PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842573

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842573

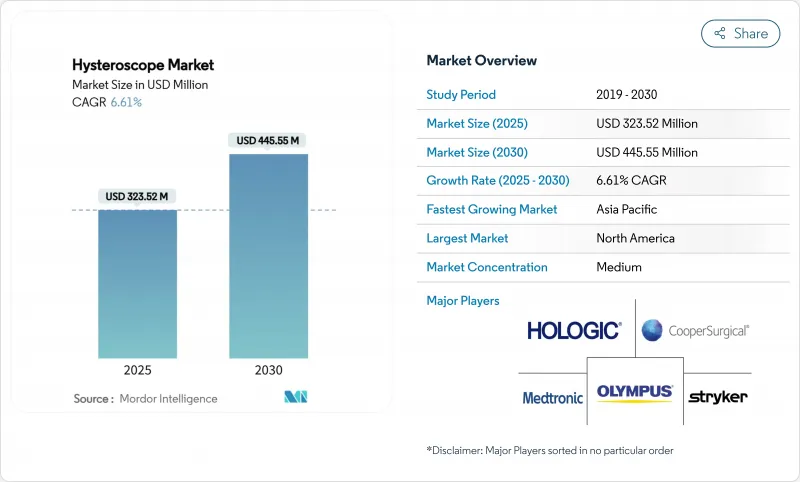

Hysteroscope - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global hysteroscope market is valued at USD 323.52 million in 2025 and is forecast to reach USD 445.55 million by 2030, translating into a 6.61% CAGR over the period.

Growth is propelled by broader uptake of minimally invasive gynecologic surgery, widening payer support for office-based care, and rapid product innovation that blends advanced optics with rigorous infection-control protocols. Single-use device platforms, cloud-connected imaging, and artificial-intelligence (AI) decision support are reshaping workflows and lowering total procedural costs, giving early adopters measurable clinical and financial advantages. Hospitals still anchor procurement volumes, yet independent gynecology clinics now capture a rising share of elective procedures as reimbursement rules reward outpatient settings. Rigid hysteroscopes remain the platform of choice inside complex surgical theaters, but disposable offerings are driving incremental procedure growth, especially where reprocessing capacity is limited. Competitive intensity is increasing as leading manufacturers pursue acquisitions to secure differentiated technologies and regional footholds.

Global Hysteroscope Market Trends and Insights

Growing Demand for Minimally Invasive Gynecologic Surgery

Clinicians now favor uterine-preserving, incision-free options that shorten recovery and limit complications. Prospective data show vaginal natural orifice transluminal endoscopic hysterectomy can cut median return-to-work from 3 months to 2 months compared with laparoscopy, a finding that resonates with payers evaluating value-based reimbursement. The Mayo Clinic cites hysteroscopic approaches as a first-line solution for intrauterine pathologies because they avoid abdominal incisions and reduce hospital stay. Emerging techniques, including high-intensity focused ultrasound and radiofrequency ablation, are opening new therapy segments for adenomyosis and fibroids. Robotic articulation, AI-enabled targeting, and enhanced visualization further improve precision, positioning operative hysteroscopy to capture share from traditional open or laparoscopic alternatives.

Rapid Adoption of Single-Use Hysteroscopes for Infection Control

Heightened scrutiny of endoscope reprocessing failures is prompting facilities to reevaluate the risk-benefit equation of reusable devices. FDA safety communications underscore contamination hazards, especially in low-volume centers where reprocessing validation is cost-prohibitive. ACOG notes the absence of definitive cost-effectiveness research but warns that surface defects and improper decontamination raise failure rates. Manufacturers such as Minerva Surgical have responded with fully disposable platforms that remove the reprocessing step while offering optics comparable to reusable scopes. If future Medicare payment adjustments cover higher per-procedure consumable costs, adoption curves could steepen quickly across ambulatory sites.

Infection Risk from Reusable Hysteroscopes

Complex device geometries challenge sterile-processing teams, and misalignment between manufacturer instructions and facility resources drives reprocessing errors. ANSI/AAMI ST108 water-quality guidelines raise infrastructure costs, while litigation fear over contamination events pushes administrators toward disposable options. NYU Langone Health reduced defects by deploying dedicated cross-functional teams, yet the resource burden is substantial, underscoring why smaller sites embrace single-use scopes despite higher unit costs.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advances in Optics & Miniaturization

- Integration of AI-Guided Imaging & Cloud Analytics

- Sustainability Concerns Around Disposable Devices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Rigid scopes held 45.35% of 2024 revenue, reflecting proven optical clarity and maneuverability during complex intrauterine surgery. The hysteroscope market size for rigid platforms reached USD 147.0 million in 2024, supported by high capital utilization rates inside tertiary centers. In contrast, single-use scopes recorded the highest growth trajectory at 15.25% CAGR, gaining rapid traction where reprocessing capacity is limited and liability insurance premiums are rising. Greater comfort for patients in office settings, coupled with reduced turnaround time between cases, makes disposables attractive for throughput-oriented clinics.

Hybrid solutions that combine a reusable imaging unit with disposable sheaths blur traditional product boundaries and may accelerate adoption by balancing cost and infection-control goals. Meditrina's second-generation platform, cleared by FDA in May 2024, highlights innovation that marries lightweight ergonomics with 4K visualization, narrowing the perceived performance gap between rigid and flexible formats. Flexible scopes remain niche, favored in anatomically difficult cases or where patient tolerance is paramount, yet higher acquisition costs and narrower procedure indications keep share growth moderate.

Diagnostic hysteroscopy represented 62.53% of total 2024 procedures, reflecting its universal role in first-line uterine assessment. Clinicians favor diagnostic scopes for their smaller diameter and simplified workflow, making them ideal for outpatient evaluation without anesthesia. Operative procedures, expanding at 9.85% CAGR, benefit from tissue-removal systems and energy devices that allow polypectomy, myomectomy, and ablation during a single encounter. Evidence from a 2025 cohort study shows cold-knife hysteroscopic separation plus hormonal therapy achieved a 94.07% success rate in severe intrauterine adhesion, outperforming historical standards.

Hospitals and advanced ambulatory centers are investing in integrated imaging stacks and AI-enabled guidance that streamline complex operative workflows. These upgrades increase capital budgets but also elevate reimbursement potential because combined diagnostic-therapeutic sessions reduce overall episode-of-care costs. Growing surgeon proficiency, aided by simulation training and telementoring, is expected to sustain double-digit procedure expansion in operative subsegments across both developed and emerging geographies.

The Hysteroscope Market Report is Segmented by Product (Rigid Hysteroscopes and More), Modality (Diagnostic and Operative), Component (Scope Shaft & Optics, Light Source, and More), Application (Polypectomy, Myomectomy, Endometrial Ablation, and More), End User (Hospitals, Ambulatory Surgical Services, and More) and Geography (North America, Europe, Asia Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with 37.63% share in 2024, buoyed by advanced payer models, extensive sub-specialty training, and rapid uptake of AI-enhanced visualization systems. The United States maintains dominant procedure volume, while Canada adopts similar technologies under its publicly funded healthcare scheme. Mexico's growing private hospital sector and medical tourism initiatives attract regional patients seeking minimally invasive care.

Asia-Pacific is the fastest-growing territory at a projected 9.91% CAGR to 2030. Rising disposable income, expanded insurance coverage, and high gynecological disease burden underpin demand. A systematic 2025 analysis forecasts persistent growth in cervical and uterine cancers, particularly across South Asia, intensifying screening and operative requirements. China and Japan invest heavily in domestic device production, shortening supply chains and supporting local installations, whereas India's new marketing code underscores regulatory maturation that should accelerate market entry for global suppliers.

Europe maintains stable growth amid stringent safety and environmental regulations that influence global manufacturing standards. The region's push toward life-cycle transparency encourages design innovation around recyclable components. Meanwhile, Middle East & Africa and Latin America see incremental adoption led by private hospitals and fertility centers in urban hubs, though workforce shortages and uneven reimbursement slow broader penetration. Targeted training collaborations and cloud-enabled remote mentoring are expected to narrow the capability gap over the forecast horizon.

- B. Braun

- Boston Scientific

- The Cooper Companies

- Gynesonics

- Hologic

- Karl Storz

- LiNA Medical

- MedGyn Products

- Medtronic

- Olympus

- Richard Wolf

- Smiths Group

- Sopro-Comeg (Acteon)

- Stryker

- XION Medical

- Cook Group

- Optomic Espana

- EndoChoice Holdings

- Omnitech Systems

- Alltion (Wuzhou)

- Shenzhen Shen Da Medical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increase In Incidence Of Uterine Diseases & Abnormalities

- 4.2.2 Growing Demand For Minimally-Invasive Gynecologic Surgery

- 4.2.3 Technological Advances In Optics & Miniaturization

- 4.2.4 Rapid Adoption Of Single-Use Hysteroscopes For Infection Control

- 4.2.5 Shift Toward Office-Based Hysteroscopy Lowering Total Cost Of Care

- 4.2.6 Integration Of AI-Guided Imaging & Cloud Analytics

- 4.3 Market Restraints

- 4.3.1 Infection Risk From Re-Usable Hysteroscopes

- 4.3.2 Shortage Of Trained Hysteroscopists In Emerging Markets

- 4.3.3 Sustainability Concerns Around Disposable Devices

- 4.3.4 Regulatory Scrutiny Of Morcellation & Fluid-Management Events

- 4.4 Porter's Five Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Rigid Hysteroscopes

- 5.1.2 Flexible Hysteroscopes

- 5.1.3 Single-use / Disposable Hysteroscopes

- 5.2 By Modality

- 5.2.1 Diagnostic

- 5.2.2 Operative

- 5.3 By Component

- 5.3.1 Scope Shaft & Optics

- 5.3.2 Camera Head / Imaging System

- 5.3.3 Light Source

- 5.3.4 Distension Media & Pumps

- 5.3.5 Accessories & Consumables

- 5.4 By Application

- 5.4.1 Polypectomy

- 5.4.2 Myomectomy

- 5.4.3 Endometrial Ablation

- 5.4.4 Infertility Assessment & Treatment

- 5.4.5 Adhesiolysis / Septum Resection

- 5.4.6 Others

- 5.5 By End User

- 5.5.1 Hospitals

- 5.5.2 Ambulatory Surgical Centers

- 5.5.3 Office-based Gynecology Clinics

- 5.5.4 Fertility Centers

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 B. Braun SE

- 6.3.2 Boston Scientific Corp.

- 6.3.3 CooperSurgical Inc.

- 6.3.4 Gynesonics

- 6.3.5 Hologic Inc.

- 6.3.6 Karl Storz SE & Co. KG

- 6.3.7 LiNA Medical

- 6.3.8 MedGyn Products Inc.

- 6.3.9 Medtronic plc

- 6.3.10 Olympus Corporation

- 6.3.11 Richard Wolf GmbH

- 6.3.12 Smith & Nephew plc

- 6.3.13 Sopro-Comeg (Acteon)

- 6.3.14 Stryker Corp.

- 6.3.15 XION Medical

- 6.3.16 Cook Medical

- 6.3.17 Optomic Espana

- 6.3.18 EndoChoice Holdings

- 6.3.19 Omnitech Systems

- 6.3.20 Alltion (Wuzhou)

- 6.3.21 Shenzhen Shen Da Medical

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment