PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842624

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842624

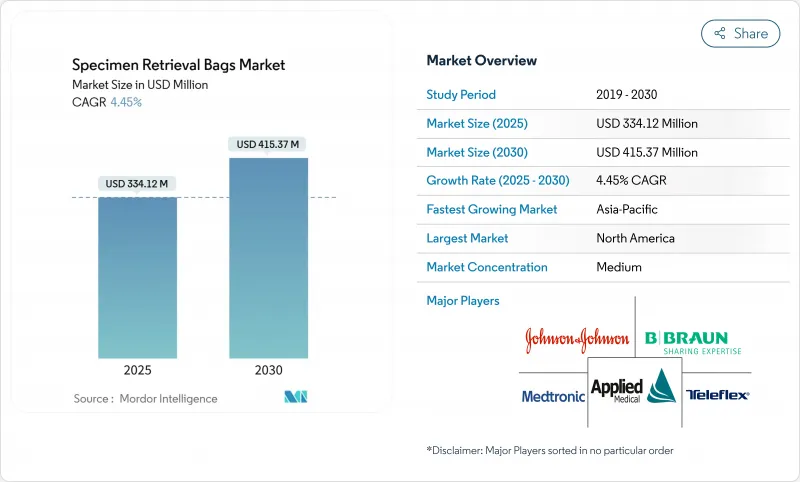

Specimen Retrieval Bags - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The specimen retrieval market stands at USD 334.12 million in 2025 and is forecast to reach USD 415.37 million by 2030, posting a 4.45% CAGR during the outlook period.

Growth reflects a mature yet resilient arena where reimbursement policies, oncology-focused containment guidelines, and the outpatient surgery boom combine to expand the addressable base of minimally invasive procedures. Rising chronic-disease burdens, notable technology refresh cycles in laparoscopic instrumentation, and an accelerating shift toward ambulatory settings keep demand steady even as value-based care heightens scrutiny of premium device pricing. Asia-Pacific achieves the fastest regional pace at 6.13% CAGR, while North America captures 42.75% revenue share on the strength of entrenched reimbursement and early adoption of post-2024 morcellation standards. Non-detachable retrieval bags hold 65.35% share, underlining surgeon trust in proven simplicity even as detachable formats register 5.23% CAGR. Competitive intensity remains moderate: large incumbents defend positions with global distribution, robust regulatory dossiers, and incremental product upgrades.

Global Specimen Retrieval Bags Market Trends and Insights

Rising Demand for Minimally-Invasive Surgery

Ambulatory surgery centers (ASCs) expect 21% procedure growth by 2034, directly elevating demand for reliable retrieval bags that fit shortened case times . Medicare raised ASC reimbursement 3.8% in 2025, widening the economic runway for laparoscopic cases despite rising supply-chain costs. Robotic workflows gain share but currently lengthen operating times in complex cases, highlighting the need for extraction devices that balance innovation with throughput. Manufacturers responding with pre-loaded, self-opening pouches emphasize ease of deployment to satisfy efficiency metrics that dominate ASC purchasing. Europe follows a similar arc, but heightened circular-economy mandates spur interest in polymer blends that enable recycling without compromising barrier integrity.

Increasing Global Surgical Volumes from Chronic Diseases

The World Bank identifies 4,433 procedures per 100,000 people in Brazil for 2024, reflecting higher case volumes tied to diabetes, cancer, and cardiovascular disease . Yet postoperative mortality in Sub-Saharan Africa remains twice the global average, underscoring infrastructure gaps that dampen high-value device uptake. Advanced economies now tailor retrieval features-including smoke evacuation-ready seals and reinforced seams-to support extensive oncologic resections, while low- and middle-income nations prioritize affordability and straightforward usability. These diverging clinical realities create tiered product strategies, prompting manufacturers to keep legacy nylon bags in portfolios alongside premium polyurethane designs offering improved puncture resistance.

High Unit Cost of Proprietary Retrieval Systems

A 2024 comparative study on laparoscopic sleeve gastrectomy found no statistical difference in complication rates between branded bags and direct extraction, intensifying price pressure on specialized devices. Latin American health ministries echo this concern, imposing reference-pricing caps that compress distributor margins. In response, global suppliers introduce value segments featuring thinner film gauges and simplified closure toggles while preserving sterile barrier performance. Asia-Pacific hospitals negotiate multiyear tenders that bundle retrieval pouches with trocars, exploiting economies of scale to trim per-unit cost. Such strategies partially offset the restraint but reinforce the need for demonstrable outcome advantages.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Upgrade Cycle in Laparoscopic Instrumentation

- Adoption Surge in Emerging Ambulatory Surgery Centers

- Evidence Questioning Clinical Benefit Versus Glove/Direct Extraction

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Non-detachable bags controlled 65.35% 2024 revenue, anchoring the specimen retrieval market through reliability that resonates in high-throughput settings. The segment benefits from simple drawstring closure that minimizes failure modes, a feature especially valuable when adopting single-site laparoscopy where articulation space is scarce. Hospitals report fewer pouch-loading errors with pre-attached rigid rings, supporting faster turnovers. Detachable formats, despite only 34.65% share, post 5.23% CAGR as surgeons appreciate staged extraction that reduces intra-abdominal manipulations. The specimen retrieval market size for detachable systems is estimated at USD 115 million in 2025 and is projected to reach USD 149 million by 2030, reflecting targeted gains in bariatric and gynecologic procedures. Applied Medical's Inzii(R) line integrates guide beads that reopen the mouth once outside the cavity, illustrating incremental advances addressing earlier usability concerns. Meanwhile, hybrid pouches featuring peripheral reinforcement and optional detachment emerge, catering to orthopedic sports-medicine arthroscopy. Manufacturers must balance inventory breadth with cost efficiency, often offering modular handle-bag combinations built on a shared introducer platform. The specimen retrieval industry continues to monitor polymer innovation, with cyclic-olefin co-polymer blends promising higher clarity for intra-operative visualization though currently at premium price points. Surgeons remain wary of latch failures on magnetic closure systems, suggesting non-detachable pouches will sustain majority share until robust field data confirm alternative reliability.

The Specimen Retrieval Market Report Segments the Industry Into by Type (Detachable Specimen Retrieval Bags, Non-Detachable Specimen Retrieval Bags), by Application (Gastrointestinal Surgeries, Urological Surgeries, Gynecological Surgeries, Other Applications), and Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 42.75% of global revenue in 2024 as robust reimbursement and early compliance with oncology containment guidance ensure high device utilization. Widespread adoption of da Vinci platform upgrades in 2025 also boosts trocar-compatible pouch demand across urology and general surgery. Yet payers invoke bundled DRG reviews to curb disposable expenditure, encouraging value offerings and prompting suppliers to introduce tiered lines in mid-2025. Asia-Pacific leads growth at 6.13% CAGR thanks to rising healthcare investment, aging demographics, and rapid diffusion of laparoscopic skills into secondary-tier cities. China's NMPA approval of Boston Scientific's FARAPULSE(TM) in 2025 signals regulatory openness to advanced systems, encouraging parallel acceptance of complementary retrieval solutions.

Japan and Australia favor premium pouches with anti-slip perimeters, while India, Indonesia, and Vietnam lean on cost-efficient nylon bags that satisfy basic leakage requirements. Europe posts moderate expansion as procurement directives emphasize circular-economy goals; hospitals in Germany and the Nordics pilot take-back schemes where used pouches are converted into industrial feedstock. The Middle East invests in large robotic surgery centers in the Gulf, translating into demand for high-capacity bags capable of removing enlarged thyroid or kidney specimens through small fascial openings. Africa remains constrained by workforce shortages and postoperative mortality challenges, though teaching hospitals in South Africa and Nigeria adopt retrieval systems for donor-derived transplant programs. Latin America, led by Brazil and Mexico, shows mixed adoption as tax incentives on locally manufactured pouches coexist with foreign-branded premium offerings in private networks.

- Johnson & Johnson

- Medtronic

- Teleflex

- Applied Medical Resources

- CONMED Corp.

- B. Braun

- Grena

- LaproSurge

- Stryker

- Purple Surgical

- The Cooper Companies

- Duomed Group

- Locamed

- Microval

- EndoEvolution

- Espiner Medical

- Victor Medical Instruments

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for minimally-invasive surgery

- 4.2.2 Increasing global surgical volumes from chronic diseases

- 4.2.3 Rapid upgrade cycle in laparoscopic instrumentation

- 4.2.4 Adoption surge in emerging ambulatory surgery centers

- 4.2.5 "In-bag" morcellation standards post-2024 oncology guidelines

- 4.2.6 Circular-economy push for recyclable polymer retrieval bags

- 4.3 Market Restraints

- 4.3.1 High unit cost of proprietary retrieval systems

- 4.3.2 Evidence questioning clinical benefit versus glove / direct extraction

- 4.3.3 Low penetration of advanced MIS in low-income countries

- 4.3.4 Skills gap for robotic-assisted specimen extraction

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value - USD Million)

- 5.1 By Type

- 5.1.1 Detachable Retrieval Bags

- 5.1.2 Non-Detachable Retrieval Bags

- 5.2 By Application

- 5.2.1 Gastrointestinal Surgeries

- 5.2.2 Urological Surgeries

- 5.2.3 Gynecological Surgeries

- 5.2.4 Other Surgeries (Thoracic, Bariatric, Oncology)

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgery Centers (ASCs)

- 5.3.3 Specialty & Physician-Owned Clinics

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 Johnson & Johnson (Ethicon)

- 6.3.2 Medtronic plc

- 6.3.3 Teleflex Inc.

- 6.3.4 Applied Medical Resources

- 6.3.5 CONMED Corp.

- 6.3.6 B. Braun SE

- 6.3.7 Grena Ltd.

- 6.3.8 LaproSurge

- 6.3.9 Stryker Corp.

- 6.3.10 Purple Surgical

- 6.3.11 CooperSurgical

- 6.3.12 Duomed Group

- 6.3.13 Locamed

- 6.3.14 Microval

- 6.3.15 EndoEvolution

- 6.3.16 Espiner Medical

- 6.3.17 Victor Medical Instruments

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment