PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842620

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842620

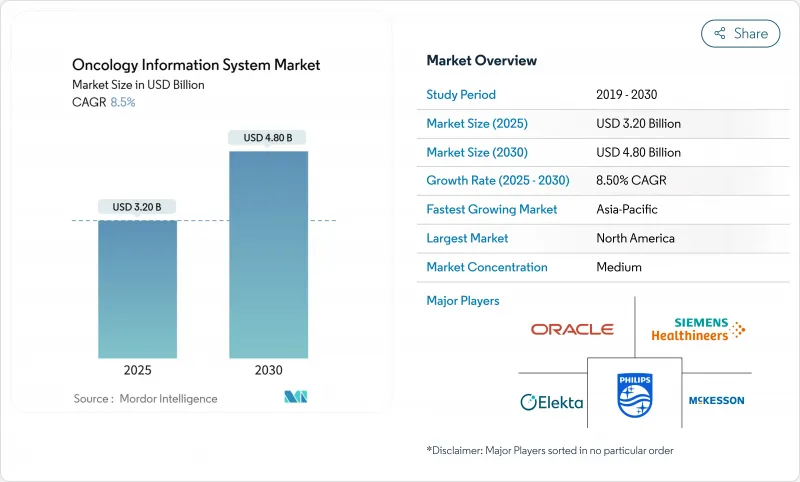

Oncology Information System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The oncology information system market size stands at USD 3.22 billion in 2025 and is forecast to reach USD 4.85 billion by 2030, advancing at an 8.50% CAGR.

The market's current momentum is underpinned by the sharp rise in global cancer incidence, interoperability mandates such as the 21st Century Cures Act, and rapid integration of artificial intelligence into clinical workflows. Providers are deploying sophisticated platforms to manage complex, multimodality treatment plans, reduce costs, and improve outcomes through data-driven decision support. Hospitals benefit from economies of scale that enable enterprise-wide rollouts, while oncology clinics leverage cloud-hosted offerings to meet value-based reimbursement requirements. The oncology information system market is further shaped by large capital investments-more than USD 4 billion in acquisitions in 2024-2025-and by escalating cybersecurity threats that underscore the need for resilient, compliant architectures.

Global Oncology Information System Market Trends and Insights

Rising Incidence of Cancer Worldwide

Global cancer burden continues to climb, with 1.7 million new cases diagnosed each year in the United States alone, placing unprecedented demands on data management and care coordination . Oncology workflows now incorporate genomic sequencing, multi-modal imaging, and real-world evidence, all of which require an integrated platform capable of supporting personalized medicine. Improved survival rates-up 33% over three decades-have created a growing cohort of cancer survivors who need long-term monitoring, further stretching information infrastructure . Demographic shifts toward aging populations amplify these pressures, pushing healthcare organizations to scale oncology information system market deployments that support multidisciplinary teams and lifelong care pathways.

Government Funding for Oncology IT Modernization

Public-sector investment is accelerating adoption of advanced cancer informatics. The United States Cancer Moonshot allocates targeted funds for standardized oncology data elements across electronic health records, while the CDC's AIMS platform and NOAH hub bring real-time pathology and laboratory analytics to state cancer registries. New York State committed USD 188 million to hospital modernization, prioritizing integrated cancer programs. The United Kingdom set aside GBP 2 billion for Cancer 360 technology, creating unified oncology information layers across NHS institutions . Such initiatives tighten interoperability rules and stimulate private investment, reinforcing growth in the oncology information system market.

High Total Cost of Ownership & Implementation

Community oncology practices must weigh capital outlays against long-term savings. Mayo Clinic's automated dose rounding study showed potential savings of USD 39.75 million over three years yet required sizable upfront investment for technology, training, and system maintenance. The Enhancing Oncology Model adds reporting and care-management obligations that strain smaller clinics. Cost-benefit frameworks underline non-financial gains-improved safety, fewer adverse events, and higher staff productivity-yet the cash flow challenge remains acute until reimbursement adjusts.

Other drivers and restraints analyzed in the detailed report include:

- Interoperability Mandates (21st Century Cures Act)

- AI-Driven Clinical Decision Support Boosting ROI

- Shortage of Oncology-Informatics Professionals

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Services held 51.01% of oncology information system market share in 2024 as hospitals and clinics relied on implementation partners for workflow mapping, system configuration, training, and ongoing support. Cardinal Health's USD 1.1 billion purchase of Integrated Oncology Network illustrates how bundled professional services amplify adoption and stickiness for enterprise clients. The oncology information system market size for services is projected to expand in tandem with growing proton-therapy and CAR-T monitoring deployments that demand bespoke integrations.

Software is the fastest-growing component, tracking an 8.98% CAGR through 2030. GE HealthCare's CareIntellect for Oncology consolidates treatment history and decision support into a single dashboard, cutting data-gathering time from hours to minutes. RaySearch Laboratories integrates plan-quality analytics into RayCare, showing how vendors differentiate on AI-enabled automation. Consulting, maintenance, and managed-service subsegments rise as providers outsource FHIR upgrades, cloud migrations, and cybersecurity hardening. The result is a blended revenue model in which software licensing and recurring services generate predictable cash flows across the oncology information system market.

The Oncology Information System Market Report is Segmented by Product and Service (Software and Services), Application (Medical Oncology, Radiation Oncology, and Surgical Oncology), End User (Hospitals, Research Centers, and Specialty Clinics), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The Market Provides the Value (USD) for the Abovementioned Segments.

Geography Analysis

North America accounted for 45.23% of oncology information system market share in 2024, supported by the Cures Act interoperability mandate, robust reimbursement mechanisms, and well-established electronic health record penetration. Federal programs such as the CDC's data-modernization initiative accelerate real-time cancer surveillance, nudging providers toward cloud-first architectures. Academic centers partner with technology firms to pioneer AI solutions, reinforcing the region's leadership stance.

Asia-Pacific is the fastest-growing region, projecting a 9.85% CAGR through 2030. China's Trinity smart-hospital blueprint outlines standards for unified EMRs and smart services, positioning local health systems to leapfrog legacy architectures . South Korea's K-CURE Public Cancer Library aggregates anonymized records for 2.26 million patients, while a USD 25 million government fund backs AI-driven drug discovery. Japan's medical DX program builds a national information platform to unify patient data, and India's All India Institute of Medical Sciences deploys AI image analytics to detect breast and ovarian cancers earlier. These coordinated efforts tighten standards, ease procurement, and seed demand across the oncology information system market.

Europe follows with pan-regional initiatives such as the European Cancer Imaging Initiative and JANE project, which create federated networks for imaging data and AI tool validation. Member states co-invest in cloud-based registries and shared analytics, encouraging vendors to certify FHIR readiness and GDPR compliance. Middle East & Africa and Latin America show incremental adoption, often through public-private partnerships that bundle tele-oncology, remote monitoring, and basic EMR upgrades as foundational steps toward a full oncology information system market rollout.

- Oracle Health (Cerner)

- Siemens Healthineers (Varian)

- Elekta

- Mckesson

- Koninklijke Philips

- F. Hoffmann-La Roche (Flatiron Health)

- Accuray

- RaySearch Laboratories

- Optum

- Epic Systems

- GE Healthcare

- Tempus Labs Inc.

- ViewRay Inc.

- Merative (IBM Watson Health)

- Medisolv

- IntelliCyt Corporation

- CEDAR Oncology Solutions

- Carevive Systems

- EndoSoft

- MIM Software

- Flatiron OncoEMR (Altos)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising incidence of cancer worldwide

- 4.2.2 Government funding for oncology IT modernization

- 4.2.3 Interoperability mandates (e.g., 21st Century Cures Act)

- 4.2.4 Cloud-hosted OIS adoption across multi-site cancer networks

- 4.2.5 AI-driven clinical-decision support boosting ROI

- 4.2.6 Value-based reimbursement models demanding real-time outcomes tracking

- 4.3 Market Restraints

- 4.3.1 High total cost of ownership & implementation

- 4.3.2 Shortage of oncology-informatics professionals

- 4.3.3 Cyber-security & patient-data-privacy risks

- 4.3.4 Integration gaps with emerging proton-therapy data formats

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 Oncology

- 5.1.1 Software

- 5.1.1.1 Patient-information systems

- 5.1.1.2 Treatment-planning systems

- 5.1.2 Services

- 5.1.2.1 Consulting

- 5.1.2.2 Implementation & Integration

- 5.1.2.3 Maintenance & Support

- 5.1.1 Software

- 5.2 By Application

- 5.2.1 Medical Oncology

- 5.2.2 Radiation Oncology

- 5.2.3 Surgical Oncology

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Oncology Clinics

- 5.3.3 Research & Academic Centers

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Oracle Health (Cerner)

- 6.3.2 Siemens Healthineers (Varian)

- 6.3.3 Elekta AB

- 6.3.4 McKesson Corporation

- 6.3.5 Koninklijke Philips N.V.

- 6.3.6 F. Hoffmann-La Roche (Flatiron Health)

- 6.3.7 Accuray Incorporated

- 6.3.8 RaySearch Laboratories

- 6.3.9 Optum Inc.

- 6.3.10 Epic Systems Corporation

- 6.3.11 GE HealthCare

- 6.3.12 Tempus Labs Inc.

- 6.3.13 ViewRay Inc.

- 6.3.14 Merative (IBM Watson Health)

- 6.3.15 Medisolv Inc.

- 6.3.16 IntelliCyt Corporation

- 6.3.17 CEDAR Oncology Solutions

- 6.3.18 Carevive Systems

- 6.3.19 EndoSoft LLC

- 6.3.20 MIM Software Inc.

- 6.3.21 Flatiron OncoEMR (Altos)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment