PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842609

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842609

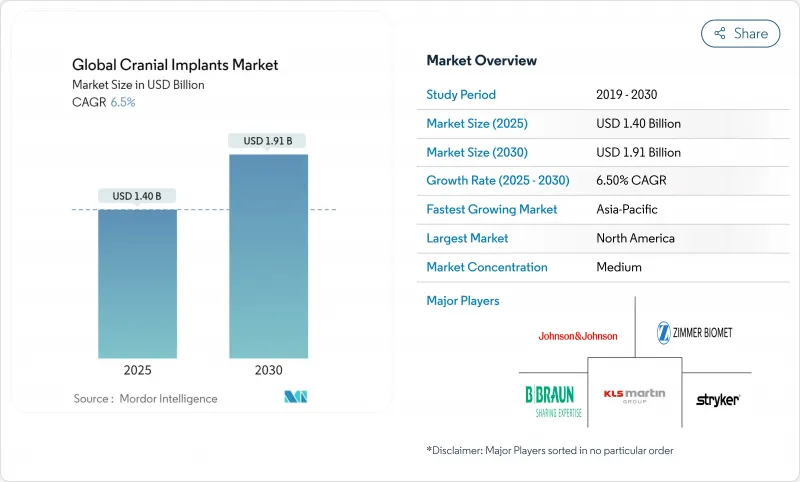

Global Cranial Implants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The cranial implants market stands at USD 1.40 billion in 2025 and is projected to expand to USD 1.91 billion by 2030, advancing at a 6.5% CAGR.

Robust demand stems from a steady rise in traumatic brain injuries, broader neurosurgical capacity in emerging economies, and a decisive shift toward 3-dimensional patient-specific manufacturing. Hospitals remain the anchor customer base, yet specialty neurosurgery centers are scaling rapidly as payers reward high-outcome facilities. Titanium retains primacy because of decades of clinical proof, but polymeric alternatives such as PEEK gain traction as surgeons prioritize artifact-free imaging. Technology adoption also pivots: conventional machining still fills high-volume needs, yet 3-D printed solutions are winning complex cases because they reduce operative time and revision risk. Regionally, North America leads revenue, while Asia-Pacific generates the fastest growth on the back of infrastructure build-outs and regulatory modernization that shorten device-approval cycles.

Global Cranial Implants Market Trends and Insights

Rising Incidence of Cranial Trauma & Neurosurgical Procedures

Worldwide, roughly 69 million traumatic brain injuries occur each year, and severe cases often necessitate cranioplasty reconstruction. Aging populations, higher motor-vehicle density, and organized sports elevate the clinical burden. Defense research into neuro-protection further amplifies demand as military surgeons require dependable synthetic plates for battlefield injuries. At the hospital level, dedicated neuro-trauma centers consolidate complex cases, creating predictable procurement cycles for high-volume suppliers. Because trauma incidence is weakly correlated with economic cycles, the cranial implants market enjoys defensive-healthcare status that supports long-term planning by manufacturers and health systems alike.

Advancements in 3-D Printing for Patient-Specific Implants

Additive manufacturing transforms a one-size-fits-all procedure into tailored reconstruction. The 2024 FDA clearance of 3D Systems' PEEK cranial plate proved the regulatory viability of polymeric additive implants. Surgeons now access cloud-based design tools that convert CT data into a ready-to-print file in minutes, trimming operating time and anesthesia exposure. Hospitals gain negotiating leverage with insurers by citing shorter length of stay and higher patient-satisfaction indices. Meanwhile, lattice infills and variable-thickness walls impossible in milling become routine, lowering weight and optimizing biomechanical stress paths. Suppliers that combine artificial intelligence with in-house printers are building widening competitive moats while legacy machine shops face commoditization risk.

Expanding Neurosurgical Infrastructure in Emerging Economies

China's healthcare reform earmarks USD 1.4 trillion through 2030 for new facilities, including trauma hubs in tier-2 cities National Health Commission of China. India's National Medical Devices Policy targets 15% annual growth and encourages joint ventures for localized implant production Government of India. As intraoperative imaging reaches community hospitals, surgeons adopt advanced cranioplasty techniques earlier in their careers. Gradual expansion of private health insurance in Southeast Asia further softens cost barriers, broadening the cranial implants market beyond major metropolitan centers.

Other drivers and restraints analyzed in the detailed report include:

- Superior Clinical Outcomes of Titanium & PEEK Implants

- High Cost & Limited Reimbursement for Customized Implants

- Post-Operative Infection Leading to Implant Removal

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Titanium held 52.76% of cranial implants market share in 2024, underscoring its entrenched clinical acceptance. The segment benefits from abundant surgeon familiarity and favorable mechanical strength-to-weight ratios. PEEK, however, is the fastest-expanding material, advancing at a 7.35% CAGR as radiologists favor its imaging clarity. In revenue terms, PEEK's portion of the cranial implants market size is forecast to widen steadily through 2030, propelled by FDA-cleared patient-specific solutions.

Hybrid constructs that embed titanium meshes inside PEEK shells mitigate stress shielding while preserving radiolucency, offering a middle path for surgeons wary of fully polymer implants. PMMA retains a niche in low-resource settings because of low unit cost, while resorbable polymers gather interest for pediatric cases where skull growth continues post-implantation. Advanced surface texturing and plasma coating technologies are improving bone ingrowth across all materials, potentially blurring performance gaps and intensifying competition within the cranial implants market.

The Cranial Implants Market Report is Segmented by Material (Titanium, Polyether-Ether-Ketone (PEEK) and More), by Technology (3-D Printed Implants, CAD/CAM-Milled Implants and More), by End-User (Hospitals, Specialty Neurosurgery Centers and More), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The Report Offers the Value (in USD) for the Above Segments.

Geography Analysis

North America generated 41.23% of 2024 revenue, anchored by Medicare coverage and an installed base of high-end imaging systems. Academic hubs such as Mayo Clinic and Johns Hopkins also function as innovation incubators, accelerating early adoption of augmented-reality navigation during cranioplasty procedures. Nevertheless, mounting payer pressure keeps list-price inflation in check, compelling suppliers to justify premium tariffs with demonstrable reductions in revision rates.

Asia-Pacific is the fastest-growing region at an 8.75% CAGR, propelled by multibillion-dollar public-hospital buildouts in China and India. Streamlined device-approval pathways and incentives for local production shorten time to market for both multinationals and domestic entrants. Japan and South Korea lead surgical robotics penetration, fostering a virtuous cycle of precise implant fit and lower complication rates. Rising household incomes and broader private-insurance availability make elective cranioplasty more accessible, sustaining momentum in the cranial implants market.

Europe exhibits steady but slower growth as the Medical Device Regulation raises compliance costs. Germany and France spearhead evidence-based procurement, obliging sellers to produce longitudinal outcome data. Nordic countries, which have digitized health records extensively, adopt patient-specific implants quickly because their single-payer systems can evaluate real-world value at national scale. In the Middle East and Gulf states, medical-tourism programs underpin premium implant demand, while African markets remain nascent but benefit from international trauma-care initiatives. Collectively, these regional nuances demand tailored go-to-market strategies from companies active in the cranial implants market.

- Stryker

- Zimmer Biomet

- Johnson & Johnson

- Integra LifeSciences Holdings

- Medtronic

- KLS Martin Group

- Xilloc Medical B.V.

- OssDsign AB

- Renishaw plc

- B. Braun (Aesculap)

- Anatomics

- Tecomet Inc.

- Synimed

- OsteoMed (An Acumed Company)

- Evonik Industries

- CranioTech Inc.

- ADEOR medical AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising incidence of cranial trauma & neurosurgical procedures

- 4.2.2 Advancements in 3-D printing for patient-specific implants

- 4.2.3 Superior clinical outcomes of titanium & PEEK implants

- 4.2.4 Expanding neurosurgical infrastructure in emerging economies

- 4.2.5 Augmented-reality assisted implant positioning (under-reported)

- 4.2.6 Military neuro-protection R&D boosting bioceramic adoption (under-reported)

- 4.3 Market Restraints

- 4.3.1 High cost & limited reimbursement for customized implants

- 4.3.2 Post-operative infection leading to implant removal

- 4.3.3 Regulatory ambiguity for bio-resorbable scaffold materials (under-reported)

- 4.3.4 Supply-chain risk for medical-grade PEEK resin (under-reported)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Material (Value, USD Million)

- 5.1.1 Titanium

- 5.1.2 Polyether-ether-ketone (PEEK)

- 5.1.3 Polymethyl-methacrylate (PMMA)

- 5.1.4 Hydroxy-apatite

- 5.1.5 Other Materials

- 5.2 By Technology (Value, USD Million)

- 5.2.1 3-D Printed Implants

- 5.2.2 CAD/CAM-Milled Implants

- 5.2.3 Conventional Machined Implants

- 5.3 By End User (Value, USD Million)

- 5.3.1 Hospitals

- 5.3.2 Specialty Neurosurgery Centers

- 5.3.3 Ambulatory Surgical Centers

- 5.4 By Geography (Value, USD Million)

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 GCC

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Stryker Corporation

- 6.3.2 Zimmer Biomet Holdings Inc.

- 6.3.3 DePuy Synthes (Johnson & Johnson)

- 6.3.4 Integra LifeSciences Holdings

- 6.3.5 Medtronic plc

- 6.3.6 KLS Martin Group

- 6.3.7 Xilloc Medical B.V.

- 6.3.8 OssDsign AB

- 6.3.9 Renishaw plc

- 6.3.10 B. Braun (Aesculap)

- 6.3.11 Anatomics Pty Ltd

- 6.3.12 Tecomet Inc.

- 6.3.13 Synimed

- 6.3.14 OsteoMed (An Acumed Company)

- 6.3.15 Evonik Industries AG

- 6.3.16 CranioTech Inc.

- 6.3.17 ADEOR medical AG

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment