PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842622

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842622

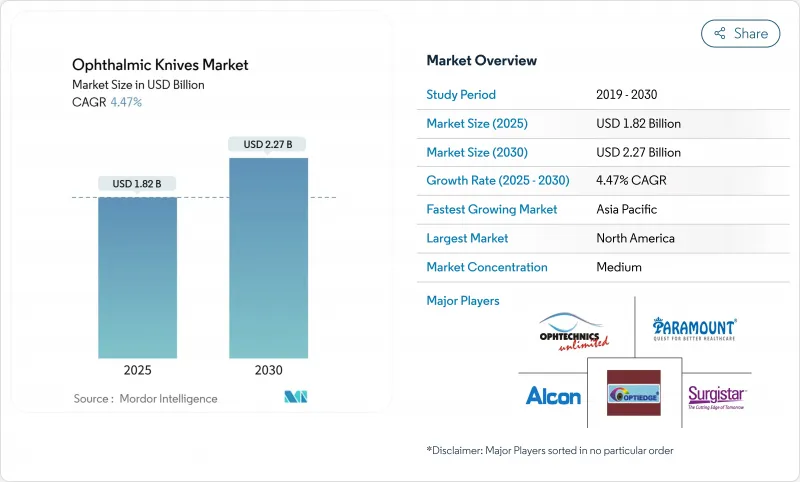

Ophthalmic Knives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Ophthalmic Knives Market size is estimated at USD 1.82 billion in 2025, and is expected to reach USD 2.27 billion by 2030, at a CAGR of 4.47% during the forecast period (2025-2030).

Demand holds steady because cataract surgery volumes keep rising, even as femtosecond laser platforms sharply reduce effective phacoemulsification time and begin to displace manual blades. Growth also reflects greater procedure throughput at outpatient facilities, ongoing material innovations such as diamond-like carbon coatings, and the push for infection-free single-use kits. At the same time, sustainability mandates complicate disposable adoption, and price pressure from declining reimbursement nudges many facilities toward reuse schemes. Consolidation among suppliers accelerates, with leading players pairing blade portfolios with laser technology and digital workflow tools to protect share in an environment of rapid technology substitution.

Global Ophthalmic Knives Market Trends and Insights

Increasing Incidence of Ophthalmic Diseases

Cataract remains the principal cause of avoidable blindness, and disability-adjusted life years linked to lens opacity continue to rise in low-sociodemographic regions. Mobile surgical camps in India now deliver more than 10 000 cataract procedures annually, achieving 79.3% rates of 6/9 visual acuity or better. China's registry shows phacoemulsification in 94.93% of cataract operations, underscoring the continuing need for high-precision incision tools. This sustained disease burden anchors baseline demand for every major blade design even as femtosecond systems gain ground.

Aging Population & Cataract Prevalence

Global demographic shifts add millions of procedures each year; by 2050 annual cataract surgeries are projected to reach 50 million. Office-based centers in the United States now exceed 150 locations and help alleviate hospital capacity constraints without compromising safety standards. Although Medicare payments have fallen 51% in real terms since 1982, procedure volumes tied to an older patient pool keep overall blade consumption trending upward.

High Unit Cost of Premium Knives

Multi-layer diamond coatings push individual blade prices well above stainless-steel alternatives, straining budgets in markets where reimbursement is flat or declining. Facilities in Latin America and parts of Southeast Asia often reuse premium knives beyond manufacturer guidance to amortize costs, a practice that heightens sterilization risk and tempers replacement demand.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advances in Blade Materials

- Shift Toward Day-Care / Minimally-Invasive Cataract Surgery

- Rapid Adoption of Femtosecond Lasers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

MVR knives posted the fastest 5.97% CAGR and benefit from surging vitreoretinal procedure complexity linked to diabetes and age-related macular degeneration. Slit knives still command the largest slice of ophthalmic knives market share at 36.94% in 2024, reflecting their utility in both primary and secondary cataract incisions. Crescent and straight blades serve niche anterior applications, but additive manufacturing is beginning to deliver bespoke angles and shaft lengths that broaden surgeon choice. Diamond-like carbon coatings lengthen edge life and improve tissue glide, encouraging uptake for multi-procedure packs in teaching hospitals. Yet femtosecond adoption tempers volume expectations beyond 2028 as laser capsulotomy reduces reliance on manual entry for routine cataract surgery. To offset the shift, suppliers emphasize ultra-high-precision MVR variants and hybrid packages that bundle vitreoretinal blades with disposable cannulas.

The design segment shows resilience because not all health systems can finance lasers, and because certain glaucoma, pediatric, and trauma cases still demand tactile feedback unavailable in robotic or laser platforms. Furthermore, custom 3D-printed trial blades let innovators explore asymmetric bevels suited to irregular corneas, opening incremental revenue channels. Slit knife suppliers are integrating radio-frequency identification tags to track sterile reprocessing cycles, a move that aligns with hospital quality metrics while locking customers into proprietary asset-management software, thereby stabilizing their foothold in the ophthalmic knives market.

The Ophthalmic Knives Market is Segmented by Design (Straight Knives, Crescent Knives, and More), Product (Reusable Ophthalmic Knives, Single-Use Ophthalmic Knives), End User (Hospitals, Specialty Clinics, Ambulatory Surgical Centers), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 36.45% of 2024 revenue thanks to roughly 4 million cataract procedures, fast adoption of premium coatings, and widespread use of ASCs. Femtosecond penetration exceeds 40% of cataract theaters, yet manual blades remain indispensable for backup and for surgeons who favor tactile feedback. Ongoing cuts to the Medicare conversion factor exert margin pressure, pushing providers toward blended reusable-disposable models that safeguard cash flow while meeting Centers for Medicare & Medicaid Services infection benchmarks.

Asia-Pacific is the fastest-growing territory at a 5.53% CAGR. China alone anticipates a 223.54% jump in cataract prevalence through 2030, and national surgical registries confirm that phacoemulsification dominates 94.93% of cases, anchoring demand for compatible incision blades. India's mobile eye camps demonstrate cost-effective outreach, with favorable visual outcomes sustaining steady inventory turnover for single-use packs. Mature markets such as Japan and Australia pursue premium diamond blades for microincisional glaucoma surgery, while Indonesia and Vietnam purchase cost-optimized steel sets to fit public-sector budgets.

Europe follows closely, driven by Germany, United Kingdom, France, and Italy. The EU Medical Device Regulation 2017/745 imposes rigorous post-market surveillance, favoring suppliers with strong quality systems. Simultaneously, the bloc's waste-reduction law compels design shifts toward recyclable or reusable components, reinforcing innovation in low-waste blade handles. Eastern European modernization programs attract vendors with mid-price stainless products, keeping growth momentum intact despite reimbursement ceilings. Overall, environmental compliance and high clinical standards give Europe an outsized influence on the next generation of blade technology in the ophthalmic knives market.

- Alcon

- Bausch Health

- Surgical Specialties

- Beaver-Visitec International

- Mani Inc.

- Katena Products

- Diamatrix

- Surgistar Inc.

- Sidapharm

- Ophtechnics

- Optiedge

- Paramount Surgimed

- GEUDER

- Millennium Surgical

- HOYA

- Carl Zeiss

- EyeKon Medical

- New World Medical

- MedXL

- Huaiyin Medical Instruments

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Incidence of Ophthalmic Diseases

- 4.2.2 Aging Population & Cataract Prevalence

- 4.2.3 Technological Advances in Blade Materials

- 4.2.4 Shift Toward Day-Care / Minimally-Invasive Cataract Surgery

- 4.2.5 Rise of Mobile Eye-Care Camps in Emerging Markets

- 4.2.6 Additive-Manufactured Custom Geometries Enabling Niche Procedures

- 4.3 Market Restraints

- 4.3.1 High Unit Cost of Premium Knives

- 4.3.2 Reimbursement Pressure on Ambulatory Surgery Centers

- 4.3.3 Regulatory Sustainability Rules Restricting Single-Use Plastics

- 4.3.4 Rapid Adoption of Femtosecond Lasers Displacing Manual Knives

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Design

- 5.1.1 Straight Knives

- 5.1.2 Crescent Knives

- 5.1.3 Slit Knives

- 5.1.4 MVR Knives

- 5.1.5 Others

- 5.2 By Product

- 5.2.1 Reusable Ophthalmic Knives

- 5.2.2 Single-Use Ophthalmic Knives

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Specialty Clinics

- 5.3.3 Ambulatory Surgical Centers

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Alcon

- 6.3.2 Bausch & Lomb

- 6.3.3 Surgical Specialties Corporation

- 6.3.4 Beaver-Visitec International

- 6.3.5 Mani Inc.

- 6.3.6 Katena Products

- 6.3.7 Diamatrix Ltd.

- 6.3.8 Surgistar Inc.

- 6.3.9 Sidapharm

- 6.3.10 Ophtechnics Unlimited

- 6.3.11 Optiedge

- 6.3.12 Paramount Surgimed

- 6.3.13 Geuder AG

- 6.3.14 Millennium Surgical Corp.

- 6.3.15 Hoya Corporation

- 6.3.16 Carl Zeiss Meditec

- 6.3.17 EyeKon Medical

- 6.3.18 New World Medical

- 6.3.19 MedXL

- 6.3.20 Huaiyin Medical Instruments

7 Market Opportunities & Future Outlook

- 7.1 White-space & unmet-need assessment