PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842637

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842637

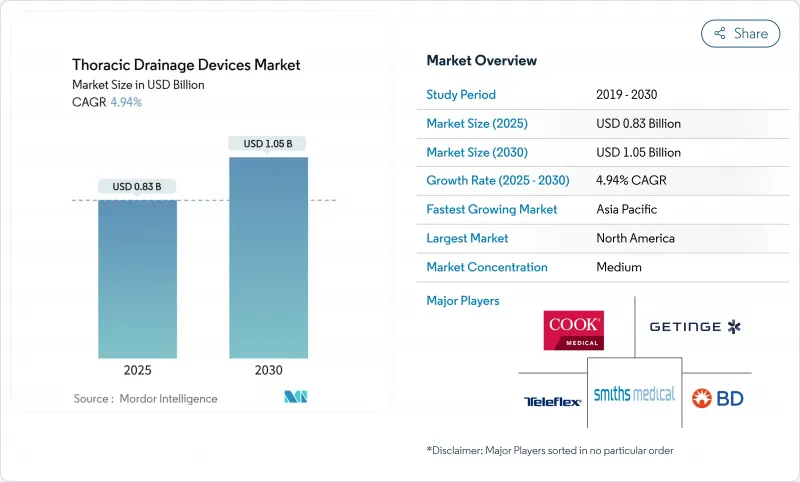

Thoracic Drainage Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The thoracic drainage systems market size stands at USD 0.83 billion in 2025 and is forecast to reach USD 1.05 billion by 2030, reflecting a 4.94% CAGR over the period.

The steady expansion rests on rising cardiovascular and thoracic surgical volumes, migration from analog water-seal devices to digital platforms, and widening adoption of portable units that shorten hospital stays. Digital technology now links chest drainage to real-time analytics, allowing clinicians to spot air leaks or fluid shifts earlier and intervene sooner. North America holds sway because of its sophisticated surgical infrastructure, yet Asia-Pacific is adding procedures faster as aging populations in China, India, and Japan swell demand for cardiac and pulmonary care. Hospitals remain the single largest end user, though ambulatory surgery centers and home-care programs are expanding quickly as payers favor outpatient models that control cost and improve patient mobility. Supply-chain resilience around specialty polymers has become a decisive differentiator because shortages of silicone and polyurethane can delay deliveries and raise prices.

Global Thoracic Drainage Devices Market Trends and Insights

Increasing Volume Of Thoracic & Cardiovascular Surgeries

Global cardiac and thoracic procedure counts keep rising as surgeons embrace minimally invasive techniques that lower operative risk and widen patient eligibility. Shorter incisions and faster recovery drive demand for drainage units that offer precise suction control and real-time leak detection. Meta-analysis shows digital devices trimming chest-tube duration by 0.72 days and hospital stay by 0.97 days, savings that offset higher acquisition cost. Hospitals value systems that automatically document drainage data into electronic records, easing staff workload and aiding reimbursement. As beating-heart and video-assisted surgeries proliferate, clinicians need devices that promptly flag subtle physiologic changes.

Rising Incidence Of Pneumothorax & Pleural Effusion

Environmental pollution, especially elevated PM2.5 levels, has correlated with more spontaneous pneumothorax cases in rapidly industrialising cities. A Chinese cohort reported a 31% prevalence among patients with diffuse cystic lung disease, underscoring the region's sizable clinical burden. Surgical intervention reduces recurrence to 11%, driving demand for durable drainage kits capable of extended placement. Product designers now favour smaller-bore catheters that maintain flow yet lessen discomfort, supporting faster ambulation and earlier discharge. Manufacturers also incorporate antimicrobial linings to curb infection risk during multi-week dwell times.

High Cost Of Advanced Thoracic Drainage Systems

Digital units can cost multiples of analog sets, stretching capital budgets in emerging economies. Beyond purchase price, buyers must fund disposables, training, and software updates. Hospitals in middle-income nations frequently delay upgrades until cost-effectiveness is proven through local data. Payers now negotiate value-based contracts where suppliers refund part of the price if agreed outcomes are not met. These financial pressures slow initial uptake of premium systems despite their clinical merits.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advancements In Digital Drainage Systems

- Growing Geriatric Population With Cardiopulmonary Diseases

- Stringent & Variable Regulatory Approvals

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Thoracic drainage systems captured 43.23% of overall 2024 revenue, underscoring their central clinical role. Analog models still dominate cost-sensitive hospitals, yet digital variants post a 7.12% CAGR as facilities pursue better monitoring and shorter stays. Integrated pumps and electronic valves help standardise suction levels, which lowers complication rates. Thoracic drainage kits complement system sales by bundling tubing, dressings, and disposables, ensuring procedural consistency.

Material advances move the needle on patient comfort and infection control. Silicone and polyurethane catheters lessen tissue irritation, while silver or antibiotic coatings curb bacterial colonisation. Closed-incision negative-pressure devices bridge drainage with wound-care needs, creating cross-selling opportunities. Vendors that offer a full procedure package, from trocar to post-op monitoring, build loyalty and lock-in among high-volume surgical centers.

Cardiac surgery generated 28.35% of 2024 sales thanks to established bypass and valve repair protocols that require dependable drainage. The thoracic drainage systems market size for ECMO, however, is projected to rise fastest at an 8.47% CAGR to 2030 as more centers adopt this life-support modality. ECMO patients need robust, leak-proof systems that manage high flow for extended durations. Digital units track pressure variations minute by minute, giving intensivists actionable insights.

Thoracic and pulmonology surgeries benefit from video-assisted lobectomies, which demand precise suction settings. Oncology cases increasingly rely on tunneled catheters for malignant effusions, creating demand for long-term, antimicrobial devices. Trauma and emergency departments prioritise quick-connect tubing and simple interfaces to speed lifesaving interventions. Each use case shapes design, reinforcing the need for broad product lines.

The Thoracic Drainage Devices Market Report is Segmented by Product Type (Thoracic Drainage Systems [Analog Systems and More], Thoracic Drainage Kits, and More), Application (Cardiac Surgery, ECMO Procedures, and More), End User (Hospitals, Ascs, and More), Technology (Analog Water-Seal, Digital Electronic and More), Material (Silicone, PVC and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with 39.45% market share in 2024, buoyed by high surgical throughput, advanced reimbursement, and early digital uptake. United States hospitals invest aggressively in software-driven systems that reduce air-leak complications and length of stay. Canadian centers benefit from harmonised procurement guidelines that facilitate cross-provincial adoption, while Mexico's private sector upgrades to digital units as medical tourism grows.

Asia-Pacific is projected to grow at a 7.67% CAGR, making it the fastest-advancing regional contributor to the thoracic drainage systems market. China's hospital construction boom and reimbursement expansion add operating-room capacity, directly lifting demand for drainage kits. Japan's super-aged society sustains valve and bypass volumes, anchoring steady demand for replacement cycles. India's tier-one cardiac institutes adopt digital systems to differentiate on clinical outcomes, while Southeast Asian nations upgrade analog fleets as incomes climb.

Europe maintains a balanced profile of innovation and volume. Germany and the United Kingdom spearhead clinical trials that validate new digital algorithms under the EU Medical Device Regulation framework, bolstering physician confidence. France, Italy, and Spain add demand through public-sector refurbishments that replace aging analog units. Regional procurement groups press suppliers for evidence-based price concessions, encouraging bundling of disposables and service contracts.

- Beckton Dickinson

- Teleflex

- Getinge

- Smiths Group

- Cardinal Health

- Cook Group

- ATMOS MedizinTechnik

- Utah Medical Products

- Vygon

- Sinapi Biomedical

- Medela

- Redax S.p.A.

- Rocket Medical

- Merit Medical Systems

- Argon Medical Devices

- Avanos Medical

- Peninsula Medical (PleurX)

- Ventlab LLC

- Boston Scientific

- Chongqing Wego Healthcare

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Volume Of Thoracic & Cardiovascular Surgeries

- 4.2.2 Rising Incidence Of Pneumothorax & Pleural Effusion

- 4.2.3 Technological Advancements In Digital Drainage Systems

- 4.2.4 Growing Geriatric Population With Cardiopulmonary Diseases

- 4.2.5 Surge In ECMO Adoption Requiring Closed-Loop Drainage

- 4.2.6 Miniaturised Portable Devices Enabling Outpatient Care

- 4.3 Market Restraints

- 4.3.1 High Cost Of Advanced Thoracic Drainage Systems

- 4.3.2 Stringent & Variable Regulatory Approvals

- 4.3.3 Supply-Chain Fragility For Specialty Polymers

- 4.3.4 Preference For Minimally-Invasive Aspiration Alternatives

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technology Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Product Type

- 5.1.1 Thoracic Drainage Systems

- 5.1.1.1 Analog (Water-Seal) Systems

- 5.1.1.2 Digital / Smart Systems

- 5.1.2 Thoracic Drainage Kits

- 5.1.3 Pleural Drainage Catheters

- 5.1.3.1 Small-Bore (<=14 Fr)

- 5.1.3.2 Large-Bore (>14 Fr)

- 5.1.4 Trocar Drains

- 5.1.5 Needles

- 5.1.5.1 Secured Needle

- 5.1.5.2 Unsecured Needle

- 5.1.6 Closed Incision Negative Pressure Systems

- 5.1.1 Thoracic Drainage Systems

- 5.2 By Application

- 5.2.1 Cardiac Surgery

- 5.2.2 Thoracic Surgery & Pulmonology

- 5.2.3 Trauma & Emergency Medicine

- 5.2.4 Oncology & Pain Management

- 5.2.5 Infectious Diseases & Sepsis

- 5.2.6 ECMO Procedures

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgery Centers

- 5.3.3 Specialized Pulmonology & Thoracic Clinics

- 5.3.4 Military & Disaster Response Units

- 5.3.5 Homecare Settings

- 5.4 By Technology

- 5.4.1 Analog Water-Seal

- 5.4.2 Digital Electronic

- 5.4.3 Portable Suction-Assisted

- 5.4.4 Vacuum-Assisted Negative Pressure

- 5.5 By Material

- 5.5.1 Silicone

- 5.5.2 Polyvinyl Chloride (PVC)

- 5.5.3 Polyurethane

- 5.5.4 Others (PEEK, TPE, etc.)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Becton, Dickinson and Company

- 6.3.2 Teleflex Incorporated

- 6.3.3 Getinge AB

- 6.3.4 Smiths Group plc

- 6.3.5 Cardinal Health

- 6.3.6 Cook Medical

- 6.3.7 ATMOS MedizinTechnik GmbH & Co. KG

- 6.3.8 Utah Medical Products, Inc.

- 6.3.9 Vygon SA

- 6.3.10 Sinapi Biomedical

- 6.3.11 Medela AG

- 6.3.12 Redax S.p.A.

- 6.3.13 Rocket Medical PLC

- 6.3.14 Merit Medical Systems, Inc.

- 6.3.15 Argon Medical Devices, Inc.

- 6.3.16 Avanos Medical, Inc.

- 6.3.17 Peninsula Medical (PleurX)

- 6.3.18 Ventlab LLC

- 6.3.19 Boston Scientific Corporation

- 6.3.20 Chongqing Wego Healthcare

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment