PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842602

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842602

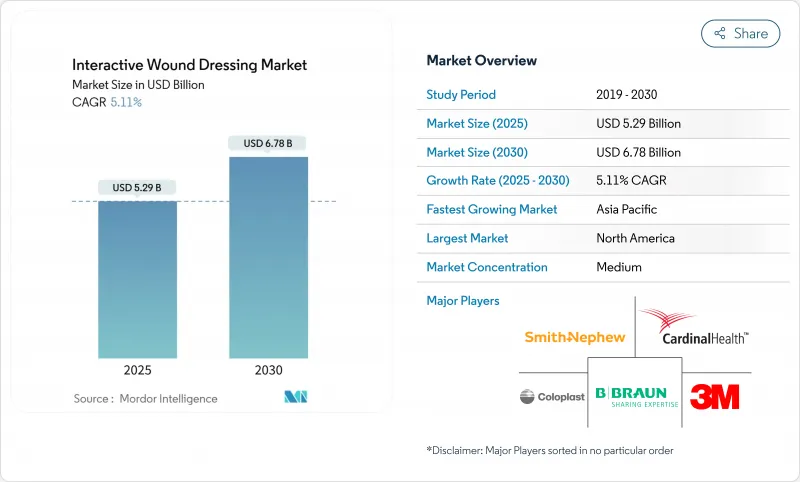

Interactive Wound Dressing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The interactive wound dressing market reached USD 5.29 billion in 2025 and is on course to expand to USD 6.78 billion by 2030, recording a 5.11% CAGR.

Technical advances that merge biosensors with conventional dressings now enable wireless monitoring and active therapeutic delivery, shortening average healing forecasts by up to 14 days compared with visual assessment alone. Hospitals continue to adopt these devices for hard-to-heal ulcers, while new telehealth reimbursement policies drive uptake in home care settings. Supply-chain pressures on polyurethane and silicone foam have raised production costs, yet manufacturers offset this with premium pricing for sensor-enabled dressings that demonstrate superior outcomes. Consolidation among leading brands, highlighted by Coloplast's purchase of Kerecis and 3M's recent wound-care spin-off, positions diversified platforms to capture the next wave of growth.

Global Interactive Wound Dressing Market Trends and Insights

Growing Incidence of Pressure Ulcers & Diabetic Foot

Diabetic foot ulcers affect more than 40 million people worldwide and cost the United States healthcare system USD 28 billion each year. Interactive dressings that read pH and temperature detect infection up to 72 hours earlier than visual checks, enabling 95% wound-area reduction in 14 days versus 89.7% with standard care . Machine-learning models built into these devices now predict closure outcomes with 98% accuracy, framing a shift toward predictive medicine that lowers readmissions and amputations. The positive clinical-economic profile reinforces premium reimbursement, boosting adoption across the interactive wound dressing market.

Rapid Technology Upgrades in Interactive Dressings

Water-powered electronics-free dressings generate therapeutic electric fields that accelerate closure by 30% at a cost of USD 2 per unit. Flexible laser-induced graphene sensors measure both strain and temperature with 0.5 °C sensitivity, giving clinicians granular insight without disturbing the wound. Microneedle-iontophoresis patches enhance drug penetration and dampen inflammation, reducing nitric-oxide buildup and cytokine expression in vivo. Such breakthroughs recast dressings from commodity disposables into therapeutic devices, reinforcing value capture in the interactive wound dressing market.

High Cost of Advanced Dressings

Bioengineered skin substitutes can push single-patient claims beyond USD 1 million, limiting access in lower-income regions. Geopolitical shocks raised specialty material costs, pushing device manufacturing overheads to 20% of revenue by late-2024. In Australia, fewer than 200 patients benefit from subsidy schemes despite 400,000 chronic wound sufferers each year, forcing households into out-of-pocket purchases. Still, model studies predict system savings of 15% when sensor dressings prevent complications, a message that may unlock broader coverage and sustain growth across the interactive wound dressing market.

Other drivers and restraints analyzed in the detailed report include:

- Smart Bio-Electronic Dressings Securing New CPT Codes

- Boom in APAC Ambulatory Wound-Care Clinics

- Stringent Multi-Region Regulatory Pathways

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Semi-permeable films retained 42.14% of the interactive wound dressing market in 2024, prized for transparency and minimal trauma during changes. Hydrogel formats hold the highest growth forecast at a 5.98% CAGR as stimuli-responsive polymers dose drugs when pH or glucose shifts. The interactive wound dressing market size for hydrogels is projected to reach USD 1.24 billion by 2030, confirming investor interest in adaptive biomaterials.

Hydrogels increasingly embed AI algorithms that trigger silver-ion release or hydration pulses when infection risk peaks, blending passive moisture control with active therapy. Films evolve too, integrating micro-perforations to balance vapor loss and exudate control in orthopedic surgery. Regulatory scrutiny of silver antimicrobials could redirect R&D budgets toward peptide coatings, but does not dampen demand for visual inspection benefits that keep film products central to the interactive wound dressing market.

Chronic wounds generated 59.87% of 2024 revenue as diabetic foot and pressure ulcers require months-long regimens. Acute wounds, however, are climbing at a 6.12% CAGR thanks to prophylactic adoption in cardiac, orthopedic, and obstetric theaters. The interactive wound dressing market size for acute wounds is expected to surpass USD 2.3 billion by 2030, mirroring hospitals' focus on surgical site infection penalties.

Advanced hydrogel patches such as AMNIODERM+(R) trimmed wound areas by 95.5% over 12 weeks, with 65% of diabetics reaching full closure. For burns, sensor meshes capture moisture gradients, reducing painful re-dressing, while live feedback adjusts cooling. Pressure-redistributing foams transmit alerts when shear load rises, averting tissue necrosis. Together, these use cases extend market relevance beyond chronic care and cement long-run expansion for the interactive wound dressing market.

The Interactive Wound Dressing Market is Segmented by Type (Semi-Permeable Films Dressing, Semi-Permeable Foams Dressing, and More), Application (Acute Wounds and Chronic Wounds), End-User (Hospitals and Clinics, and Ambulatory Surgical Centers), Technology (Passive Interactive Dressings, Smart Connected Dressings, and Bioactive Dressings), and Geography. The Report Offers the Value (in USD Million) for the Above Segments.

Geography Analysis

North America kept 43.17% of 2024 sales, supported by Medicare coverage for lymphedema compression and new telehealth codes for caregiver training. FDA reclassification proposals raise compliance costs yet validate the clinical significance of antimicrobial and sensor-based products within the interactive wound dressing market. Smith+Nephew reported significant increase in Q1 2025 revenue growth in Advanced Wound Management following ALLEVYN Ag+ SURGICAL rollout, underscoring continued innovation .

Asia-Pacific, led by China, will record the fastest CAGR of 6.31% through 2030. National guidelines promote community-based chronic-wound programs that pair compression with smart bandages, while domestic manufacturing lowers acquisition prices. Exports of basic bandages finance R&D in bioactive foams, enabling regional suppliers to enter premium segments of the interactive wound dressing market. Telehealth apps bridge specialist gaps, cutting outpatient visits by 50%, which further entrenches sensor dressings in rural care protocols.

Europe shows steady momentum as aging demographics swell the chronic-wound pool. CE-mark rigor ensures quality and encourages multinational trials that quantify cost avoidance from early infection detection. Germany and the United Kingdom pilot reimbursement schemes for dressings with embedded analytics, rewarding total-cost savings over device price tags. Emerging economies in the Middle East, Africa, and Latin America adopt interactive dressings selectively, focusing on trauma centers and military medicine. However, inconsistent reimbursement and high import duties temper near-term scale, creating white-space for public-private partnerships to unlock latent demand across the interactive wound dressing market.

- 3M

- Smiths Group

- Molnlycke Health Care

- Johnson & Johnson

- Convatec

- B. Braun

- Coloplast

- Cardinal Health

- Integra LifeSciences Holdings Corp.

- Hartmann Group

- Medline Industries

- Mativ Holdings Inc. (Scapa)

- Acelity (KCI, 3M)

- Urgo Medical

- MediWound Ltd.

- Avery Dennison Medical

- Freudenberg

- Lohmann & Rauscher

- Aroa Biosurgery Ltd.

- Derma Sciences (Integra)

- Cutimed (Essity)

- Advanced Medical Solutions Group

- Hollister

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing incidence of pressure ulcers & diabetic foot

- 4.2.2 Rising volume of surgical procedures

- 4.2.3 Rapid technology upgrades in interactive dressings

- 4.2.4 Smart bio-electronic dressings securing new CPT codes

- 4.2.5 Home-based chronic-wound reimbursement incentives

- 4.2.6 Boom in APAC ambulatory wound-care clinics

- 4.3 Market Restraints

- 4.3.1 High cost of advanced dressings

- 4.3.2 Stringent multi-region regulatory pathways

- 4.3.3 Polyurethane & silicone foam supply shortages

- 4.3.4 Data-security liability for sensor-enabled dressings

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment & Patent Analysis

5 Market Size & Growth Forecasts (Value - USD Million)

- 5.1 By Type

- 5.1.1 Semi-permeable Film Dressings

- 5.1.2 Semi-permeable Foam Dressings

- 5.1.3 Hydrogel Dressings

- 5.1.4 Hydrocolloid Dressings

- 5.1.5 Alginate Dressings

- 5.1.6 Collagen-Matrix Dressings

- 5.1.7 Antimicrobial Silver Dressings

- 5.1.8 Smart Sensor-enabled Dressings

- 5.1.9 Bioactive/Nanofiber Dressings

- 5.2 By Application

- 5.2.1 Acute Wounds

- 5.2.1.1 Surgical & Traumatic Wounds

- 5.2.1.2 Burns

- 5.2.2 Chronic Wounds

- 5.2.2.1 Diabetic Foot Ulcers

- 5.2.2.2 Pressure Ulcers

- 5.2.2.3 Venous Leg Ulcers

- 5.2.2.4 Other Chronic Wounds

- 5.2.1 Acute Wounds

- 5.3 By End-User

- 5.3.1 Hospitals & Clinics

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Home Healthcare

- 5.3.4 Others

- 5.4 By Technology

- 5.4.1 Passive Interactive Dressings

- 5.4.2 Smart Connected Dressings

- 5.4.3 Bioactive Dressings

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 3M

- 6.3.2 Smith & Nephew plc

- 6.3.3 Molnlycke Health Care AB

- 6.3.4 Johnson & Johnson (Ethicon)

- 6.3.5 ConvaTec Group PLC

- 6.3.6 B. Braun Melsungen AG

- 6.3.7 Coloplast A/S

- 6.3.8 Cardinal Health Inc.

- 6.3.9 Integra LifeSciences Holdings Corp.

- 6.3.10 PAUL HARTMANN AG

- 6.3.11 Medline Industries LP

- 6.3.12 Mativ Holdings Inc. (Scapa)

- 6.3.13 Acelity (KCI, 3M)

- 6.3.14 Urgo Medical

- 6.3.15 MediWound Ltd.

- 6.3.16 Avery Dennison Medical

- 6.3.17 Freudenberg Performance Materials

- 6.3.18 Lohmann & Rauscher GmbH & Co. KG

- 6.3.19 Aroa Biosurgery Ltd.

- 6.3.20 Derma Sciences (Integra)

- 6.3.21 Cutimed (Essity)

- 6.3.22 Advanced Medical Solutions Group plc

- 6.3.23 Hollister Incorporated

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment