics

- 5.1.2.1 In-Situ Sequencing

- 5.1.2.2 Fluorescence in Situ Hybridization (FISH)

- 5.1.2.3 In-Situ Capture

- 5.1.1 Spatial Transcriptomics

- 5.2 By Product

- 5.2.1 Instruments

- 5.2.2 Consumables

- 5.2.3 Software and Services

- 5.3 By Sample Type

- 5.3.1 FFPE Tissue

- 5.3.2 Fresh-Frozen Tissue

- 5.3.3 Organoids & 3D Cell Cultures

- 5.4 By Application

- 5.4.1 Oncology

- 5.4.2 Neurology

- 5.4.3 Immunology & Infectious Diseases

- 5.4.4 Developmental Biology

- 5.4.5 Drug Discovery & Screening

- 5.5 By End-User

- 5.5.1 Pharmaceutical & Biotechnology Companies

- 5.5.2 Academic & Research Institutes

- 5.5.3 CROs & Diagnostic Labs

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 10x Genomics

- 6.3.2 NanoString Technologies

- 6.3.3 Akoya Biosciences

- 6.3.4 Vizgen

- 6.3.5 Advanced Cell Diagnostics

- 6.3.6 Bio-Techne

- 6.3.7 Illumina

- 6.3.8 Dovetail Genomics

- 6.3.9 Fluidigm

- 6.3.10 Horizon Discovery

- 6.3.11 S2 Genomics

- 6.3.12 Seven Bridges Genomics

- 6.3.13 Bruker

- 6.3.14 Ultivue

- 6.3.15 Leica Biosystems

- 6.3.16 Roche (OmniSeq)

- 6.3.17 PacBio

- 6.3.18 Singular Genomics

- 6.3.19 Bionano Genomics

- 6.3.20 CARTANA (10x)

- 6.3.21 Parse Biosciences

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment