PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842585

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842585

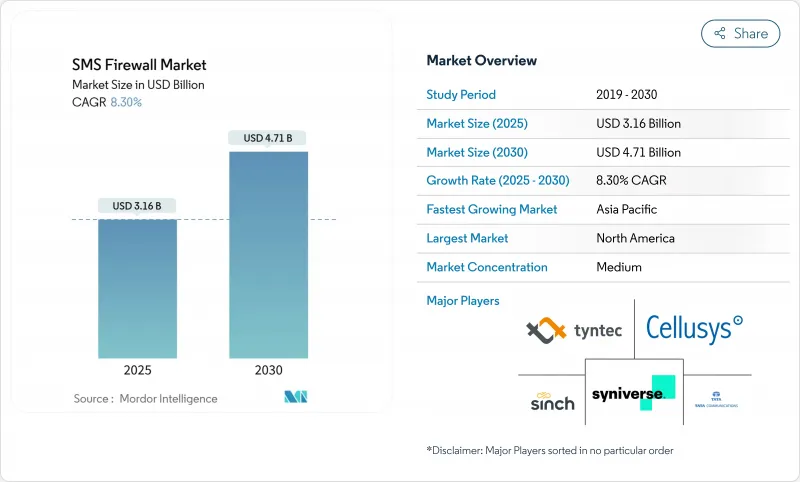

SMS Firewall - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The SMS Firewall Market size is estimated at USD 3.16 billion in 2025, and is expected to reach USD 4.71 billion by 2030, at a CAGR of 8.30% during the forecast period (2025-2030).

Operators are investing in next-generation firewalls to secure A2P revenues, comply with new traceability mandates, and guard 5G network slices from signaling threats. Migration from SS7 to Diameter firewalls, accelerated 5G rollouts in early-adopter countries, and national data-sovereignty rules that force on-shore filtering keep capital spending elevated. At the same time, CPaaS consolidation is compressing vendor margins, prompting suppliers to differentiate with AI-driven analytics and managed services offers. Moderate fragmentation among suppliers leaves space for niche specialists that target tier-3 and tier-4 mobile network operators with cloud-native, subscription-based tools.

Global SMS Firewall Market Trends and Insights

Surge in A2P Traffic Monetisation

Operators face declining voice income, so authenticated A2P messaging has become pivotal for revenue recovery. India's distributed ledger framework showed a 40% cut in leakage and a 98% spam drop for Airtel customers. Similar monetisation programs in Brazil and Nigeria rely on advanced traffic analytics that separate legitimate enterprise messages from grey routes. The model also lets carriers resell premium delivery services with embedded security. Although profitable, rollout demands machine-learning inspection tools that smaller carriers cannot host on legacy infrastructure.

Intensifying Mobile Fraud and Grey-Route Losses

SIM-box fraud causes USD 3.11 billion in yearly losses and represents 7.8% of total telecom fraud. Artificially inflated traffic and phishing campaigns now combine voice, SMS, and social apps, pressuring regulators to act. India's AI-based anti-spoofing platform cut fraudulent calls by 90% in three months. Such successes push other regulators to demand integrated SMS firewall capability within wider fraud-prevention stacks, expanding the SMS firewall market.

Low Technical Awareness Among Tier-3/4 MNOs

Thousands of smaller operators grapple with DLT registration and rule optimization, as seen when 27,000 entities in India sought compliance assistance. Continuous tuning of machine-learning rules and integration of live threat feeds push these operators toward managed services, yet budget limits slow adoption.

Other drivers and restraints analyzed in the detailed report include:

- SS7 to Diameter Firewall Upgrade Cycle

- 5G Slicing Opening New Attack Surfaces

- Pricing Pressure from CPaaS Consolidations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

A2P messaging held 65.3% of the SMS firewall market share in 2024, underpinned by mandatory authentication rules across finance, healthcare, and public services. The SMS firewall market size for A2P segments is set to expand at an 8.3% CAGR as enterprises pay for guaranteed delivery and spam control. Enterprises also invest in secure P2P alerts, pushing the P2P enterprise category to a 10.2% CAGR. Jack Henry already moves 12-15 million secured alerts each month through Twilio and plans a fifty-fold volume growth.

A2P growth accelerates firewall upgrades that filter grey routes, while P2A use cases such as inbound customer queries hinge on authentication that shields enterprises from impersonation attacks. Competing channels like RCS slow P2A momentum, yet regulated sectors still rely on SMS for universal reach. The rising volume of one-time passwords and service notifications keeps security-rich A2P traffic central to operator revenue strategies, fortifying the SMS firewall market.

On-premise deployments retained 53.22% revenue share in 2024 because tier-1 carriers favor local data control. Even so, cloud options are projected to record a 13.1% CAGR, reflecting strong demand from smaller operators. The SMS firewall market size for cloud deployments is forecast to rise sharply as regulators in regions that allow cross-border processing endorse shared-threat feeds.

Hybrid architectures gain traction where data localization laws exist, letting operators analyze metadata in the cloud while storing message content on shore. Edge nodes positioned inside carrier facilities provide near-real-time analytics without moving sensitive data off-site. This flexibility spurs additional investment, ensuring that the SMS firewall market continues to grow in both traditional and emerging deployment models.

The SMS Firewall Market is Segmented by SMS Type (A2P, P2A, and P2P), Deployment Mode (On-Premise and Cloud), Service Type (Professional Services and Managed Services), End-User Industry (BFSI, Government and Public Safety, and More), Network Generation (2G/3G, 4G/LTE, and 5G), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with a 37.8% revenue share in 2024, thanks to stringent privacy rules, early 5G adoption, and large CPaaS ecosystems that embed firewalls into enterprise communication stacks. Carrier spending stays strong in 2025 as cross-border messaging with Canada and Mexico triggers new audit trail mandates. Federal attention on robocalls and smishing scams further boosts demand, anchoring North American leadership within the SMS firewall market.

Asia-Pacific is the fastest-growing region at a 12.5% CAGR to 2030. India's DLT framework enforces end-to-end message traceability and functions as a regional blueprint, while China's aggressive 5G slicing deployment accelerates next-generation firewall uptake. Southeast Asian operators follow with spam-reduction drives that mirror India's performance gains, collectively enlarging the SMS firewall market.

Europe balances GDPR compliance with pan-EU cross-border traffic rules that require granular consent logs. Data-sovereignty clauses push operators toward on-shore filtering, yet shared threat feeds encourage cloud adoption in low-risk categories. In the Middle East and Africa, mobile-first economies adopt cloud-native firewalls to reduce capital expenses, though awareness gaps among smaller MNOs slow penetration. South America mirrors India by mandating KYC verification on messages, fueling demand for low-cost, regulation-ready solutions.

- Cellusys Telecommunications

- Tyntec GmbH

- Tata Communications Ltd.

- Syniverse Technologies LLC

- Sinch AB

- Omobio (Pvt) Ltd.

- Route Mobile Ltd.

- AMD Telecom S.A.

- BICS SA/NV

- SAP SE

- Monty Mobile

- NewNet Communication Technologies

- Mahindra Comviva

- Infobip Ltd.

- Twilio Inc.

- Anam Technologies

- Mobileum Inc.

- Mavenir Systems Inc.

- Proofpoint Inc.

- AdaptiveMobile Security (Enea)

- NetNumber Global Data Services

- Openmind Networks

- HORISEN AG

- Sparkle (Telecom Italia)

- Orange Wholesale International

- VOX Solutions

- Global Message Services AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in A2P traffic monetisation

- 4.2.2 Intensifying mobile fraud and grey-route losses

- 4.2.3 SS7 -> Diameter firewall upgrade cycle

- 4.2.4 National data-sovereignty clauses forcing on-shore filtering

- 4.2.5 Operator focus on subscriber QoE and brand trust

- 4.2.6 5G slicing opening new attack surfaces

- 4.3 Market Restraints

- 4.3.1 Low technical awareness among Tier-3/4 MNOs

- 4.3.2 Pricing pressure from CPaaS consolidations

- 4.3.3 Delayed RCS roll-outs blurring capex timing

- 4.3.4 Regulatory ambiguity on cross-border message inspection

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By SMS Type

- 5.1.1 A2P

- 5.1.2 P2A

- 5.1.3 P2P (Enterprise Flash/Alert)

- 5.2 By Deployment Mode

- 5.2.1 On-Premise

- 5.2.2 Cloud

- 5.3 By Service Type

- 5.3.1 Professional Services (Consulting, Integration)

- 5.3.2 Managed Services (24X7 Monitoring, SOC)

- 5.4 By End-user Industry

- 5.4.1 BFSI

- 5.4.2 Government and Public Safety

- 5.4.3 IT and Telecom

- 5.4.4 Healthcare and Life Sciences

- 5.4.5 Retail and E-Commerce

- 5.4.6 Media and Entertainment

- 5.4.7 Education

- 5.4.8 Manufacturing

- 5.4.9 Other End-user Industries

- 5.5 By Network Generation

- 5.5.1 2G / 3G

- 5.5.2 4G / LTE

- 5.5.3 5G

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Chile

- 5.6.2.4 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 Malaysia

- 5.6.4.6 Singapore

- 5.6.4.7 Australia

- 5.6.4.8 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 United Arab Emirates

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Cellusys Telecommunications

- 6.4.2 Tyntec GmbH

- 6.4.3 Tata Communications Ltd.

- 6.4.4 Syniverse Technologies LLC

- 6.4.5 Sinch AB

- 6.4.6 Omobio (Pvt) Ltd.

- 6.4.7 Route Mobile Ltd.

- 6.4.8 AMD Telecom S.A.

- 6.4.9 BICS SA/NV

- 6.4.10 SAP SE

- 6.4.11 Monty Mobile

- 6.4.12 NewNet Communication Technologies

- 6.4.13 Mahindra Comviva

- 6.4.14 Infobip Ltd.

- 6.4.15 Twilio Inc.

- 6.4.16 Anam Technologies

- 6.4.17 Mobileum Inc.

- 6.4.18 Mavenir Systems Inc.

- 6.4.19 Proofpoint Inc.

- 6.4.20 AdaptiveMobile Security (Enea)

- 6.4.21 NetNumber Global Data Services

- 6.4.22 Openmind Networks

- 6.4.23 HORISEN AG

- 6.4.24 Sparkle (Telecom Italia)

- 6.4.25 Orange Wholesale International

- 6.4.26 VOX Solutions

- 6.4.27 Global Message Services AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-Space and Unmet-Need Assessment