PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842590

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842590

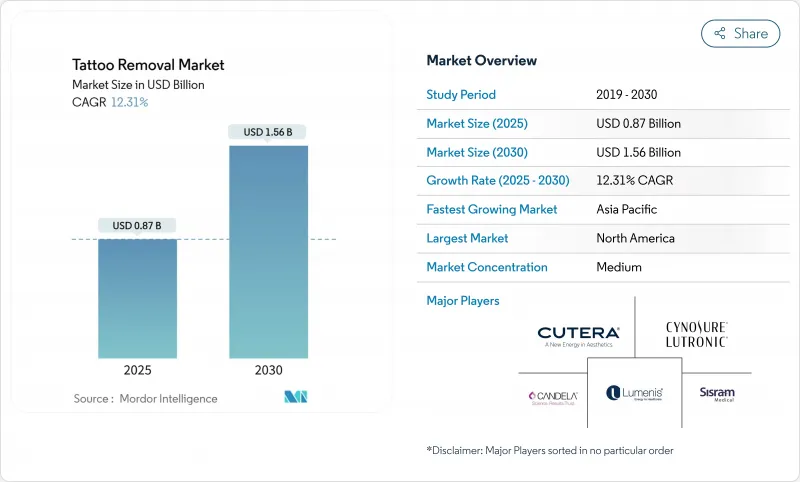

Tattoo Removal - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Tattoo Removal Market size is estimated at USD 0.87 billion in 2025, and is expected to reach USD 1.56 billion by 2030, at a CAGR of 12.31% during the forecast period (2025-2030).

This healthy rise mirrors a shift in consumer attitudes that now favor reversible body art, stricter workplace appearance rules and steady gains in medical-aesthetic spending. Multi-wavelength picosecond lasers are shortening treatment times and improving clearance rates, while government moves to restrict unsafe ink chemicals are nudging many consumers toward professional removal rather than at-home solutions. Clinic networks are multiplying across major cities, capitalizing on greater disposable income among young adults who view skin "reset" procedures as an investment in employability and self-branding. At the same time, private-pay economics remain a barrier for some, keeping premium providers in a strong position.

Global Tattoo Removal Market Trends and Insights

Rising Global Prevalence of Tattoo Regret Among Millennials and Gen Z

One-quarter of tattooed adults report regret, and younger cohorts account for most removal inquiries, reinforcing a steady, demographically driven funnel for the tattoo removal market. Career shifts, identity evolution and greater buying power combine to turn removal into a planned life-cycle event rather than a last-minute remedy. Clinics note that women and recent graduates represent a sizable share of consultations, suggesting sustained demand as this cohort ages. This trend is amplified by social media influence and changing workplace expectations that make tattoo removal a strategic career investment rather than purely aesthetic choice.

Shifting Lifestyle Aesthetics Toward "Clean-Skin" Look

The cultural pendulum is swinging toward minimalist aesthetics, with "clean-skin" becoming a status symbol that signals adaptability and professional versatility. Prominent personalities such as Pete Davidson have publicized multi-session erase campaigns that destigmatize the procedure among fans. Professional networking sites likewise reward a "versatile" appearance, turning removal into both a cosmetic and economic decision. The cultural pendulum is swinging toward minimalist aesthetics, with "clean-skin" becoming a status symbol that signals adaptability and professional versatility.

High Overall Treatment Cost Due to Multi-Session Protocols

Removal remains a premium out-of-pocket service. The American Society of Plastic Surgeons pegs average session fees at USD 697, and most patients need 5-8 visits for satisfactory clearance. Financing plans help, yet the cumulative burden restricts uptake among lower-income groups. Payment plan availability and package discounts are emerging as competitive differentiators, but the fundamental cost barrier limits market expansion to higher-income segments. The cost challenge is particularly acute for large or complex tattoos that may require 10-20 sessions, pushing total costs into luxury purchase territory that excludes broad market participation.

Other drivers and restraints analyzed in the detailed report include:

- Growing Disposable Income in Emerging APAC Economies

- Continuous Technological Advancements in Multi-Wavelength Laser Platforms

- Limited Reimbursement Coverage and Absence of Insurance Support

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Laser systems represented 64.35% of tattoo removal market revenue in 2024, validating decades of clinical use and multiple FDA clearances. The tattoo removal market size for laser platforms is projected to keep expanding, yet ultrasound devices are charting the fastest 13.56% CAGR as practitioners test non-thermal pigment fragmentation. Picosecond technology is resetting performance benchmarks, especially for multicolor artwork, which historically needed double-digit sessions. Manufacturers such as Cutera, Candela and Fotona have added multi-wavelength modes that address diverse ink profiles in fewer passes, enhancing clinic productivity. High-intensity focused ultrasound, though niche, appeals to darker skin phototypes that face higher post-inflammatory hyperpigmentation risk with thermal lasers. Radio-frequency combinations remain minor but attractive for clinics offering concurrent skin tightening.

Competitive dynamics inside the laser segment increasingly revolve around service contracts, software upgrades and consumable sales rather than hardware alone. Vendors provide training bundles and marketing toolkits to clinics, cementing long-term lock-in and differentiating the tattoo removal market offering. Intellectual-property disputes over pulse-duration engineering continue, indicating a technology arms race not yet settled.

The Tattoo Removal Market Report is Segmented by Device (Laser, Radio-Frequency, Ultrasound-Based, and Other Devices), End User (Hospitals and Laser Centers, Dermatology and Aesthetic Clinics, Medical Spas and Other End Users), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa and South America). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

North America held 40.21% of tattoo removal market revenue in 2024, aided by a 32% adult tattoo prevalence in the United States and a well-developed aesthetic-device distribution network. Federal oversight provides predictable clearance pathways, giving consumers confidence in treatment safety. Financing programs that spread multi-session costs over 12-18 months also boost accessibility. Growth now tilts toward secondary cities where clinic density was previously sparse, although saturation in tier-one metros could slow regional CAGR.

Europe's market benefits from robust consumer-safety regulations and high aesthetic spending. The European Directorate for the Quality of Medicines & HealthCare promotes stringent tattoo ink oversight,and a 2024 ban on 4,000 hazardous chemicals, including Blue 15 and Green 7 pigments, spurred many long-term wearers to schedule removals. Germany, France, the United Kingdom and Italy anchor demand, with Southern and Eastern markets showing catch-up potential as clinic infrastructure expands.

Asia Pacific is poised for the quickest 13.95% CAGR through 2030. Rising disposable income among China, India and Southeast Asia's young urbanites fuels both tattoo adoption and subsequent removal. Competitive service pricing-far below North American levels-helps democratize access. Regulatory frameworks vary, but large private hospital groups and franchised med-spa chains are rolling out accredited laser suites, signalling a scale game similar to that seen in facial aesthetics. Australia, Japan and South Korea remain premium sub-markets favoring U.S.-made picosecond devices and shorter protocols.

- Cutera

- Cynosure Lutronic

- Candela Medical

- Lumenis

- Astanza Laser

- Sisram Medical

- Sciton

- Quanta System S.p.A.

- Fotona d.o.o.

- Zimmer MedizinSystems

- Asclepion Laser Tech.

- EL.En. S.p.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising global prevalence of tattoo regret among millennials and Gen Z

- 4.2.2 Shifting lifestyle aesthetics toward "clean-skin" look

- 4.2.3 Growing disposable income in emerging APAC economies

- 4.2.4 Continuous technological advancements in multi-wavelength laser platforms

- 4.2.5 Rapid expansion of dermatology and aesthetic clinic chains in urban centers

- 4.2.6 Employment-screening policies refraining tattoos

- 4.3 Market Restraints

- 4.3.1 High overall treatment cost due to multi-session protocols

- 4.3.2 Post-procedure adverse events and scarring risk

- 4.3.3 Limited reimbursement coverage and absence of insurance support

- 4.3.4 Insufficient skilled laser operators in lower-income and rural regions

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value and Volume)

- 5.1 By Device

- 5.1.1 Laser

- 5.1.2 Radio-frequency

- 5.1.3 Ultrasound-based

- 5.1.4 Other Devices

- 5.2 By End User

- 5.2.1 Hospitals and Laser Centers

- 5.2.2 Dermatology and Aesthetic Clinics

- 5.2.3 Medical Spas

- 5.2.4 Other End Users

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Cutera Inc.

- 6.3.2 Cynosure Lutronic

- 6.3.3 Candela Corporation

- 6.3.4 Lumenis Ltd

- 6.3.5 Astanza Laser

- 6.3.6 Sisram Medical Ltd (Alma Lasers)

- 6.3.7 Sciton Inc.

- 6.3.8 Quanta System S.p.A.

- 6.3.9 Fotona d.o.o.

- 6.3.10 Zimmer MedizinSystems

- 6.3.11 Asclepion Laser Tech.

- 6.3.12 EL.En. S.p.A.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment