PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842601

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842601

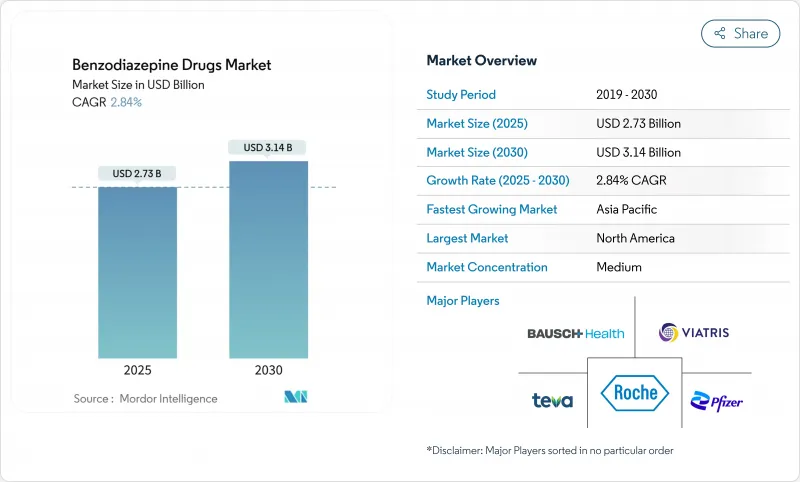

Benzodiazepine Drugs - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The benzodiazepine drugs market size reached USD 2.73 billion in 2025 and is forecast to attain USD 3.14 billion by 2030, advancing at a 2.84% CAGR.

Demand stays resilient because anxiety prevalence remains high, hospital protocols still favor rapid-acting sedatives, and regulators now allow controlled telemedicine prescribing. Growth also stems from expanding intranasal and pediatric indications, wider generic uptake in emerging economies, and steady uptake in alcohol-withdrawal protocols. Counterbalancing forces include stringent monitoring rules, recurring API shortages, and substitution by non-benzodiazepine anxiolytics, yet the net effect keeps the benzodiazepine drugs market on a measured upward path.

Global Benzodiazepine Drugs Market Trends and Insights

Rising Prevalence of Anxiety & Panic Disorders

Global anxiety incidence keeps climbing, especially in BRICS economies. U.S. data showed 18.2% of adults screened positive for anxiety symptoms in 2025, up from pre-pandemic baselines. This epidemiological pressure sustains prescriptions even as guidelines tighten. Reproductive-age women report higher medication adherence, amplifying script volumes. Telehealth now broadens reach, notably after the DEA allowed Schedule III-V benzodiazepine e-prescribing under special registration rules. Professional bodies nevertheless push gradual tapering for long-term users, underscoring the balancing act between need and safety.

Ageing Population with Multiple Comorbidities

Aging societies contribute a steady patient pool with anxiety, insomnia and seizure comorbidity. A 2024 seven-nation survey found 14.9% benzodiazepine use among Europeans aged 65+, peaking at 35.5% in Croatia. Prescribers prefer longer-acting diazepam for simplified dosing yet must monitor fall and cognition risks. Health agencies promote deprescribing campaigns, but the clinical reality of complex multimorbidity keeps benzodiazepines in geriatric toolkits.

High Risk of Dependence, Abuse & Diversion

Designer analogues fuel overdose deaths, with 141 fatalities linked in the last one and a half decades. Scottish prison screens frequently detect etizolam, illustrating illicit penetration. Young adult prescribing has crept upward since 2008, diverging from the overall decline, driving regulators to intensify monitoring. The UK has already proposed Class C controls on fifteen novel agents.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Insomnia Linked to Digital-Lifestyle Fatigue

- Growing Adoption of Low-Cost Generics

- Intensifying Regulatory Scrutiny & Up-Scheduling Initiatives

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, alprazolam generated 33.43% of revenue, anchoring the benzodiazepine drugs market size. Demand stems from frontline anxiety protocols and prescriber familiarity. The benzodiazepine drugs market size for diazepam is projected to rise at a 4.28% CAGR, fueled by seizure, alcohol-withdrawal, and pediatric nasal-spray extensions. Diazepam was again the most widely traded psychotropic agent, reported by 158 nations. Supply interruptions hit clonazepam and lorazepam during 2024, exposing how concentrated manufacturing magnifies the risk of shortage.

Innovators now pursue delivery upgrades. In April 2025, the FDA cleared diazepam nasal spray for children down to age 2, stretching exclusivity for Neurelis. Such milestones signal an era where differentiated formats rather than new molecules sustain margins within the benzodiazepine drugs market.

Anxiety disorders accounted for 54.48% of the benzodiazepine drugs market share in 2024, a position underpinned by persistently high symptom prevalence. Alcohol-withdrawal management, though smaller, will exhibit a 3.69% CAGR through 2030, aided by detox program growth and evidence favoring benzodiazepines for seizure prophylaxis.

Intranasal diazepam and midazolam have improved emergency seizure care response times. Insomnia scripts remain controlled as payers push non-drug therapies, yet technology-induced sleep disruption keeps a niche need alive. Muscle spasm relief and pre-operative sedation add incremental volumes.

The Benzodiazepine Drugs Market Report is Segmented by Product (Alprazolam, Diazepam, and More), Application (Anxiety Disorders, Seizures, and More), Time of Action (Ultra-Short Acting, Short Acting, and More), Route of Administration (Oral, Parenteral, and More), Distribution Channel (Hospital Pharmacies and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 40.32% of 2024 revenue and will grow at 2.41% CAGR. Anxiety prevalence of 18.2% in U.S. adults underscores continuing demand. Supply disruptions in clonazepam and lorazepam during 2024 revealed manufacturing concentration risks, while three-tier DEA rules now govern tele-prescribing.

Europe advances at 2.78% CAGR to 2030. Elderly prescription prevalence reaches 35.5% in Croatia, 33.5% in Spain, highlighting intra-region variance. EMA's centralised referrals, such as for lorazepam Macure, harmonise safety messaging and ensure cross-border consistency. Surveillance of 36 new designer analogues keeps regulatory vigilance high.

Asia-Pacific records the fastest 3.37% CAGR. India saw a 113.30% surge in anxiety cases over three decades. China's Category I reclassification of midazolam raises compliance stakes. Japan could soon launch the first locally approved diazepam nasal spray following Aculys Pharma's orphan-drug submission. Markets in the Middle East & Africa and South America grow at roughly 3% under improved mental-health recognition and broader health-system funding.

- Accord Healthcare

- Amneal Pharmaceuticals

- Apotex

- Aurobindo Pharma Ltd.

- Bausch Health

- Cipla

- Dr. Reddy's Laboratories

- Endo International

- Roche

- Fresenius

- Glenmark Pharmaceuticals

- Hikma Pharmaceuticals

- Lupin

- Neurelis Inc.

- Nichi-Iko Pharmaceutical Co. Ltd.

- Orion

- Pfizer

- Sandoz Group AG

- Sun Pharmaceuticals Industries

- Teva Pharmaceutical Industries

- Torrent Pharmaceuticals

- Viatris

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising prevalence of anxiety & panic disorders

- 4.2.2 Ageing population with multiple comorbidities

- 4.2.3 Growing adoption of low-cost generics

- 4.2.4 Increasing insomnia linked to digital-lifestyle fatigue

- 4.2.5 Expansion of palliative-care protocols using benzodiazepines

- 4.2.6 Shortages of alternative anti-anxiety APIs driving formulary substitution

- 4.3 Market Restraints

- 4.3.1 High risk of dependence, abuse & diversion

- 4.3.2 Intensifying regulatory scrutiny & up-scheduling initiatives

- 4.3.3 Emergence of non-benzo anxiolytics (e.g., Z-drugs, CBD-based)

- 4.3.4 API supply-chain vulnerabilities (China-India chokepoints)

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Alprazolam

- 5.1.2 Diazepam

- 5.1.3 Lorazepam

- 5.1.4 Clonazepam

- 5.1.5 Temazepam

- 5.1.6 Others

- 5.2 By Application

- 5.2.1 Anxiety Disorders

- 5.2.2 Seizures

- 5.2.3 Insomnia

- 5.2.4 Alcohol Withdrawal

- 5.2.5 Other Applications

- 5.3 By Time of Action

- 5.3.1 Ultra-short Acting

- 5.3.2 Short Acting

- 5.3.3 Intermediate Acting

- 5.3.4 Long Acting

- 5.4 By Route of Administration

- 5.4.1 Oral

- 5.4.2 Parenteral

- 5.4.3 Intranasal

- 5.4.4 Others

- 5.5 By Distribution Channel

- 5.5.1 Hospital Pharmacies

- 5.5.2 Retail Pharmacies

- 5.5.3 Online Pharmacies

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Competitive Benchmarking

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Accord Healthcare

- 6.4.2 Amneal Pharmaceuticals LLC

- 6.4.3 Apotex Inc.

- 6.4.4 Aurobindo Pharma Ltd.

- 6.4.5 Bausch Health Companies Inc.

- 6.4.6 Cipla Ltd.

- 6.4.7 Dr. Reddy's Laboratories Ltd.

- 6.4.8 Endo International plc

- 6.4.9 F. Hoffmann-La Roche AG

- 6.4.10 Fresenius Kabi

- 6.4.11 Glenmark Pharmaceuticals Ltd

- 6.4.12 Hikma Pharmaceuticals plc

- 6.4.13 Lupin Ltd.

- 6.4.14 Neurelis Inc.

- 6.4.15 Nichi-Iko Pharmaceutical Co. Ltd.

- 6.4.16 Orion Corporation

- 6.4.17 Pfizer Inc.

- 6.4.18 Sandoz Group AG

- 6.4.19 Sun Pharmaceutical Industries Ltd.

- 6.4.20 Teva Pharmaceutical Industries Ltd.

- 6.4.21 Torrent Pharmaceuticals Ltd.

- 6.4.22 Viatris Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment