PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842595

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842595

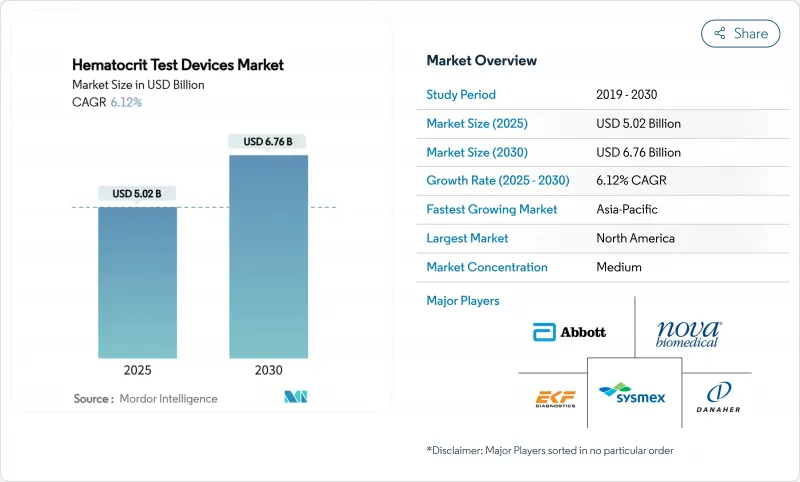

Hematocrit Test Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The hematocrit test devices market reached USD 5.02 billion in 2025 and is projected to climb to USD 6.76 billion by 2030, advancing at a 6.12% CAGR over the forecast period.

Expanding diagnostic demand created by the global anemia burden, rapid migration toward automated 5-part differential analyzers, and integration of artificial intelligence into point-of-care (POC) platforms are the primary growth catalysts. Hospitals continue to upgrade to high-throughput systems that cut manual workload, while militaries and emergency services drive adoption of ultra-portable microfluidic meters that deliver hematocrit (Hct) results within seconds. Regulatory tightening, such as the 2024 CLIA rule that cut allowable Hct error margins by one-third, is simultaneously raising performance expectations and spurring innovation. Competitive intensity is moderate; incumbents leverage global installed bases and reagent lock-in models, yet handheld and smartphone-based entrants are reshaping customer expectations around convenience and cost.

Global Hematocrit Test Devices Market Trends and Insights

Rising Prevalence of Anemia Worldwide

Anemia affects nearly 2 billion people and 39.8% of children under five, driving continuous demand for reliable hematocrit testing devices. Updated 2024 WHO hemoglobin cutoffs tightened diagnostic thresholds, compelling providers to deploy more precise instruments in both clinics and resource-limited outreach settings. Regions with high iron-deficiency rates, notably South Asia, are funding mobile screening programs that rely on battery-operated Hct meters. These initiatives reinforce long-term uptake of the hematocrit test devices market, particularly for consumables that accompany each field test. Preventing disease progression through early Hct screening also lowers treatment costs and improves maternal and child health outcomes.

Rapid Adoption of Fully Automated 5-Part Analyzers

Clinical laboratories confront staff shortages and mounting sample volumes, prompting a shift toward automated 5-part differential systems capable of handling thousands of complete blood counts per hour. Sysmex recorded 2,977 million CBCs in fiscal 2023, reflecting its 54.6% share of the automated hematology field. New platforms embed digital cell morphology and AI algorithms that now identify arterial oxygen saturation patterns with 96% accuracy during hemodialysis. Partnerships such as Siemens Healthineers-Scopio Labs shorten turnaround times by 60%, raising clinical throughput.

Stringent FDA & CE Approval Timelines

The FDA now requires manufacturers to flag supply-chain disruptions and submit broader clinical datasets, stretching approval cycles for innovative Hct platforms. Class II designation for coagulation devices illustrates the agency's tighter stance, which raises entry barriers for start-ups. In Europe, MDR compliance adds cost and paperwork, delaying commercialization of novel microfluidic cartridges and AI software.

Other drivers and restraints analyzed in the detailed report include:

- Growing Geriatric Population With Blood Disorders

- Shift to Intra-Operative Hct Monitoring

- Accuracy Concerns in Non-Invasive Optical Wearables

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Reagents and consumables held 39.35% of 2024 revenue, a testament to the installed-base model that locks in repeat purchases of cuvettes, cartridges, and quality-control reagents for every test run. Each new analyzer installation amplifies this annuity stream across hospitals, diagnostics labs, and field units, making the category a profit anchor for suppliers. Hematocrit test analyzers, the fastest-growing product group at 12.25% CAGR, reflect laboratories' migration to fully automated 5- or 6-part systems that integrate CBC, ESR, and blood-gas functions in one console.

Handheld meters are carving out niches in emergency medical services and rural clinics by offering six-second turnaround using capillary blood, while veterinary practices adopt mobile analyzers validated for canine hematology applications. This broadening user mix keeps the hematocrit test devices market expanding on both capital equipment and disposable fronts. In dollar terms, the hematocrit test devices market size for reagents is projected to widen in tandem with global analyzer placements, reinforcing suppliers' focus on supply-chain resilience and predictable pricing contracts.

Electrical impedance retained 38.53% hematocrit test devices market share in 2024 due to decades of trust among lab directors. Yet microfluidic and lab-on-chip platforms are outpacing legacy methods at 13.85% CAGR because they require only microliters of blood and function with gravity-driven flow, slashing pump costs. Researchers now fabricate polymer channels with femtosecond lasers at one-eighth of traditional cost, accelerating commercialization.

Optical spectrometry remains valuable for non-invasive monitoring, though precision still lags invasive assays. Conductivity and acoustofluidic techniques add options for niche applications such as platelet-free plasma preparation and red-cell deformability studies. As microfluidic production scales, vendors bundle cloud analytics and AI algorithms, redefining value beyond simple cell counting. The hematocrit test devices market size for microfluidic systems is on track to command a growing revenue slice as buyers prioritize portability without sacrificing laboratory-grade accuracy.

The Hematocrit Test Devices Market Report is Segmented by Product (Hematocrit Test Meters, Hematocrit Test Analyzers, and More), Technology (Electrical Impedance, and More), Application (Anemia Diagnosis & Monitoring, Polycythemia Vera Management, and More), End User (Hospitals, Diagnostic Laboratories, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 39.82% of global revenue in 2024, underpinned by sophisticated hospital networks, favorable reimbursement, and rapid uptake of integrated hematology workstations. Defense funding for blood substitutes and the FDA's active supply-chain surveillance further shape demand by ensuring product continuity and elevating quality benchmarks. Canada and Mexico contribute through public-sector modernization programs that broaden access to automated CBC testing.

Asia-Pacific is the fastest-growing region at a 13.61% CAGR as China, India, Japan, South Korea, and Southeast Asian nations overhaul infrastructure and address aging demographics. Government tenders in China now favor mid- and low-end analyzers, pressuring pricing yet lifting unit volumes. India's smartphone-based anemia screening exemplifies leapfrog adoption in areas with limited laboratory capacity. Japan's elderly population, where up to 50% of males exceed normal hemoglobin thresholds, fuels sustained analyzer demand tailored to geriatric reference ranges.

Europe remains a key revenue pillar thanks to strict quality protocols and broad insurance coverage. Germany, the United Kingdom, and France lead high-end analyzer deployments, while Southern European markets scale POC meters to manage chronic-disease clinics. Middle East and Africa witness rising procurement backed by anemia prevalence that tops 60% among children in parts of the continent. South America follows, with Brazil and Argentina investing in public lab upgrades to combat nutritional anemia and renal disease. Collectively, these regional dynamics ensure the hematocrit test devices market continues its steady global expansion.

- Abbott Laboratories

- Boule Diagnostics

- Danaher

- EKF Diagnostics Holdings plc

- Roche

- HORIBA

- Nova Biomedical

- Siemens Healthineers

- Sysmex

- Nihon Kohden

- Sensa Core

- HemoCue AB

- Radiometer Medical

- Mindray Bio-Medical Electronics

- Seamaty

- Diamond Diagnostics

- Hilab (Phelcom Technologies)

- Scopio Labs

- Agappe Diagnostics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence Of Anemia Worldwide

- 4.2.2 Rapid Adoption Of Fully-Automated 5-Part Analyzers

- 4.2.3 Growing Geriatric Population With Blood Disorders

- 4.2.4 Shift To Intra-Operative Hct Monitoring To Cut Transfusion Costs

- 4.2.5 Military Demand For Ultra-Portable Microfluidic Meters

- 4.2.6 Integration Of AI-Enabled Self-Testing Apps For Chronic Care

- 4.3 Market Restraints

- 4.3.1 Stringent FDA & CE Approval Timelines

- 4.3.2 Limited Awareness & Training In Low-Income Regions

- 4.3.3 Microfluidic Cartridge Supply-Chain Fragility

- 4.3.4 Accuracy Concerns In Non-Invasive Optical Hct Wearables

- 4.4 Porter's Five Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Hematocrit Test Meters

- 5.1.1.1 Hand-held POC Meters

- 5.1.1.2 Benchtop Meters

- 5.1.2 Hematocrit Test Analyzers

- 5.1.2.1 Automated 3-part Differential

- 5.1.2.2 Automated 5/6-part Differential

- 5.1.2.3 Integrated Blood-gas & Hct Platforms

- 5.1.2.4 Veterinary-specific Analyzers

- 5.1.3 Reagents & Consumables

- 5.1.3.1 Hct Cuvettes & Micro-tubes

- 5.1.3.2 Calibration & QC Reagents

- 5.1.3.3 Test Cartridges/Strips

- 5.1.1 Hematocrit Test Meters

- 5.2 By Technology

- 5.2.1 Electrical Impedance

- 5.2.2 Optical / Photometric

- 5.2.3 Conductivity-based

- 5.2.4 Microfluidic & Lab-on-Chip

- 5.2.5 Non-invasive Spectroscopy

- 5.3 By Application

- 5.3.1 Anemia Diagnosis & Monitoring

- 5.3.2 Polycythemia Vera Management

- 5.3.3 Congenital Heart Disease

- 5.3.4 Surgery & Critical-Care Blood Management

- 5.3.5 Dialysis & Renal Care

- 5.3.6 Oncology Supportive Care

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Diagnostic Laboratories

- 5.4.3 Blood Banks & Transfusion Centers

- 5.4.4 Point-of-Care Settings

- 5.4.5 Others

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 Boule Diagnostics AB

- 6.3.3 Danaher Corporation (Beckman Coulter)

- 6.3.4 EKF Diagnostics Holdings plc

- 6.3.5 F. Hoffmann-La Roche Ltd

- 6.3.6 HORIBA Ltd

- 6.3.7 Nova Biomedical

- 6.3.8 Siemens Healthineers AG

- 6.3.9 Sysmex Corporation

- 6.3.10 Nihon Kohden Corporation

- 6.3.11 Sensa Core

- 6.3.12 HemoCue AB

- 6.3.13 Radiometer Medical

- 6.3.14 Mindray Bio-Medical Electronics

- 6.3.15 Seamaty

- 6.3.16 Diamond Diagnostics

- 6.3.17 Hilab (Phelcom Technologies)

- 6.3.18 Scopio Labs

- 6.3.19 Agappe Diagnostics

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment