PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842605

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842605

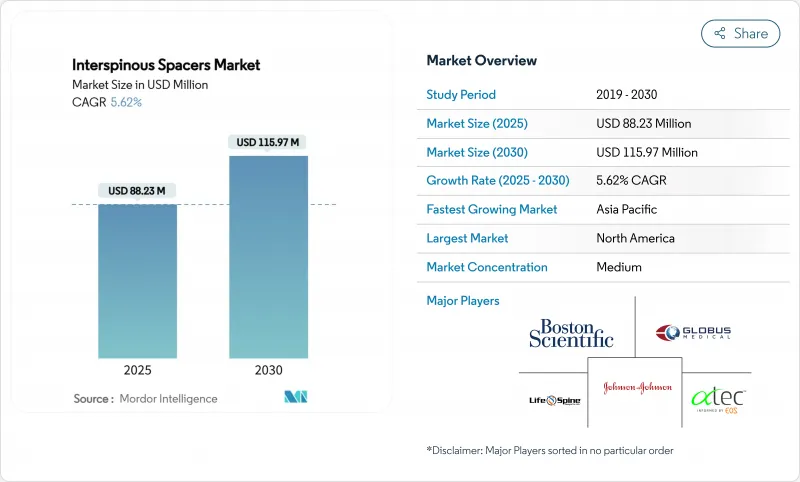

Interspinous Spacers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The interspinous spacers market is valued at USD 88.23 million in 2025 and is forecast to advance to USD 115.97 million by 2030, reflecting a 5.62% CAGR.

Demand continues to expand as surgeons replace traditional fusion with motion-preserving implants that decompress lumbar stenosis without rigid fixation. Commercial traction is supported by the ageing demographic, growing outpatient spine volumes and steady reimbursement reforms that reward minimally invasive care. Device makers differentiate through biomaterial innovation, hybrid designs that balance motion with stability and data-enabled follow-up systems that document outcomes. Asia-Pacific investment in new surgical centres and North American payer incentives for same-day discharge further strengthen the interspinous spacers market outlook.

Global Interspinous Spacers Market Trends and Insights

Rising Demand for Minimally Invasive Lumbar Decompression

Interspinous spacers enable indirect decompression by distracting spinous processes and preserving motion, which reduces operative time and blood loss compared with laminectomy. Surgeons in Asia-Pacific increasingly prefer these minimally invasive techniques, according to AO Spine surveys. Broader access to imaging guidance enhances accuracy, shrinks the learning curve and stimulates device demand.

Growing Geriatric Population with Lumbar Spinal Stenosis

Up to 47% of adults aged >= 65 exhibit lumbar stenosis, creating a large candidate pool for motion-preserving treatment. Five-year durability data for stand-alone interspinous decompression supports its suitability in elderly cohorts unable to tolerate fusion. Rapid ageing in Japan and South Korea accelerates procedure volumes across the region.

High Device Revision Rates Beyond Five Years

Follow-up studies highlight migration, spinous fractures and adjacent-segment degeneration after year 5, prompting payer scrutiny of revision cost exposure. Biomechanical modelling shows hybrid systems reduce peak stress at bone-implant interfaces, which may improve longevity.

Other drivers and restraints analyzed in the detailed report include:

- Favorable Reimbursement Revisions for Outpatient Spine Surgery

- Rapid Adoption of Ambulatory Surgical Centres in Emerging Markets

- Stringent Post-Market Clinical Evidence Requirements in EU MDR

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Static non-compressible implants controlled 52.35% of 2024 revenue, underscoring surgeon familiarity. Yet the hybrid cohort is growing at a 12.25% CAGR as it blends controlled motion with required stability. Finite-element work confirms that hybrid designs maintain physiologic range while reducing facet stress during vibration. Rising clinical evidence positions hybrids to reshape the interspinous spacers market over the forecast period.

The interspinous spacers market continues to diversify as expandable and segmental models give surgeons more intra-operative flexibility. Adaptive materials embedded in hybrid units automatically respond to load, meeting a wider spectrum of pathologies and reframing implant selection discussions inside theatre teams.

Titanium maintained 42.53% share in 2024 owing to proven strength and imaging clarity. Surgeons now pursue resorbable PLGA and PLA formats that eliminate long-term foreign body and imaging artefacts and are climbing at a 9.85% CAGR. Custom 3D-printed bioresorbable implants tailored to patient anatomy are emerging at point of care, signalling another catalyst inside the interspinous spacers market.

Pioneering trials show resorbable polylactic acid spacers achieving solid fusion when combined with autograft, bypassing complex bone-graft procurement. Developers continue to refine degradation timelines so structural support disappears only after the spinal column remodels.

The Interspinous Spacers Market Report is Segmented by Product Type (Static, Expandable, and More), Biomaterial (Titanium & Titanium Alloys, and More), Minimally-Invasive Approach (Open Posterior Approach and Percutaneous), Application (Lumbar Spinal Stenosis, and More), End-User (Hospitals, Orthopedic & Spine Clinics, and More), and Geography (North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America sustained 41.71% share in 2024 on the back of high procedure volumes, structured reimbursement and an installed base of spine surgeons experienced in interspinous spacer techniques. Medicare's 2025 payment adjustment and bundled care pilots continue to reward outpatient pathways, thereby preserving positive momentum for the interspinous spacers market.

Asia-Pacific is the fastest growing geography at a 9.61% CAGR. Regional health ministries pour capital into surgical robotics, endoscopic suites and surgeon fellowship programmes. Japan's PMDA fast-track nurtures novel implant approvals while China's expanding middle class drives self-pay uptake for motion preservation options.

Europe maintains steady demand despite MDR compliance pressure. Transitional allowances until 2028 permit legacy interspinous spacer sales, though manufacturers must intensify post-market studies to retain CE marks. Uptake is strongest in Germany and France where public payers fund minimally invasive decompression to reduce lengthy rehab associated with fusion. Emerging markets in the Middle East, Africa and South America contribute additional upside as private hospital networks import leading brands and partnered training expands the regional surgeon base.

- Stryker

- Boston Scientific

- Johnson & Johnson

- Globus Medical

- Zimmer Biomet

- ATEC Spine

- Life Spine Inc.

- Aurora Spine Inc.

- Paradigm Spine (RTI Surgical)

- Medtronic

- NuVasive

- Surgalign Holdings Inc.

- Premia Spine Ltd.

- Vertebral Technologies Inc.

- Orthofix

- SpineArt SA

- Back Bone Innovations LLC

- Wenzel Spine Inc.

- Xtant Medical Holdings

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand For Minimally-Invasive Lumbar Decompression

- 4.2.2 Growing Geriatric Population With Lumbar Spinal Stenosis

- 4.2.3 Favorable Reimbursement Revisions For Outpatient Spine Surgery

- 4.2.4 Rapid Adoption Of Ambulatory Surgical Centers In Emerging Markets

- 4.2.5 Advances In Bio-Adaptive, Motion-Preserving Spacer Materials

- 4.2.6 Cloud-Connected Post-Operative Monitoring Driving Surgeon Confidence

- 4.3 Market Restraints

- 4.3.1 High Device Revision Rates Beyond Five Years

- 4.3.2 Stringent Post-Market Clinical-Evidence Requirements In EU MDR

- 4.3.3 Surgeon Learning-Curve Deterring Smaller Hospitals

- 4.3.4 Pricing Pressure From Bundled-Payment Spinal Care Models

- 4.4 Porter's Five Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Static (Non-compressible Spacers)

- 5.1.2 Expandable/Segmental Static Spacers

- 5.1.3 Dynamic (Compressible Spacers)

- 5.1.4 Hybrid Dynamic-Static Systems

- 5.2 By Biomaterial

- 5.2.1 PEEK

- 5.2.2 Titanium & Titanium Alloys

- 5.2.3 Silicone & Polyurethane

- 5.2.4 Bio-resorbable Polymers

- 5.3 By Minimally-Invasive Approach

- 5.3.1 Open Posterior Approach

- 5.3.2 Percutaneous/Endoscopic Approach

- 5.4 By Application

- 5.4.1 Lumbar Spinal Stenosis

- 5.4.2 Degenerative Disc Disease

- 5.4.3 Adjacent-Segment Degeneration

- 5.4.4 Others

- 5.5 By End-User

- 5.5.1 Hospitals

- 5.5.2 Orthopedic & Spine Clinics

- 5.5.3 Ambulatory Surgical Centers

- 5.5.4 Academic & Research Centers

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Stryker Corporation

- 6.3.2 Boston Scientific Corporation

- 6.3.3 Johnson & Johnson (DePuy Synthes)

- 6.3.4 Globus Medical, Inc.

- 6.3.5 Zimmer Biomet Holdings Inc.

- 6.3.6 Alphatec Spine Inc.

- 6.3.7 Life Spine Inc.

- 6.3.8 Aurora Spine Inc.

- 6.3.9 Paradigm Spine (RTI Surgical)

- 6.3.10 Medtronic plc

- 6.3.11 NuVasive Inc.

- 6.3.12 Surgalign Holdings Inc.

- 6.3.13 Premia Spine Ltd.

- 6.3.14 Vertebral Technologies Inc.

- 6.3.15 Orthofix Medical Inc.

- 6.3.16 SpineArt SA

- 6.3.17 Back Bone Innovations LLC

- 6.3.18 Wenzel Spine Inc.

- 6.3.19 Xtant Medical Holdings Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment