PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842594

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842594

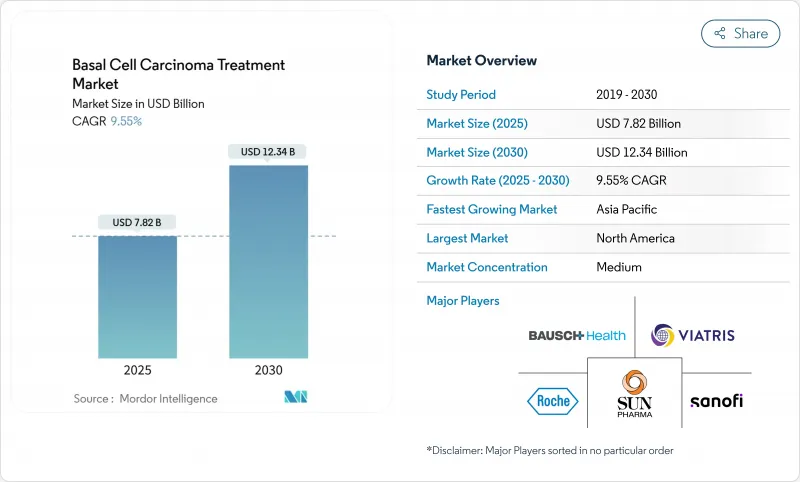

Basal Cell Carcinoma Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The basal cell carcinoma treatment market is valued at USD 7.82 billion in 2025 and is forecast to reach USD 12.34 billion by 2030, advancing at a 9.55% CAGR.

Strong growth reflects the convergence of rising global skin-cancer incidence, the shift toward minimally invasive therapies, and broader access to specialty dermatology services across emerging economies. Momentum is amplified by an aging population that has accumulated decades of ultraviolet exposure and by environmental changes that have intensified average UV radiation. Surgical excision remains the standard of care, yet photodynamic therapy is scaling rapidly as non-invasive devices and topical photosensitizers gain commercial traction. AI-driven dermoscopy and FDA-cleared diagnostic devices are shortening detection-to-treatment intervals, which in turn supports earlier-stage interventions. North America sustains leadership through mature reimbursement systems, while Asia-Pacific posts the fastest growth on the back of surging incidence in Korea and Japan.

Global Basal Cell Carcinoma Treatment Market Trends and Insights

Rising prevalence of skin cancers

Global basal cell carcinoma incidence reached 4.4 million new cases in 2021, equal to an age-standardized rate of 51.71 per 100,000. Enhanced dermatology coverage and image-based triage in primary care expose historically hidden caseloads in underserved regions. Climate-model forecasts show that every 1% depletion of ozone could elevate basal cell carcinoma incidence by 2.7%, while a 2 °C temperature rise could add 11% more cases by 2050. Japan illustrates demographic acceleration, with individuals aged >= 90 now comprising 17% of diagnoses. Occupational exposure remains high among outdoor workers, prompting employers to invest in UV-protective gear and routine screenings.

Aging population with higher cumulative UV exposure

The share of patients older than 70 increased from 44% to 74% in Japanese cancer registries between 1989 and 2021. DNA damage due to thymine-dimer formation accumulates across decades, making geriatric cohorts especially susceptible. Healthcare systems have responded by adding geriatric dermatology divisions and lowering screening thresholds for senior citizens, which fosters earlier-stage identification and improves cost-effectiveness.

High cost of advanced drug therapies & surgeries

Vismodegib and cemiplimab list at USD 13,000 and USD 10,000 per month, respectively, placing them out of reach for many self-pay patients. Mohs micrographic surgery costs 120-370% more than standard excision, even though five-year cure rates exceed 98%. Average per-patient spending rose from USD 1,000 in 2006 to USD 1,600 in 2011 and continues to climb. Market entry lags can span up to seven years in lower-income economies, evidencing affordability and regulatory challenges. Patch-based approaches such as SkinJect target a USD 1,000 price point, aiming to close the affordability gap.

Other drivers and restraints analyzed in the detailed report include:

- AI-driven dermoscopy enabling earlier detection & treatment

- Environmental changes increasing average UV radiation

- Under-diagnosis in primary-care settings

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Surgical techniques accounted for 36.14% of the basal cell carcinoma treatment market size in 2024, underscoring clinician confidence in wide excision and Mohs micrographic protocols. Mohs utilization expanded 700% from 1992 to 2009, yet premium costs have triggered payer scrutiny. Radiation therapy records 80-92% local-control rates for patients unsuitable for surgery. Photodynamic therapy is the fastest-growing modality at an 11.13% CAGR, buoyed by short healing times and cosmetic advantages. Combination topical regimens-5-fluorouracil plus calcipotriene-now achieve clearance within seven-to-14 days compared with four-week monotherapy. Hedgehog-pathway inhibitors and checkpoint antibodies extend life in advanced cases: cemiplimab delivers 29% objective responses in locally advanced and 21% in metastatic cohorts. Novel oncolytic peptides such as VP-315 yielded 97% overall response and 51% complete histologic clearance in Phase 2, indicating a disruptive non-surgical future.

Second-generation delivery platforms and AI-guided lesion mapping complement these therapeutic shifts. Optical coherence tomography reaches 95.5% accuracy at lesion centers, allowing surgeons to limit excision margins and preserve healthy tissue. Such precision reduces operative stages, accelerating patient throughput and lessening facility costs. As technology penetrates outpatient centers, the basal cell carcinoma treatment market size for photodynamic and topical agents is projected to expand proportionally.

The Basal Cell Carcinoma Treatment Market Report is Segmented by Treatment Type (Surgery [Surgical Excision and More], Radiation Therapy, and More), Disease Stage (Superficial, Nosular, and More), End-User (Hospitals, Specialty Clinics, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America controls 43.58% of the basal cell carcinoma treatment market revenue in 2024 and is positioned for an 8.89% CAGR to 2030. Cutting-edge diagnostics such as FDA-approved DermaSensor widen primary-care capabilities, but high-deductible health plans temper therapy uptake as Mohs costs remain 120-370% above standard excision. Regulatory agility benefits innovators, evidenced by breakthrough designations for cemiplimab and cosibelimab, yet supply-chain fragilities surfaced via EFUDEX shortages from December 2024 to July 2025.

Asia-Pacific is the basal cell carcinoma treatment market's fastest-growing region at 10.36% CAGR. Korea saw cases climb seven-fold from 1999 to 2019, with basal cell carcinoma soaring from 488 to 3,908 diagnoses. Regulatory bodies green-lit canofyMD SCAI AI software at 80.9% accuracy, underscoring tech-forward adoption. Japan's registries show patients aged >= 90 now represent 17% of cases, spotlighting demographic pressure. Differences in histological subtypes mandate region-specific guidelines, as superficial lesions are less frequent than in Western cohorts.

Europe advances at 9.12% CAGR fueled by universal coverage and strict UV-exposure policies. The European Commission approved cemiplimab as the first immunotherapy for advanced basal cell carcinoma, showcasing a receptive regulatory landscape. Photodynamic therapy trials with BF-200 ALA register 90.9% clearance, reinforcing Europe's lead in cosmetically sensitive treatments. Middle East and Africa progress at 9.94% CAGR, catalyzed by expanding private healthcare and governmental trial approvals. The UAE authorized Medicus Pharma's SkinJect microneedle patch trials in May 2025, marking a shift toward local clinical research capacity. Yet rural dermatology access remains sparse, pressing teledermatology platforms into service. South America grows at 9.67% but faces reimbursement hurdles for newer biologics, paving the way for cost-effective generics and remote screening pilots.

- Abbvie

- Bausch Health

- BridgeBio Pharma Inc

- Bristol-Myers Squibb

- Castle Biosciences Inc.

- Eisai

- Roche

- Galderma

- Leo Pharma

- Medicus Pharma Ltd

- Medivir

- Merck

- Novartis

- Perrigo Company

- Pfizer

- Regeneron Pharmaceuticals

- Regeneron Pharmaceuticals

- Sanofi

- Sun Pharmaceuticals Industries

- Taro Pharmaceutical Industries

- Verrica Pharmaceuticals Inc.

- Viatris

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising prevalence of skin cancers

- 4.2.2 Aging population with higher cumulative UV exposure

- 4.2.3 AI-driven dermoscopy enabling earlier detection & treatment

- 4.2.4 Environmental changes increasing average UV radiation

- 4.2.5 Label expansions of Hedgehog-pathway inhibitors

- 4.2.6 Workplace sun-safety legislation boosting screening demand

- 4.3 Market Restraints

- 4.3.1 High cost of advanced drug therapies & surgeries

- 4.3.2 Under-diagnosis in primary-care settings

- 4.3.3 Reimbursement hurdles for checkpoint-inhibitor combinations

- 4.3.4 Safety concerns over long-term Hedgehog-inhibitor toxicity

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Epidemiology Trends

5 Market Size & Growth Forecasts (Value)

- 5.1 By Treatment Type

- 5.1.1 Surgery

- 5.1.1.1 Surgical Excision

- 5.1.1.2 Mohs Micrographic Surgery

- 5.1.1.3 Electrodesiccation and Curettage (ED&C)

- 5.1.2 Radiation Therapy

- 5.1.3 Photodynamic Therapy

- 5.1.4 Cryotherapy

- 5.1.5 Topical Chemotherapy

- 5.1.5.1 5-fluorouracil (5-FU)

- 5.1.5.2 Tirbanibulin

- 5.1.5.3 Imiquimod

- 5.1.6 Oral Medications

- 5.1.7 Intravenous Medications

- 5.1.1 Surgery

- 5.2 By Disease Stage

- 5.2.1 Superficial

- 5.2.2 Nodular

- 5.2.3 Infiltrative

- 5.2.4 Metastatic

- 5.3 By End-User

- 5.3.1 Hospitals

- 5.3.2 Specialty Clinics

- 5.3.3 Ambulatory Surgical Centers

- 5.3.4 Others

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Competitive Benchmarking

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 AbbVie (Allergan)

- 6.4.2 Bausch Health Companies Inc.

- 6.4.3 BridgeBio Pharma Inc

- 6.4.4 Bristol Myers Squibb Co.

- 6.4.5 Castle Biosciences Inc.

- 6.4.6 Eisai Co., Ltd.

- 6.4.7 F. Hoffmann-La Roche AG

- 6.4.8 Galderma S.A.

- 6.4.9 LEO Pharma A/S

- 6.4.10 Medicus Pharma Ltd

- 6.4.11 Medivir AB

- 6.4.12 Merck & Co., Inc.

- 6.4.13 Novartis AG

- 6.4.14 Perrigo Company plc

- 6.4.15 Pfizer Inc.

- 6.4.16 Regeneron Pharmaceuticals Inc.

- 6.4.17 Regeneron Pharmaceuticals Inc.

- 6.4.18 Sanofi S.A.

- 6.4.19 Sun Pharmaceutical Industries Ltd

- 6.4.20 Taro Pharmaceutical Industries Ltd

- 6.4.21 Verrica Pharmaceuticals Inc.

- 6.4.22 Viatris Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment