PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842604

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842604

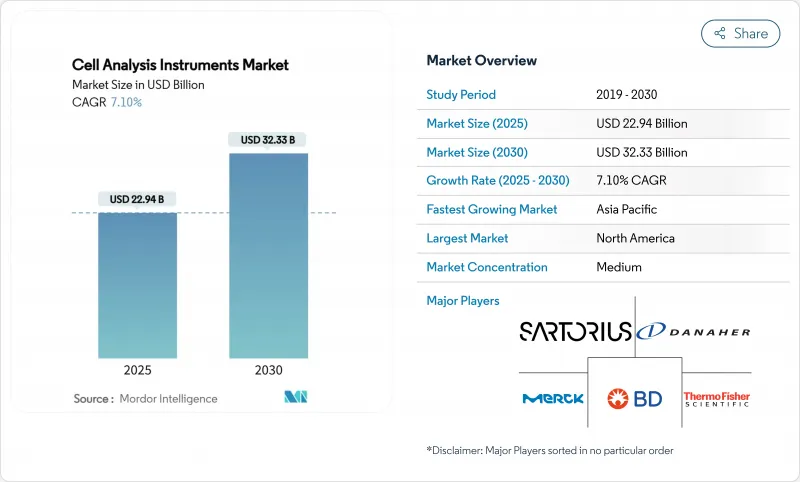

Cell Analysis Instruments - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The cell analysis instruments market is valued at USD 22.94 billion in 2025 and is forecast to advance to USD 32.33 billion by 2030, translating into a steady 7.1% CAGR.

Demand rises as chronic disease management shifts toward early molecular detection, artificial-intelligence (AI) driven imaging, and large-scale single-cell sequencing workflows that are now affordable for mid-sized laboratories. Consumables keep laboratories operational on a daily basis and already account for nearly half of 2024 revenue, while instrument innovation pushes spectral, high-content, and automation features into routine bench work. Geographically, North America continues to set the purchasing pace through generous National Institutes of Health (NIH) and National Science Foundation (NSF) instrumentation grants, whereas Asia-Pacific registers double-digit growth on the back of expanding biomanufacturing capacity. Regulatory clarity is improving; the US Food and Drug Administration (FDA) in 2025 classified multiplexed antimicrobial susceptibility cell-analysis systems as Class II devices, signalling confidence in advanced analytical platforms. Mergers and acquisitions-such as Thermo Fisher Scientific's multi-year USD 40-50 billion expansion budget-underscore how scale and portfolio breadth will determine long-term competitive advantage.

Global Cell Analysis Instruments Market Trends and Insights

Rise in chronic disease prevalence

Growing cancer, cardiovascular, and metabolic disorder caseloads force health systems to prioritise early detection, pushing demand for high-throughput cellular profiling platforms that can uncover subtle phenotypic changes before symptoms manifest. The FDA's 2024 approval of the Shield blood-based assay-with 83% colorectal cancer detection accuracy-demonstrates how multiparametric cell analysis supports mainstream screening. AI-enhanced histopathology algorithms now outperform manual reads in identifying invasive breast-tumour patterns. Cervical-cancer programmes that must screen 70% of women aged 35-45 by 2030 are adopting automated slide readers to compensate for pathologist shortages. These use cases cement a feedback loop in which clinical adoption validates technology and, in turn, draws further investment into the cell analysis instruments market.

Expansion of biotech and cell-therapy pipelines

More than 1,200 active US cell- and gene-therapy trials in 2024 propel purchases of spectral sorters, high-content imagers, and GMP-grade flow cytometers for in-process control. Roche's USD 1.0-1.5 billion acquisition of Poseida Therapeutics highlights the rush to secure allogeneic CAR-T platforms that require rigorous cell phenotyping during scale-up. Tenpoint Therapeutics plans first-in-human retinal cell therapy studies by late 2025, widening analytical demand beyond oncology. Contract development and manufacturing organisations (CDMOs) fill capability gaps for smaller biotechs, bolstering instrument sales as they build analytical suites to serve multiple clients. Consequently, the cell analysis instruments market sees growth in both instrument platforms and consumable kits optimised for GMP environments.

High capital cost of flagship instruments

State-of-the-art spectral flow cytometers, high-content imagers, and mass cytometry platforms often list above USD 500,000, pricing out many teaching hospitals and public universities. NIH attempts to bridge the gap with High-End Instrumentation grants that award USD 750,000-2 million for single items. Yet the number of eligible proposals still far exceeds available funds, evidenced by Bio-Rad's 5.4% year-over-year decline in academic sales during Q1 2025. Shared-use cores improve utilisation but lengthen queue times, occasionally compromising experimental timelines. Currency swings and import levies amplify costs in developing markets, dampening unit shipments and slowing cell analysis instruments market penetration where unmet medical need is rising fastest.

Other drivers and restraints analyzed in the detailed report include:

- Falling single-cell sequencing costs

- AI-enabled image analysis boosting throughput

- Complex multi-jurisdiction regulatory path

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Consumables generated 59.35% of 2024 revenue and deliver predictable margins because laboratories reorder assay kits, reagents, and disposable cartridges throughout an instrument's life cycle. Flagship instrument launches nevertheless propel top-line growth; the BD FACSDiscover S8 spectral sorter marries high-speed imaging with traditional fluorescence to enable phenotype-based sorting, a first for the category. Yokogawa's CellVoyager CQ3000 offers live 3-D imaging of organoids using sCMOS cameras, broadening single-plate analytical capacity. As new optical paths and on-board AI shorten protocols, laboratories replace older hardware earlier than the typical seven-year depreciation curve, supporting a 12.25% CAGR for instruments. Spectrophotometers, microarrays, and advanced microscopes plug into cloud-based analytic dashboards that automate compliance documentation, securing recurring software subscriptions that anchor vendors deeper into the cell analysis instruments market.

Second-order effects further reinforce consumable demand. AI-assisted assays often multiplex more biomarkers per run, increasing reagent pull-through. Spectral flow cytometry requires proprietary dye panels optimised for narrow emission bins, converting technique adoption directly into consumable sales. Collectively, these drivers ensure that consumables remain the volume backbone, while big-ticket hardware remains the swing factor in annual revenue for the cell analysis instruments industry.

The Cell Analysis Instruments Market Report is Segmented by Product (Instruments [Microscopes, Flow Cytometers, and More], and Consumables), Application (Cell Counting, Cell Viability, Cell Identification, and More), End-User (Academic and Research Institutes, Pharmaceutical & Biotechnology Companies, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retains leadership with 40.63% of 2024 revenue, anchored by NIH High-End Instrumentation grants of USD 750,000-2 million per award and USD 421 million in NSF biotechnology budget for fiscal 2025. Robust venture funding, a mature biopharma cluster, and early-adopter culture pushed laboratories to adopt AI-enabled analytical platforms ahead of other regions. Canada's federal innovation funds and Mexico's burgeoning contract-manufacturing footprint add to regional demand; Shimadzu's new Mexican subsidiary aims for 150% business growth by 2028, signalling instrument vendors' confidence in the market. The current cell analysis instruments market size for North America supports vendors specialising in premium instrumentation, bioprocess analytics, and cloud-connected data services.

Asia-Pacific registers the highest growth rate at 11.91% CAGR through 2030. China's pivot toward Southeast Asian biopharma investments and control of 90% global rare-earth output influences supply security for optical components. India's ambition to become a Quad biomanufacturing hub positions the region for demand in closed, GMP-compliant analytical suites. Japan's Nikon and Yokogawa supply cutting-edge imagers that feed back into domestic adoption, while South Korea invests heavily in precision-medicine infrastructure. Consequently, the cell analysis instruments market enjoys both manufacturing cost advantages and large untapped clinical segments across Asia's diverse economies.

Europe maintains a solid installed base thanks to clustered pharma activity in Germany, the United Kingdom, and France. Coordinated research funding, combined with IVDR roll-out, ensures a stable if moderate demand trajectory. Eastern European nations look to EU structural funds to modernise laboratory infrastructure, creating future unit-growth pockets. Meanwhile, the Middle East and Africa begin to modernise pathology labs and life-science education facilities, often bundled with technology-transfer agreements. These regions contribute a small but rising share of the global cell analysis instruments market as governments diversify away from hydrocarbon-driven economies.

- Beckton Dickinson

- Danaher Corp. (Beckman Coulter Life Sciences)

- Thermo Fisher Scientific

- Merck

- Sartorius

- Miltenyi Biotec

- Agilent Technologies

- Bio-Rad Laboratories

- GE Healthcar

- PerkinElmer (Revvity)

- 10x Genomics

- Luminex (DiaSorin)

- Olympus

- Sysmex

- Promega

- Terumo

- Stem Cell Technologies

- Chemometec A/S

- Countstar (Ruiyu Biotech)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise In Chronic Disease Prevalence

- 4.2.2 Expansion Of Biotech & Cell-Therapy Pipelines

- 4.2.3 Falling Single-Cell Sequencing Costs

- 4.2.4 Government Funding For Life-Science Tools

- 4.2.5 AI-Enabled Image-Analysis Boosting Throughput

- 4.2.6 Growing Demand For Closed, GMP-Compliant Microfluidic Systems

- 4.3 Market Restraints

- 4.3.1 High Capital Cost Of Flagship Instruments

- 4.3.2 Complex Multi-Jurisdiction Regulatory Path

- 4.3.3 Shortage Of Bio-Informatic Talent For Multi-Omics Workflows

- 4.3.4 Supply-Chain Risk For Rare Earth Optics & Detectors

- 4.4 Porter's Five Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Instruments

- 5.1.1.1 Microscopes

- 5.1.1.2 Flow Cytometers

- 5.1.1.3 Spectrophotometers

- 5.1.1.4 Cell Microarrays

- 5.1.1.5 Other Instruments

- 5.1.2 Consumables

- 5.1.1 Instruments

- 5.2 By Application

- 5.2.1 Cell Counting

- 5.2.2 Cell Viability

- 5.2.3 Cell Identification

- 5.2.4 Target Identification

- 5.2.5 PCR / qPCR

- 5.2.6 Other Applications

- 5.3 By End-User

- 5.3.1 Academic & Research Institutes

- 5.3.2 Pharmaceutical & Biotechnology Companies

- 5.3.3 Contract Research & CDMO

- 5.3.4 Other End-Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Becton, Dickinson and Company

- 6.3.2 Danaher Corp. (Beckman Coulter Life Sciences)

- 6.3.3 Thermo Fisher Scientific Inc.

- 6.3.4 Merck KGaA

- 6.3.5 Sartorius AG

- 6.3.6 Miltenyi Biotec

- 6.3.7 Agilent Technologies

- 6.3.8 Bio-Rad Laboratories

- 6.3.9 GE Healthcar

- 6.3.10 PerkinElmer (Revvity)

- 6.3.11 10x Genomics

- 6.3.12 Luminex (DiaSorin)

- 6.3.13 Olympus Corporation

- 6.3.14 Sysmex Corporation

- 6.3.15 Promega Corporation

- 6.3.16 Terumo BCT

- 6.3.17 STEMCELL Technologies

- 6.3.18 Chemometec A/S

- 6.3.19 Countstar (Ruiyu Biotech)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment