PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842583

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842583

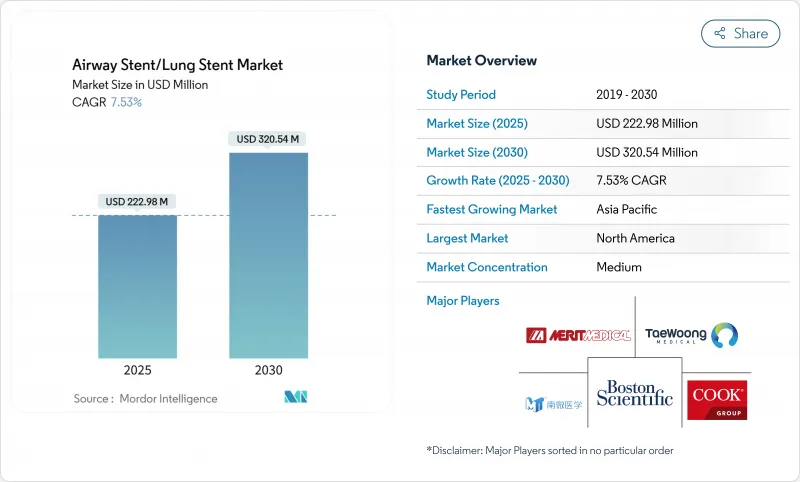

Airway Stent/Lung Stent - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The airway stents market stands at USD 222.98 million in 2025 and is forecast to advance to USD 320.54 million by 2030, a steady 7.53% CAGR that underscores the growing clinical acceptance of minimally invasive interventional pulmonology and the widening respiratory disease burden worldwide.

Demand is fueled by rapid developments in device design, including 3D-printed patient-specific implants, biodegradable polymers that dissolve once the airway heals, and drug-eluting coatings that curb granulation tissue formation. North America remains the anchor of global revenue thanks to mature reimbursement frameworks and early adoption of robotic bronchoscopy, while Asia-Pacific leads growth on the back of rising COPD and lung-cancer incidence, broader health-insurance coverage, and government investments in tertiary respiratory centers. Material-level innovation accelerates product turnover as hospitals and specialty clinics transition from durable metals to resorbable polymers that eliminate removal surgeries. At the same time, competition intensifies as incumbents such as Boston Scientific and Cook Group defend share against start-ups focused on custom bioresorbable devices and AI-guided placement platforms. Regulatory convergence, notably the United States Quality System Regulation revisions effective 2026, is set to smooth cross-border approvals and hasten technology diffusion.

Global Airway Stent/Lung Stent Market Trends and Insights

Rising Prevalence of Lung and Chronic Respiratory Disorders

Respiratory Research reported 213.39 million COPD cases in 2024, reflecting better diagnostics and longer survival that in turn keep interventional demand high. Lung-cancer-related airway obstruction frequently requires palliative stents that restore patency and improve breathing comfort. Smoking, which still drives 34.8% of COPD disability-adjusted life-years, and ambient particulate pollution at 22.2% sustain a large patient pipeline. Aging populations amplify case volumes in developed economies, whereas India alone tallied 37.8 million COPD cases, underscoring opportunity in fast-growing Asia-Pacific markets.

Growing Preference for Minimally Invasive Procedures

High-frequency jet ventilation using silicone catheters achieved 84% procedural success in 2024 with median operating times of 35 minutes and no postoperative complications, strengthening the clinical case for bronchoscopic stenting over open surgery.Hospitals embrace outpatient protocols to contain costs and accelerate recovery, while cone-beam CT and digital tomosynthesis sharpen placement accuracy. Robotic bronchoscopy systems deliver diagnostic yields of 88-94% for peripheral lesions, further easing physician adoption.

Availability of Alternative Interventions

Balloon dilation solves many benign strictures with 88.9% efficacy and leaves no implant behind, while surgical reconstruction offers definitive cures for localized stenosis in fit patients. Techniques such as laser, cryotherapy, and argon plasma coagulation recanalize blocked airways quickly, and Montgomery T-tubes provide another removable option in post-tracheotomy stenosis.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Material Innovation in 3D-Printed and Drug-Eluting Bioresorbable Stents

- Benefits Linked to Pulmonary Stent Usage

- Device-Related Complications

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Self-expandable devices held 59.56% of 2024 revenue, confirming their versatility across benign and malignant obstructions. These stents expand gently after deployment and maintain steady radial force, helping physicians manage variable airway diameters. Balloon-expandable units target scenarios that demand exact sizing, such as pediatric tracheal narrowing. Non-expandable and 3D-printed custom designs are on track for an 8.91% CAGR to 2030. The shift toward personalized implants reflects growing awareness that geometry differences call for tailored solutions. AnatomikModeling and Toulouse University Hospital executed one of the earliest custom placements in 2016 and have since demonstrated improved migration profiles in validation studies. Michigan Medicine's 2025 infant trial underscores the new frontier of resorbable, bespoke devices.

Self-expandable devices are reliable in collapse-prone segments, yet physicians increasingly prescribe custom-printed stents for airways distorted by tumors or postsurgical changes. This trend aligns with hospital investment in point-of-care 3D-printing labs that compress turnaround times and lower logistic costs. As these centers mature, non-expandable personalized units will claim a larger slice of the airway stents market, even as self-expandable lines remain workhorse solutions for general obstruction.

Metal frameworks remain the default in fast-progressing tumors thanks to high radial strength and radiopaque profiles that help imaging follow-up. They captured 51.23% of 2024 sales. Yet biodegradable polymers are the fastest risers at a 9.22% CAGR through 2030, as clinicians prize temporary support without the burden of removal surgery. Silicone options stay popular in benign disease because they are less prone to infection and can be extracted easily. Composite designs that marry metal skeletons with polymer linings seek the best of both worlds, adding drug-eluting layers to blunt granulation.

In adult trials, polydioxanone devices achieved 89.7% clinical effectiveness and then resorbed, freeing the airway from foreign material. Iron-scaffold data revealed 95.4% absorption within three years with no loss of mechanical stability. Surface laser texturing promoted endothelial growth while curbing smooth-muscle proliferation by roughly 75%, which can cut restenosis risk. As price gaps narrow, polymer adoption will accelerate, shrinking metal's share of the airway stents market.

Airway Stent/Lung Stent Market is Segmented by Product (Self-Expandable Stents, Balloon- Expandable Stents and More), Material (Metal, Silicone, and More), Type (Tracheobronchial Stents, Laryngeal Stents and More), Indication (Malignant Central Airway Obstruction, Benign Tracheal Stenosis and More), End User (Hospitals, Ambulatory Surgical Centers and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 38.75% of revenue in 2024, underpinned by advanced reimbursement policies and rapid adoption of precision placement technologies. The FDA's 2024 De Novo clearance for Peytant's stent system demonstrates a supportive regulatory climate. Forthcoming Quality System Regulation alignment with ISO standards by 2026 will streamline manufacturing compliance and help innovative devices reach hospitals faster. Robotic bronchoscopy diagnostic yields of up to 94% cement the region's leadership in technology-driven care . While Medicare covers core interventional pulmonology codes, payment gaps persist for customized implants, tempering near-term adoption of 3D-printed solutions.

Asia-Pacific is the growth engine with a 9.34% CAGR to 2030. COPD prevalence, 37.8 million cases in India alone, aligns with high urban air-pollution exposure and smoking rates. China's hospital build-out and a rising middle class enlarge the treated population, even though medtech investment fell 22% in 2024 amid tighter capital markets. Japan's so-called device-lag underscores approval delays, but recent harmonization initiatives aim to shorten time to market. Together, these dynamics propel a sizeable addressable base for the airway stents market.

Europe offers steady expansion supported by universal healthcare and a strong evidence culture. AnatomikModeling's collaboration with Toulouse University Hospital showcases the continent's prowess in custom 3D stents. Multi-center biodegradable trials report 89.7% effectiveness, keeping Europe at the forefront of resorbable research [bmcpulmmed.biomedcentral.com]. Medical Device Regulation creates uniform safety benchmarks that promote cross-border device adoption, though cost pressures require demonstrable value before large-scale deployment.

- Boston Scientific

- Taewoong Medical Co. Ltd.

- Micro-Tech (Nanjing) Co. Ltd.

- Merit Medical Systems

- Cook Group

- Endo-Flex

- Efer Endoscopy

- Bess Medizintechnik

- Standard Sci Tech

- E. Benson Hood Laboratories

- Novatech

- M.I. Tech Co. Ltd.

- A.B. Polyp Co. Ltd.

- Stening SRL

- Hyundai Medical Co. Ltd.

- Bentley Innomed GmbH

- Olympus

- Medtronic

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence Of Lung & Chronic Respiratory Disorders

- 4.2.2 Growing Preference For Minimally Invasive Procedures

- 4.2.3 Rapid Material Innovation: 3d-Printed & Drug-Eluting Bioresorbable Stents

- 4.2.4 Benefits Associated with Usage of Pulmonary Stents

- 4.2.5 Emergence Of Fully Biodegradable Stents and Innovative Stents

- 4.2.6 Robotic Bronchoscopy Enabling Precise Stent Placement

- 4.3 Market Restraints

- 4.3.1 Availability Of Alternative Interventions

- 4.3.2 Device-Related Complications

- 4.3.3 Reimbursement Gaps For Customized & Biodegradable Stents

- 4.3.4 Regulatory Ambiguity For Patient-Specific 3D-Printed Devices

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technology Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Product

- 5.1.1 Self-Expandable Stents

- 5.1.2 Balloon-Expandable Stents

- 5.1.3 Non-Expandable / Customized 3D-Printed Stents

- 5.2 By Material

- 5.2.1 Metal

- 5.2.2 Silicone

- 5.2.3 Hybrid (Covered / Composite)

- 5.2.4 Bioresorbable Polymers

- 5.3 By Type

- 5.3.1 Tracheobronchial Stents

- 5.3.2 Laryngeal Stents

- 5.3.3 Y-Shaped Carinal Stents

- 5.4 By Indication

- 5.4.1 Malignant Central Airway Obstruction

- 5.4.2 Benign Tracheal Stenosis

- 5.4.3 Post-Lung-Transplant Airway Complications

- 5.4.4 Tracheoesophageal Fistula

- 5.5 By End User

- 5.5.1 Hospitals

- 5.5.2 Ambulatory Surgical Centers

- 5.5.3 Specialty Pulmonology Clinics

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Boston Scientific Corporation

- 6.3.2 Taewoong Medical Co. Ltd.

- 6.3.3 Micro-Tech (Nanjing) Co. Ltd.

- 6.3.4 Merit Medical Systems Inc.

- 6.3.5 Cook Group Incorporated

- 6.3.6 Endo-Flex GmbH

- 6.3.7 Efer Endoscopy

- 6.3.8 Bess Medizintechnik GmbH

- 6.3.9 Standard Sci Tech Inc.

- 6.3.10 E. Benson Hood Laboratories Inc.

- 6.3.11 Novatech SA

- 6.3.12 M.I. Tech Co. Ltd.

- 6.3.13 A.B. Polyp Co. Ltd.

- 6.3.14 Stening SRL

- 6.3.15 Hyundai Medical Co. Ltd.

- 6.3.16 Bentley Innomed GmbH

- 6.3.17 Olympus Corporation

- 6.3.18 Medtronic plc

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment