PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842630

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842630

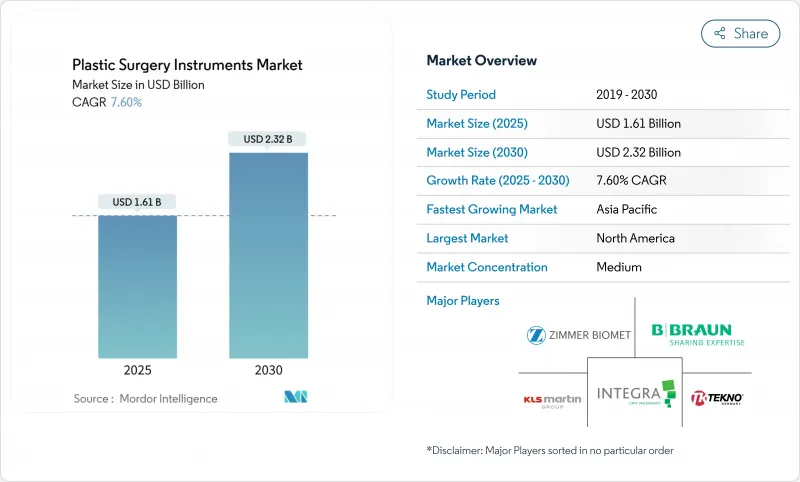

Plastic Surgery Instruments - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Plastic Surgery Instruments Market size is estimated at USD 1.61 billion in 2025, and is expected to reach USD 2.32 billion by 2030, at a CAGR of 7.60% during the forecast period (2025-2030).

Strong growth reflects rising global procedure volumes, rapid uptake of electrosurgical systems, and sustained demand from both cosmetic and reconstructive surgery. Electrosurgical devices outpace traditional handheld tools with a 9.89% CAGR as surgeons adopt energy-based technologies that shorten operative times and minimize tissue trauma. Asia-Pacific leads regional momentum with a 13.23% CAGR, supported by medical tourism and expanding middle-class purchasing power, while North America retains leadership through a 42.34% revenue share anchored by early technology adoption and high discretionary income. Hospitals remain the dominant care setting, but specialty clinics and ambulatory centers are capturing share as minimally invasive techniques enable same-day discharge.

Global Plastic Surgery Instruments Market Trends and Insights

Rising Global Procedural Volumes in Cosmetic Surgery

Surging demand for rhinoplasty, liposuction, and male aesthetic procedures in India, Brazil, and the United States enlarges the plastic surgery instruments market by increasing equipment turnover requirements. High-volume practices now prioritize reusable forceps and precision cutters engineered for extended sterility cycles. Manufacturers are scaling production of anatomy-specific cannulas and micro-scissors to align with diverse patient characteristics. The emphasis on volume efficiency accelerates instrument refresh rates, benefiting suppliers able to guarantee durability under intensive reprocessing. Hospitals that optimize tray contents have realized annual savings of USD 159,600, which can be redirected toward next-generation devices.

Shift Toward Minimally-Invasive & Electrosurgical Techniques

Energy-based devices such as Harmonic ACE+7 scalpels cut breast reconstruction operative time to 179 minutes versus 286 minutes with legacy cautery and nearly halve intraoperative bleeding. Second-generation radio-frequency liposuction systems reduce complication rates to 0.7% from 8.3% for first-generation units, prompting rapid replacement of older platforms. Bio-Active Electrode technology yields 5-8 micron lateral tissue damage, vastly narrower than the 20-90 micron range of conventional electrodes, which improves cosmetic outcomes and pathology accuracy. As a result, hospital procurement teams are accelerating capital budgeting for precision energy systems.

Post-Operative Complications & Infection Risk

Implant-based breast reconstruction shows 8.53% infection rates that trigger implant removal in 31.2% of cases and abandonment in 20.7% of infected patients. Microbiological audits reveal skin flora contamination on surgical packs due to inadequate sterilizer maintenance and improper handling. No-touch expander techniques have eliminated infections in controlled trials, highlighting how redesigned clamps and insertion sleeves can mitigate risk. Persistent infection concerns elevate sterilization costs and may defer elective surgeries.

Other drivers and restraints analyzed in the detailed report include:

- Aging Population Seeking Age-Related Reconstructive Work

- Expanding Medical Tourism Hubs

- High Capital Cost of Powered/Electrosurgical Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Handheld devices accounted for 44.62% of the plastic surgery instruments market share in 2024 as essential tools across diverse procedures. Electrosurgical systems, while smaller in base, are set to surge at a 9.89% CAGR as surgeons chase precision and hemostatic efficiency. LigaSure technology enables 90.2% bloodless pocket creation versus 59.4% with traditional cautery, markedly lowering postoperative drain volumes. This clear outcome differential fuels rapid capital allocation toward energy-based generators and innovative electrodes.

Growing momentum is reshaping the plastic surgery instruments market as bipolar platforms eclipse monopolar systems, cutting compressive forces by 31% and tissue trauma by 37%. AI-integrated consoles like Stryker SurgiCount+ add real-time blood-loss analytics, tightening surgical quality loops. As disposable-tip models proliferate, suppliers align with hospital sustainability goals by offering reprocessable handpieces that keep consumable costs in check.

The Plastic Surgery Instruments Market Report Segments the Industry Into by Type (Handheld Instruments, and Electrosurgical Instruments), Procedure (Cosmetic Surgery, and Reconstructive Surgery), End User (Hospitals, and More), and Geography (North America, Europe, Asia-Pacific, Middle-East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America has the highest adoption of AI-guided energy platforms and advanced robotic systems, safeguarding its 42.34% market share of plastic surgery instruments in 2024 despite rising competition. Continuous FDA engagement, such as February 2025 dermal-filler hearings, underpins a rigorous safety culture that shapes device rollout timelines. Canada and Mexico complement U.S. demand by serving cross-border patients and offering cost-conscious packages.

Asia-Pacific posts a 13.23% CAGR propelled by Thailand's accreditation-led tourism, India's skilled surgeon surplus, and robust domestic demand in China and Japan. Korean clinics set aesthetic trends that spread throughout the region, increasing uptake of micro-powered cannulas and precision endoscopic cutters. Market entrants partner with local distributors to navigate heterogeneous regulatory environments.

Europe maintains consistent growth driven by Germany, France, and the United Kingdom where public reimbursement supports reconstructive cases. Circular-economy policies spur hospitals to convert from single-use to reprocessable devices, influencing supplier product lines. Eastern European states leverage cost advantages to court intra-EU medical travelers. The Middle East and Africa accelerate instrument purchases for new surgical hubs in the Gulf, while South Africa functions as a regional skills center.

- KLS Martin Group

- Integra LifeSciences

- Zimmer Biomet

- B. Braun

- Sklar Surgical Instruments

- Tekno-Medical Optik-Chirurgie

- BMT Medizintechnik

- Anthony Products

- Bolton Surgical

- Surgicon Pvt.

- Blink Medical

- Medtronic

- Stryker

- Johnson & Johnson

- Conmed

- Olympus

- Ethicon

- Boston Scientific

- MicroAire

- Arthrex

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Global Procedural Volumes in Cosmetic Surgery

- 4.2.2 Shift Toward Minimally-Invasive & Electrosurgical Techniques

- 4.2.3 Aging Population Seeking Age-Related Reconstructive Work

- 4.2.4 Expanding Medical Tourism Hubs

- 4.2.5 OR Tray-Optimization Cuts Hospital Costs, Boosts Instrument Refresh Cycles

- 4.2.6 3-D Printed Patient-Specific Guides Shortening Re-Op Rates

- 4.3 Market Restraints

- 4.3.1 Post-Operative Complications & Infection Risk

- 4.3.2 High Capital Cost of Powered/Electrosurgical Systems

- 4.3.3 Growing ESG Scrutiny on Single-Use Instruments' Waste Stream

- 4.3.4 Supply-Chain Exposure to Cluster Geopolitical Risks

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product Type

- 5.1.1 Handheld Instruments

- 5.1.1.1 Forceps

- 5.1.1.2 Scissors

- 5.1.1.3 Retractors

- 5.1.1.4 Others

- 5.1.2 Electrosurgical Instruments

- 5.1.2.1 Bipolar Instruments

- 5.1.2.2 Monopolar Instruments

- 5.1.1 Handheld Instruments

- 5.2 By Procedure

- 5.2.1 Cosmetic Surgery

- 5.2.1.1 Breast Procedures

- 5.2.1.2 Face & Head Cosmetic Surgery

- 5.2.1.3 Body & Extremities Procedures

- 5.2.2 Reconstructive Surgery

- 5.2.2.1 Breast Reconstruction

- 5.2.2.2 Congenital Deformity Correction

- 5.2.2.3 Tumor Removal

- 5.2.2.4 Other Reconstructive Surgeries

- 5.2.1 Cosmetic Surgery

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Specialty & Cosmetic Clinics

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 KLS Martin Group

- 6.3.2 Integra LifeSciences

- 6.3.3 Zimmer Biomet

- 6.3.4 B. Braun Melsungen

- 6.3.5 Sklar Surgical Instruments

- 6.3.6 Tekno-Medical Optik-Chirurgie

- 6.3.7 BMT Medizintechnik

- 6.3.8 Anthony Products

- 6.3.9 Bolton Surgical

- 6.3.10 Surgicon Pvt.

- 6.3.11 Blink Medical

- 6.3.12 Medtronic

- 6.3.13 Stryker

- 6.3.14 Johnson & Johnson

- 6.3.15 Conmed Corporation

- 6.3.16 Olympus Corporation

- 6.3.17 Ethicon

- 6.3.18 Boston Scientific

- 6.3.19 MicroAire

- 6.3.20 Arthrex

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment