PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842607

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842607

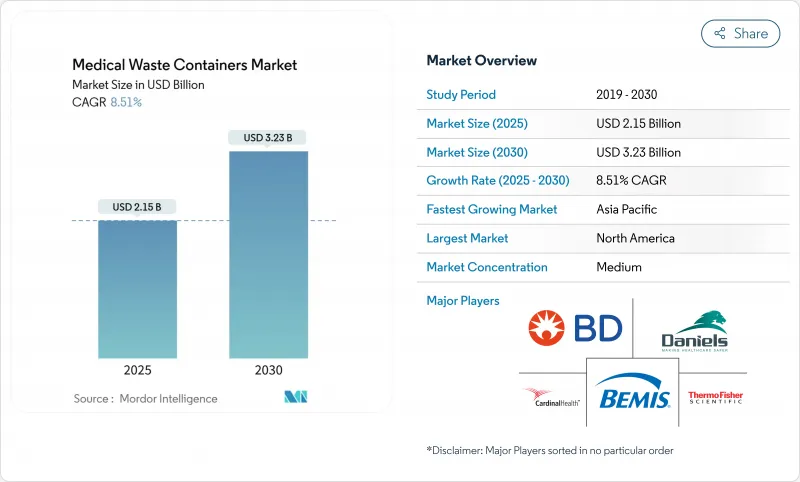

Medical Waste Containers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Medical Waste Containers Market size is estimated at USD 2.15 billion in 2025, and is expected to reach USD 3.23 billion by 2030, at a CAGR of 8.51% during the forecast period (2025-2030).

Heightened post-pandemic waste volumes, stricter regulatory oversight and a shift toward reusable containment systems continue to lift demand, while the recent convergence of waste management and digital technology reshapes product portfolios. Healthcare facilities collectively generate nearly 6 million tons of regulated waste each year, and about 15% requires specialized containment that supports on-site segregation, transport safety and traceability. Mergers such as Waste Management's 2024 acquisition of Stericycle are redrawing competitive boundaries, prompting regional specialists to double down on clinical performance and sustainability features. Smart, IoT-enabled vessels post double-digit growth as hospitals prioritize real-time fill-level alerts, compliance logs and predictive maintenance, whereas supply chain uncertainty around medical-grade polypropylene adds cost tension for one-time-use container lines.

Global Medical Waste Containers Market Trends and Insights

Rising Infectious Waste Post-Pandemic

Global hospitals generated up to 3.4 kg of hazardous waste per person per day at pandemic peaks, a level that remains above pre-2020 norms. Turkish facilities alone reported a jump from 98,729 tons in 2017 to 130,401 tons in 2022, reinforcing the structural nature of the surge. Continued reliance on single-use PPE, higher outpatient volumes and rigorous infection-control protocols sustain elevated waste streams in 2025. Container designs that incorporate hands-free lids and antimicrobial surfaces are gaining favor among infection-control teams.

Tightening Global Waste Management Regulations

Forty US states now enforce the Hazardous Waste Generator Improvements Rule, widening documentation and container-specification demands on healthcare providers. Michigan's 2024 extension for partially filled sharps boxes and China's nationwide recycling build-out both create nuanced opportunities for manufacturers offering extended-storage vessels and standardized color-coding. Compliance complexity favors suppliers with turnkey audit support and digital traceability.

Disposal Cost Pressures on Small-Scale Healthcare Providers

Waste transport and treatment bills can consume up to 25% of operating budgets in rural clinics, raising resistance to premium container systems despite their safety benefits. Studies show that 90% of operating-room trash is non-infectious yet often ends up in red-bag bins, inflating disposal invoices. Demand therefore splits: high-compliance incumbents retain larger accounts, while value-tier products address cost-sensitive practices.

Other drivers and restraints analyzed in the detailed report include:

- Growth of Healthcare Infrastructure in Emerging Economies

- Push Toward Sustainable Waste Solutions

- Volatility in Supply of Medical-Grade Plastics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Infectious and hazardous waste vessels captured 33.42% of the medical waste containers market share in 2024. Hospitals rely on them for microbiological samples, blood-soaked materials and isolation-ward disposables, which drive consistent base demand. Cytotoxic and chemotherapy containers are a smaller but fastest-expanding niche, advancing at an 8.93% CAGR as oncology infusion volumes climb and national agencies tighten hazardous-drug rules.

Rising oncology caseloads push pharmacies to segregate bulk versus trace chemo residues, spurring orders for color-coded yellow and black vessels that withstand high-temperature incineration. Sharps bins remain indispensable but see moderate growth as some biologic injectables switch to safety-engineered pens. Non-infectious general waste containers lose share as staff training improves segregation accuracy, cutting over-classification.

The Medical Waste Containers Market Report Segments the Industry Into by Type of Waste (Infectious & Hazardous Waste, Sharps Waste, and More), Product (Sharps Containers, Chemotherapy Rated Containers, and More), End User (Hospitals & Private Clinics, and More), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained leadership with a 40.91% medical waste containers market share in 2024, underpinned by an entrenched compliance culture, advanced logistics and the Waste Management-Stericycle mega-network that services more than 3,700 healthcare facilities. State-level variations such as Michigan's storage-time flexibility nurture innovation in extended-hold designs, while federal RCRA tracking sharpens paperwork needs that smart containers readily address.

Europe continues to emphasize circular economy mandates. Germany alone produces 4.8 million tons of healthcare refuse annually, creating fertile ground for reusable fleet rollouts and plastic reduction pilots. The Single-Use Plastics Directive and national ecomodulated fees steer provider preference toward containers with documented life-cycle savings.

Asia-Pacific delivers the fastest 8.93% CAGR, buoyed by hospital buildouts in China, India and ASEAN states. The medical waste containers market size for the region is projected to double within ten years as governments subsidize capacity to meet universal coverage goals. Vendors succeed by pairing international certifications with tiered pricing that aligns to local budgets.

The Middle East and Africa trail in absolute terms but demonstrate double-digit uptake where oil-funded hospital clusters or donor-backed clinics demand Western-grade waste segregation infrastructure. Latin America shows steady replacement cycles, particularly in outpatient clinics shifting away from improvised jars toward certified sharps receptacles.

- Beckton Dickinson

- Stericycle (WM)

- Daniels Health

- Sharps Compliance

- Cardinal Health

- Veolia Environment Services

- Clean Harbors

- Suez

- Waste Management Inc.

- Bondtech

- Bemis Manufacturing Company

- Brockway Standard

- Medgen Medical Products

- Thermo Fisher Scientific

- Remondis Medison GmbH

- Sharpak

- Ningbo Maxcon Medical Technology

- Trilogy MedWaste

- Red Bag Solutions

- SoClean

- Waste Connections

- A-Solutions Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Infectious Waste Post-Pandemic

- 4.2.2 Tightening Global Waste Management Regulations

- 4.2.3 Growth of Healthcare Infrastructure in Emerging Economies

- 4.2.4 Push Toward Sustainable Waste Solutions

- 4.2.5 Proliferation of Smart Waste Management Technologies

- 4.2.6 Hospital Adoption of On-Site Sterilization Systems

- 4.3 Market Restraints

- 4.3.1 Disposal Cost Pressures on Small-Scale Healthcare Providers

- 4.3.2 Volatility in Supply of Medical-Grade Plastics

- 4.3.3 Regulatory Scrutiny in Industry Consolidation

- 4.3.4 Declining Sharps Volume Due to Drug Delivery Innovation

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Type of Waste

- 5.1.1 Infectious & Hazardous Waste

- 5.1.2 Sharps Waste

- 5.1.3 Non-Infectious / General Waste

- 5.1.4 Cytotoxic & Chemotherapy Waste

- 5.1.5 Pharmaceutical Waste

- 5.1.6 Radioactive Waste

- 5.1.7 Pathological Waste

- 5.2 By Product

- 5.2.1 Sharps Containers

- 5.2.1.1 Disposable Sharps Containers

- 5.2.1.2 Reusable Sharps Containers

- 5.2.2 Chemotherapy-Rated Containers

- 5.2.3 Bio-hazardous Red-Bag Containers

- 5.2.4 RCRA-Compliant Hazardous-Waste Containers

- 5.2.5 Pharmaceutical Waste Containers

- 5.2.6 Smart / IoT-Enabled Containers

- 5.2.7 Antimicrobial-treated Containers

- 5.2.1 Sharps Containers

- 5.3 By End User

- 5.3.1 Hospitals & Private Clinics

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Dialysis Centers

- 5.3.4 Diagnostic & Pathology Laboratories

- 5.3.5 Pharmaceutical & Biotechnology Companies / CROs

- 5.3.6 Academic & Research Institutes

- 5.3.7 Veterinary Hospitals & Clinics

- 5.3.8 Home Healthcare Settings

- 5.3.9 Dental Clinics

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Becton, Dickinson and Company

- 6.3.2 Stericycle (WM)

- 6.3.3 Daniels Health

- 6.3.4 Sharps Compliance Inc.

- 6.3.5 Cardinal Health Inc.

- 6.3.6 Veolia Environment Services

- 6.3.7 Clean Harbors

- 6.3.8 Suez SA

- 6.3.9 Waste Management Inc.

- 6.3.10 Bondtech Corporation

- 6.3.11 Bemis Manufacturing Company

- 6.3.12 Brockway Standard

- 6.3.13 Medgen Medical Products

- 6.3.14 Thermo Fisher Scientific Inc.

- 6.3.15 Remondis Medison GmbH

- 6.3.16 Sharpak

- 6.3.17 Ningbo Maxcon Medical Technology

- 6.3.18 Trilogy MedWaste

- 6.3.19 Red Bag Solutions

- 6.3.20 SoClean

- 6.3.21 Waste Connections

- 6.3.22 A-Solutions Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment