PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842575

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842575

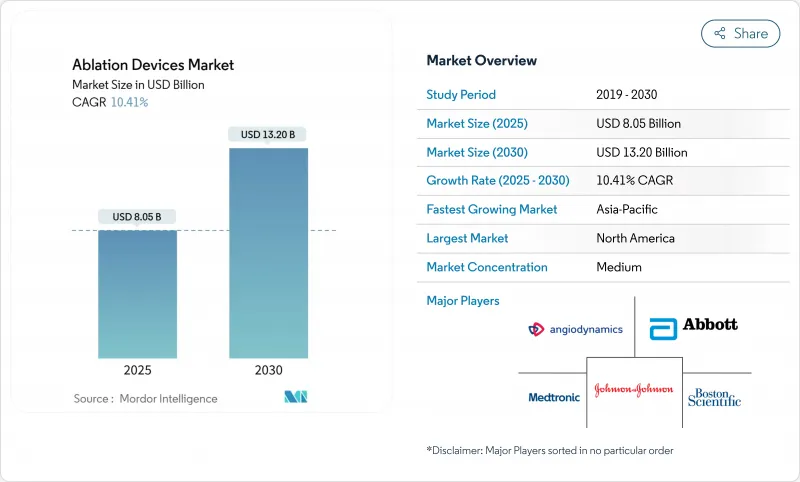

Ablation Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The ablation device market reached USD 8.05 billion in 2025 and is forecast to rise to USD 13.20 billion by 2030, registering a 10.41% CAGR.

Strong demand for minimally invasive care, rapid regulatory clearances for pulsed-field ablation, and the growing burden of chronic diseases sustain this upward curve. Radiofrequency platforms still anchor revenues, yet non-thermal systems gain traction as early data confirm shorter procedures and lower complication risks. Regional growth tilts toward Asia-Pacific, where healthcare modernization widens access to advanced therapies, while North America maintains revenue leadership through premium pricing and steady replacement cycles. Consolidation and aggressive R&D spending sharpen competitive rivalry, but the market continues to reward firms that can pair energy delivery innovations with precise imaging and mapping solutions.

Global Ablation Devices Market Trends and Insights

Technological Advancements in Ablation Devices

Pulsed-field ablation (PFA) delivers tissue-selective energy that avoids thermal injury to adjacent organs and cuts procedure times nearly in half. In the ADVENT trial, Boston Scientific's FARAPULSE achieved 81.6% arrhythmia-free survival at 12 months while completing most cases under 60 minutes. Medtronic's PulseSelect posted 88% freedom from recurrence and similar time savings, and Abbott's Volt platform reported 94.5% freedom from repeat ablation. FDA approvals for multiple PFA systems in 2024-2025 signal regulatory confidence and encourage global roll-outs. Broader portfolios that integrate advanced mapping and closed-loop control are expected to further expand the ablation device market.

Rapid Commercial Adoption of PFA Systems

Hospitals justify PFA investment through measurable operating gains. European centers reported per-patient savings of USD 850 versus cryoablation and USD 1,301 against radiofrequency as fewer complications and shorter room times trimmed resource use. More than 200,000 patients have already been treated worldwide with FARAPULSE, and early adopter feedback notes average procedure times near 30 minutes, an efficiency that accelerates learning curves for new users. As physicians gain confidence across paroxysmal and persistent atrial fibrillation, PFA transitions from niche to platform technology, reinforcing growth across the ablation device market.

High Cost of Ablation Devices & Disposables

Capital investments above USD 500,000 and single-use catheter prices ranging from USD 3,000 to USD 8,000 deter small facilities from adopting next-generation systems. Annual service contracts add 15-20% to ownership costs. Providers now request value-based pricing that links payments to clinical outcomes, compelling manufacturers to craft shared-savings or pay-per-use models that temper upfront spending.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Demand for Minimally Invasive Procedures

- Growing Incidence of Atrial Fibrillation

- Reimbursement Uncertainty for Novel Energy Modalities

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Radiofrequency ablation retained 43.55% ablation device market share in 2024 through decades of clinical familiarity and efficient reimbursement pathways. However, pulsed-field systems are forecast to post a 23.25% CAGR, the fastest within the ablation device market, as physicians embrace shorter cases and improved safety. Cryoablation remains important for pulmonary vein isolation, while microwave systems gain ground in oncology where larger, uniform ablation zones are prized. Histotripsy recently secured FDA clearance for liver tumors with 85-95% success, signaling broader acceptance of mechanical energy therapies.

The technology mix is also influenced by artificial intelligence that tailors power delivery to patient anatomy, producing consistent lesion sets and reducing operator variability. Laser and high-intensity focused ultrasound are expanding beyond dermatology into pain and gynecology, while integrated mapping plus therapy catheters shorten lab time. As capital budgets migrate toward multi-energy consoles, suppliers able to consolidate modalities on one platform are positioned to capture greater ablation device market opportunity.

Oncology commanded 39.53% of the ablation device market in 2024 thanks to established protocols for liver, lung, and renal tumors. Cardiovascular ablation is projected to grow at 12.35% CAGR, sharpening competition for share of the ablation device market size among EP labs that increasingly ablate early in atrial fibrillation. Ophthalmology and pain management niche uses expand steadily due to micro-catheters that target delicate tissues without open surgery. In gynecology, minimally invasive fibroid treatment gains traction as fertility-preserving options rise in demand.

Clinical data continue to validate cardiac growth. Durability rates above 90% at 12 months have been reported when advanced 3-D mapping guides lesion placement. AI-driven algorithms further personalize ablation lines, while wearable monitors capture post-procedure rhythm metrics, reinforcing physician confidence and boosting volumes within the ablation device market.

The Ablation Devices Market Report is Segmented by Device Technology (Radiofrequency (RF), Cryoablation, Ultrasound, and More), Application (Oncology, Cardiovascular Disease, Ophthalmology, and More), End-Users (Hospitals and Clinics, Ambulatory Surgical Centers, and More), Mode of Procedure (Percutaneous, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 38.82% of global revenue in 2024. A mature reimbursement system, accelerated FDA approvals, and strong replacement cycles sustain leadership. Boston Scientific treated more than 40,000 patients with FARAPULSE during its first commercial year, underscoring rapid uptake. The region also hosts leading research centers that generate pivotal data supporting new indications, which reinforces confidence across hospitals and ambulatory centers.

Asia-Pacific is the fastest-growing territory, projected at 12.52% CAGR to 2030. National health reforms and expanding device manufacturing in China and India lower procurement costs and improve availability. Japanese regulators authorized FARAPULSE in September 2024, and early hospital demand signals strong appetite for non-thermal technologies. Demographic shifts toward older populations and rising chronic disease prevalence assure continued growth of the ablation device market in the region.

Europe delivers steady expansion under a harmonized Medical Device Regulation framework that still promotes innovation while safeguarding patients. The early CE Mark approval of Abbott's Volt PFA system in March 2025 illustrates the region's role as a launchpad for advanced platforms. Academic hospitals continue to lead investigator-initiated studies, especially in oncology and neurologic uses, helping European clinicians refine protocols that ripple worldwide.

- Abbott Laboratories

- Alcon

- AngioDynamics

- AtriCure

- Bausch + Lomb

- BIOTRONIK

- Boston Scientific

- CardioFocus

- Conmed

- HealthTronics

- Imricor Medical Systems

- Johnson & Johnson

- Medtronic

- Monteris Medical

- Olympus

- Smiths Group

- Stryker

- Terumo

- Siemens Healthineers

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise In Prevalence Of Chronic Diseases Requiring Surgery

- 4.2.2 Technological Advancements In Ablation Devices

- 4.2.3 Surge In Demand For Minimally-Invasive Procedures

- 4.2.4 Growing Incidence Of Atrial Fibrillation Driving Cardiac Ablation Adoption

- 4.2.5 Rapid Commercial Adoption Of Pulsed-Field Ablation (PFA) Systems

- 4.3 Market Restraints

- 4.3.1 High Cost Of Ablation Devices & Disposables

- 4.3.2 Procedural Risks (Thermal Injury, Arrhythmia Recurrence, Etc.)

- 4.3.3 Reimbursement Uncertainty For Novel Energy Modalities

- 4.4 Supply-Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Device Technology

- 5.1.1 Radiofrequency (RF)

- 5.1.2 Cryoablation

- 5.1.3 Microwave

- 5.1.4 Laser / Light

- 5.1.5 Ultrasound / HIFU

- 5.1.6 Pulsed-Field (PFA)

- 5.1.7 Others

- 5.2 By Application

- 5.2.1 Oncology

- 5.2.2 Cardiovascular Disease

- 5.2.3 Ophthalmology

- 5.2.4 Gynecology

- 5.2.5 Urology

- 5.2.6 Cosmetic & Dermatology

- 5.2.7 Pain Management & Neurology

- 5.3 By End-User

- 5.3.1 Hospitals & Clinics

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Specialty & Cancer Centers

- 5.4 By Mode of Procedure

- 5.4.1 Percutaneous

- 5.4.2 Laparoscopic

- 5.4.3 Open / Surgical

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 Alcon

- 6.3.3 AngioDynamics

- 6.3.4 AtriCure

- 6.3.5 Bausch + Lomb

- 6.3.6 Biotronik

- 6.3.7 Boston Scientific

- 6.3.8 CardioFocus

- 6.3.9 Conmed

- 6.3.10 HealthTronics

- 6.3.11 Imricor Medical Systems

- 6.3.12 Johnson & Johnson (Biosense Webster)

- 6.3.13 Medtronic plc

- 6.3.14 Monteris Medical

- 6.3.15 Olympus Corporation

- 6.3.16 Smith & Nephew

- 6.3.17 Stryker

- 6.3.18 Terumo Corporation

- 6.3.19 Siemens Healthineers

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment