PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842610

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842610

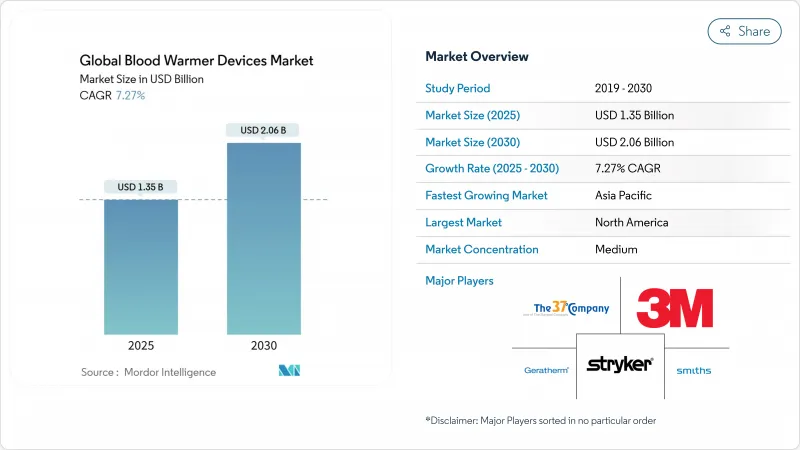

Global Blood Warmer Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The blood warmer devices market stands at USD 1.35 billion in 2025 and is set to reach USD 2.06 billion by 2030, advancing at a 7.27% CAGR.

Strong momentum comes from the push to keep surgical and trauma patients normothermic, escalating trauma procedure volumes, and rapid military uptake of portable systems. Continuous-warming mandates issued by the Association of periOperative Registered Nurses in March 2025 have heightened hospital compliance efforts, while recent FDA guidance on medical-device supply-chain resilience has sharpened focus on uninterrupted product availability. Manufacturers respond with integrated IoT logging, battery life extensions, and battlefield-grade ruggedisation-features that win new contracts from defense and emergency-medical service (EMS) buyers.

Global Blood Warmer Devices Market Trends and Insights

Rising Trauma & Emergency Surgery Volumes

Global trauma caseloads keep climbing, driven by road accidents, ageing populations and prolonged conflict zones. The U.S. Joint Trauma System recorded a 44% drop in battlefield deaths once automated blood-warming logistics became standard practice health.mil. Emergency-department studies show prehospital transfusion programs could benefit as many as 900,000 U.S. patients annually, underscoring the need for reliable warmers that avert hypothermia-related mortality. Mass-transfusion protocols now embed warming requirements, making the blood warmer devices market central to hospital trauma-care budgets.

Stringent Peri-operative Normothermia Guidelines

Updated AORN guidelines mandate continuous warming from pre-induction through recovery, threatening legal exposure for facilities that fail to comply. Complementary FDA test-protocols released in March 2024 standardise thermal-effect evaluation, accelerating procurement of systems with automatic shut-off and +-0.1 °C accuracy. Clinical evidence ties uncorrected peri-operative hypothermia to 9% higher complication rates and a 14% lift in acute kidney injury, further motivating hospitals to deploy state-of-the-art devices.

Risk of Hemolysis & Protein Denaturation

Temperatures exceeding 46 °C cause measurable red-cell rupture, while proteins begin denaturing at 43 °C after two-hour exposure. Trials on irradiated leukoreduced units warmed to 60 °C recorded sharp potassium release, elevating cardiac-arrest risk in neonates. Device makers now integrate triple sensors, automatic bypass and instant shut-off, which add cost and raise validation hurdles but are essential for patient safety.

Other drivers and restraints analyzed in the detailed report include:

- Adoption of Portable Warmers in Military & EMS

- Integration of IoT Temperature Logging for Compliance

- Capital-Cost Sensitivity in LMIC Hospitals

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Intravenous in-line systems controlled 40.65% of 2024 revenue, demonstrating the blood warmer devices market preference for seamless integration and tight temperature control. Units such as 3M's Ranger 245 reach set-point in 45 seconds and manage concurrent infusions between 37 °C and 41 °C, making them the workhorse for operating-theatre and trauma-bay protocols. Surface warmers, although niche in absolute sales, register an 8.23% CAGR, propelled by EMS crews that value flexible wrapping pads deployable inside ambulances or aircraft.

Clinical evidence underlines why in-line models dominate. Comparative trials show fresh blood warmed at 47 °C for one hour displayed no cell damage, whereas immersion baths showed higher variability. Cabinet units such as Sarstedt's SAHARA-III still serve blood banks needing large-volume processing without water immersion, yet growth pivots to smaller, agile devices for point-of-care use.

The Blood Warmer Devices Market is Segmented by Product Type (Intravenous In-Line, Surface/Convective Fluid and More), by Modality (Portable and Stationary), by Application (Surgery & Peri-Operative Care, Critical Care (ICU/ER) and More) and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with 45.23% of 2024 revenue, reflecting mature reimbursement, stringent FDA oversight and a well-funded EMS network that already fields blood on board in 23 states. Medicare payment updates for 2025-2026 increase quality incentives tied to normothermia compliance, driving new hospital upgrades federalregister.gov. Pentagon innovations such as the Automated Battlefield Trauma System, which delivered a 44% mortality reduction, spill over into civilian care and sustain upstream demand.

Europe shows balanced expansion as harmonised Medical Device Regulation and intensive-care society guidelines reinforce thermal-management standards. Consensus on targeted temperature control for traumatic brain injury, adopted by leading centres in Germany, France and the United Kingdom, secures a steady cadence of procurement despite supply-chain frictions triggered by regional geopolitical tensions

Asia-Pacific delivers the fastest compound growth at 10.23%, propelled by massive trauma caseloads and government infrastructure programmes in China, India and Southeast Asia. While venture funding dips curtailed some local start-ups, state procurement of battlefield-grade equipment after natural-disaster responses keeps the adoption curve steep. Price-sensitive public hospitals increasingly trial lower-cost portable units, opening new avenues for manufacturers that can tier offerings without diluting accuracy.

- 3M

- Stryker Corporation (Belmont)

- ICU Medical

- Barkey

- Belmont Medical Technologies

- Fresenius

- GE HealthCare Technologies Inc.

- Gentherm Medical

- Vyaire Medical

- Princeton Medical Scientific Inc.

- Emit Corporation

- The 37Company B.V.

- SOMATEX Medical Technologies GmbH

- Keewell Medical Technology Co. Ltd.

- Qingdao Flux Medical

- ThermoGenesis Holdings Inc.

- Sarstedt

- Smiths Group

- Inspiration Healthcare Group plc

- Enthermics Medical Systems

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising trauma & emergency surgery volumes

- 4.2.2 Stringent peri-operative normothermia guidelines

- 4.2.3 Adoption of portable, battery-operated warmers in military & EMS

- 4.2.4 Integration of IoT temperature logging for compliance

- 4.2.5 AI-assisted real-time perfusion monitoring (under-the-radar)

- 4.2.6 Stem-cell & apheresis therapy growth needing large-volume warming (under-the-radar)

- 4.3 Market Restraints

- 4.3.1 Risk of hemolysis & protein denaturation at supra-physiologic temps

- 4.3.2 Capital cost sensitivity in LMIC hospitals

- 4.3.3 Disposable set incompatibility across brands (under-the-radar)

- 4.3.4 Supply-chain fragility for heating elements rare-earths (under-the-radar)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 by Product Type (Value)

- 5.1.1 Intravenous In-Line

- 5.1.2 Surface/Convective Fluid

- 5.1.3 Enclosure Cabinet Warmers

- 5.2 by Modality (Value)

- 5.2.1 Portable

- 5.2.2 Stationary

- 5.3 by Application (Value)

- 5.3.1 Surgery & Peri-operative Care

- 5.3.2 Critical Care (ICU/ER)

- 5.3.3 Blood Banks & Apheresis Centers

- 5.3.4 Military & EMS Use

- 5.4 Geography (Value)

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 GCC

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.3.1 3M Company

- 6.3.2 Stryker Corporation (Belmont)

- 6.3.3 ICU Medical Inc. (Smiths Medical)

- 6.3.4 Barkey GmbH & Co. KG

- 6.3.5 Belmont Medical Technologies

- 6.3.6 Fresenius SE & Co. KGaA

- 6.3.7 GE HealthCare Technologies Inc.

- 6.3.8 Gentherm Medical

- 6.3.9 Vyaire Medical Inc.

- 6.3.10 Princeton Medical Scientific Inc.

- 6.3.11 Emit Corporation

- 6.3.12 The 37Company B.V.

- 6.3.13 SOMATEX Medical Technologies GmbH

- 6.3.14 Keewell Medical Technology Co. Ltd.

- 6.3.15 Qingdao Flux Medical

- 6.3.16 ThermoGenesis Holdings Inc.

- 6.3.17 Sarstedt AG & Co. KG

- 6.3.18 Smiths Group plc

- 6.3.19 Inspiration Healthcare Group plc

- 6.3.20 Enthermics Medical Systems

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment