PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842617

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842617

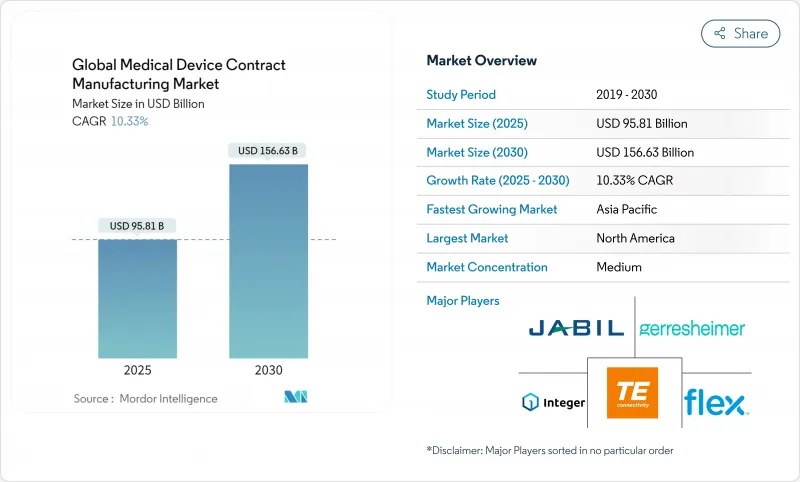

Global Medical Device Contract Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global medical device contract manufacturing market size stands at USD 95.81 billion in 2025 and is projected to reach USD 156.63 billion by 2030, reflecting a 10.33% CAGR across the period.

Rapid expansion is underpinned by OEMs accelerating outsourcing to manage cost pressure, navigating stringent post-COVID regulations, and adopting advanced digital production. High-value therapies that integrate electronics and software, such as connected drug-delivery and Class III life-support devices, continue to migrate toward specialist CMOs. Investors are backing vertical integration plays, especially in precision engineering, sterilization, and packaging, to capture more of the value chain. Meanwhile, near-shoring strategies, expansion of smart-factory investments, and sustained demand from an aging population collectively create sizable capacity requirements in North America, Europe, and advanced Asia Pacific hubs.

Global Medical Device Contract Manufacturing Market Trends and Insights

Cost-Pressure-Driven OEM Outsourcing

OEMs cite cost containment, faster commercialization, and access to specialist skills as prime reasons to deepen strategic outsourcing. Forty-two percent of senior executives name cost optimization as the leading trigger for shifting volume to CMOs. Multi-year partnerships increasingly bundle design, regulatory, and post-market services, enabling OEMs to limit capital spend while CMOs secure predictable revenue streams. Scale players continue to invest in cleanrooms, additive manufacturing, and high-volume automation to absorb larger, more complex programs. As a result, the medical device contract manufacturing market is steadily moving from transactional supply toward integrated lifecycle management.

Post-COVID Surge in IVD & PoC Diagnostics

Sustained adoption of point-of-care testing keeps IVD volumes elevated well beyond the pandemic peak. Diagnostics developers now embed connectivity and AI analytics that demand electronics miniaturization and secure firmware upgrades, pushing OEMs toward CMOs with strong electromechanical and software validation skills. The diagnostic device outsourcing sub-segment is expanding to a 9.8% CAGR, with quality-by-design and rapid prototyping reducing development cycles. Harmonized data standards introduced in 2025 further compress review timelines, favoring suppliers that pair robust QMS with multi-regional regulatory insight.

OEM Consolidation Squeezing CMO Margins

Large device multinationals, fortified by M&A, wield greater purchasing leverage and regularly optimize supplier rosters. The resulting volume concentration triggers aggressive price negotiations, pressing CMOs to defend profitability via operational excellence and service differentiation. Some suppliers respond by merging 84 deals closed between 2014 and mid-2020, creating regional champions with broader portfolios that appeal to consolidated buyers. Yet the top 10 CMOs still account for only 24.9% of the medical device contract manufacturing market, leaving room for niche specialists to flourish.

Other drivers and restraints analyzed in the detailed report include:

- Complex Class III Device Pipeline Expansion

- Aging Population Amplifying Device Volumes

- Divergent Global Regulatory Pathways

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

IVD devices generate 28.2% of 2025 revenue, cementing their status as the largest slice of the medical device contract manufacturing market. Contract manufacturers support sustained demand for molecular diagnostics, immunoassays, and portable analyzers that migrated from centralized labs to point-of-care settings. High-throughput reagent filling, precision plastic molding, and cartridge assembly lines operate under fully automated quality gates to meet tight turnaround targets.

Drug-delivery platforms, while smaller, post the fastest expansion at 12.4% CAGR through 2030. On-body pumps, wearable injectors, and connected inhalers that incorporate sensors, wireless modules, and user-feedback loops require multidisciplinary integration. CMOs respond by building sterile fill-finish suites, silicone-free syringe coating, and scalable electronics assembly under medical-grade standards. For biologics exceeding 2 mL, next-generation gas-powered autoinjectors open new modal possibilities. Reusable casings and modular drug cassettes lower waste, reinforcing sustainability mandates and underpinning volume growth across the medical device contract manufacturing industry.

The Medical Device Contract Manufacturing Market is Segmented by Device (In-Vitro Diagnostic Devices, Drug-Delivery Devices {Syringes, Pen Injectors, and More} and More), Service (Device Development & Manufacturing Services {Device Engineering, and More}, Quality Management Services, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retains leadership with a 39.1% share in 2025, supported by robust R&D funding, deep clinical networks, and early adoption of digital surgery and connected therapeutics. CMOs in the United States scale Industry 4.0 pilots into fully networked plants, deploying AI predictive maintenance and paperless batch records to mitigate a projected 3.8-million-person labor gap by 2033. Mexico strengthens the regional supply chain as a near-shore base, leveraging USMCA tariff clarity and same-day trucking to major distribution hubs.

Asia Pacific records the fastest trajectory, rising at a 10.5% CAGR as Chinese and Indian governments court high-tech manufacturing. Chinese MedTech firms enjoy state support worth up to EUR 3.8 billion (USD 4.3 billion), enabling local CMOs to compete on sophisticated catheter, endoscope, and implant assemblies. Japanese suppliers retain specialist niches in imaging optics and miniaturized motors, while South Korean players focus on MEMS sensors and battery management for wearable therapeutics. A burgeoning talent pool and cost advantage entice Western OEMs to co-locate innovation centers, expanding the medical device contract manufacturing market across the region.

Europe continues to anchor precision engineering, with Germany, Switzerland, and Ireland excelling in micro-machining, combination-product sterilization, and high-grade polymer molding. Stringent MDR rules lengthen certification timelines, prompting many US startups to initially launch stateside before back-transferring to European plants once design is frozen. Eastern European economies gain traction for mid-volume disposables, offering competitive labor yet EU-aligned quality. The Middle East and Africa gradually scale single-use device production to serve expanding local healthcare demand, while Brazil and Costa Rica drive Latin American growth. Multi-regional diversification remains a core resilience strategy after pandemic-era supply shocks highlighted single-site vulnerabilities.

List of Companies Covered in this Report:

- Jabil

- Flex

- Integer Holdings Corp.

- Gerresheimer

- TE Connectivity Ltd.

- Nordson

- Celestica

- Synecco

- Teleflex

- Sanmina Corporation

- Phillips-Medisize (Molex)

- Viant Medical

- Nissha Medical Technologies

- Heraeus Medical Components

- SteriPack Group

- Biomerics

- Nortech Systems Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cost-Pressure?Driven OEM Outsourcing

- 4.2.2 Post-COVID Surge in IVD & PoC Diagnostics

- 4.2.3 Complex Class III Device Pipeline Expansion

- 4.2.4 Aging Population Amplifying Device Volumes

- 4.2.5 Near-Shoring to Offset Tariff & Geopolitical Risks

- 4.2.6 Smart-Factory/Industry 4.0 Adoption by CMOs

- 4.3 Market Restraints

- 4.3.1 OEM Consolidation Squeezing CMO Margins

- 4.3.2 Divergent Global Regulatory Pathways

- 4.3.3 Shortage Of Skilled Medtech Manufacturing Talent

- 4.3.4 Specialty Resin & Chip Supply Volatility

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Device

- 5.1.1 In-vitro Diagnostic (IVD) Devices

- 5.1.2 Diagnostic Imaging Devices

- 5.1.3 Cardiovascular Devices

- 5.1.4 Drug-Delivery Devices

- 5.1.4.1 Syringes

- 5.1.4.2 Pen Injectors

- 5.1.4.3 Others

- 5.1.5 Endoscopy Devices

- 5.1.6 Ophthalmology Devices

- 5.1.7 Orthopedic Devices

- 5.1.8 Dental Devices

- 5.1.9 Other Devices

- 5.2 By Service

- 5.2.1 Device Development & Manufacturing Services

- 5.2.1.1 Device Engineering

- 5.2.1.2 Process Development

- 5.2.1.3 Device Manufacturing

- 5.2.2 Quality Management Services

- 5.2.2.1 Inspection & Testing

- 5.2.2.2 Packaging Validation

- 5.2.3 Assembly & Finished-Goods Services

- 5.2.1 Device Development & Manufacturing Services

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Australia

- 5.3.3.6 Rest of Asia

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Jabil Inc.

- 6.3.2 Flex Ltd.

- 6.3.3 Integer Holdings Corp.

- 6.3.4 Gerresheimer AG

- 6.3.5 TE Connectivity Ltd.

- 6.3.6 Nordson Corporation

- 6.3.7 Celestica Inc.

- 6.3.8 Synecco

- 6.3.9 Teleflex Incorporated

- 6.3.10 Sanmina Corporation

- 6.3.11 Phillips-Medisize (Molex)

- 6.3.12 Viant Medical

- 6.3.13 Nissha Medical Technologies

- 6.3.14 Heraeus Medical Components

- 6.3.15 SteriPack Group

- 6.3.16 Biomerics

- 6.3.17 Nortech Systems Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment