PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842571

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842571

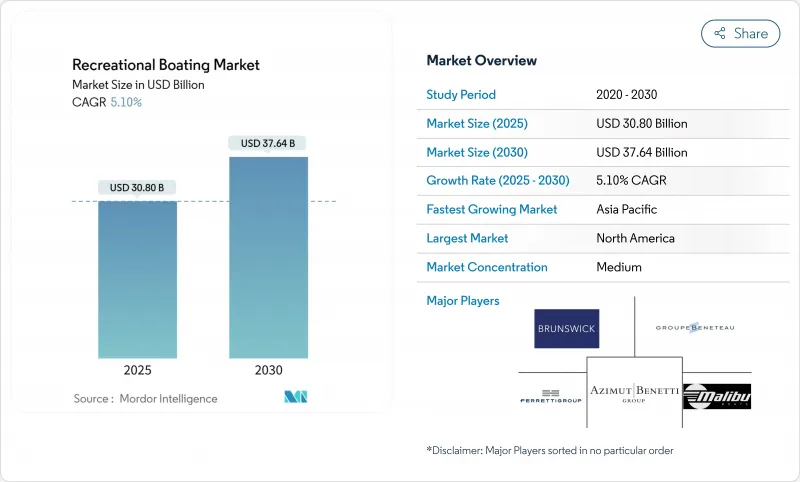

Recreational Boating - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Recreational Boating Market size is estimated at USD 30.80 billion in 2025, and is expected to reach USD 37.64 billion by 2030, at a CAGR of 5.10% during the forecast period (2025-2030).

The sector continues to attract outdoor-oriented consumers even under inflationary pressure, helped by rising participation in watersports, affluent buyers moving up to larger yachts, and rapid expansion of marina infrastructure in Asia. Digital direct-to-consumer channels are accelerating vessel turnover, particularly among 20-50 ft craft, while experience-based access models such as boat clubs are converting first-time users into long-term customers. Manufacturers are countering raw-material cost inflation by shifting toward advanced composites and recyclable hull technologies, and they are investing in connected-boat systems to suit younger, tech-savvy owners.

Global Recreational Boating Market Trends and Insights

Millennial & Gen-Z Boaters Redefine Participation Patterns

North American watersports participation has risen 15% since 2021, bringing a younger, experience-first cohort into the recreational boating market. Many of these consumers prefer flexible access rather than full ownership, prompting OEMs to redesign vessels around modular seating, integrated infotainment, and smartphone-based telematics. Brunswick Corporation's connected-boat ecosystem exemplifies the pivot toward intuitive interfaces that align with digital lifestyles. Manufacturers that package technology with hassle-free maintenance options are capturing loyalty and lengthening replacement cycles.

HNWI Expansion Fuels Luxury Yacht Segment Growth

The super-yacht category accounted for the single largest revenue slice of the yacht market in 2023, with Europe alone contributing 38.9%. Wealth creation in financial services, energy, and crypto assets is lifting custom-build backlogs across Italian, Dutch, and Turkish yards. Dubai's move to position itself as a super-yacht hub has translated into longer marina waitlists and premium berth pricing. Builders are responding with hybrid-propulsion flagships that meet tightening emission standards while delivering extended cruising ranges.

Raw Material Price Inflation Squeezes Manufacturer Margins

Surges in fiberglass and resin prices have compressed OEM gross margins by 3-5% since 2023. Hull segment leaders are therefore trialing alternative lay-ups, adopting closed-mold infusion, and negotiating multi-year supply contracts to stabilize costs. Some yards are accelerating the switch to thermoplastic composites that support automated recycling.

Other drivers and restraints analyzed in the detailed report include:

- Boat Clubs Revolutionize Market Access and First-Time Conversions

- Eco-tourism push drives electric propulsion

- Marina Infrastructure Constraints Limit Market Expansion

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Outboard models generated 42.10% of 2024 revenue, reflecting their ease of transport, shallow-draft versatility, and continuous powertrain innovation. Mercury Marine's top-end V12 Verado exemplifies performance advances with steerable gear cases and two-speed transmissions that enhance fuel efficiency. Personal watercraft, however, are on course for the fastest expansion at a 7.80% CAGR, buoyed by younger riders seeking affordable thrills and compact storage. Manufacturers have responded with entry-level sit-down PWCs under USD 10,000, often bundled with smartphone-tied safety geofencing.

Vessel rental fleets across Florida, the Mediterranean, and Southeast Asia are adding high-seat PWCs fitted with ride-by-wire throttle calibrations and simplified docking modes. As a result, the recreational boating market increasingly captures first-time watersports consumers who later migrate to outboard bowriders or day cruisers for family outings, preserving the broader ownership pipeline.

Fiberglass/GRP maintained a 65.55% foothold in 2024 thanks to cost efficiency and OEM familiarity. Closed-mold vacuum infusion has further reduced styrene emissions and trimmed rework times, solidifying its role in high-volume runabouts and pontoon decks. Advanced carbon-kevlar composites, while expensive, are winning favor among performance catamarans and racing monohulls seeking weight savings and corrosion resistance. Forecast 10.10% CAGR for composites mirrors aviation-driven resin improvements and availability of prepreg formats suitable for semi-custom series.

European yards now showcase prototypes built with Arkema's Elium thermoplastic resin, allowing in-factory recycling of offcuts, thereby lowering waste disposal costs and meeting circular-economy targets. Consequently, the recreational boating market size for composite hulls is projected to reach significant value by 2030 as production automates and economies of scale improve. In parallel, natural-fiber composites sourced from flax and hemp achieve double-digit growth rates, supported by consumer demand for plant-based alternatives and favorable life-cycle assessments.

The Recreational Boating Market Report is Segmented by Boat Type (Inboard & Sterndrive Boats and More), Hull Material (Fiberglass / GRP, and More), Length (LOA) (Less Than 20 Ft and More), Power Source (IC Engine, and More), Activity / Application (Watersports, and More), Distribution Channel (Dealer / Showroom (OEM), and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

North America dominated with a 47.10% in 2024, strong lake and coastal cultures, well-established marina networks, and widespread financing options underpin steady 5.10% CAGR to 2030. Boat-club memberships and fractional ownership continue to expand, bringing younger households into boating and boosting replacement demand for 20-35 ft multipurpose craft. OEMs are therefore deploying certified pre-owned channels to keep inventory flowing and maintain brand affinity.

Asia Pacific is the fastest-growing region, projected at 9.50% CAGR between 2025 and 2030. Government-sponsored marina rollouts in China's Hainan Free Trade Port, coupled with tax incentives on yacht imports, are nurturing a nascent leisure fleet. Urban millennials in coastal megacities view boating as a lifestyle symbol, fueling sales of 25-40 ft cabin cruisers fit for weekend island hops. India, Indonesia, and Vietnam are beginning to replicate similar infrastructure initiatives, adding incremental upside to the recreational boating market.

Europe remains a heavyweight in the luxury yacht segment, with Italian, Dutch, and French yards supplying global super-yacht demand. Despite moderate 5.20% CAGR, the region benefits from affluent tourism along the Cote d'Azur, Balearics, and Adriatic. Regulatory emphasis on low-emission propulsion is accelerating hybrid retrofits and electric tender uptake. The Middle East is set for 6.8% CAGR, powered by waterfront mega-projects in the United Arab Emirates and Saudi Arabia's Red Sea developments, while the Caribbean advances 6.20% despite rising insurance premiums. Oceania enjoys a consistent 5.30% CAGR, supported by high per-capita boat ownership in Australia and a digitally savvy buyer base in New Zealand. Digital dealerships cut the average sales cycle for 20-50 ft vessels, cementing the region's role as an early adopter of online marine retail.

List of Companies Covered in this Report:

- Brunswick Corporation

- Groupe Beneteau

- Azimut-Benetti Group

- Ferretti Group

- Malibu Boats Inc.

- Sunseeker International Ltd.

- Princess Yachts Ltd.

- MasterCraft Boat Holdings Inc.

- Polaris Inc. (Godfrey Pontoon, Bennington)

- Marine Products Corporation

- Bavaria Yachtbau GmbH

- Tracker Marine (White River Marine Group)

- Ranger Boats

- Hobie Cat Company

- Sportsman Boats Manufacturing Inc.

- Catalina Yachts

- HanseYachts AG

- X-Yachts A/S

- Alubat Alumarine

- Jeanneau

- Yamaha Motor Co., Ltd. (PWC Division)

- Walker Bay Boats

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Participation in Watersports Fueled by Millennial & Gen-Z Demographics in North America

- 4.2.2 High-Net-Worth Individual Wealth Expansion Accelerating Yacht Purchases in Europe & the Middle East

- 4.2.3 Rise of Boat-Club & Fractional Ownership Models Increasing First-Time Buyer Conversions in the United States & Canada

- 4.2.4 Eco-Tourism Push Driving Demand for Small Electric Cruisers in Nordic & Alpine Lakes

- 4.2.5 Government Marina Expansion Programs in China's Hainan & Guangdong Provinces

- 4.2.6 Digital Dealer Platforms Shortening Sales Cycles for 20-50 ft Boats in Australia & New Zealand

- 4.3 Market Restraints

- 4.3.1 Inflation-Linked Surge in Fiberglass & Resin Prices Compressing OEM Margins

- 4.3.2 Lengthy Coastal Permit Lead-Times for New Marina Slips in Mediterranean Hot-Spots

- 4.3.3 IC-Engine Emission Restrictions on Alpine & Scandinavian Lakes Limiting Legacy Fleet Usage

- 4.3.4 Insurance Premium Hardening for Vessels > 50 ft in Hurricane-Prone Caribbean Waters

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory & Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers / Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD), Volume (Units))

- 5.1 By Boat Type

- 5.1.1 Inboard & Sterndrive Boats

- 5.1.2 Outboard Powerboats

- 5.1.3 Personal Watercraft (PWC)

- 5.1.4 Sailboats

- 5.1.5 Yachts (30-120 ft)

- 5.1.6 Inflatable & RIB Boats

- 5.2 By Hull Material

- 5.2.1 Fiberglass / GRP

- 5.2.2 Aluminum

- 5.2.3 Wood

- 5.2.4 Steel

- 5.2.5 Composites (Carbon, Kevlar)

- 5.3 By Length

- 5.3.1 Less than20 ft

- 5.3.2 20-50 ft

- 5.3.3 Greater than 50 ft

- 5.4 By Power Source

- 5.4.1 Internal-Combustion Engine

- 5.4.2 Electric / Hybrid

- 5.4.3 Sail-Propelled

- 5.5 By Activity / Application

- 5.5.1 Watersports

- 5.5.2 Angling / Fishing

- 5.5.3 Cruising & Coastal Tourism

- 5.5.4 Dive & Charter Operations

- 5.6 By Distribution Channel

- 5.6.1 Dealer / Showroom (OEM)

- 5.6.2 Online Direct-to-Consumer

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Caribbeans

- 5.7.1.4 Rest of North America

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Rest of South America

- 5.7.3 Asia Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 India

- 5.7.3.4 Australia

- 5.7.3.5 South Korea

- 5.7.3.6 Southeast Asia

- 5.7.3.7 Rest of Asia Pacific

- 5.7.4 Europe

- 5.7.4.1 Germany

- 5.7.4.2 United Kingdom

- 5.7.4.3 France

- 5.7.4.4 Italy

- 5.7.4.5 Spain

- 5.7.4.6 Netherlands

- 5.7.4.7 Rest of Europe

- 5.7.5 Middle East and Africa

- 5.7.5.1 Saudi Arabia

- 5.7.5.2 United Arab Emirates

- 5.7.5.3 Qatar

- 5.7.5.4 Turkey

- 5.7.5.5 Rest of Middle East and Africa

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Brunswick Corporation

- 6.4.2 Groupe Beneteau

- 6.4.3 Azimut-Benetti Group

- 6.4.4 Ferretti Group

- 6.4.5 Malibu Boats Inc.

- 6.4.6 Sunseeker International Ltd.

- 6.4.7 Princess Yachts Ltd.

- 6.4.8 MasterCraft Boat Holdings Inc.

- 6.4.9 Polaris Inc. (Godfrey Pontoon, Bennington)

- 6.4.10 Marine Products Corporation

- 6.4.11 Bavaria Yachtbau GmbH

- 6.4.12 Tracker Marine (White River Marine Group)

- 6.4.13 Ranger Boats

- 6.4.14 Hobie Cat Company

- 6.4.15 Sportsman Boats Manufacturing Inc.

- 6.4.16 Catalina Yachts

- 6.4.17 HanseYachts AG

- 6.4.18 X-Yachts A/S

- 6.4.19 Alubat Alumarine

- 6.4.20 Jeanneau

- 6.4.21 Yamaha Motor Co., Ltd. (PWC Division)

- 6.4.22 Walker Bay Boats

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment