PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842580

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842580

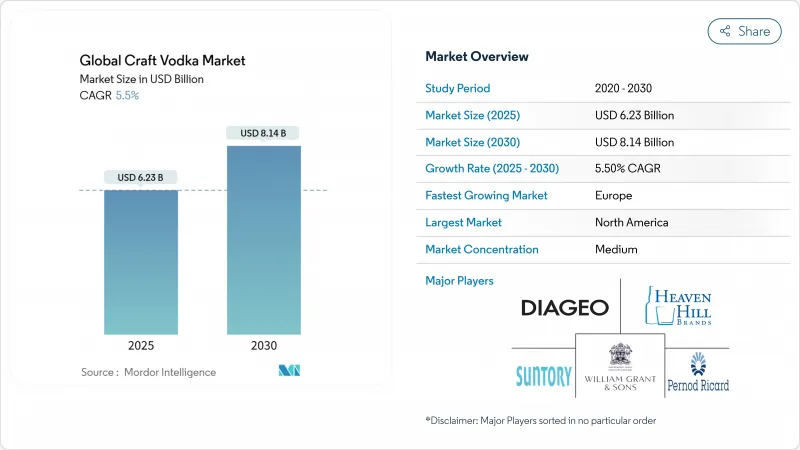

Global Craft Vodka - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The craft vodka market is valued at USD 6.23 billion in 2025 and is on course to expand to USD 8.14 billion by 2030, progressing at a 5.50% CAGR.

Rising disposable incomes, a global premiumization trend in beverage alcohol, and stronger direct-to-consumer legislation are steering consumers toward small-batch labels that emphasize provenance, transparency, and sensory complexity. North America remains the largest regional base, benefiting from a mature distribution infrastructure. Europe is the fastest-growing territory as the craft vodka market converts cocktail culture, tourism, and sustainability priorities into shelf gains. Flavor innovation, alternative raw materials, and digital engagement help younger, independent distillers capture occasions historically dominated by mass-market brands. Supply-side momentum is reinforced by small producer tax relief in the United Kingdom and expanded tasting-room privileges in California, bolstering cash-flow resilience.

Global Craft Vodka Market Trends and Insights

Increasing number of microbreweries propelling the demand for craft spirits

In the United States, the extensive presence of microbreweries is shaping the business landscape for emerging vodka brands. The integration of overlapping supply chains, community-driven storytelling, and engaging tasting-room experiences, key features of the microbrewery ecosystem, is now streamlining market entry for new vodka producers. For small-scale distillers targeting regional growth, shared distributor networks and retail shelf arrangements originally tailored for craft beer have significantly reduced entry barriers. States with a high concentration of breweries, such as Kentucky, highlight the strategic benefits of clustering. These regions provide access to skilled labor pools, established adjunct ingredient contracts, and robust tourism circuits, all of which enhance the visibility and marketability of local spirits. Furthermore, consumers accustomed to seeking limited-edition products are finding similar value in single-estate vodkas, enabling producers to position their offerings at premium price points. Additionally, brand narratives emphasizing grain-to-glass authenticity align seamlessly with the marketing strategies of microbrewery trails, driving consumer engagement, encouraging product trials, and fostering repeat purchases.

Technological advancements in terms of production

Craft vodka producers are leveraging advanced stills with superior temperature and pressure control to enhance the distillation process, delivering cleaner and smoother spirits. Automated systems ensure consistent quality across batches while maintaining the integrity of small-batch production. Modern, scalable distillation units enable producers to increase output without compromising their artisanal appeal. By adopting innovative technologies, they are reducing energy consumption and waste, lowering production costs, and strengthening eco-conscious branding. Continuous distillation systems with patented stills produce higher proof neutral spirits while preserving congeners essential for mouthfeel, aligning artisanal craftsmanship with consistency demands. Sensor-enabled process controls streamline compliance with neutral-spirit purity regulations by adjusting reflux ratios in real-time, ensuring adherence to legal standards set by HM Revenue and Customs. These operational efficiencies help offset the disadvantages of smaller-scale production and accelerate breakeven timelines for emerging distilleries.

Stringent government regulations

Regulatory complexities pose significant barriers for craft vodka producers. The Alcohol and Tobacco Tax and Trade Bureau's proposed allergen and nutritional labeling requirements, with a compliance deadline set five years after the final rule's publication, increase administrative challenges for smaller producers. Additionally, variations in state-level regulations add to compliance difficulties. For instance, Mississippi's Senate Bill 2869 establishes craft spirit definitions and permitting requirements that differ from federal standards. Furthermore, state laws favoring local producers create legal uncertainties under the Commerce Clause, as demonstrated in cases like Granholm v. Heald, which addressed discrimination against out-of-state manufacturers. These regulatory pressures disproportionately impact smaller producers with limited compliance resources, potentially restricting their market entry and growth opportunities.

Other drivers and restraints analyzed in the detailed report include:

- Innovation in flavor and ingredients

- Growing tourism and hospitality sector

- Consumers' inclination toward healthy beverages

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Non-flavored expressions retained 85.32% of 2024 revenues, anchoring the craft vodka market as the workhorse for classic martinis and high-ball serves. Flavored lines, however, will lift revenues at a 5.97% CAGR through 2030 as distillers roll out natural botanicals and single-fruit macerations that sidestep artificial additives. In retail data sets, lemon-verbena and cucumber-mint SKUs reorder faster than legacy vanilla or cherry extensions, validating a pivot toward nuanced profiles. Demand for season-limited drops stimulates tasting-room traffic and supports higher bottle prices that fortify brand margins.

Growth momentum aligns with Alcohol and Tobacco Tax and Trade Bureau(TTB) revisions that permit minimal sweetening while retaining vodka's neutral standard, giving producers latitude to layer subtle sweetness and acidity without drifting into liqueur classification. The strategy responds to wellness cues, focusing on real-fruit extracts and clean-label callouts instead of heavy-syrup flavors.

Grain remains the backbone at 69.45% of production in 2024, leveraging cost efficiencies and consumer familiarity with wheat and corn distillates. Regional grain procurement underpins sustainability messaging and fosters farmer-distiller partnerships that secure traceable supply at negotiated forward contracts. Yet alternative bases such as quinoa, rice, and even milk permeate launch calendars, fuelling a 6.32% CAGR for the "others" segment.

The adoption of these unconventional substrates addresses growing consumer concerns about allergens and introduces unique flavor profiles that cater to the preferences of adventurous and experimental drinkers. Additionally, technical expertise provided by the Scotch Whisky Research Institute on optimizing novel starches is expediting the development of innovative recipes. This shift toward a broader range of raw materials not only diversifies the segment but also creates significant opportunities for regional specialization and the establishment of robust agricultural partnerships.

The Craft Vodka Market is Segmented Into Product Type (Flavored and Non-Flavored), Raw Material (Grain-Based, Potato-Based, and Others), End User (Men and Women), Category (Mass and Premium), Distribution Channel (On-Trade and Off-Trade), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America anchors the craft vodka market with a 38.55% revenue share in 2024. The region's competitive position is strengthened by mature distribution networks, celebrity-backed product launches, and a stable supply of corn and wheat. States such as California and Texas leverage direct-to-consumer privileges, reducing reliance on national wholesalers and enabling profitable tasting-room business models.

Europe is projected to achieve a 7.64% annual growth rate through 2030, driven by the rise of experiential tourism and the growing influence of eco-conscious consumers. Sustainability-focused travelers are increasingly engaging in distillery tours and purchasing bottles, contributing to market growth. Additionally, Spirits Europe's consistent messaging on responsible drinking supports premium brands that emphasize moderation and craftsmanship over high-volume sales.

Asia-Pacific offers significant growth potential, fueled by the expansion of high-income consumer segments. The region's evolving cocktail culture is creating opportunities for premium vodka brands. In Thailand and Vietnam, where tourism thrives, locally crafted rice-based vodka is emerging as a popular gift, rivaling imported brands. Though current sales volumes are modest, the region's growth outpaces global averages, underscoring its significance in the coming years. Factors like a surge in tourist arrivals, urbanization, and a burgeoning middle class are shaping trends in the Middle East and Africa, and South America. Additionally, social media's sway in these areas is amplifying consumers' eagerness to explore novel flavors and varieties.

- Titos Handmade Vodka

- Sazerac Company

- Diageo Plc

- Pernod Ricard SA

- Suntory Global Spirits Inc

- William Grant and Sons Ltd

- Heaven Hill Brands

- St. George Spirits

- Woody Creek Distillers

- E. and J. Gallo Winery

- LVMH Mot Hennessy Louis Vuitton SE

- Next Frontier Brands

- Roust Corporation

- Beluga Group

- Bacardi Ltd

- Copperworks Distilling Co.

- Phillips Distilling Company

- Maine Distilleries LLC.

- Becle SAB de

- Stoli Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing number of microbreweries propelling the demand for craft spirits

- 4.2.2 Technological advancement in terms of production

- 4.2.3 Innovation in flavor and ingredients

- 4.2.4 Growing tourism and hospitality sector

- 4.2.5 Sustainability and ethical sourcing

- 4.2.6 Strategic expansion by pub and bar chains

- 4.3 Market Restraints

- 4.3.1 Stringent government regulations

- 4.3.2 Consumers' inclination towards healthy beverages

- 4.3.3 Health issues over excessive consumption

- 4.3.4 Growing demand for low alcohol products

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porters Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Flavored

- 5.1.2 Non-Flavored

- 5.2 By Raw Material

- 5.2.1 Grain-based

- 5.2.2 Potato-based

- 5.2.3 Others

- 5.3 By End User

- 5.3.1 Men

- 5.3.2 Women

- 5.4 By Category

- 5.4.1 Mass

- 5.4.2 Premium

- 5.5 By Distribution Channel

- 5.5.1 On-Trade

- 5.5.2 Off-Trade

- 5.5.2.1 Specialty/Liquor Stores

- 5.5.2.2 Others Off Trade Channels

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.1.4 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 Italy

- 5.6.2.4 France

- 5.6.2.5 Spain

- 5.6.2.6 Netherlands

- 5.6.2.7 Poland

- 5.6.2.8 Belgium

- 5.6.2.9 Sweden

- 5.6.2.10 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 Australia

- 5.6.3.5 Indonesia

- 5.6.3.6 South Korea

- 5.6.3.7 Thailand

- 5.6.3.8 Singapore

- 5.6.3.9 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Colombia

- 5.6.4.4 Chile

- 5.6.4.5 Peru

- 5.6.4.6 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 South Africa

- 5.6.5.3 Egypt

- 5.6.5.4 Morocco

- 5.6.5.5 Nigeria

- 5.6.5.6 Rest of Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Titos Handmade Vodka

- 6.4.2 Sazerac Company

- 6.4.3 Diageo Plc

- 6.4.4 Pernod Ricard SA

- 6.4.5 Suntory Global Spirits Inc

- 6.4.6 William Grant and Sons Ltd

- 6.4.7 Heaven Hill Brands

- 6.4.8 St. George Spirits

- 6.4.9 Woody Creek Distillers

- 6.4.10 E. and J. Gallo Winery

- 6.4.11 LVMH Mot Hennessy Louis Vuitton SE

- 6.4.12 Next Frontier Brands

- 6.4.13 Roust Corporation

- 6.4.14 Beluga Group

- 6.4.15 Bacardi Ltd

- 6.4.16 Copperworks Distilling Co.

- 6.4.17 Phillips Distilling Company

- 6.4.18 Maine Distilleries LLC.

- 6.4.19 Becle SAB de

- 6.4.20 Stoli Group

7 MARKET OPPORTUNITY AND FUTURE OUTLOOK