PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842574

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842574

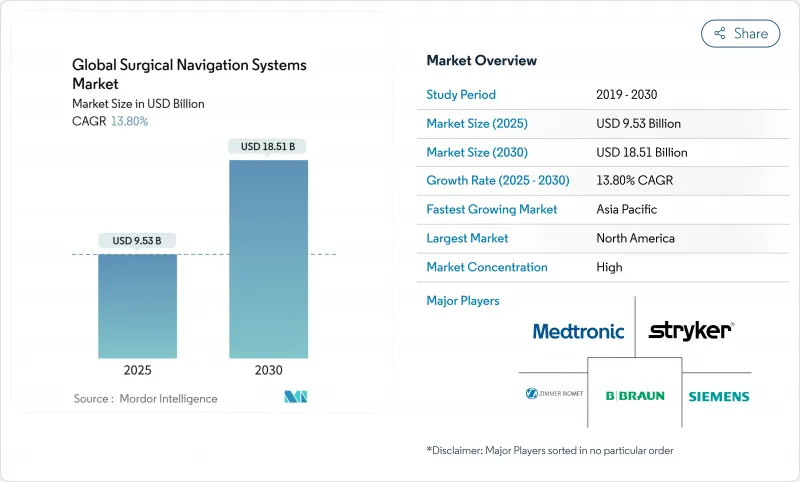

Global Surgical Navigation Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The surgical navigation systems market size stands at USD 9.53 billion in 2025 and is forecast to reach USD 18.51 billion by 2030, advancing at a 13.8% CAGR.

The acceleration reflects widespread migration toward precision-guided, minimally invasive procedures that cut revision rates and shorten patient recovery timelines. Higher clinical complexity in spine, neurosurgery, and orthopedic cases pushes hospitals to invest in image-guided technologies, while AI-enabled planning tools shrink operative time and improve implant positioning accuracy. Broader reimbursement coverage and bundled-payment models reward providers that demonstrate outcome gains, further lifting adoption. Rapid infrastructure expansion across Asia Pacific creates fresh demand for connected platforms that slot into hybrid operating rooms. Vendors differentiate by fusing 3D imaging with machine-learning algorithms, but must also navigate cybersecurity rules and a shortage of trained technicians that could slow roll-outs.

Global Surgical Navigation Systems Market Trends and Insights

Increasing Prevalence of Complex Surgical Cases

Eighty-four percent of complex spinal deformity operations now rely on navigation to achieve grade A screw accuracy versus 50-80% under fluoroscopy, cutting revision-surgery costs that average USD 33,939 per case. Aging populations with multi-morbidity enlarge case volumes, so providers justify the capital outlay by linking precision guidance to lower complication rates and shorter stays. Demand therefore stays resilient even in budget-tight environments, bolstering the surgical navigation systems market. Vendors bolstered by long clinical track records further raise confidence among surgeons, accelerating refresh cycles in high-volume centers.

Rising Adoption of Minimally Invasive and Robotic Procedures

Robotic-assisted total knee arthroplasty already represents 13% of US volume, and navigation is integral for accurate bone resection and implant alignment. Surgeons typically achieve proficiency after only 12-17 robotic cases, lowering the learning-curve barrier. Outpatient facilities capture these procedures, backed by Medicare rates that favor ambulatory settings and yielded USD 28.7 billion in savings between 2011 and 2018. This migration sustains multi-year tailwinds for the surgical navigation systems market as precision tools become essential for safe minimally invasive approaches

High Capital and Lifecycle Expenditure Requirements

Acquiring an O-arm with navigation can cost USD 589,205 over four years, and 77% of spine surgeons cite price as the top barrier to adoption. Pay-per-procedure leases and manufacturer financing packages attempt to soften the blow, but smaller hospitals and emerging-market providers still struggle. Cost anxiety may cap first-time installs, though economic models prove positive returns in high-volume centers that avoid expensive revision surgeries. As vendors introduce modular upgrades, they aim to flatten spending curves and defend growth in the surgical navigation systems market.

Other drivers and restraints analyzed in the detailed report include:

- Continuous Innovations in 3D Imaging and AI Algorithms

- Broader Reimbursement and Funding for Advanced OR Technologies

- Escalating Cybersecurity and Data-Privacy Concerns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Electromagnetic platforms held 41.9% of the surgical navigation systems market share in 2024 due to their proven performance in anatomy, where line-of-sight is obstructed. Hospitals appreciate their ability to track instruments through soft tissue without cumbersome reflectors. However, optical solutions are catching up; aided by faster cameras and AI-based markerless tracking, they chart an 8.3% CAGR. The segment's ascent reveals that operating rooms value quicker set-up and lower drift errors in a crowded surgical field, nudging facilities toward dual-modality suites that can toggle between tracking modes.

Hybrid configurations combine coils and cameras within a unified cart, letting surgeons switch mid-procedure modalities. Fluoroscopy-based and CT-based navigation secure niche demand in trauma and complex spine but face radiation-exposure scrutiny. Emerging modalities such as augmented-reality headsets and MRI-adaptive electromagnetic probes sit in the "Others" bucket and promise step-change gains once price and regulatory paths mature. These innovations help sustain the long-run expansion of the surgical navigation systems market.

The Surgical Navigation Systems Market is Segmented by Technology (Electromagnetic Navigation Systems, Hybrid Navigation Systems, and More), Application (Neurosurgery, Orthopedic Surgery, ENT Surgery, and More), End User (Hospitals, Ambulatory Settings, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captures 38.2% of 2024 revenue, supported by strong reimbursement, widespread hybrid-OR buildouts and early uptake of AI modules. The United States leads regional growth, helped by CPT pathways that reimburse stereotactic navigation in spine and brain procedures, while Canada expands provincial funding for capital upgrades. Mexico's cross-border device-supply agreements make high-end consoles more accessible to private hospitals. Nonetheless, saturation in metropolitan centers steers the North American surgical navigation systems market toward replacement rather than first-time purchases, nudging manufacturers to highlight workflow and cybersecurity upgrades rather than raw accuracy gains.

Asia Pacific is the fastest-growing arena at an 8.0% CAGR through 2030. China prioritizes domestic neuro-robot programs, and National Medical Products Administration reforms have cut approval times for innovative platforms, encouraging local and foreign entrants alike. Japan and South Korea leverage robust electronics supply chains to accelerate OEM partnerships, while India's burgeoning medical-tourism clusters demand cost-efficient yet advanced navigation consoles.

Europe shows steady but variable uptake due to multi-layer reimbursement and CE-mark timelines. Germany and France adopt early owing to strong hospital budgets and surgeon lobbying, yet tariff ambiguities in DRG systems can delay procurement in Italy and Spain. Cross-border research consortia keep innovation vibrant, while the EU AI Act could harmonize digital-health standards, easing region-wide launches. Middle East & Africa's spending spurt in GCC states and South Africa opens fresh lanes for vendors, whereas Latin America's macro volatility tempers near-term installs outside Brazil's private network. Over the forecast period these mixed drivers collectively reinforce the long-run expansion of the surgical navigation systems market.

- Medtronic

- Stryker

- Brain Lab

- Siemens Healthineers

- Zimmer Biomet

- B. Braun (Aesculap)

- KARL STORZ SE

- Fiagon GmbH

- DePuy Synthes (J&J)

- CAScination AG

- Intuitive Surgical

- Smiths Group

- Globus Medical

- GE Healthcare

- Royal Philips

- Accuray

- Surgalign Holdings

- Scopis GmbH (Stryker)

- Synaptive Medical

- Elvation Medical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Prevalence of Complex Surgical Cases

- 4.2.2 Rising Adoption of Minimally Invasive and Robotic Procedures

- 4.2.3 Continuous Innovations In 3D Imaging and AI Algorithms

- 4.2.4 Broader Reimbursement and Funding for Advanced OR Technologies

- 4.2.5 Rapid Infrastructure Expansion in Emerging Healthcare Markets

- 4.2.6 Integration Of Navigation Platforms with Hybrid Operating Rooms

- 4.3 Market Restraints

- 4.3.1 High Capital and Lifecycle Expenditure Requirements

- 4.3.2 Prolonged Multiregional Regulatory Approval Processes

- 4.3.3 Shortage Of Skilled Clinical and Technical Personnel

- 4.3.4 Escalating Cybersecurity and Data Privacy Concerns

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Technology

- 5.1.1 Electromagnetic Navigation Systems

- 5.1.2 Optical Navigation Systems

- 5.1.3 Hybrid Systems

- 5.1.4 Fluoroscopy-based Systems

- 5.1.5 CT-based Systems

- 5.1.6 Others

- 5.2 By Application

- 5.2.1 Neurosurgery

- 5.2.2 Orthopedic & Trauma Surgery

- 5.2.3 Spine Surgery

- 5.2.4 ENT Surgery

- 5.2.5 Cardiac & Thoracic Surgery

- 5.2.6 Dental & Maxillofacial Surgery

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgical Centers (ASC)

- 5.3.3 Others

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Medtronic plc

- 6.3.2 Stryker Corporation

- 6.3.3 Brainlab AG

- 6.3.4 Siemens Healthineers

- 6.3.5 Zimmer Biomet Holdings

- 6.3.6 B. Braun (Aesculap)

- 6.3.7 KARL STORZ SE

- 6.3.8 Fiagon GmbH

- 6.3.9 DePuy Synthes (J&J)

- 6.3.10 CAScination AG

- 6.3.11 Intuitive Surgical

- 6.3.12 Smith & Nephew

- 6.3.13 Globus Medical

- 6.3.14 GE Healthcare

- 6.3.15 Royal Philips

- 6.3.16 Accuray Inc.

- 6.3.17 Surgalign Holdings

- 6.3.18 Scopis GmbH (Stryker)

- 6.3.19 Synaptive Medical

- 6.3.20 Elvation Medical

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment