PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842634

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842634

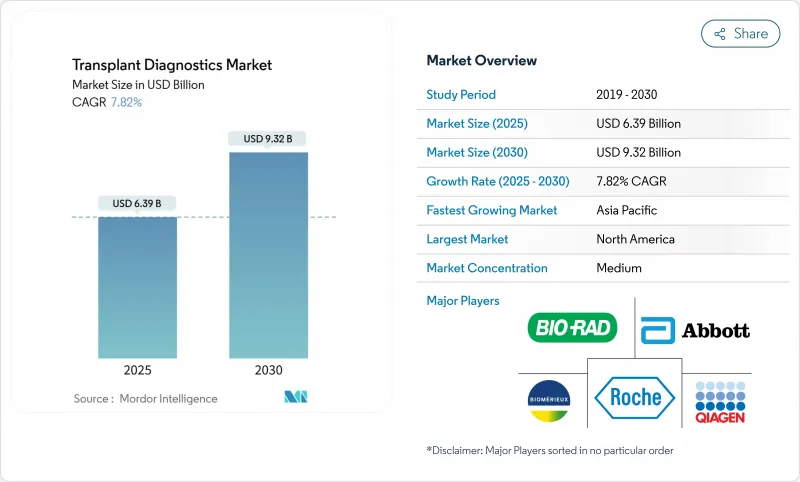

Transplant Diagnostics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The transplant diagnostics market size stands at USD 6.39 billion in 2025 and is forecast to reach USD 9.32 billion by 2030, advancing at a 7.82% CAGR.

Robust transplant volumes, rapid NGS adoption, AI-driven decision support, and payer recognition of precision medicine collectively sustain double-digit revenue momentum across major laboratories and kit suppliers. High-resolution HLA sequencing delivers decisive gains in turnaround times and allelic resolution, encouraging pay-per-use procurement models that lower capital barriers for smaller programs. Reagent pull-through remains strong because NGS workflows require validated library kits, while predictive dd-cfDNA surveillance is displacing invasive biopsies in routine follow-up. Competitive intensity is rising as diagnostics majors and transplant-focused specialists race to integrate analytics, automation, and digital pathology into unified offerings.

Global Transplant Diagnostics Market Trends and Insights

Growing Transplant Volumes (Solid Organ & Cell Therapy)

US hospitals performed 48,000-plus organ transplants in 2024, a 3.3% rise that mirrors broader global gains. Donation-after-circulatory-death grafts now contribute 36% of deceased-donor procedures, expanding the recipient pool. Parallel momentum in hematopoietic stem-cell transplants is linked to high-resolution HLA typing that validates partially mismatched donors, especially benefitting ethnically diverse patients. Continuous distribution for lungs has already lifted transplant rates 16% within 12 months. Each increment in procedure volume converts into higher demand for compatibility assays, post-operative monitoring, and longitudinal rejection surveillance. Consequently, the transplant diagnostics market records sustained reagent pull-through and greater installed-base utilization.

Shift to NGS-Based HLA & dd-cfDNA Surveillance

NGS platforms provide simultaneous high-resolution typing of multiple HLA loci via sample barcoding, boosting throughput while cutting cost per allele. dd-cfDNA assays now flag graft injury earlier than histology, with hazard ratios of 2.56 for elevated signals in heart recipients. National payers increasingly recognize the downstream savings from fewer biopsy complications, accelerating reimbursement approvals. Laboratories gain flexibility through reagent-rental contracts that bundle sequencers, software, and consumables into predictable per-sample fees, propelling wider NGS adoption across mid-tier centers.

High Assay Costs & Capital Outlay

Comprehensive NGS systems can exceed USD 500,000 before validation, while premium reagents reach USD 400 per sample aruplab.com. FDA oversight of Laboratory-Developed Tests adds compliance expenditures near USD 1.29 billion over 10 years. Laboratories with limited throughput struggle to amortize these expenses, prompting consolidation toward high-volume reference centers. Cost pressure also affects dd-cfDNA assays where payer fee schedules lag analytical complexity, delaying widespread roll-out in low-income settings.

Other drivers and restraints analyzed in the detailed report include:

- AI-Assisted Histocompatibility Matching

- Reagent-Rental & Pay-Per-Use Pricing

- Patchwork Global Reimbursement

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Molecular assays captured 69.35% of transplant diagnostics market share in 2024 owing to unrivaled allelic resolution and multiplex capacity. The segment's 7.9% CAGR through 2030 benefits from lab automation that consolidates extraction, library prep, and sequencing on unified decks, shortening hands-on time. Complementary non-molecular tests such as flow-cytometric crossmatch remain indispensable for urgent deceased-donor allocation, growing 12.25% CAGR on specialized use cases.

Platform enhancements now merge NGS reads with AI-based imputation to reconcile ambiguous alleles, raising call confidence in under-sequenced regions. dd-cfDNA kits layered on the same sequencers raise reagent consumption per patient episode, lifting the transplant diagnostics market size for molecular workflows. External proficiency programs covering 19 years of benchmarking show genotype concordance steadily increasing, underscoring technology maturity.

Reagents and consumables remained the revenue anchor with 65.53% share in 2024 because every NGS run consumes barcoded primers, polymerases, and capture probes. Yet software and analytics is expected to post 13.85% CAGR, expanding the transplant diagnostics market size for digital services as algorithms automate QC, phasing, and clinical reporting.

Cloud-native platforms reduce on-premise infrastructure needs and support real-time variant databases that update with each global allele submission. Instruments shift toward usage-based leases, reallocating capex to operating budgets and dampening hardware growth. Vendors bundle AI licenses with reagent kits, embedding data subscriptions into every assay cycle to capture recurring revenue.

The Transplant Diagnostics Market Report is Segmented by Technology (Molecular and Non-Molecular), Product (Instrument, Reagents, and More), Transplant Type (Solid Organ, Stem Cell, and Soft Tissue), Application (Diagnostic and Research), End User (Independent Reference Laboratories, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 42.82% of global revenue in 2024 due to comprehensive Medicare policies, 48,000 transplant procedures, and dense center networks that routinely deploy dd-cfDNA monitoring. Widespread adoption of AI analyzers and early reimbursement decisions support mid-single-digit unit price premiums. FDA regulation of LDTs may pinch smaller facilities, provoking outsourcing to national reference laboratories that command scale efficiencies.

Europe presents mature infrastructure with harmonized quality schemes; however, GDPR limits rare-allele data exchange, complicating multicenter study design and slowing biomarker validation. Health-technology-assessment bodies often request extended clinical outcome data, extending payback periods for vendors. Nonetheless, population aging and rising solid-organ waitlists sustain steady test volumes.

Asia-Pacific registers the fastest expansion at 11.61% CAGR as Japan pioneers gene-edited xenograft readiness and India scales transplant capacity with 85-90% one-year survival benchmarks. Governments invest in local bioprinting and NGS manufacturing to mitigate import dependence, amplifying reagent accessibility. Diverse HLA profiles across large populations further elevate demand for high-resolution genotyping, expanding the transplant diagnostics market.

- Abbott Laboratories

- Becton, Dickinson & Co

- bioMerieux

- Bio-Rad Laboratories

- CareDx Inc.

- Roche

- Hologic

- Illumina

- QIAGEN

- Thermo Fisher Scientific

- Immucor

- Omixon

- GenDx (GenCell)

- BioGenuix

- Oxford Nanopore Technologies

- Eurofins

- Natera

- BGI

- Eurofins Transplant Genomics

- Genetron Health

- Pacific Biosciences

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Transplant Volumes (Solid-Organ & Cell Therapy)

- 4.2.2 Shift To NGS-Based HLA & Ccfdna Surveillance

- 4.2.3 Reagent Rental + Pay-Per-Use Pricing By Vendors

- 4.2.4 AI-Assisted Histocompatibility Matching

- 4.2.5 3-D Printed Micro-Organs As Reference Controls

- 4.3 Market Restraints

- 4.3.1 High Assay Costs & Capital Outlay

- 4.3.2 Patchwork Global Reimbursement

- 4.3.3 Data-Privacy Hurdles In Cross-Border Registries

- 4.4 Porter's Five Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Technology

- 5.1.1 Molecular

- 5.1.1.1 PCR-based Molecular Assays

- 5.1.1.2 Sequencing-based Molecular Assays

- 5.1.2 Non-Molecular

- 5.1.1 Molecular

- 5.2 By Product

- 5.2.1 Instruments

- 5.2.2 Reagents & Consumables

- 5.2.3 Software / Analytics

- 5.3 By Transplant Type

- 5.3.1 Solid Organ

- 5.3.2 Stem Cell / Bone Marrow

- 5.3.3 Soft Tissue

- 5.4 By Application

- 5.4.1 Diagnostic

- 5.4.2 Research

- 5.5 By End User

- 5.5.1 Independent Reference Laboratories

- 5.5.2 Hospital & Transplant Centres

- 5.5.3 Academic & Research Institutes

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 Becton, Dickinson & Co

- 6.3.3 bioMerieux SA

- 6.3.4 Bio-Rad Laboratories Inc.

- 6.3.5 CareDx Inc.

- 6.3.6 F. Hoffmann-La Roche AG

- 6.3.7 Hologic Inc.

- 6.3.8 Illumina Inc.

- 6.3.9 Qiagen NV

- 6.3.10 Thermo Fisher Scientific Inc.

- 6.3.11 Immucor Inc.

- 6.3.12 Omixon Ltd.

- 6.3.13 GenDx (GenCell)

- 6.3.14 BioGenuix

- 6.3.15 Oxford Nanopore Technologies

- 6.3.16 Eurofins Scientific

- 6.3.17 Natera Inc.

- 6.3.18 BGI Genomics

- 6.3.19 Eurofins Transplant Genomics

- 6.3.20 Genetron Health

- 6.3.21 Pacific Biosciences

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment