PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842614

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842614

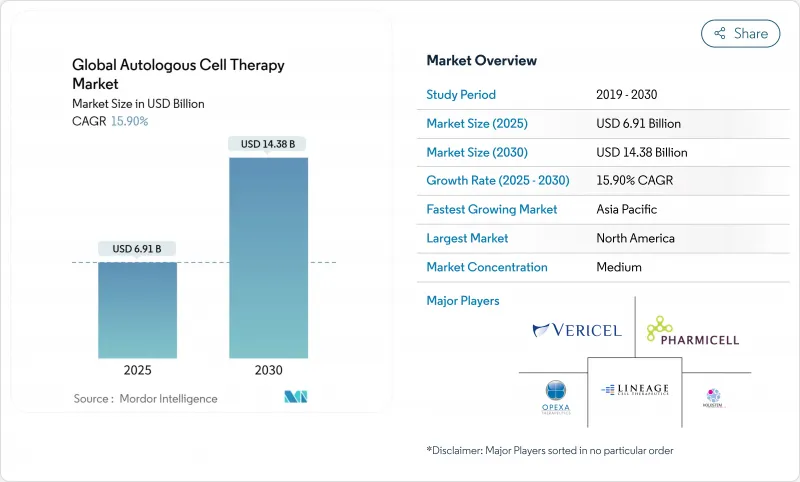

Global Autologous Cell Therapy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The autologous stem cell therapy market size reached USD 6.91 billion in 2025 and is projected to advance to USD 14.38 billion by 2030, registering a 15.8% CAGR over the forecast period Cell & Gene.

Heightened clinical adoption of patient-specific CAR-T products, rapid scale-up of point-of-care micro-factories, and United States FDA RMAT designations that cleared eight cell and gene therapies in 2024 underpin this acceleration. Competitive intensity has increased as pharmaceutical majors acquire automation assets to shorten vein-to-vein time from weeks to days, while outcomes-based contracts in Europe and Japan address payer concerns over single-administration costs exceeding USD 400,000 per patient Frontiers in Pharmacology. North America continues to command the largest regional position in the autologous stem cell therapy market at 53.34%, but Asia-Pacific is expanding the fastest at an 18.01% CAGR on the back of regulatory modernization and lower manufacturing overheads.

Global Autologous Cell Therapy Market Trends and Insights

Post-approval CAR-T Therapy Roll-outs Worldwide

Global deployment of licensed CAR-T products is broadening beyond hematology to autoimmune and solid-tumor indications. Gilead's anito-cel, positioned for a 2026 launch, targets multiple myeloma with the ambition to convert 20% of inpatient infusions to outpatient settings during pivotal trials. Bristol Myers Squibb's CD19 NEX-T program applies optimized manufacturing to severe systemic lupus erythematosus, signalling a strategic pivot from oncology into immune reset therapies. A USD 200 million BioNTech-Autolus alliance underscores consolidation around shared production platforms able to support multi-asset pipelines Autolus Therapeutics. Real-world evidence from Kite Pharma confirms that Yescarta can be administered safely in outpatient oncology clinics, reducing bed occupancy and total care costs Kite Pharma. Together, these milestones widen patient access while improving the economic narrative that surrounds the autologous stem cell therapy market.

Rapid Adoption of Closed-system Point-of-care Bioreactors

Closed, automated bioreactors integrate cell isolation, transduction, and expansion inside a sealed cassette, trimming manual touch-points that previously drove batch failures. Ori Biotech's IRO platform achieved 69% viral transduction versus 45% in legacy workflows while halving per-dose costs through 25% shorter production cycles. Xcell Biosciences reports consistent T-cell outgrowth in its AVATAR Foundry across 50 mL to 1.5 L scale, enabling decentralized runs within hospital cleanrooms. These improvements strengthen supply resilience and create a virtuous feedback loop in the autologous stem cell therapy market, whereby faster turn-around amplifies clinical adoption.

High Cost & Limited Economies of Scale

Per-patient manufacturing totals GBP 2,260-3,040 versus GBP 930-1,140 for allogeneic options due to donor-specific screening, unique batch records, and low equipment utilization BioPharm International. Mobilization procedures average USD 10,605, with merely 20% of candidates achieving optimal CD34+ cell yields without adverse events Nature Blood & Marrow Transplantation. Until automation neutralizes labor intensity, high cost tempers diffusion of the autologous stem cell therapy market.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Cell-processing Micro-factories Inside Transplant Centres

- Emergence of Cryopreserved Autologous Starting-material Banks

- Complex Vein-to-Vein Logistics & QC Bottlenecks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Immune-cell products held 43.54% of autologous stem cell therapy market share in 2024, growing at a 17.45% CAGR as CAR-T, TCR-T, and tumor-infiltrating lymphocyte therapies validate curative potential beyond hematology. Breakthroughs such as next-generation CD19 constructs with shortened culture times underpin rising clinical confidence. Meanwhile, natural-killer cell programs trialed in refractory solid tumors promise broader immune coverage yet retain autologous compatibility advantages.

Stem-cell modalities remain integral through hematopoietic transplantation and mesenchymal stem cell (MSC) applications in inflammatory disorders. FDA clearance of remestemcel-L in 2025 gave MSC therapies their first pediatric GVHD label, revitalizing investor appetite. Induced pluripotent stem cell pipelines target ischemic cardiomyopathy but will require cost-of-goods below USD 80,000 per dose to compete with existing options. Gene-modified non-immune cells occupy niche regenerative segments, benefiting from CRISPR-Cas precision yet facing extensive release testing demands.

The Autologous Cell Therapy Market Report Segments the Industry Into by Therapy Modality (Stem Cell Therapy, Immune Cell Therapy, Gene-Modified Non-Immune Cell Therapies), by Application (Oncology, Cardiovascular, Orthopaedic & Musculoskeletal Disorders, Neurology and More ), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD)

Geography Analysis

North America maintained 53.34% of autologous stem cell therapy market share in 2024, propelled by Medicare's CGT Access Model that reimburses approved products contingent on registry data collection CMS. The region's robust CDMO network shortens supply lines, and FDA's Office of Therapeutic Products expects 10-20 annual approvals by 2025, sustaining leadership.

Asia-Pacific recorded the highest 18.01% CAGR owing to supportive regulation under Japan's fast-track Sakigake program and China's provincial insurance pilots that now cover select CAR-T therapies. Localized micro-factories dampen logistics costs by up to 40%, an essential factor in emerging economies. India leverages medical tourism, while Australia and South Korea invest in regional GMP hubs, further enlarging the autologous stem cell therapy market.

Europe grows steadily as managed entry agreements align multi-year payments with clinical benefit. Germany's NUB reimbursement path grants temporary funding ahead of formal price negotiation, easing market access hurdles. Eastern Europe and Russia remain nascent but represent long-run whitespace as regulatory clarity improves.

- Novartis

- Gilead Sciences / Kite Pharma

- Bristol-Myers Squibb

- Vericel

- Anterogen Co. Ltd.

- Pharmicell Co. Ltd.

- Osiris Therapeutics / Smith+Nephew

- SanBio Co. Ltd.

- Kolon TissueGene

- Boehringer Ingelheim (Stemlab)

- Medipost Co. Ltd.

- ReNeuron Group

- Takeda Pharmaceutical (TiGenix)

- Cell Therapies Pty Ltd.

- Lonza Group (Autologous CDMO)

- Minaris Regenerative Medicine

- Fate Therapeutics

- Tessa Therapeutics

- CliniMACS / Miltenyi Biotec

- MaxCyte

- BioNTech Cell & Gene

- Iovance Biotherapeutics

- NorthX Biologics

- Vineti Inc.

- Ori Biotech

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Post-approval CAR-T therapy roll-outs worldwide

- 4.2.2 Rapid adoption of closed-system point-of-care bioreactors

- 4.2.3 Expansion of cell-processing micro-factories inside transplant centres

- 4.2.4 Emergence of cryopreserved autologous starting-material banks

- 4.2.5 Outcomes-based reimbursement pilots in EU & Japan

- 4.3 Market Restraints

- 4.3.1 High cost & limited economies of scale

- 4.3.2 Complex vein-to-vein logistics & QC bottlenecks

- 4.3.3 Scarcity of viable cells in heavily pre-treated oncology patients

- 4.3.4 Inter-patient cellular phenotype variability

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Therapy Modality (Value)

- 5.1.1 Stem Cell Therapies

- 5.1.1.1 Hematopoietic Stem Cells (HSC)

- 5.1.1.2 Mesenchymal Stem Cells (MSC)

- 5.1.1.3 Induced Pluripotent Stem Cells (iPSC)

- 5.1.2 Immune Cell Therapies

- 5.1.2.1 CAR-T Cells

- 5.1.2.2 TCR-T Cells

- 5.1.2.3 Tumour-Infiltrating Lymphocytes (TIL)

- 5.1.2.4 Natural Killer (NK) Cells

- 5.1.3 Gene-Modified Non-immune Cell Therapies

- 5.1.1 Stem Cell Therapies

- 5.2 By Application (Value)

- 5.2.1 Oncology

- 5.2.2 Cardiovascular Diseases

- 5.2.3 Orthopaedic & Musculoskeletal Disorders

- 5.2.4 Neurology

- 5.2.5 Dermatology & Wound Healing

- 5.2.6 Auto-immune Disorders

- 5.2.7 Others

- 5.3 By End User (Value)

- 5.3.1 Hospitals & Transplant Centres

- 5.3.2 Specialty Clinics

- 5.3.3 Academic & Research Institutes

- 5.3.4 Others

- 5.4 By Geography (Value)

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Russia

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Novartis AG

- 6.3.2 Gilead Sciences / Kite Pharma

- 6.3.3 Bristol Myers Squibb

- 6.3.4 Vericel Corporation

- 6.3.5 Anterogen Co. Ltd.

- 6.3.6 Pharmicell Co. Ltd.

- 6.3.7 Osiris Therapeutics / Smith+Nephew

- 6.3.8 SanBio Co. Ltd.

- 6.3.9 Kolon TissueGene

- 6.3.10 Boehringer Ingelheim (Stemlab)

- 6.3.11 Medipost Co. Ltd.

- 6.3.12 ReNeuron Group

- 6.3.13 Takeda Pharmaceutical (TiGenix)

- 6.3.14 Cell Therapies Pty Ltd.

- 6.3.15 Lonza Group (Autologous CDMO)

- 6.3.16 Minaris Regenerative Medicine

- 6.3.17 Fate Therapeutics

- 6.3.18 Tessa Therapeutics

- 6.3.19 CliniMACS / Miltenyi Biotec

- 6.3.20 MaxCyte Inc.

- 6.3.21 BioNTech Cell & Gene

- 6.3.22 Iovance Biotherapeutics

- 6.3.23 NorthX Biologics

- 6.3.24 Vineti Inc.

- 6.3.25 Ori Biotech

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment