PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842576

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842576

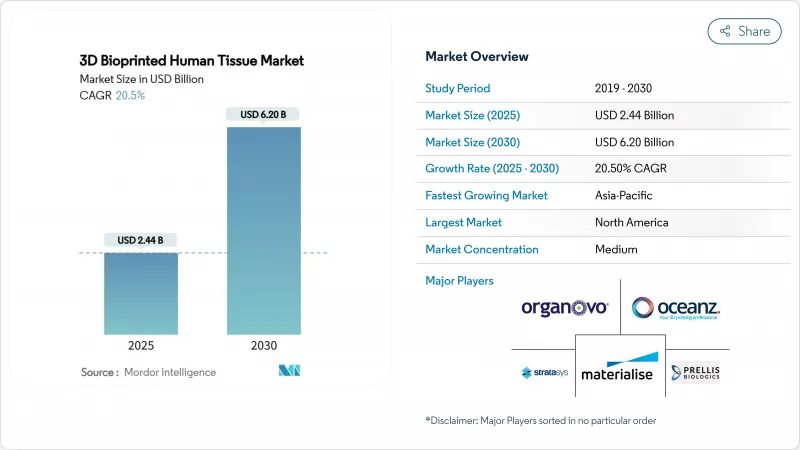

3D Bioprinted Human Tissue - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The 3D bioprinting market was valued at USD 2.44 billion in 2025 and is forecast to reach USD 6.20 billion by 2030, reflecting a 20.5% CAGR during 2025-2030.

The current growth trajectory stems from clearer regulatory frameworks, rapid advances in stem-cell-based bioinks, and record venture funding that is pushing laboratory concepts toward routine clinical practice. In December 2024, the US FDA cleared PrintBio's 3DMatrix, the first resorbable surgical mesh fabricated entirely by additive manufacturing, validating regulatory confidence in bioprinted medical devices. Europe is following suit; a refined Advanced Therapy Medicinal Products (ATMP) framework from the European Medicines Agency specifies classification routes for cell-laden constructs, lowering regulatory ambiguity for commercial developers. Large pharmaceutical groups are accelerating the adoption of printed tissue models to cut late-stage failure rates, while hospital systems view patient-specific implants as a long-term answer to transplant shortages. Collectively, these factors have shifted the narrative from proof-of-concept toward scalable manufacturing, opening substantial white-space opportunities for platform suppliers that can combine printing hardware, qualified bioinks, and regulatory documentation in a single package.

Global 3D Bioprinted Human Tissue Market Trends and Insights

Growing Demand for Regenerative Medicine Solutions

Organ shortages now leave more than 100,000 patients on US transplant waiting lists, prompting regulators to endorse translational research that can create functional tissue substitutes. The FDA's December 2024 clearance of Symvess, an acellular tissue-engineered vessel for vascular trauma, underscored this shift toward printed grafts. Japan's Kyoto University Hospital subsequently reported 100% sensory improvement 48 weeks after autologous Bio 3D nerve conduit implantation, marking the first human trial of a fully printed peripheral-nerve graft. Vascularization remains the main biological hurdle; Carnegie Mellon University's FRESH printing method now builds perfusable constructs at the organ scale, greatly improving nutrient diffusion and cell survival. As regulatory clarity rises and clinical success stories mount, regenerative medicine will remain the single most powerful growth catalyst over the next decade.

Escalating Investment in Bioprinting Research and Development

Series-B and Series-C funding rounds routinely surpass USD 50 million, led by Aspect Biosystems, which announced CAD 165 million (USD 120 million) for printed-tissue therapeutics in January 2025. Nuclera raised USD 75 million in October 2024 for its desktop protein bioprinter, reflecting a broader move to shrink printing platforms onto benchtops while maintaining GMP capabilities. Pharmaceutical alliances add non-dilutive capital; CN Bio's multi-year organ-on-chip collaboration with Pharmaron is expected to integrate printed liver, lung, and gut models into global discovery workflows. Capital intensity is therefore no longer a prohibitive barrier for agile innovators, but access to scale-up funds now determines competitive positioning.

High Capital and Operational Costs of Bioprinting Platforms

Industrial-grade printers range between USD 500,000 and USD 2 million, while GMP-compliant cleanrooms add multimillion-dollar overheads, limiting entry by small institutes. Proprietary bioinks often cost 10-50X standard media, and shortages of experienced tissue-engineering scientists inflate labor budgets. Contract development and manufacturing organizations (CDMOs) are emerging to spread CapEx across multiple clients, exemplified by Biological Lattice Industries' pay-per-print model launched after a USD 1.8 million seed round. Even so, investors remain cautious until equipment-as-a-service models achieve meaningful utilization rates.

Other drivers and restraints analyzed in the detailed report include:

- Advances in Stem-Cell and Biomaterial Technologies

- Increasing Strategic Collaborations and Industry Partnerships

- Regulatory and Ethical Uncertainty Surrounding Bioprinted Tissues

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Drug testing and development captured 29.1% CAGR through 2030, eroding the historical dominance of tissue engineering that still accounts for the largest absolute revenue pool. Pharmaceutical users increasingly cite bioprinted liver and gut models as key to cutting attrition in late-stage trials, a shift reinforced by regulatory pressure to reduce animal studies. POSTECH's artificial lung model exemplifies how printed constructs replicate disease states more faithfully than two-dimensional cell cultures, accelerating antiviral research. Cosmetic and reconstructive surgery applications gained momentum once CollPlant successfully printed 200 cc breast implants, moving aesthetic indications from concept to pre-clinical validation. Food safety and cultured-protein applications remain small but highly publicized following the FDA's first pre-market consultation on cell-based foods in July 2025.

Rising adoption in pharmacology has reshaped supplier roadmaps: many platform providers now bundle printer hardware with validated liver, cardiac, and kidney bioinks to target CROs and pharma innovation centers. These end-users demand multi-tissue arrays that allow parallel testing of toxicity, metabolism, and efficacy across organ systems. Meanwhile, regenerative orthopedics continues to secure public grants as governments seek printed cartilage and bone grafts that reduce donor-site morbidity. Collectively, application diversification supports a broad revenue base, though near-term margin expansion is concentrated in contract drug-testing services.

Extrusion printers still generated 38.1% of 2024 revenue because of proven reliability, broad material compatibility, and favorable cost-of-ownership. Nonetheless, hybrid and 4D configurations are growing 31.4% a year as they combine extrusion with light-based curing or acoustic positioning to deposit multiple bioinks with microscale precision. Stanford University used algorithm-generated vascular lattices to accelerate print times 200-fold, illustrating why hybrid platforms excel at perfusable tissues. Ink-jet modalities maintain relevance in high-throughput screening, while laser-assisted systems dominate applications requiring <20 µm resolution such as corneal stroma.

In vivo printing technologies, such as Caltech's ultrasound-guided deposition, highlight a future where therapeutic material is formed directly inside patients, bypassing graft maturation ex vivo. Printer OEMs now integrate closed-loop imaging and AI-driven feedback to correct deposition in real time, enhancing construct fidelity and reducing batch failure. As validation datasets accumulate, industry analysts expect hybrid printers to overtake extrusion for high-value therapeutic tissues before 2030, though extrusion retains an edge in low-complexity scaffolds and educational markets.

The 3D Bioprinted Human Tissue Market is Segmented by Application (Tissue Engineering, Drug Testing & Development, and More), Technology (Extrusion-Based, IHybrid/4D, and More), Material/Bio-Ink (Living Cells, Hydrogels, and More), End User (Pharmaceutical & Biotechnology Companies, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 49.1% of global revenue in 2024, underpinned by the FDA's proactive stance on printed devices and a venture ecosystem that routinely funds nine-digit rounds. Academic centers at Stanford, Carnegie Mellon, and the University of Pittsburgh anchor intellectual property output, while companies such as Redwire leverage microgravity bioprinting on the International Space Station to solve vascularization challenges in organ fabrication. Federal grants from the National Institutes of Health complement private venture capital, ensuring a balanced funding mix even as operational costs and talent shortages persist.

Europe ranks second in value thanks to a harmonized ATMP pathway and generous Horizon Europe funding calls. Germany's machine-tool heritage accelerates adoption in industrial biomedical printing, whereas the United Kingdom's post-Brexit regulatory regime maintains alignment with EMA quality benchmarks to preserve market access. Scandinavian nations champion sustainable bio-based inks, reflecting broader EU green-deal ambitions that favor circular-economy solutions in medical manufacturing.

Asia Pacific posts the fastest 22.8% CAGR through 2030, propelled by China's Five-Year Plan incentives for biomanufacturing and the rapid licensing of hospital-based printing labs. Japan's aging population drives demand for cartilage and vascular grafts, leveraging local excellence in materials science. South Korea applies consumer-electronics precision to desktop bioprinters, while India grows as an outsourcing hub for cost-sensitive pre-clinical testing. Regional challenges include patchy IP enforcement and varying ethical guidelines, yet localized manufacturing clusters are emerging around Shanghai, Yokohama, and Bengaluru.

- Organovo

- BICO (CELLINK)

- 3D Systems

- Stratasys

- Materialise

- Poietis

- Aspect Biosystems

- Allevi (Rokit Healthcare)

- REGENHU

- FluidForm

- Prellis Biologics

- CollPlant

- Cyfuse Biomedical

- Advanced Solutions LifeSciences

- FabRx

- 3D Bioprinting Solutions

- Inventia Life Science

- CELLuink

- Viscient Biosciences

- Xylyx Bio

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand For Regenerative Medicine Solutions

- 4.2.2 Escalating Investment In Bioprinting Research And Development

- 4.2.3 Advancements In Stem Cell And Biomaterial Technologies

- 4.2.4 Increasing Strategic Collaborations And Industry Partnerships

- 4.2.5 Supportive Government Funding And Grant Initiatives

- 4.2.6 Rising Prevalence Of Chronic Diseases And Trauma Injuries

- 4.3 Market Restraints

- 4.3.1 High Capital And Operational Costs Of Bioprinting Platforms

- 4.3.2 Regulatory And Ethical Uncertainty Surrounding Bioprinted Tissues

- 4.3.3 Limited Scalability And Standardization Of Manufacturing Processes

- 4.3.4 Shortage Of Skilled Workforce In Bioprinting And Tissue Engineering

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Application

- 5.1.1 Tissue Engineering

- 5.1.2 Drug Testing & Development

- 5.1.3 Cosmetic & Reconstructive Surgery

- 5.1.4 Food Safety & Novel Foods

- 5.1.5 Other Applications

- 5.2 By Technology

- 5.2.1 Extrusion-based

- 5.2.2 Ink-jet

- 5.2.3 Laser-Assisted

- 5.2.4 Microfluidic & Acoustic

- 5.2.5 Magnetic Levitation

- 5.2.6 Hybrid / 4D

- 5.3 By Material

- 5.3.1 Living Cells

- 5.3.2 Hydrogels

- 5.3.3 Extracellular-Matrix Components

- 5.3.4 Synthetic Polymers

- 5.3.5 Natural Polymers

- 5.3.6 Others

- 5.4 By End-User

- 5.4.1 Pharmaceutical & Biotechnology Companies

- 5.4.2 Academic & Research Institutes

- 5.4.3 Hospitals & Surgical Centres

- 5.4.4 Contract Research Organisations

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Organovo

- 6.3.2 BICO (CELLINK)

- 6.3.3 3D Systems

- 6.3.4 Stratasys

- 6.3.5 Materialise

- 6.3.6 Poietis

- 6.3.7 Aspect Biosystems

- 6.3.8 Allevi (Rokit Healthcare)

- 6.3.9 RegenHU

- 6.3.10 FluidForm

- 6.3.11 Prellis Biologics

- 6.3.12 CollPlant

- 6.3.13 Cyfuse Biomedical

- 6.3.14 Advanced Solutions LifeSciences

- 6.3.15 FabRx

- 6.3.16 3D Bioprinting Solutions

- 6.3.17 Inventia Life Science

- 6.3.18 CELLuink

- 6.3.19 Viscient Biosciences

- 6.3.20 Xylyx Bio

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment