PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842636

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842636

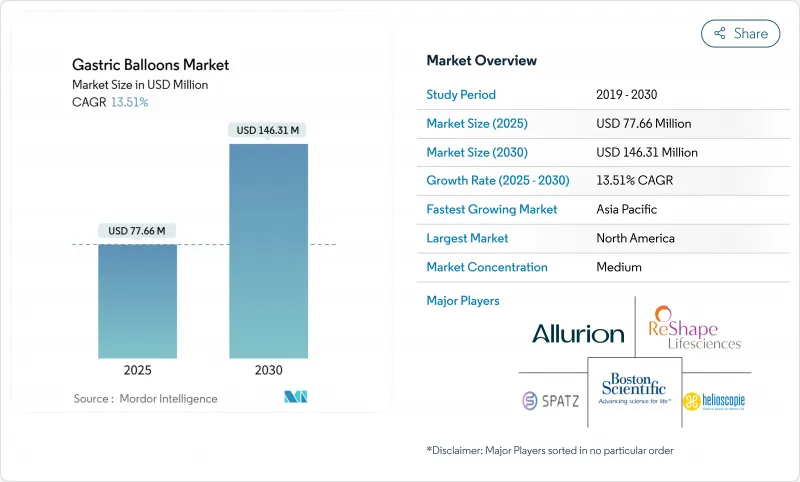

Gastric Balloons - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The gastric balloons market size stands at USD 77.66 million in 2025 and is forecast to reach USD 146.31 million by 2030, reflecting a sound 13.51% CAGR.

Accelerating obesity prevalence, procedureless balloon innovations, and rising payer openness to cover reversible therapies fuel this growth. Demand is strongest among individuals with body mass index (BMI) 30-40 kg/m2 who reject surgery but seek durable weight control, while clinicians increasingly view balloons as a bridge between lifestyle change and bariatric surgery. Technological advances such as swallowable capsules, soft-robotic pressure adjustment, Internet-of-Things (IoT) telemetry, and concurrent glucagon-like peptide-1 (GLP-1) pharmacotherapy showcase how device makers intend to improve efficacy, comfort, and metabolic impact.

Global Gastric Balloons Market Trends and Insights

Rising Prevalence of Obesity

Obesity has been reclassified as a chronic disease requiring formal medical intervention. The United States' 2024 proposal to reimburse anti-obesity drugs under Medicare Part D signals institutional recognition that fuels demand for complementary device-based options. Health systems see balloons as a cost-effective route to mitigate diabetes, hypertension, and sleep-apnea expenditures. Meta-analyses indicate 55.5% resolution in type 2 diabetes, 58.8% in hypertension, and 57.8% in obstructive sleep apnea within four months of balloon therapy. Rising adolescent obesity opens a younger segment that favours reversible, nonsurgical tools.

Increasing Demand for Minimally-invasive Weight-loss Procedures

Patients increasingly seek interventions that avoid surgery, preserve future options, and permit swift return to routine. Procedureless balloons eliminate sedation, operating theatre time, and the need for gastroenterologist supervision, making therapy accessible in primary-care settings. Swallowable devices show serious adverse events under 3.1%, favourably contrasting with surgical complication profiles. Outpatient-friendly workflows widen provider networks, encouraging rapid adoption despite endoscopy's current 74% share dominance.

Limited Long-term Efficacy versus Bariatric Surgery

Weight regain after device removal remains a core concern. Evidence shows only 44.7% of balloon patients keep meaningful loss 12 months post-extraction, whereas laparoscopic sleeve gastrectomy delivers better durability ajendoscopicsurg.org. This limitation narrows the eligible cohort to individuals prioritising reversibility over maximal weight reduction. Long-term nutritional counselling and digital coaching add cost and complexity.

Other drivers and restraints analyzed in the detailed report include:

- Combination Therapy with GLP-1 Agonists Unlocking New Indications

- Growing Clinical Evidence Base & Guideline Endorsements

- Competitive Threat from Next-generation Endoscopic Sleeve Gastroplasty

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, single devices controlled 68.1% of the gastric balloons market, underwritten by decades of safety data and straightforward placement requirements. Orbera's lineage illustrates sustained physician confidence, which translates into predictable revenue for hospitals and clinics. Patients often select singles for lower cost and well-documented outcomes. Market incumbents reinforce this position by bundling balloons with nutrition coaching apps that maximise post-procedure support.

Triple-balloon systems record the highest 13.62% CAGR and illustrate how innovation can command premium reimbursement. Spatz's adjustable platform lets physicians modulate volume to counter weight-loss plateaus, achieving 15% total body weight loss in controlled trials. This adaptability differentiates triple balloons in performance-driven patient segments and signals a route to extend indwell time, potentially mitigating the long-term efficacy gap.

Saline remains the default fill, occupying 81.67% share in 2024 due to radiographic visibility and long-term safety documentation. Hospitals appreciate the control saline affords during placement and removal, which aligns with standard endoscopy workflow. Moreover, device suppliers maintain mature supply chains for sterile saline kits, supporting cost efficiency.

Gas-filled balloons, led by Obalon, advance at 13.72% CAGR as patients value lighter intragastric load and reduced nausea. Swallowable capsule delivery eliminates sedation and can be completed in under 15 minutes, a major draw for outpatient settings. Despite slightly longer removal duration, improved tolerability supports broader adoption, particularly in primary-care networks seeking scalable interventions.

The Gastric Balloons Market is Segmented by Product Type (Single Gastric Balloons, Dual Gastric Balloons, and More), Filling Materials (Saline Filled Balloons and Gas Filled Balloons), Insertion Method (Endoscopic and Oral), End User (Hospitals, Bariatric & Metabolic Clinics, and More) and Geography (North America, Europe, Asia-Pacific, and More). The Report Offers the Value (in USD) for the Above Segments.

Geography Analysis

North America accounted for 40.21% of the gastric balloons market in 2024, boosted by FDA-cleared device variety and strong clinician awareness. Medicare's evolving coverage stance and employer wellness initiatives keep demand resilient.

Europe maintains significant weight through broad physician adoption and proactive guideline inclusion. Reimbursement, however, remains patchy, producing a mosaic of regional uptake-Germany's statutory insurers reimburse balloons selectively, whereas southern Europe often relies on self-pay models.

Asia Pacific exhibits a 13.92% CAGR, the fastest globally. Rising disposable incomes and surging obesity prevalence create favourable demand in China, Japan, and India. Japan's 15-year registry shows 46.6% mean excess weight loss, instilling confidence among regional gastroenterologists. Yet payer fragmentation and offshore medical tourism mean market development leans toward private-sector hospitals and wellness chains that target affluent urban populations.

- Boston Scientific

- Allurion Technologies

- ReShape Lifescience

- Spatz FGIA, Inc.

- Helioscopie Medical Implants

- Districlass Medical

- Silimed

- ENDALIS

- LEXEL

- Medispar CVBA

- Medsil

- Izsam Medical

- ReShape Duo (ReShape Medical)

- Heliosphere Bag (Heliosphere)

- Ullorex Medical

- Semistationary Antral Balloon (SAB)

- Medicone

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of Obesity

- 4.2.2 Increasing Demand for Minimally-invasive Weight-loss Procedures

- 4.2.3 Growing Clinical-evidence Base & Guideline endorsements

- 4.2.4 Expanding Reimbursement Coverage in Key Markets

- 4.2.5 Combination Therapy with GLP-1 Agonists Unlocking New Indications

- 4.2.6 Smart/adjustable Balloons Enabled by Soft-robotics & IoT Tracking

- 4.3 Market Restraints

- 4.3.1 Limited Long-term Efficacy versus Bariatric Surgery

- 4.3.2 Adverse-event Profile (Early deflation, pancreatitis, migration)

- 4.3.3 Patchwork Reimbursement in Emerging Economies

- 4.3.4 Competitive Threat from Next-generation Endoscopic Sleeve Gastroplasty

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Single Gastric Balloons

- 5.1.2 Dual Gastric Balloons

- 5.1.3 Triple Gastric Balloons

- 5.2 By Filling Material

- 5.2.1 Saline-Filled Balloons

- 5.2.2 Gas-Filled Balloons

- 5.3 By Insertion Method

- 5.3.1 Endoscopic Placement

- 5.3.2 Swallowable / Pill-Form (Oral)

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Bariatric & Metabolic Clinics

- 5.4.3 Ambulatory Surgical Centers

- 5.5 Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.5 South America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Boston Scientific Corporation

- 6.3.2 Allurion Technologies, Inc.

- 6.3.3 Reshape Lifesciences Inc.

- 6.3.4 Spatz FGIA, Inc.

- 6.3.5 Helioscopie Medical Implants

- 6.3.6 Districlass Medical SA

- 6.3.7 Silimed, Inc.

- 6.3.8 ENDALIS

- 6.3.9 LEXEL S.R.L

- 6.3.10 Medispar CVBA

- 6.3.11 Medsil

- 6.3.12 Izsam Medical

- 6.3.13 ReShape Duo (ReShape Medical)

- 6.3.14 Heliosphere Bag (Heliosphere)

- 6.3.15 Ullorex Medical

- 6.3.16 Semistationary Antral Balloon (SAB)

- 6.3.17 Medicone

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment